- QNT’s breakout from its descending trendline and bullish indicators signaled potential gains to $229

- On-chain metrics and declining exchange reserves highlighted growing demand and reduced selling pressure

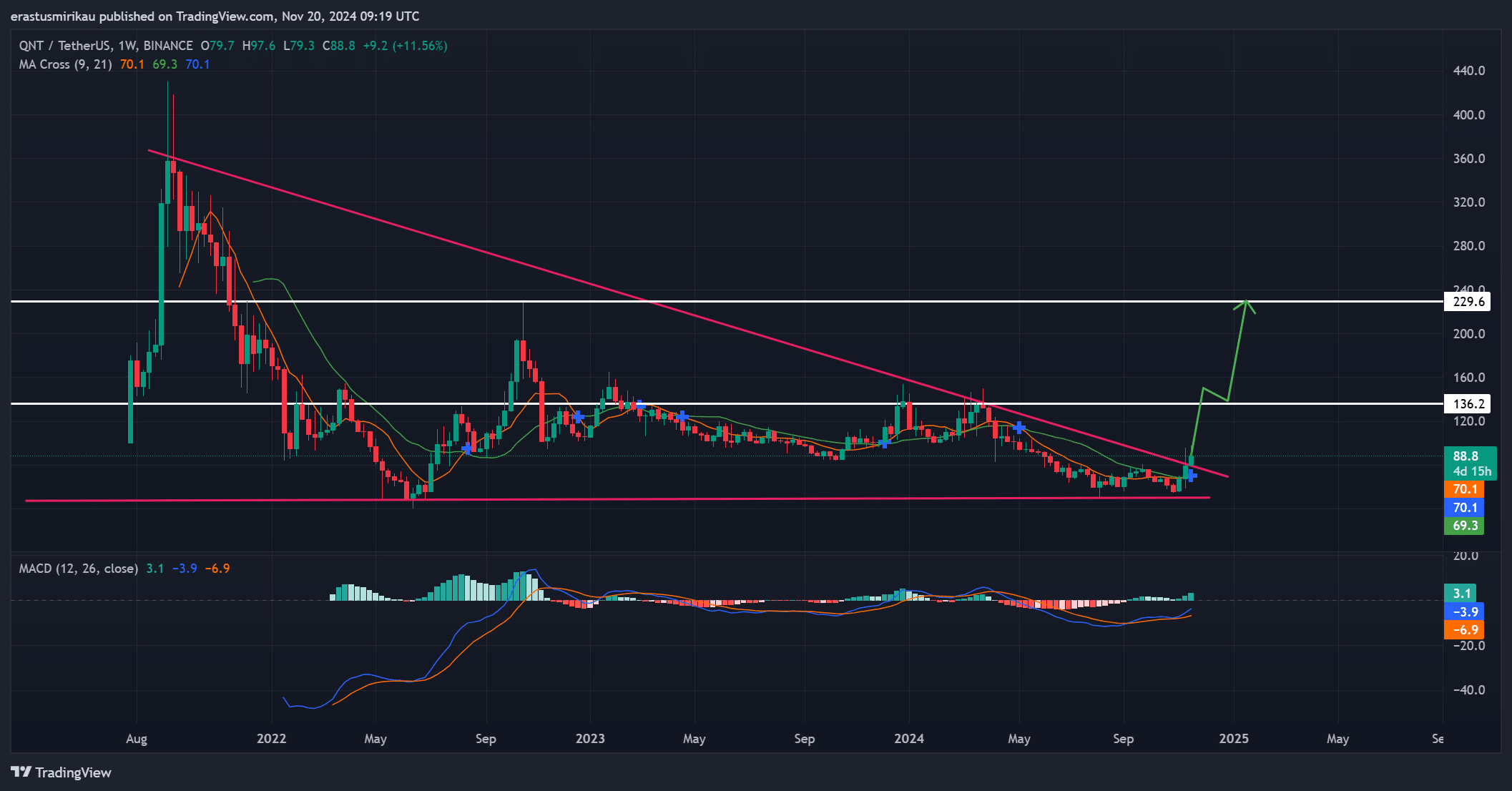

As a seasoned researcher with over a decade of experience in the crypto market, I have witnessed numerous bull and bear cycles. However, the recent breakout by Quant [QNT] from its descending trendline has piqued my interest. The technical indicators suggest that this could be more than just another fleeting rally – it might signal the start of a major bullish phase for QNT.

As a crypto investor, I’m thrilled about the recent breakout of Quant (QNT) from a prolonged descending trendline on its weekly chart. This development has stirred anticipation among traders and analysts, suggesting a potential reversal of the bearish trend that has persisted for months. Currently, QNT is trading at $88.76, marking an increase of 0.81% over the past day.

However, the question remains – Can QNT sustain this momentum and hit new highs on the charts?

Technical analysis hints at bullish targets

Quant’s exit from its downward trending channel signaled a notable change in investor optimism. This technological event hinted that the cryptocurrency might target its initial resistance level at approximately $136.2.

Furthermore, should the rally continue, Quantumscape Corporation (QNT) could potentially push higher towards the crucial $229 mark, presenting a promising opportunity for gains.

Furthermore, the crossover in the Moving Average indicated strengthening bullish sentiment. Specifically, the 9-week average price at $70.1 surpassed the 21-week average price at $69.3. Historically, this pattern is often associated with an increase in the stock’s value.

Furthermore, the MACD (Moving Average Convergence Divergence) indicator reinforced this perspective, as its histogram displayed a positive value at the time of analysis, equating to 3.1. This suggests that the bullish momentum is growing stronger. Combining these technical indications, it appears we might be headed towards significant resistance levels around $136.2 and $229 in the short term, suggesting potential price increases.

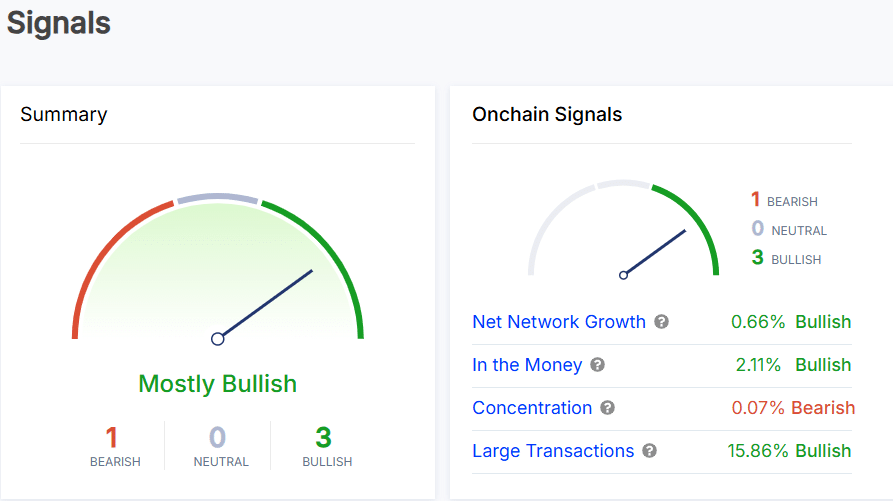

QNT’s bullish on-chain metrics add further confidence

The data recorded on the blockchain offers additional grounds for positivity. For example, the Network Growth Metric increased by 0.66%, suggesting an uptick in new users and activity within the Quant network. Moreover, the “In the Money” indicator shows that approximately 2.11% of QNT holders are currently making a profit – an indication of more favorable investor attitudes.

As a crypto investor, I’ve noticed a significant spike of about 15.86% in large transactions, suggesting increased interest from high net-worth individuals or institutions. While the dominance of large holders remained relatively unchanged, hinting at minimal bearish pressure, the overall picture on the blockchain appears heavily biased towards bullish activity.

As an analyst, I found that QNT’s on-chain activity appeared consistently aligned with its optimistic technical breakthrough.

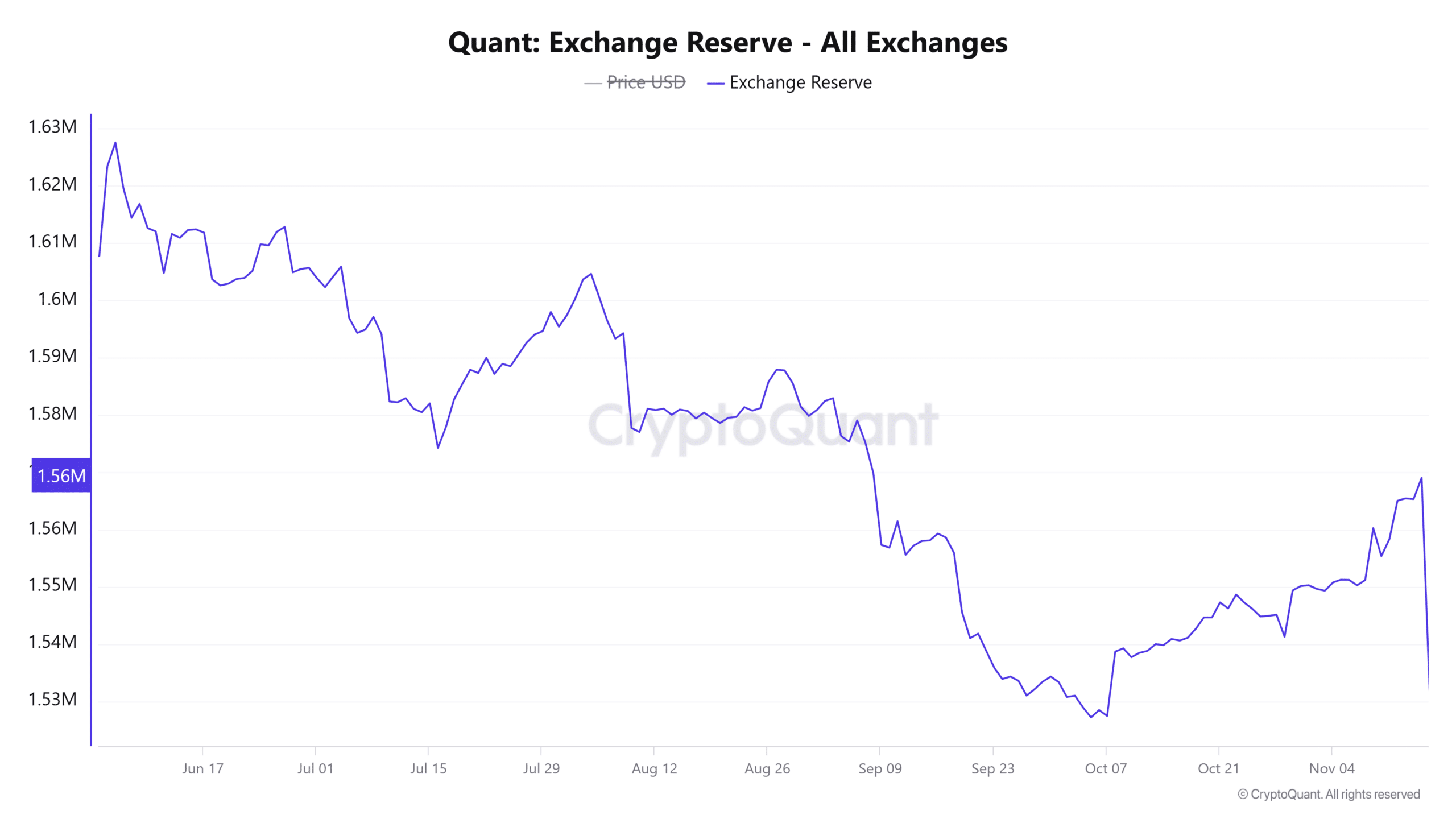

QNT exchange reserves point to lower selling pressure

At the current moment, Quant’s estimated exchange reserves are at approximately 1.526 million, having decreased by 0.07% over the past day.

A decrease in available exchange reserves might indicate that investors are holding onto their assets for the long term instead of selling them. This shift could lead to a scarcity of supply in the market, which may strengthen the ongoing price increase.

Read Quant’s [QNT] Price Prediction 2024–2025

The surge of QNT beyond its downward sloping trendline, combined with optimistic technical signals and solid on-chain statistics, hints at potential continued increases in the value of this cryptocurrency.

Should it manage to surpass the $136 barrier, there’s a strong possibility it could trend upwards towards $229. This suggests that Quant (QNT) might be on the verge of a significant bullish run, making it an intriguing token to keep an eye on in the short term.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

2024-11-21 07:35