- QNT broke out of a descending wedge, retesting the $139 resistance with strong technical indicators

- Market sentiment and on-chain metrics, including a 3.59% surge in large transactions, remained bullish too

As a seasoned analyst with over a decade of experience in the dynamic world of financial markets, I find myself intrigued by Quant [QNT]’s recent developments. The bullish breakout and strong technical indicators have piqued my interest, especially given the crucial resistance retest at $139.

Quant (QNT) is making waves in the cryptocurrency sector due to its bullish surge and robust technical signals. Currently trading at $141.98 following a 6.08% drop, QNT appears to be reassessing an important resistance point near $139.

In this critical juncture, I find myself observing whether the token will continue its ascending trend or not, as it vigorously strives to preserve its positive trajectory.

QNT chart analysis – The breakout and key resistance retest

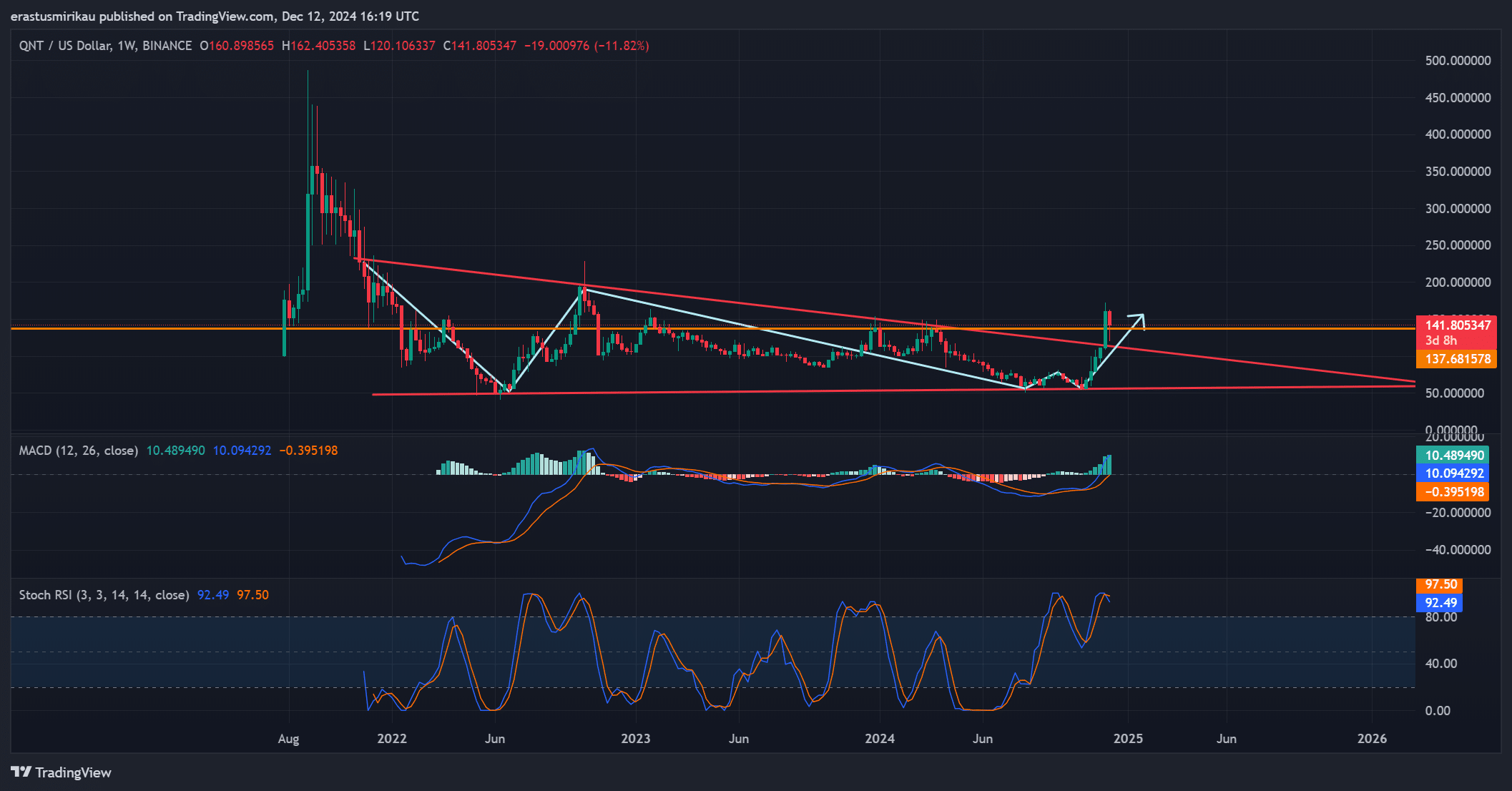

Lately, Quant (QNT) has burst free from a prolonged descending triangle, a frequently observed technical formation suggesting potential bullish reversals. Yet, the current re-evaluation of the $139 resistance point is pivotal. If this barrier endures, it might verify the breakout and pave the way for higher price objectives.

In summary, while technical indicators gave a somewhat conflicting yet predominantly optimistic forecast, the Moving Average Convergence Divergence (MACD) displayed a slight bearish trend that’s on a downward trajectory, with a reading of -0.39. On the flip side, the Stochastic Relative Strength Index (RSI) stood at 97.50, signaling overbought conditions and suggesting robust buying pressure.

In other words, with these numbers combined suggesting a rise, it’s crucial that the $139 level holds firm for the positive outlook to continue being relevant.

On-chain signals reveal growing strength

The data on the blockchain supports a positive outlook for QNT. The network is experiencing growth as its user base increases, indicated by a 0.84% rise in network expansion. Furthermore, there’s been an uptick of 3.59% in large transactions, suggesting increased attention from big-time investors and institutions.

Although the number of “in-the-money” addresses dipped slightly by 0.22%, suggesting a minor drop in profitability for holders, it’s worth noting that exchange reserves also decreased by 0.07%. This means there are now only 1.542 million QNT coins held on exchanges, as revealed by CryptoQuant analytics. This decrease suggests reduced selling pressure, which can often signal an upcoming price increase.

Market sentiment is turning optimistic

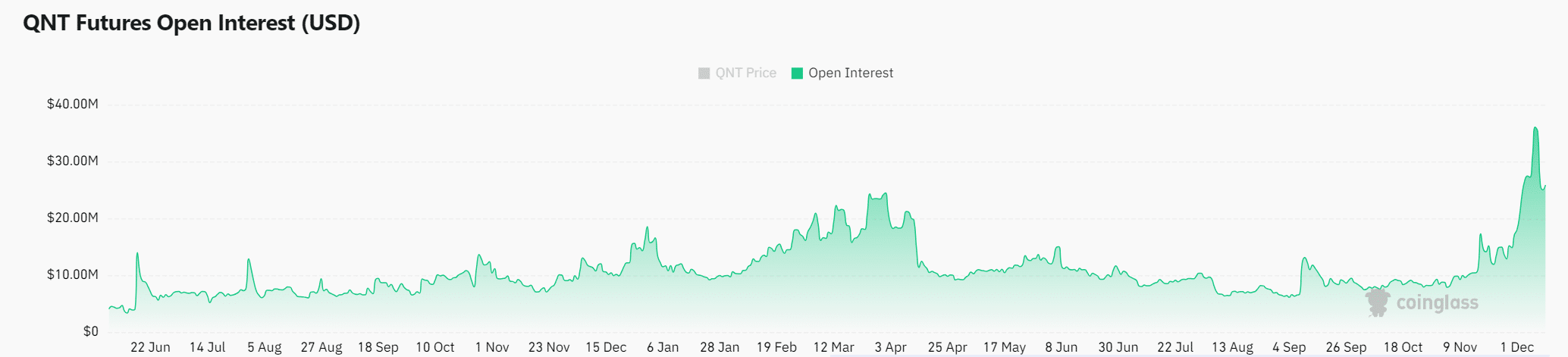

The general feeling towards QNT is optimistic, as indicated by a 3.72% rise in open trades, amounting to approximately $28.27 million. This increase suggests an increase in trading activities and investor confidence.

Moreover, the general public’s opinion and the actions of intelligent investors appeared to be consistent as well, which added more confidence to the expectation that the price trend of QNT would be favorable.

Read Quant’s [QNT] Price Prediction 2024–2025

Can QNT rally into 2025?

It’s likely that Quant (QNT) will continue its upward trend and potentially increase even more. This optimistic outlook is based on its technical prowess, favorable on-chain indicators, and increasing bullish sentiment among investors, suggesting a potential surge in value.

Conversely, maintaining a position above $139 is vital for validating this breakthrough and potentially yielding substantial returns by 2025.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

2024-12-13 11:35