-

Project Golem moved over $124 million worth of ETH for staking.

Ethereum’s staking frenzy surged ahead of U.S. spot ETH ETFs launch.

As a seasoned crypto investor, I’ve witnessed the Ethereum [ETH] ecosystem evolve significantly over the years. The recent news of Project Golem staking 40K ETH worth over $124 million on the Ethereum network is an exciting development that underscores the growing adoption and confidence in Ethereum’s decentralized infrastructure.

Project Golem, the Ethereum [ETH]-driven marketplace for distributed computing, has jumped on the bandwagon of Ethereum staking.

On July 11th, according to reports from Lookonchain, the firm unexpectedly purchased $124.6 million worth of Ethereum (40K ETH) instead of selling as they had been doing recently.

Golem Network affirmed the Ethereum staking initiative, explaining that this action aimed to “make room” for contributors to actively engage with the network.

Today marks the official debut of the Golem Ecosystem Fund! We’ve set aside 40,000 ETH from the Golem reserve for this initiative. This significant investment will pave the way for innovators, academics, and business visionaries to realize their projects and enrich the Golem Network and its associated ecosystem.

Ethereum staking frenzy

The excitement for staking Ethereum has reached a fever pitch, with only a few days left before the possible launch of a U.S. spot ETH Exchange-Traded Fund (ETF). Notably, an unidentified wallet recently secured over 6,000 ETH at an undisclosed location.

The Golem Project’s decision to secure 40,000 ETH on July 11th led to a new record high for the Ethereum Beacon Chain, with a total of approximately 47.5 million ETH now locked in, representing over $140 billion at current market prices.

Beacon Chain is Ethereum’s system that handles the validation of new blocks.

![]()

Based on a recent article by AMBCrypto, the rising number of Ethereum (ETH) being staked before the launch of the U.S. spot Ethereum Exchange-Traded Fund (ETF) indicates a positive outlook among investors.

More ETH has been moved from exchanges, further reinforcing the bullish expectations.

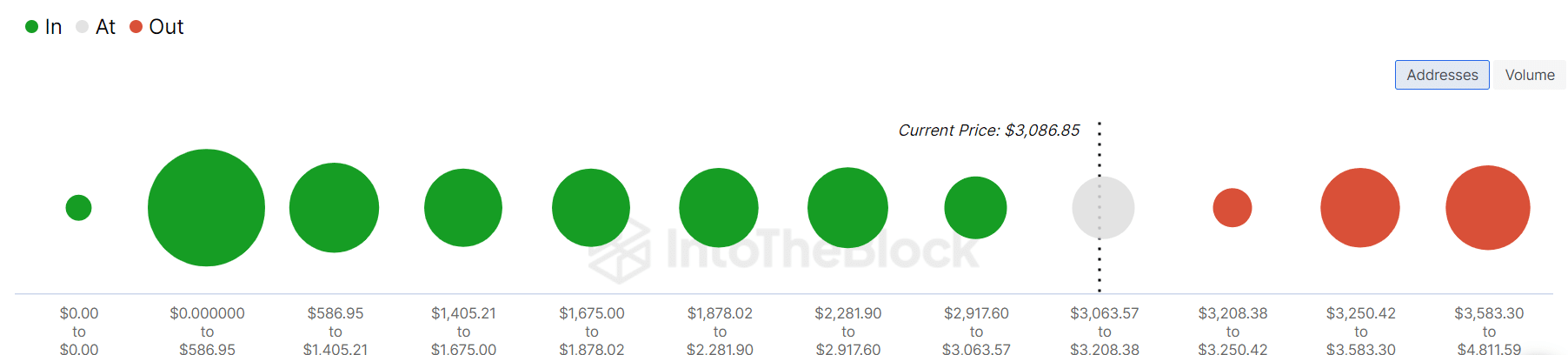

During this period, some investors faced losses at approximately $3.2K and $3.5K. If these levels are reached again and an investor has broken even, they might consider taking profits.

These prices are key levels to watch in the short term.

Read More

- OM PREDICTION. OM cryptocurrency

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oblivion Remastered – Ring of Namira Quest Guide

- Poppy Playtime Chapter 4: Release date, launch time and what to expect

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Solo Leveling Arise Amamiya Mirei Guide

- Serena Williams’ Husband’s Jaw-Dropping Reaction to Her Halftime Show!

- Ian McDiarmid Reveals How He Almost Went Too Far in Palpatine’s Iconic ‘Unlimited Power’ Moment

- Why Tina Fey’s Netflix Show The Four Seasons Is a Must-Watch Remake of a Classic Romcom

- Avowed Update 1.3 Brings Huge Changes and Community Features!

2024-07-13 03:03