- Pyth Network’s recent $36 billion transaction volume surge and price breakout signal a potential bullish trend ahead.

- Rising open interest and social dominance reinforce market confidence, positioning Pyth for further price appreciation.

As a seasoned researcher with years of experience under my belt, I can confidently say that Pyth Network’s recent surge in transaction volume and price breakout has piqued my interest. The impressive growth in open interest and social dominance underscores a rising market confidence that positions Pyth for further price appreciation.

In the last month, Pyth Network’s [PYTH] impressive transaction volume of $36 billion places it as a significant competitor, surpassing Chainlink [LINK] in this aspect.

As a researcher, I’m thrilled to observe the significant surge in usage, which underscores the growing acceptance of Pyth’s groundbreaking pull-based Oracle model, particularly within the Decentralized Finance (DeFi) realm.

As I’m typing this, Pyth is currently trading at around $0.4038 – a 5.63% jump over the past 24 hours! This positive trend indicates that Pyth might be on track to grab a larger piece of the market pie and potentially draw in more crypto investors like myself.

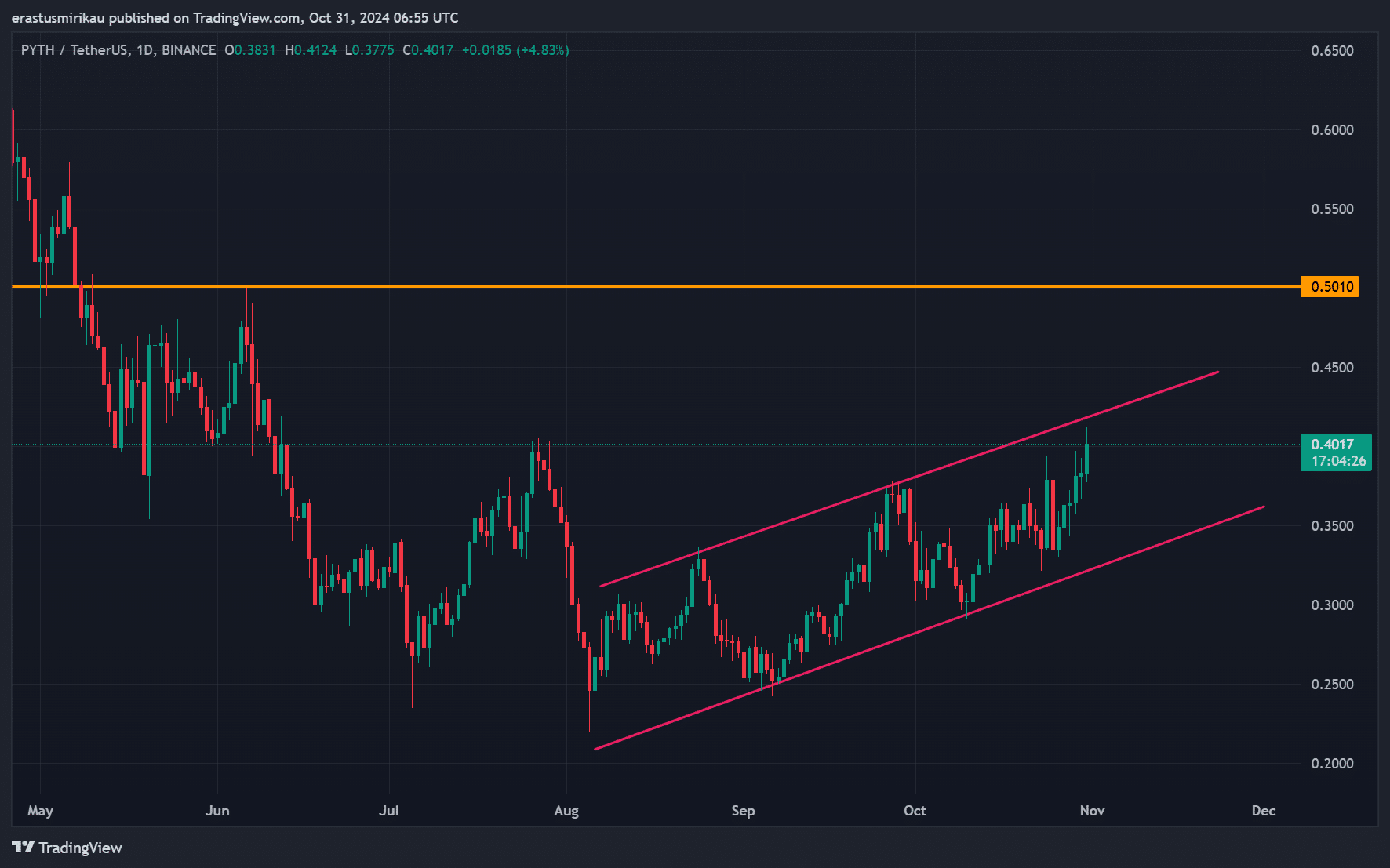

Are we witnessing a breakout? Chart analysis of Pyth Network

The recent market behavior suggests that Pyth has breached an evident uptrend line, which could mean a change in direction and possible sustained growth. Experts have marked $0.5010 as a significant resistance point to watch out for.

If it surpasses this boundary, it might stimulate additional positive feelings among investors. Analyzing the price trend within this range suggests a strong possibility of continued growth in the short term.

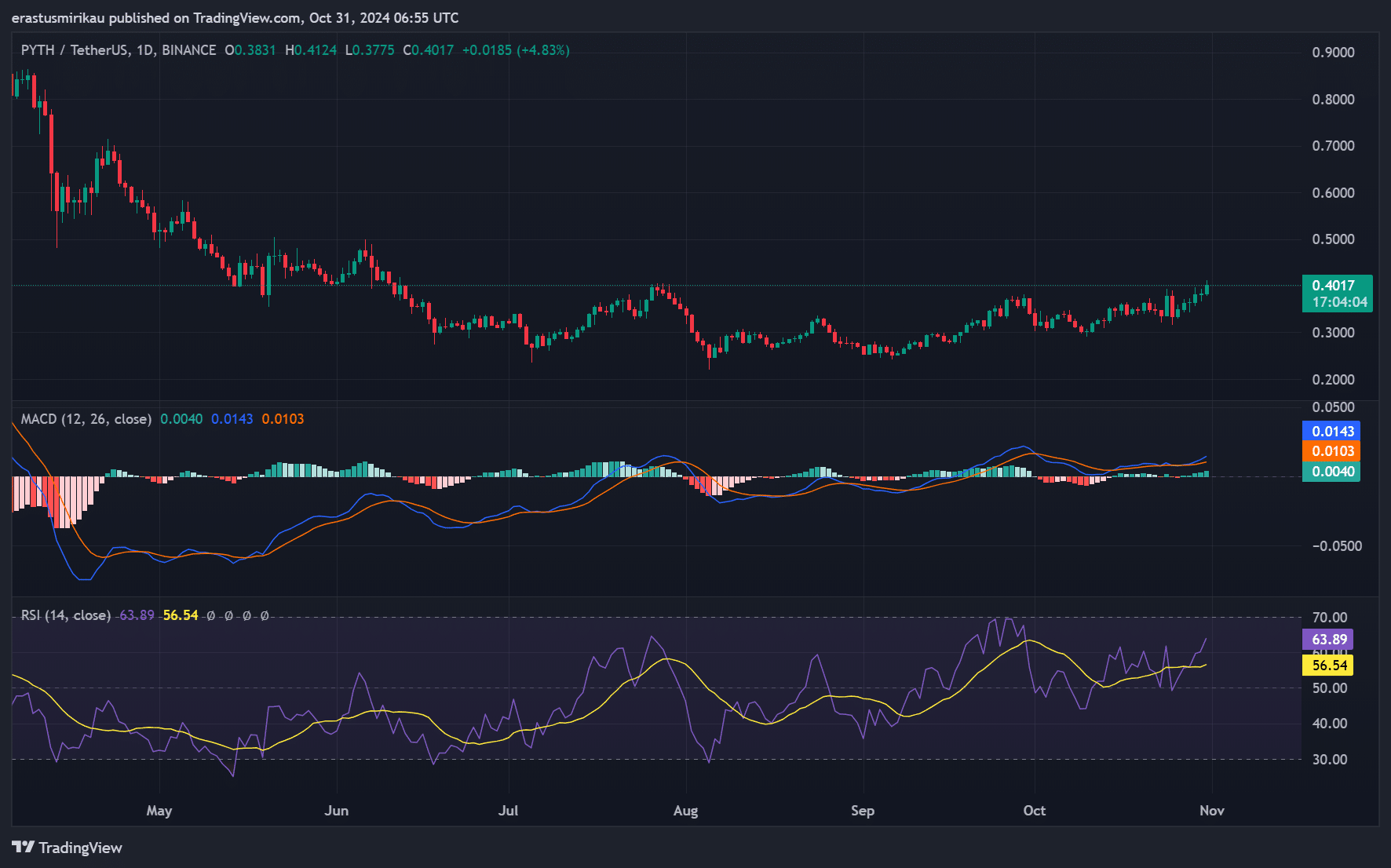

What do the indicators say? Analyzing RSI and MACD

Looking at the technical analysis, the Relative Strength Index (RSI) stands at 63.89, suggesting that Pyth is nearing overbought conditions, potentially triggering a price adjustment. Yet, it still has enough power to drive prices upward.

Furthermore, the MACD (Moving Average Convergence Divergence) line demonstrates a bullish merge, implying that the current market movements support further growth. Together, these indicators offer a well-rounded perspective, suggesting that although vigilance is essential, the overall trend continues to be positive.

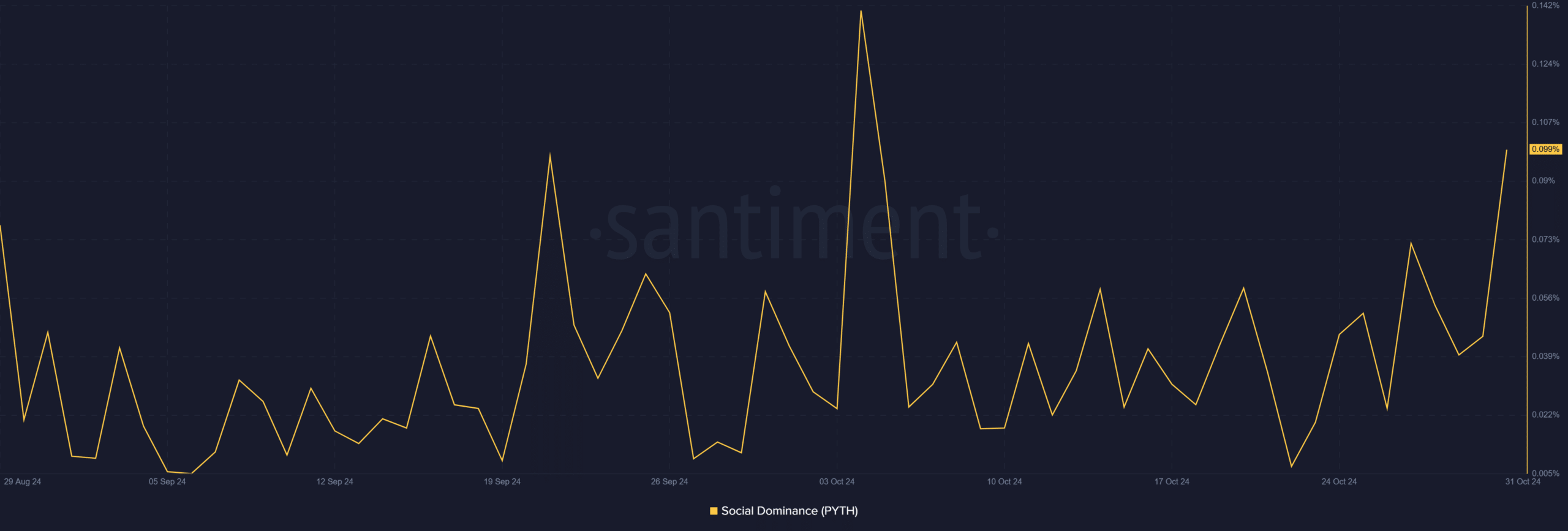

Pyth’s social dominance: How does it stack up?

Currently, the level of social dominance stands at a mere 0.0994%, indicating growing community involvement and interest. This heightened engagement is pivotal in shaping future market dynamics.

Stronger social standing typically goes hand-in-hand with a higher trading volume, which further cements Pyth’s role in the market. Given the increasing level of interaction, this could draw in additional investors eager to profit from its current surge.

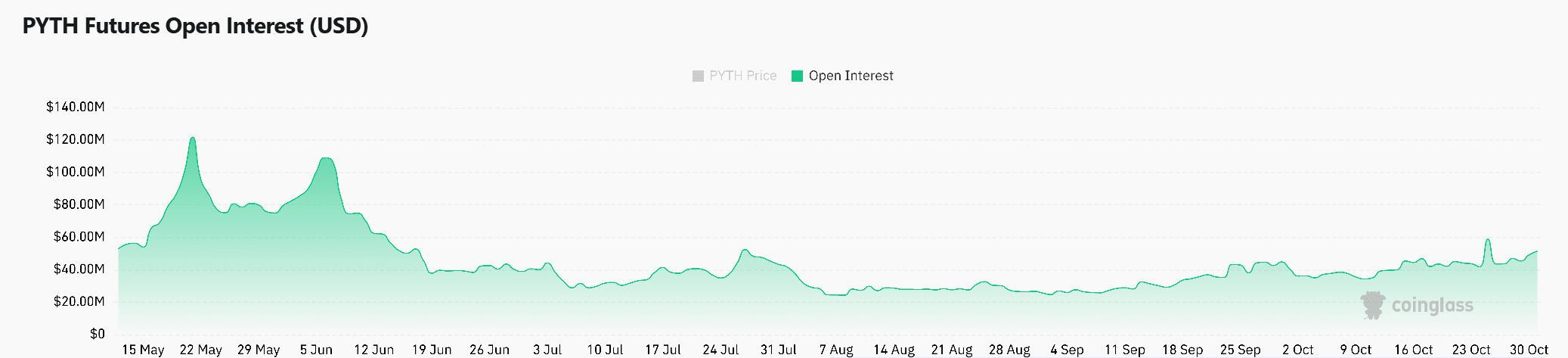

Market sentiment: Is the open interest growing?

The amount of outstanding contracts significantly rose by about 30.77%, totaling approximately $66.39 million. This substantial growth suggests that traders continue to be optimistic about the market trends and are probably preparing their positions in anticipation of possible profits, given their bullish sentiments.

As a result, an increase in open interest often means more traders are joining the market, which tends to strengthen price consistency and development.

Realistic or not, here’s PYTH market cap in BTC’s terms

PYTH poised for a significant upward trajectory

Based on its latest accomplishments and technological signals, Pyth Network appears to be heading towards a robust bullish phase. There’s been a substantial surge in transaction activity, a bust through its upward trend line, and an uptick in social influence – all of which point to the potential for even more price growth in the future.

Consequently, keep an eye on Pyth’s progress since it intends to overcome critical resistance points. This potential achievement may strengthen its position as a premier Oracle service provider.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-10-31 22:16