Ah, 2025! A year of market tempests and geopolitical squalls, during which, mirabile dictu, privacy coins emerged as the darlings of the cryptocurrency set. 🧐

Analysts, those modern-day soothsayers, and privacy advocates, bless their hearts, suggest this is no mere accident. Nay, some even dare to whisper that this outperformance is but the prelude to a grand, sweeping drama in the global financial theater. One wonders if they’ve had their tea spiked with optimism. ☕

Why Privacy Coins Are the Top Performers in a Market Gripped by Fear (and Maybe a Little Hysteria)

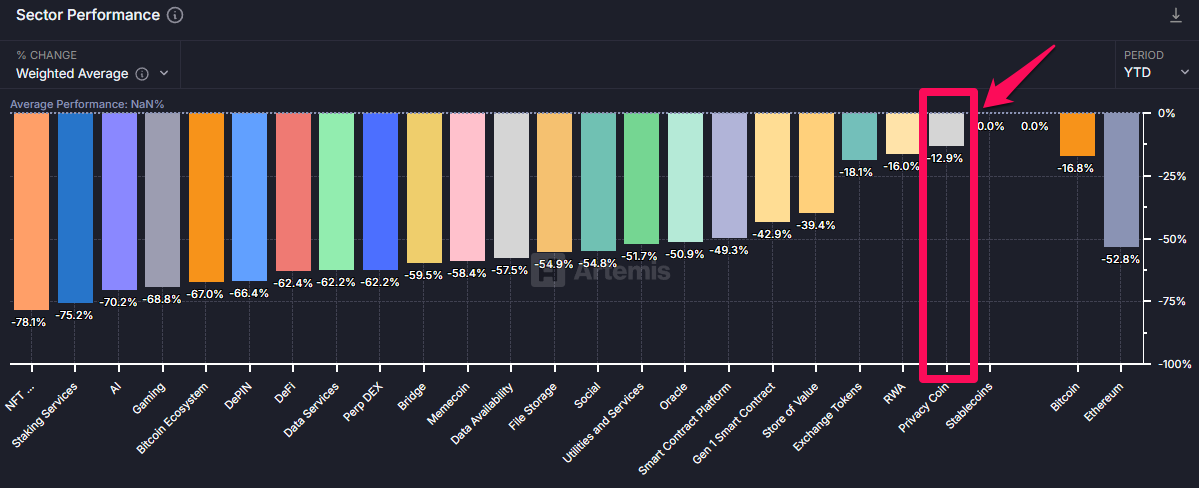

According to the latest pronouncements from Artemis, those number-crunching wizards, privacy-focused cryptocurrencies have only slipped a paltry 12.9% since the dawn of the year. A mere scratch compared to the market’s other, more flamboyant wounds.

In contrast, Bitcoin (BTC), that venerable old warhorse, has stumbled by 16.8%. And Ethereum (ETH), oh, the indignity, has plummeted a staggering 52.8% year-to-date (YTD). One almost feels a twinge of pity… almost. 😈

Data, that fickle mistress, reveals that over the past month, our privacy coin heroes have held their own against BTC. Monero (XMR) has only dipped 8.1%. Zcash (ZEC), in a feat of sheer audacity, has even risen a respectable 9.1%. Bitcoin, meanwhile, has shed 9.8% of its considerable bulk.

Indeed, privacy coins have outshone the broader cryptocurrency circus in the past 24 hours. The privacy sector has only wilted by 7.0%, while the global crypto market has taken an 8.3% tumble. A veritable ballet of financial fortunes. 🩰

Patrick Scott, a fellow with the grand title of Head of Growth at DefiLlama, attributes this triumph to the grand machinations of macroeconomics in a recent post on X (formerly Twitter). One is tempted to ask if he also reads tea leaves.

“Privacy coins were the best-performing crypto sector during the crash. This isn’t about hype. It’s macro,” he declared. A statement of profound depth, no doubt. 🤔

Scott posits that nations are becoming more economically isolated, like grumpy hermits in their caves, due to rising tariffs and the specter of capital controls. He argues that privacy coins, with their talent for evading prying eyes, will become ever more crucial, transforming from mere “narrative” to practical necessity.

“The outperformance isn’t random. It’s an early reaction to a shifting global regime and the breakdown of the post-WW2 international order,” Scott proclaimed. One might even call it… fate! 🎭

Meanwhile, other luminaries of the industry echo these sentiments. Vikrant Sharma, Founder and CEO of Cake Investments, a name that conjures images of decadent pastries, expressed his ardent support for privacy-focused solutions.

“I am a maxi.. a privacy maxi. That’s why I support privacy coins and tools like XMR, Zano, silent payments, and pay join for BTC, LTC-MWB, and yes, I think Zcash is fine too,” he posted. A veritable ode to privacy! 🎶

Others, such as Mike Adams, the founder of Brighteon, a name that sounds vaguely like a futuristic toothpaste, also stressed the vital importance of privacy in matters of commerce.

“Use privacy crypto, folks. Monero, Zano, Firo… not BTC, which is completely transparency and has zero privacy,” stated Adams. A stark warning, indeed. 🚨

In addition to these lofty considerations, the demand for privacy coins is also being fueled by their increasing popularity in less savory activities. A recent report suggests that privacy coins are the currency of choice for those seeking to operate in the shadows.

While Bitcoin and stablecoins still play their part in such endeavors, privacy coins like Monero are gaining ground thanks to their superior ability to conceal one’s financial footprints. A fact that perhaps casts a slightly darker hue on their recent success. 🤫

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2025-04-07 08:51