-

QNT crypto has soared to its highest price in nearly two weeks.

The gains come amid a surge in open interest and network activity.

As a seasoned crypto investor with scars from the 2017 bull run and the subsequent bear market, I can confidently say that the recent surge of Quant [QNT] has caught my attention. After years of watching the market ebb and flow, I’ve learned to read between the lines of charts and data, and QNT’s current performance is sending some very promising signals.

Over the past 24 hours, Quant [QNT] has surpassed many other cryptocurrencies, achieving a 7.5% increase. This upward trend occurs as demand for the token escalates, resulting in trading volumes jumping by over 200%, according to data from CoinMarketCap.

At the moment of writing, Quant (QNT) was priced at $70.95 – a level not seen in almost two weeks. However, with the overall cryptocurrency market trending bearish, what exactly is driving the increase in QNT crypto value?

Bulls take charge

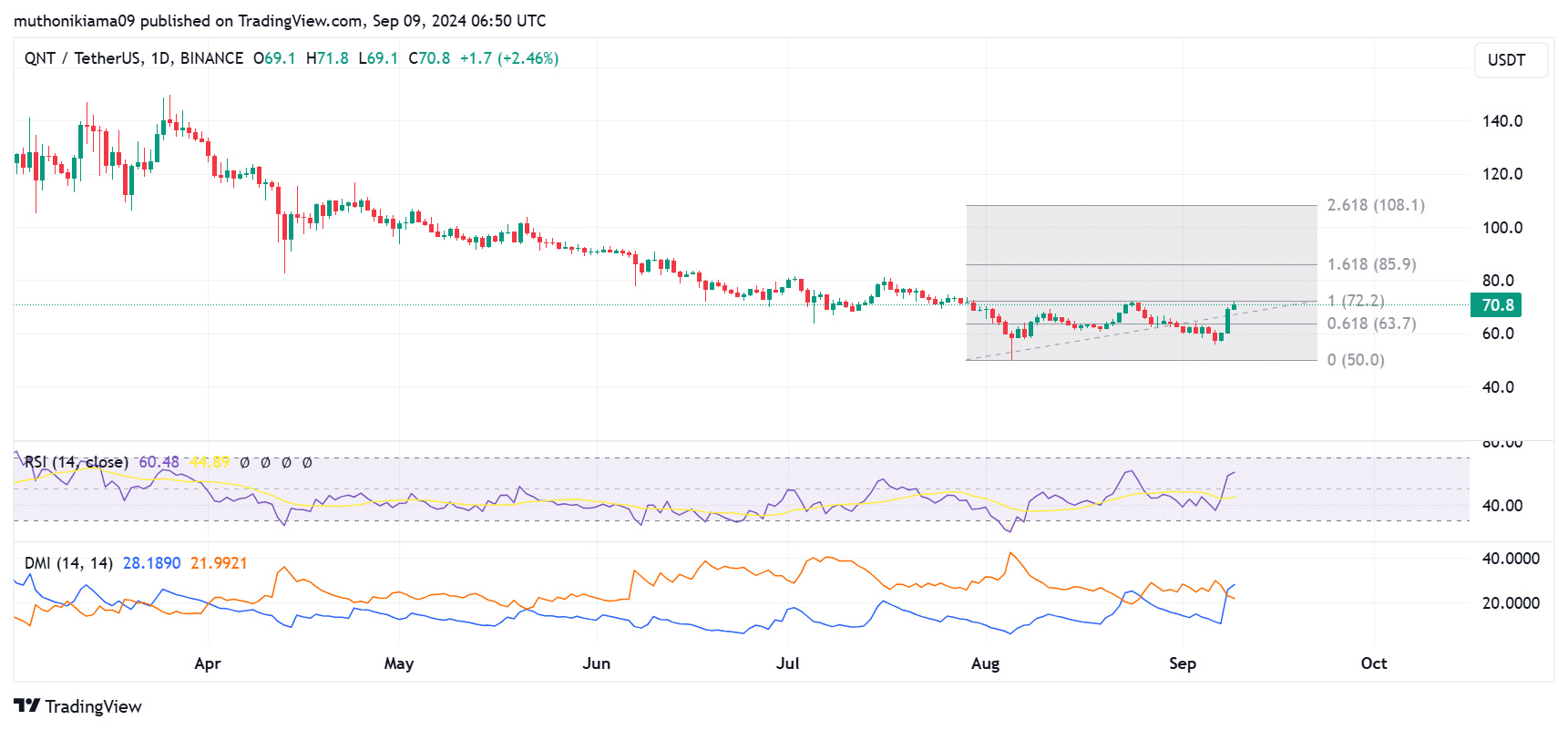

A surge in buying activity is behind QNT’s rally. The Relative Strength Index (RSI) was at 61, showing bullish momentum. Moreover, despite an influx of buyers, QNT is not yet overbought, an indication that there is room for further growth.

The Relative Strength Index (RSI) line has significantly increased and surpassed its signal line, indicating that demand is stronger than supply, meaning buyers are more active than sellers.

In simpler terms, the upward trend’s potency is reinforced by the Directional Movement Index (DMI), since the Positive Directional Index (+DI) has moved above the Negative Directional Index (-DI). This crossover could be interpreted as a buying signal by traders, suggesting that they may expect the price to keep increasing.

As QNT approached a significant resistance of around $72, which is also the 100% Fibonacci level, it’s worth noting that this price point has historically proven to be robust. Previous surges have often been halted when QNT gets close to it.

Yet, as more buyers are joining the market, it’s plausible that a breakthrough could occur. Should QNT surpass its current resistance point, the subsequent aim is approximately $85, or the 1.618 Fibonacci level.

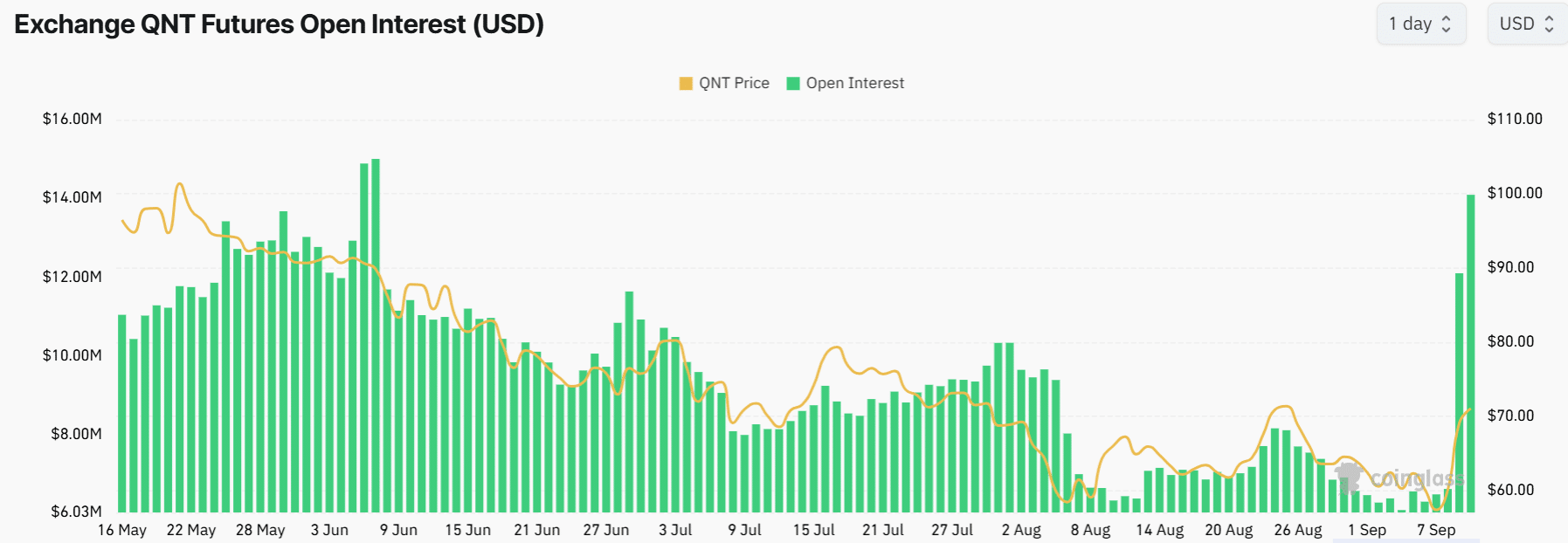

There’s been growing attention towards the QNT cryptocurrency on the derivatives market, as indicated by the recent surge in Open Interest to its highest level in several months.

QNT’s Open Interest was $14 million at press time, an over two-fold increase within 24 hours as seen on Coinglass.

On-chain metrics support QNT crypto rally

As an analyst, I’m observing a bullish trend for QNT based on on-chain data analysis. According to CryptoQuant, exchange reserves for QNT have plummeted to levels not seen since mid-July, suggesting increased withdrawal activity and potentially reduced supply available for sale.

A decrease in the number of QNT tokens available for trading on exchanges often implies increased scarcity. As demand increases while supply remains steady, this trend bolsters the bullish argument.

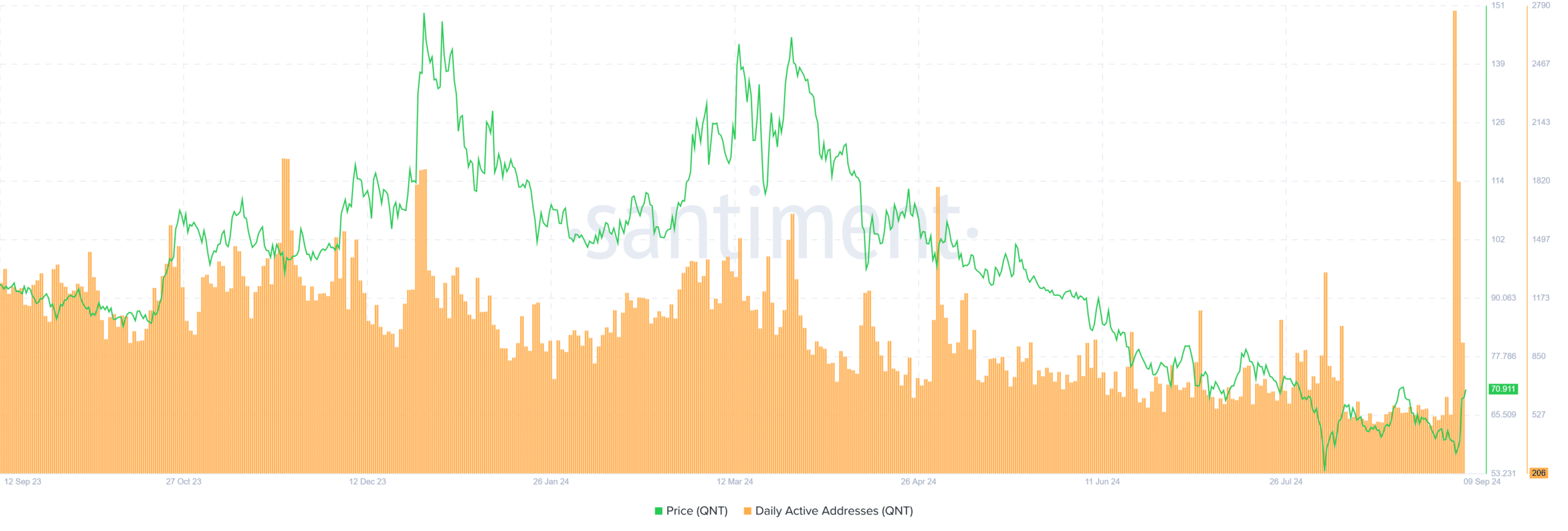

Additionally, it’s worth noting that there’s been an increase in activity on the Quant Network. According to data from Santiment, the number of daily active addresses reached its peak in more than a year, suggesting robust growth and increased adoption for the network.

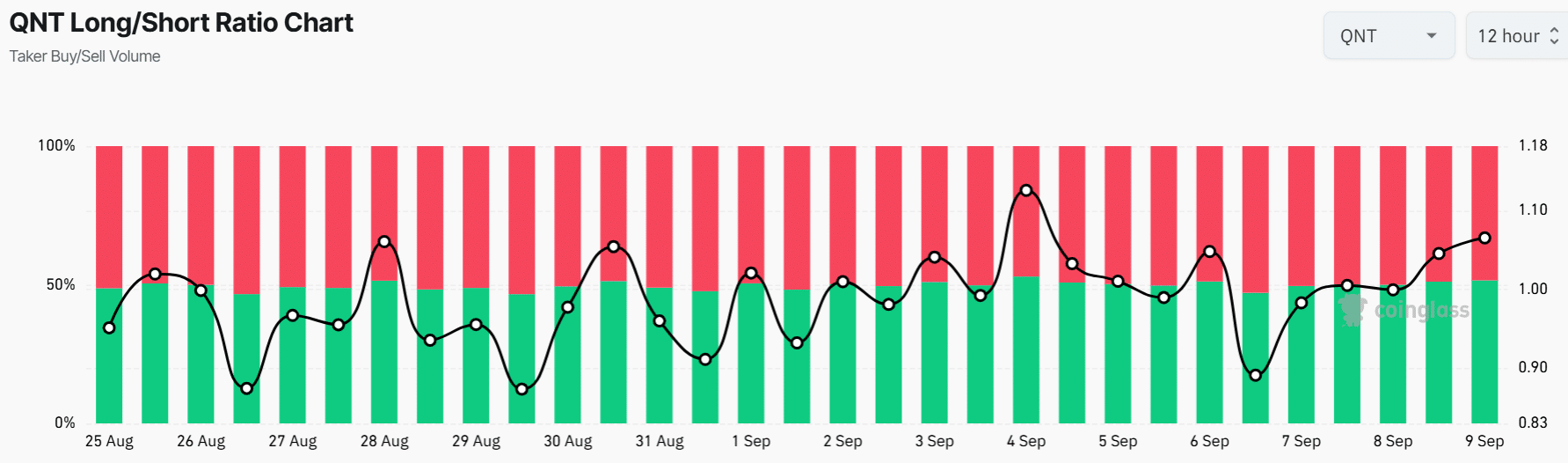

With additional optimistic indicators surfacing, the current Quant (QNT) long/short ratio is subtly climbing from less than 1 to 1.06 as we speak, signifying a modest uptick in long investments. Yet, this ratio suggests that the market remains relatively evenly balanced.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

2024-09-10 07:03