- Pump Fun continued its selling spree with the latest release of 40,000 SOL tokens worth $6.68 million.

- Although this continued dump was causing market speculation, overall sentiment remained bullish.

As a seasoned crypto investor with a few battle scars and victories under my belt, I have learned to navigate through the tumultuous seas of the digital asset market with a mix of caution, optimism, and a dash of humor. After witnessing the recent events surrounding Solana [SOL], I find myself standing at an interesting crossroads.

Over the past month, after a prolonged period of decrease, Solana (SOL) appears to be exhibiting renewed activity. Consequently, the digital currency has staged a notable recovery.

Regardless of the recent increase, there remains a positive outlook in market speculation, particularly following the wave of buying triggered by the Pump Fun event.

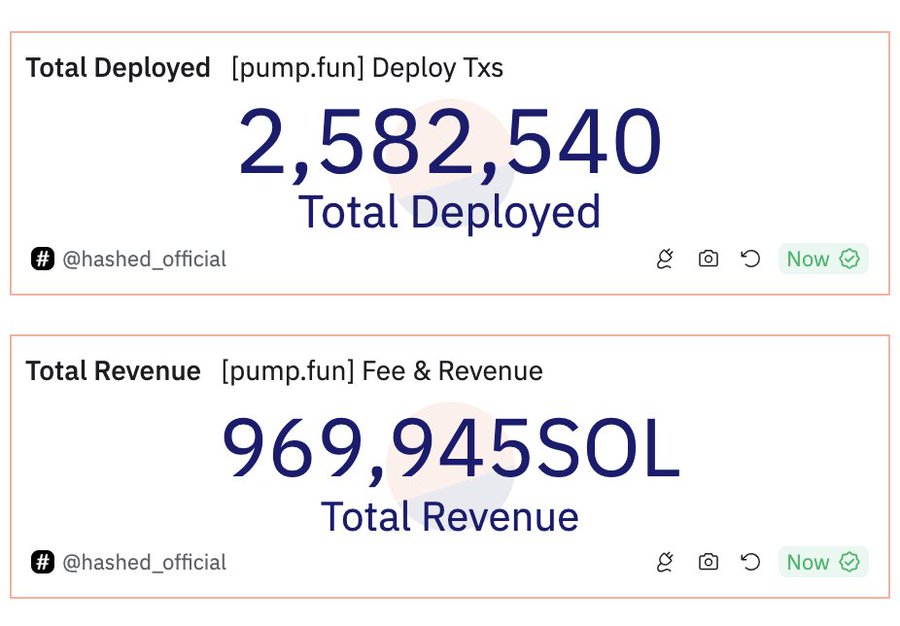

Pump Fun sells $6.68M SOL

As reported by Lookonchain, Pump Fun has just offloaded an additional 40,000 SOL valued at approximately $6.68 million. To date, this entity has sold a jaw-dropping 500,000 SOL tokens worth a whopping $78.7 million.

The persistent influx of data has sparked discussions among market participants about its potential effects on the wider Solana market. Consequently, given this pattern, investors are concerned that recurring closures might be causing temporary price squeezes, leading to a decline in values.

Impact on SOL?

Just as anticipated, the market responded swiftly, causing Solana (SOL) to dip slightly by 0.73% at this moment in time, going against the broader market’s upward trend.

Previously, the value of Solana was steadily increasing. It climbed by 8.34% over the course of a week and 14.60% over a month, hitting a new two-month peak of $168 on both weekly and monthly charts.

Based on my years of trading experience, I have observed that even when a stock like SOL experiences a steep drop in its daily charts, it doesn’t necessarily mean that the overall market sentiment has turned negative. In fact, I have seen instances where the broader market remained positive despite individual stocks experiencing significant declines. This teaches us the importance of not basing our investment decisions solely on short-term fluctuations but rather keeping a long-term perspective and considering the broader context.

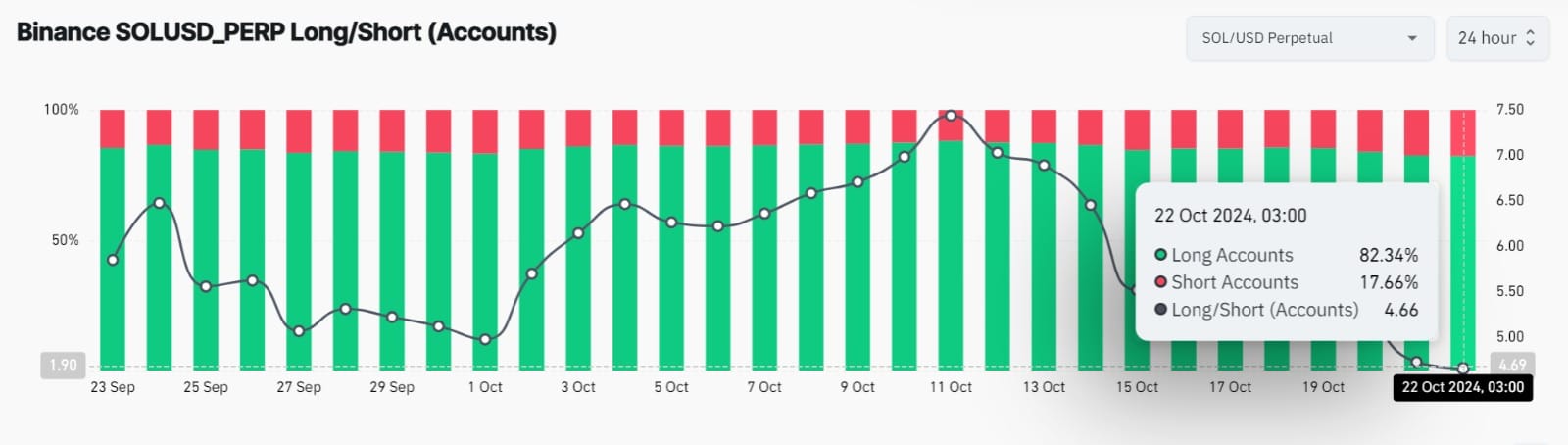

This market sentiment is shown by the fact that most traders are taking long positions.

Based on Coinglass data, it appears that the majority of Solana’s perpetual futures are held by users with long positions.

In other words, approximately 82.34% of traders have taken a long position, while only about 4.66% have gone short. This suggests that the majority of traders anticipate the prices to increase.

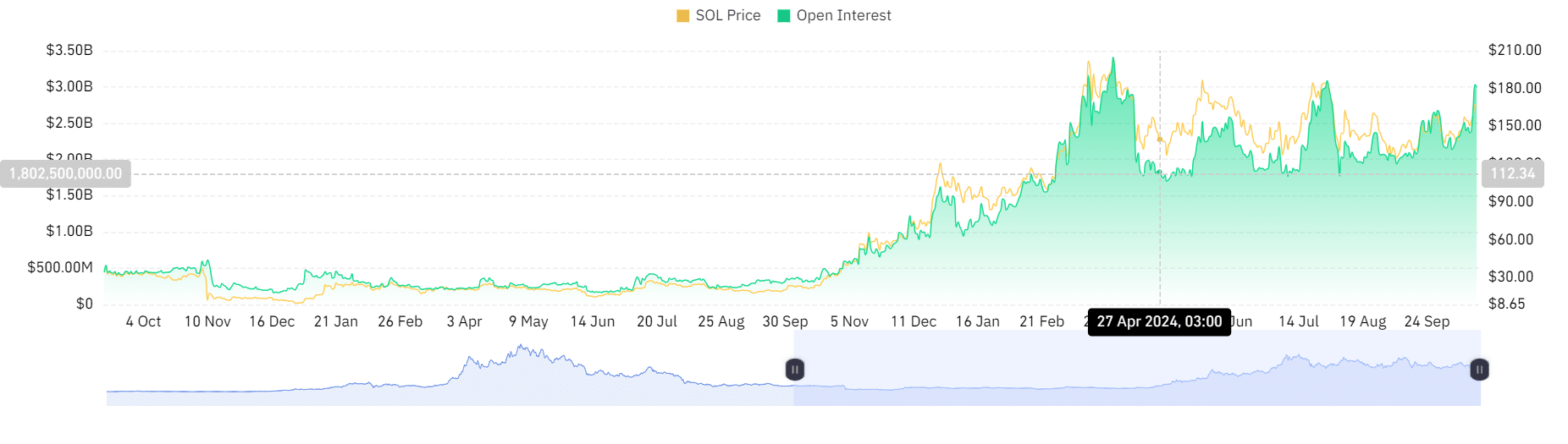

Moreover, the Open Interest (OI) on Solana’s exchanges has significantly increased in the past week, rising from a minimum of $705.3 million to $965.17 million.

This indicates that investors are persistently adding new investments, all while keeping their current ones, despite the market experiencing a decline.

This is further strengthened by the fact that OI has hit a three-month high of $3 billion.

Simply put, although Pump Fun is continually increasing supply, the overall market remains bullish.

This trend is clear as many investors are choosing to go long on an asset, and there’s a growing number of open contracts. If this pattern persists, it’s likely that SOL will aim for its next major resistance point around $185.

Read More

- PI PREDICTION. PI cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- PS5 Finally Gets Cozy with Little Kitty, Big City – Meow-some Open World Adventure!

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

2024-10-23 02:15