- QNT nears a potential breakout with key resistance at $80.38, bolstered by bullish sentiment.

- Mixed on-chain signals hint at cautious optimism, with large transactions showing bullish interest.

As a seasoned crypto investor who has navigated through market cycles and witnessed the rise and fall of numerous digital assets, I find myself cautiously optimistic about Quant [QNT]. The technical indicators suggest a potential breakout, but as we all know, nothing is ever guaranteed in this wild world of cryptos.

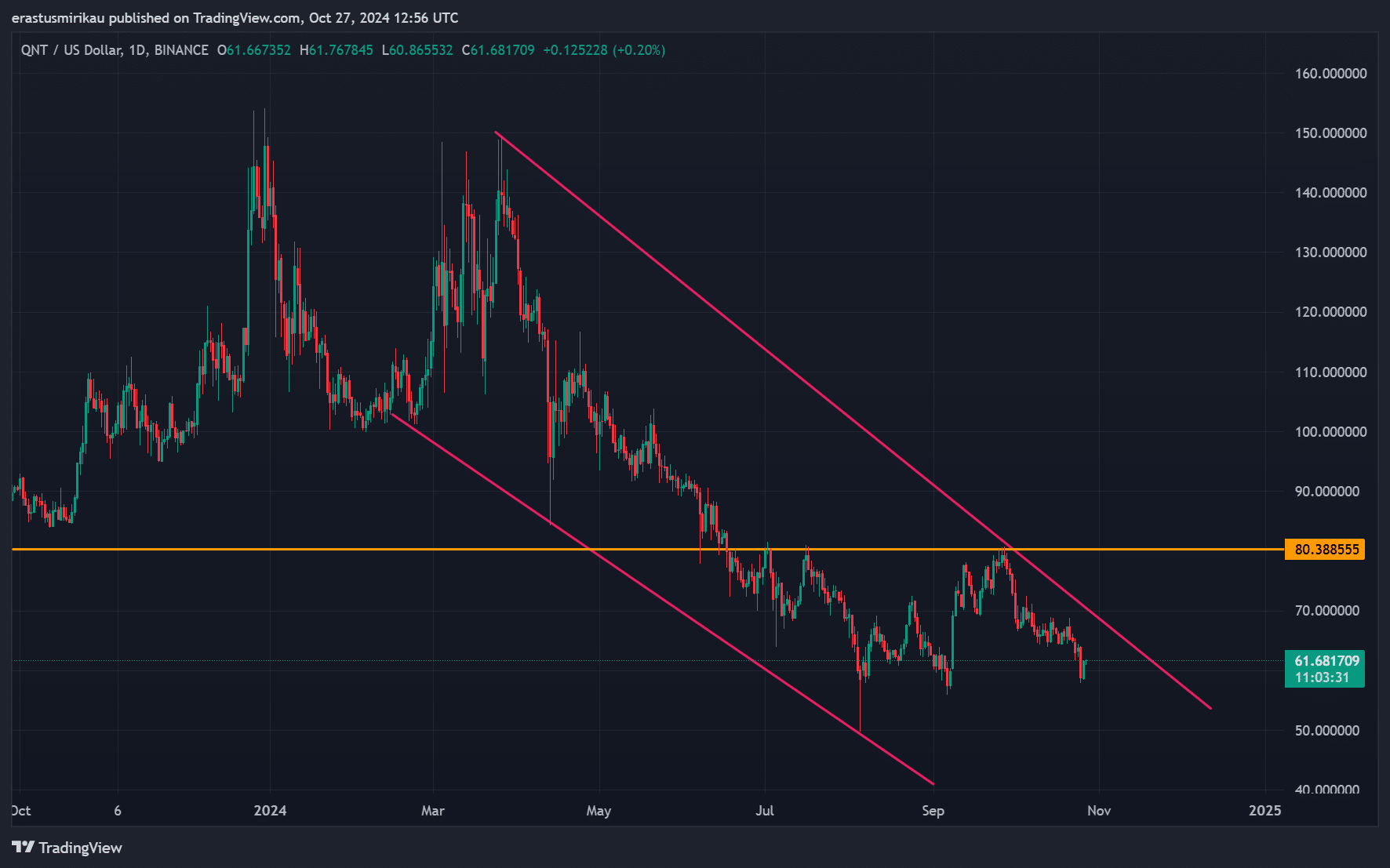

As I analyze the current market position of Quant [QNT], it seems we’re on the verge of a significant shift. The stock is moving within a falling wedge pattern, which often indicates an impending bullish reversal. This extended downtrend appears to be nearing its end, potentially paving the way for a noteworthy price surge.

At the current moment, Quant is trading at $61.65 and has risen by 3.24%. As of now, a significant resistance level lies near $80.38. If this level is surpassed, it might indicate a resumption of the bullish trend.

Furthermore, it appears that the general public’s sentiment and the smart money’s sentiment are both positive, with values of 0.29 and 0.86 respectively. This seems to indicate a bullish outlook among market participants, who expect an increase in the price of Quant. Consequently, the upcoming market behavior may play a significant role in determining its future trend.

Key technical indicators: Bollinger Bands, RSI add weight to bullish sentiment

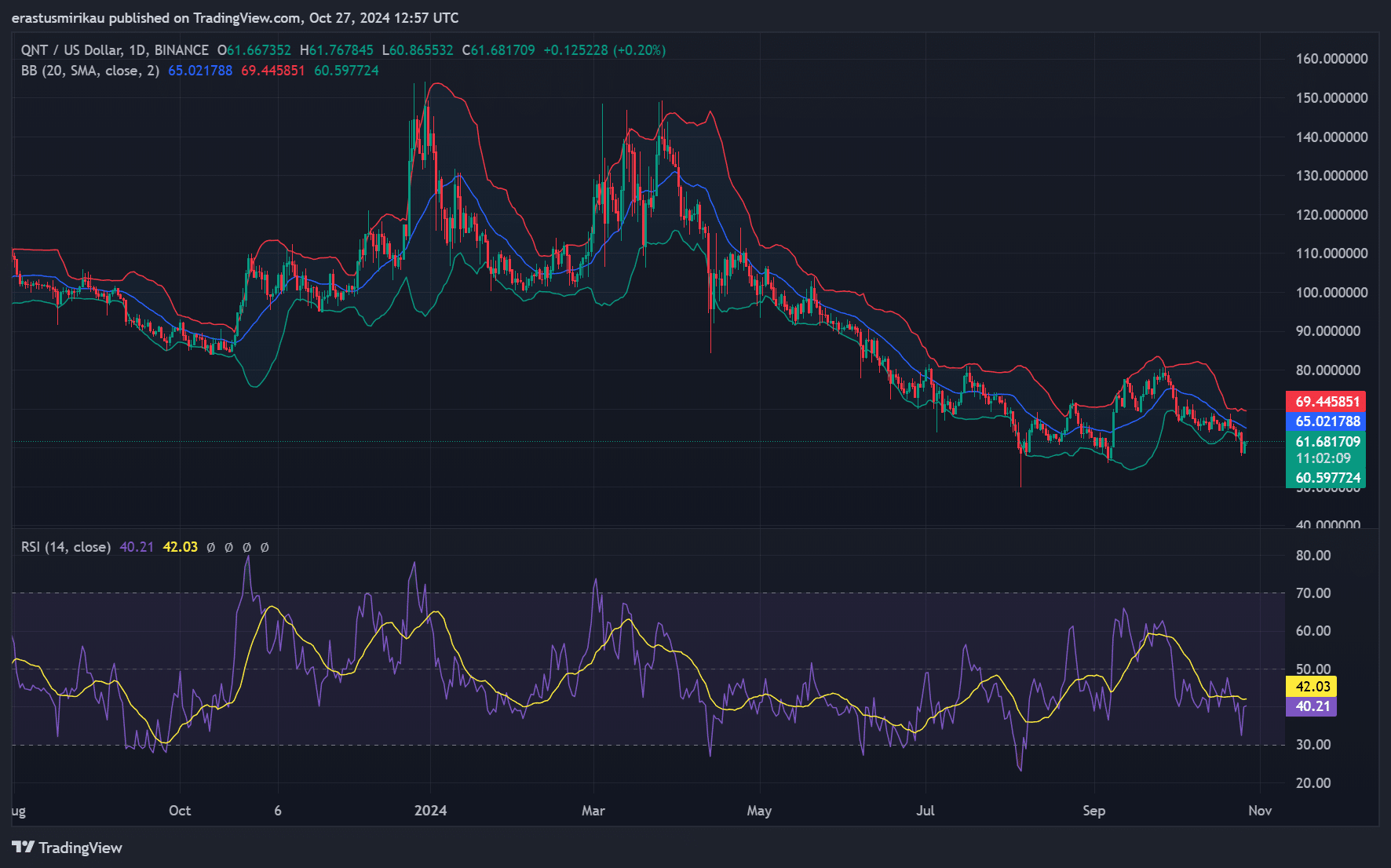

A closer look at QNT’s technical indicators suggests a possible breakout, as its price movement has been close to the lower limit of the Bollinger Bands displayed on the daily chart.

Based on my years of trading experience, I find that when a market appears to be oversold, it usually indicates a buying opportunity. This is because oversold conditions often lead to a reversal, as buyers step in to capitalize on undervalued assets. I’ve seen countless instances where this pattern has played out, and I believe that understanding and recognizing these moments can be crucial for successful trading.

As a crypto investor, I’ve noticed that the Relative Strength Index (RSI) for Quant has dipped down to 42, signaling it’s starting to leave oversold territory. If this RSI trend continues and moves higher, it could potentially trigger more buying activity, boosting the chances of a breakout.

The signs point towards an impending surge in the market, but it’s essential to break through the resistance level before that can happen.

QNT price and DAA divergence: Is a network boost needed?

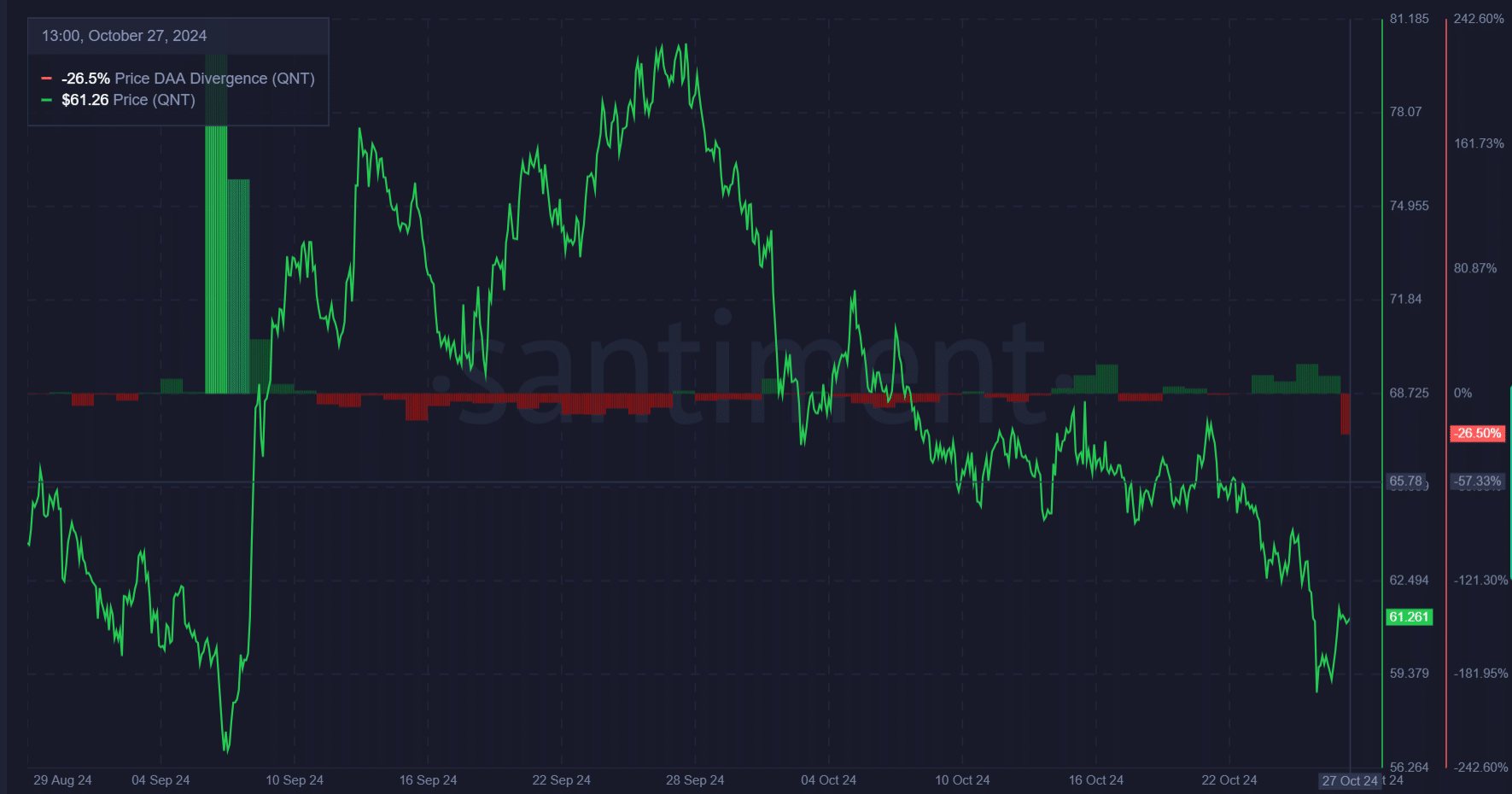

It’s worth noting that the price trend of QNT seems to differ from the Daily Active Addresses (DAA), an essential on-chain indicator. At a divergence rate of -26.5%, the current network activity appears to trail behind the recent growth in price.

This divergence often implies that although price shows strength, network engagement needs to catch up to sustain a rally.

Consequently, if the difference between DAA (Daily Accumulation Average) and price narrows, it could boost bullish sentiments. When the trends of price and DAA align, it provides a stronger base for Quantstamp (QNT) to potentially surge and decreases the chance of a brief upswing being short-lived.

On-chain signals: Mixed indicators, but large transactions bullish

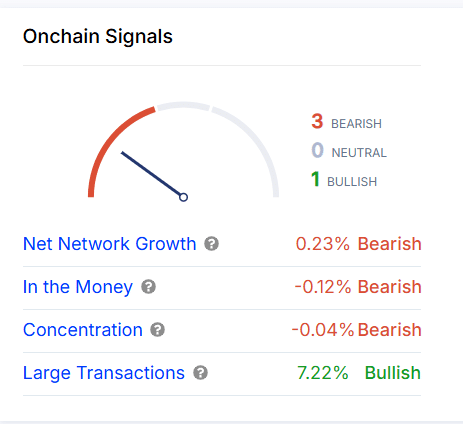

Looking at additional indicators from the blockchain paints a somewhat ambiguous picture. Factors like positive network growth (by 0.23%), decreasing number of in-the-money addresses (-0.12%), and reduced concentration (-0.04%) suggest a slightly bearish trend is emerging.

On the other hand, significant transactions have experienced a 7.22% increase, indicating a strong buying trend among bigger investors. This accumulation by larger holders might establish a solid foundation of support. If other indicators also strengthen, it could lead to a more powerful price rise.

Read Quant’s [QNT] Price Prediction 2024–2025

Based on the collective public opinion, the actions of astute investors, and technical signals, Quant (QNT) seems ready for a significant surge.

If the price surpasses $80.38, it might trigger an upward surge, rekindling enthusiasm throughout the market. But to maintain a bullish momentum, it’s crucial that on-chain activities mirror the price increase.

Read More

2024-10-28 10:16