-

Solana’s rally has shown signs of exhaustion after a recent breakout past $150.

On-chain data shows mixed signals on whether SOL price could rally to $200.

As a seasoned analyst with over a decade of experience in the cryptocurrency market, I must say that Solana [SOL] is currently presenting a fascinating yet complex picture. While its recent rally past $150 was impressive, the on-chain data seems to suggest a potential slowdown in its momentum towards the elusive $200 mark.

Solana [SOL] traded at $144 at press time. Despite its recent bounce from a multi-month support level, SOL remains down by around 6% in the last 30 days.

Over the past seven days, I’ve observed a positive surge in Solana’s value. The price climbed from $127 to $151, reflecting a robust recovery. This upward trend can largely be attributed to the overall strength of the cryptocurrency market, as Bitcoin [BTC] and many altcoins also reported significant gains.

Given the indications that Solana’s surge may be slowing down, is there on-chain evidence suggesting a prolonged optimistic perspective that could potentially drive its price up to $200?

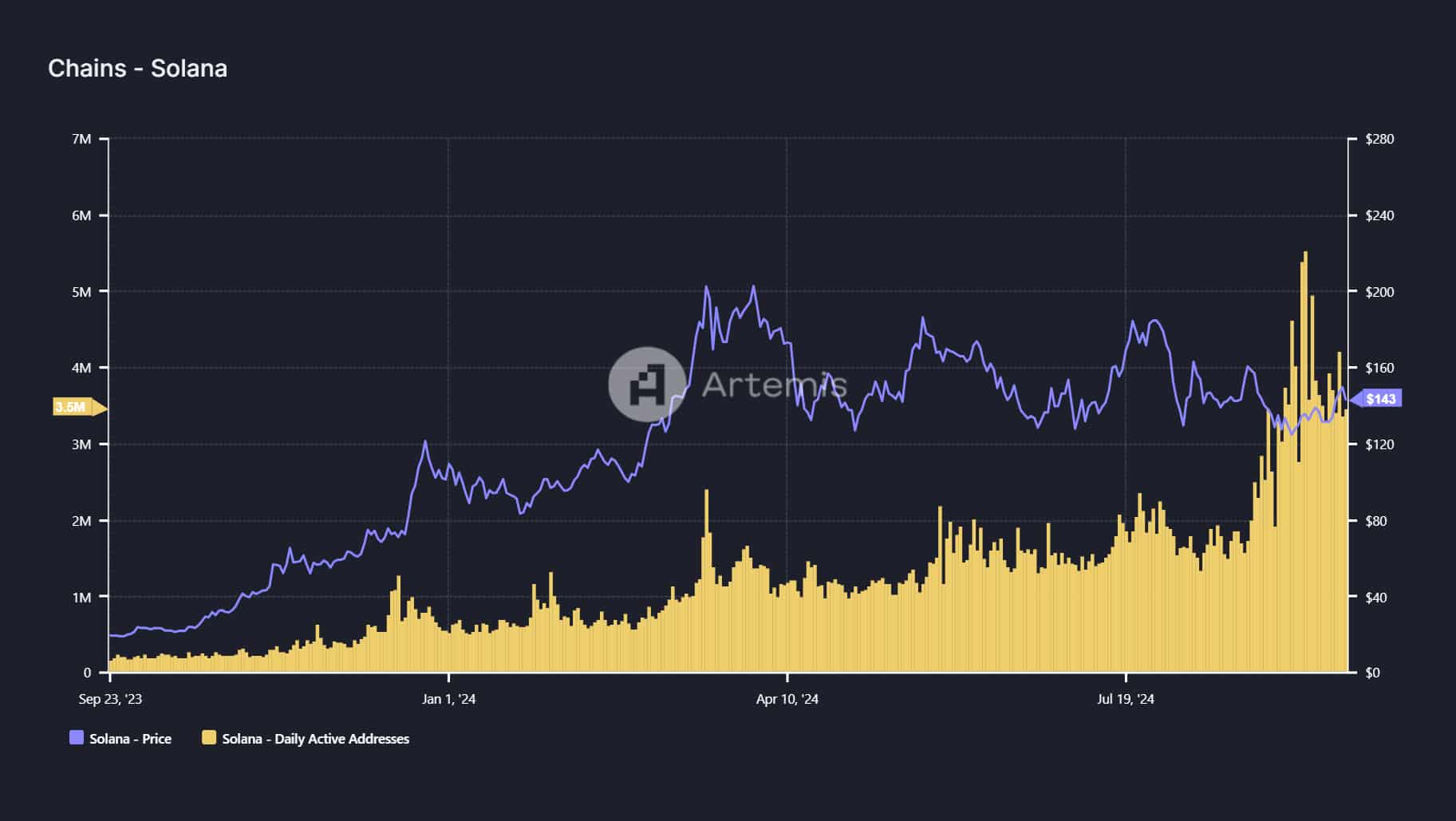

Solana’s active addresses

According to data provided by Artemis, it appears that the number of monthly active addresses on the Solana network has reached an all-time peak. However, this data also indicates that the rate of daily active addresses is decreasing, suggesting a potential slowdown in short-term user engagement.

On September 19th, the number of daily active addresses on the Solana network hit a one-year peak of 5.5 million. However, this figure has since decreased to approximately 3.5 million.

A decrease in the number of daily active addresses on Solana suggests that network activity is decreasing. In order for the price of SOL to surge to $200, there must be an increase in network usage.

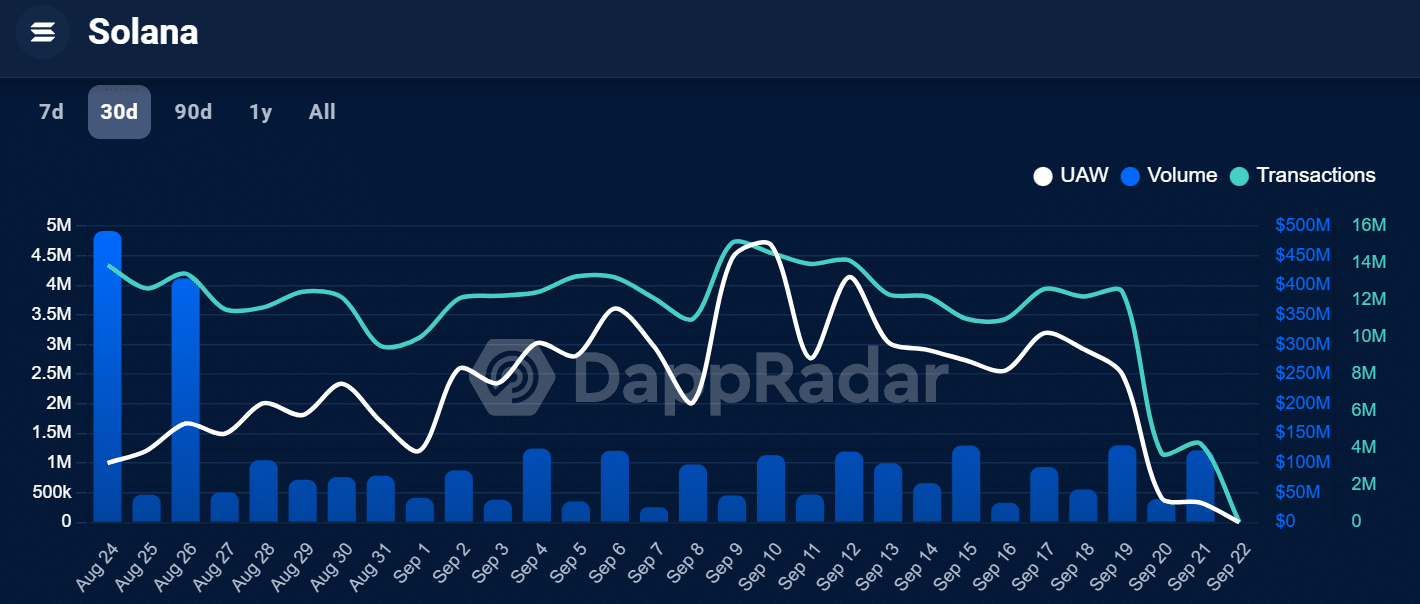

dApp volumes remain low

Over the past month, I’ve noticed a significant dip in the activity of decentralized applications (DApps) on the Solana network, according to DappRadar data. This decrease in engagement is something I’m keeping a close eye on.

The amount of transactions on Decentralized Applications (DApps) on the blockchain has significantly decreased, going down from approximately $400 million in late August to just $121 million currently.

A similar drop is also seen in the number of transactions and the Unique Active Wallets (UAWs).

To keep growing, the need for increased interest in the SOL token arises as users engage with decentralized applications (dApps) built upon the blockchain network.

DeFi TVL surpasses $5 billion

For the very first time this month, the combined value locked in Decentralized Finance (DeFi) platforms on the Solana blockchain surpassed $5 billion.

According to DeFiLlama, Solana has added more than $500M to its TVL within two weeks.

An increase in activity within Decentralized Finance (DeFi) on the Solana blockchain might lead to an upward trend in its price, since users engaging with the DeFi protocols built on this network typically require SOL to execute their transactions.

As an analyst, I’ve observed that one of the key factors fueling the surge in Decentralized Finance (DeFi) on the blockchain is the protocol known as Jupiter. Notably, its Total Value Locked (TVL) has just hit a new all-time high.

Read Solana’s [SOL] Price Prediction 2024–2025

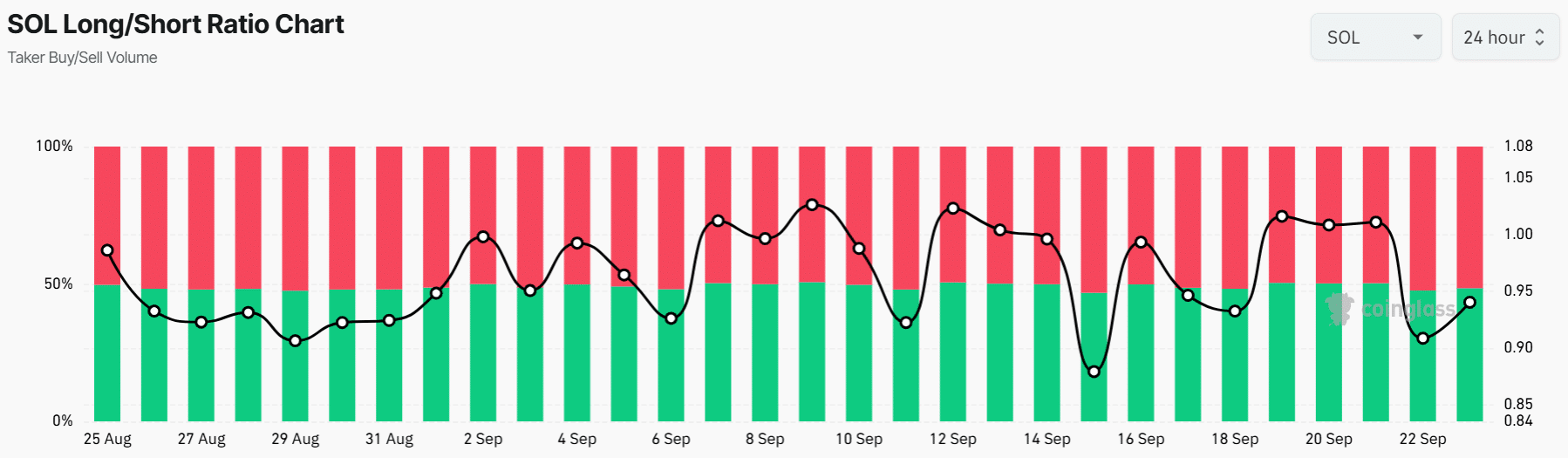

As a crypto investor, I’m noticing some ambiguous signs from Solana’s network, but what stands out is that the number of short positions exceeds the number of long positions, subtly suggesting a bearish sentiment among traders.

This implies that traders have doubts about Solana’s potential for rapid growth to $200 within a brief period.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-09-24 12:09