-

Bitcoin addresses with some BTC balance continued to grow, as buyers took advantage of the dips.

Assessing the risk of Bitcoin’s price potentially dipping below key levels.

As a seasoned analyst with over two decades of experience in the financial markets, I have witnessed numerous market cycles and learned to read between the lines. The current state of Bitcoin (BTC) is intriguing, to say the least.

Two major Bitcoin [BTC] narratives have been dominant for the last few months.

1 Option A speaks about the potential for a significant increase (rally) in Bitcoin’s value, while Option B discusses the possibility that this rally might not occur, with Bitcoin’s price possibly dipping below $50,000 instead.

In the past five months, it appears that the two scenarios for Bitcoin have given large investors (whales) and institutions an opportunity to capitalize on the volatile price fluctuations driven by emotions.

Bitcoin dipped below $50,000 once courtesy of a major panic selling event in August.

As an analyst, I observed that the recent selling pressure episode was swiftly counterbalanced by a surge in capital influx as traders seized the opportunity to purchase at a reduced price. Interestingly, the latest downturn incident last week proved unsuccessful for the bears, who failed to drive the price below $52,000.

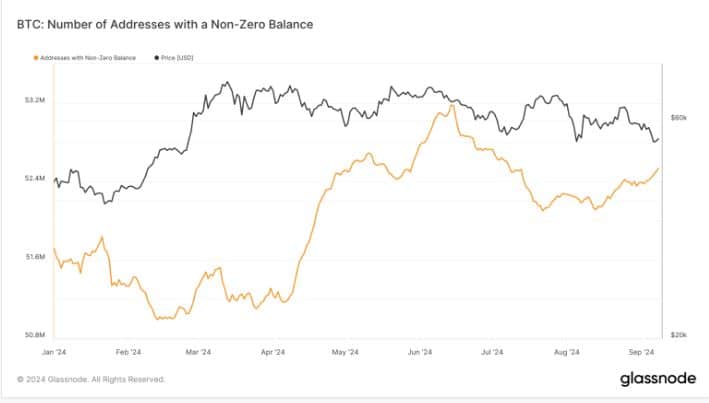

Glassnode’s data confirmed a resurgence of accumulation.

As reported by Glassnode, there were nearly 53 million wallets holding no balances at the current moment, which is a positive sign as it represents a strong rebound from the lowest points in August.

Even though these levels were lower than what was initially seen in early July, it suggests that there remains a degree of unpredictability within the market.

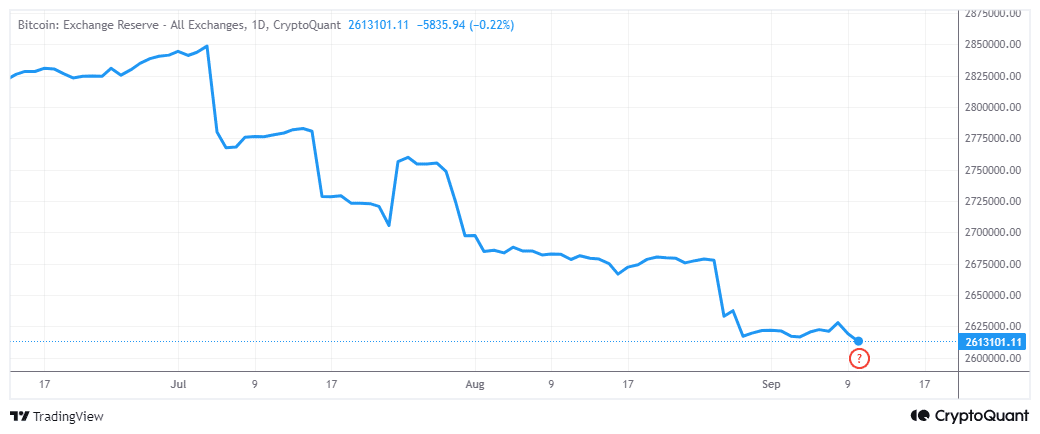

Additionally, it’s important to mention that the amount of Bitcoin held in exchange reserves was once again decreasing. This suggests that fewer Bitcoins were being kept on exchanges, which is a contrast to the slight increase noticed at the beginning of September.

Improved exchange reserves could signal positivity for the bullish investors, and this trend coincides with the increasing number of active non-zero wallets. Yet, it doesn’t provide a definitive insight into the actions taken by whales and institutions.

Bitcoin’s other extreme

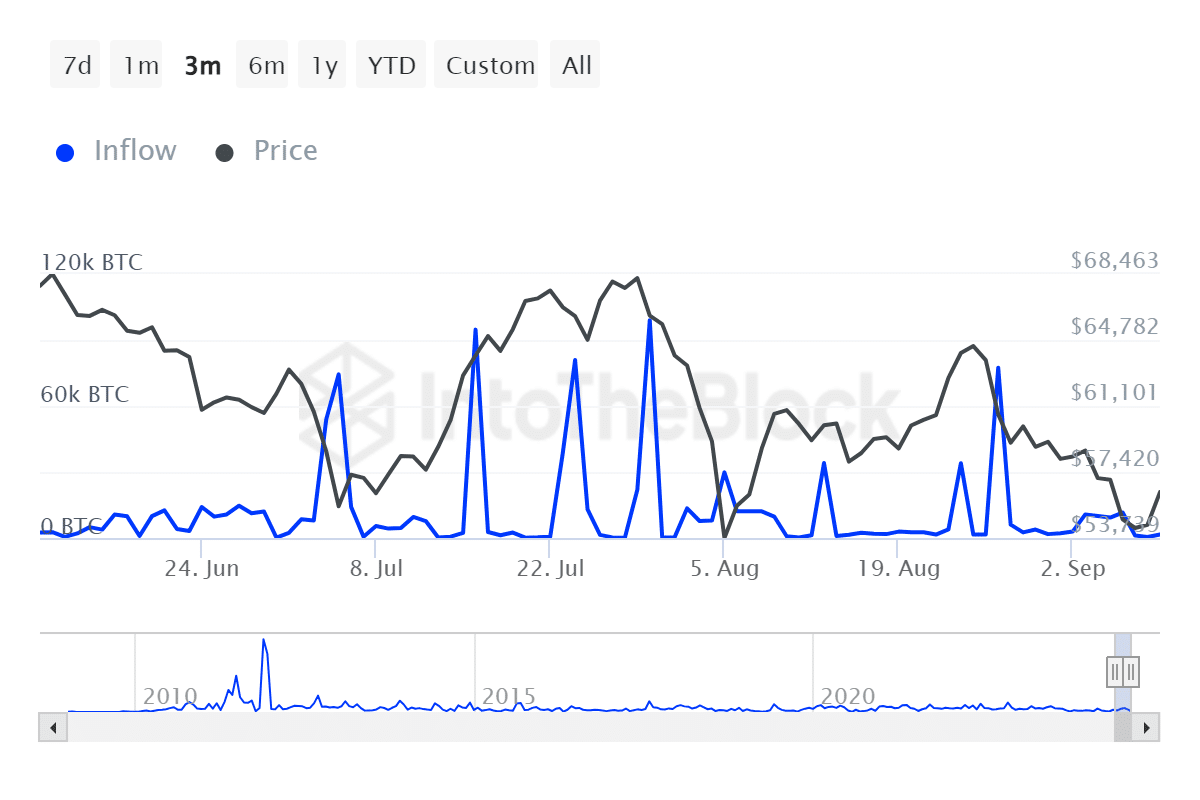

It seems that whales have been less busy in September compared to June through August. The data on their activity suggests a decrease in the past fortnight.

It seems that the number of whales (large investors) participating was low at the same time as there was a decline in the demand for Bitcoin ETFs, indicated by significant outflows. Additionally, this period saw Bitcoin’s trend appear to decrease over the past five months.

Bitcoin’s highest points have been decreasing with each bullish effort, indicating a decline in bullish optimism.

Read Bitcoin’s [BTC] Price Prediction 2024–2025

Essentially, Bitcoin could drop as low as $50,000 or even further, but those holding back (the “whales”) might seize the opportunity to buy at reduced prices.

There’s a chance that experienced traders might be holding back on major decisions until they have more definite information about market trends from the Federal Reserve in the coming week.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-09-10 18:15