-

QNT struggled to break the $85 resistance, with support holding at $75 amid mixed RSI signals.

On-chain indicators showed whale accumulation and a positive funding rate, hinting at a potential rally.

As a seasoned crypto investor with a knack for spotting emerging trends and analyzing market data, I find myself intrigued by Quant (QNT). The recent price action has been a rollercoaster ride, with QNT testing the $85 resistance before retreating to support at $75.

The digital asset Quant (QNT) remains captivating for both individual investors and large financial institutions, primarily because it exhibits a robust optimistic trend.

Based on the latest figures, there’s an overall positive outlook towards the market, leading some to ponder if Quant (QNT) will continue its progress or encounter additional hurdles instead.

Currently, Quantum Network Token (QNT) is being traded at $75.36, marking a decrease of 1.88% over the past day. However, despite this minor drop, numerous investors continue to be intrigued by its prospective surge. Whether QNT can maintain its upward trajectory will depend on various factors.

Key resistance levels and price action analysis

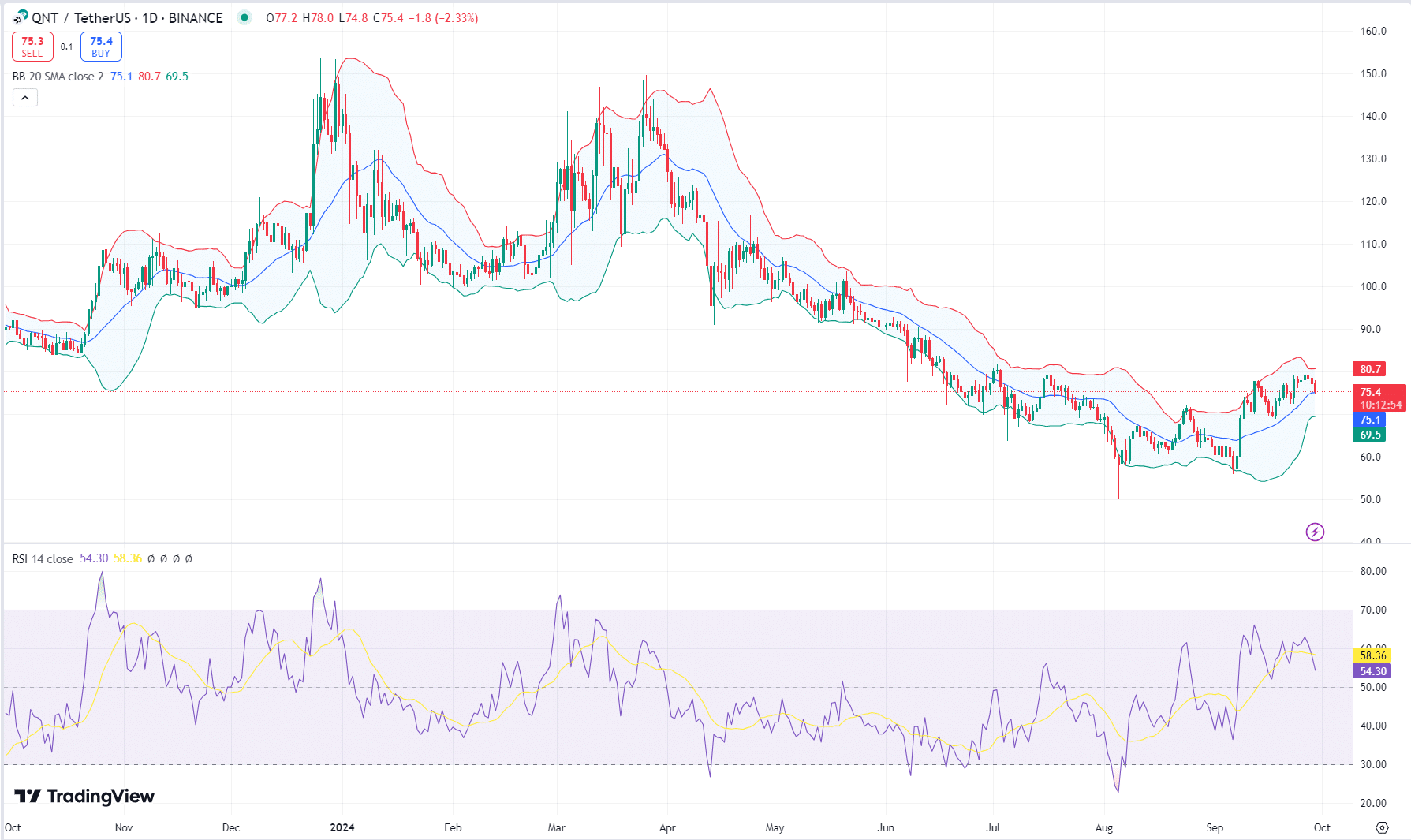

In simpler terms, the price of QNT reached approximately $85 after a continuous increase in September, but it failed to surpass this level and instead fell back into the region around $75. At present, the 20-day Simple Moving Average (SMA) stands at about $75.1, serving as significant support for the price.

Consequently, maintaining this level is crucial if we’re to expect any more bullish advancements. Should Quantstamp (QNT) stay above this particular level, it might challenge the upper boundary of the Bollinger Band around $80.7, offering a temporary advantage to the bulls.

Moreover, the Relative Strength Index (RSI), currently at 58.36, shows no clear sign of extremes, implying potential for price fluctuations in both bullish and bearish trends.

If the price of QNT drops below $75, the next notable support lies around $69.5. Dropping below this level might indicate a more extensive correction, potentially making it difficult for QNT to resume its upward trend.

Mixed signals for network growth and transactions

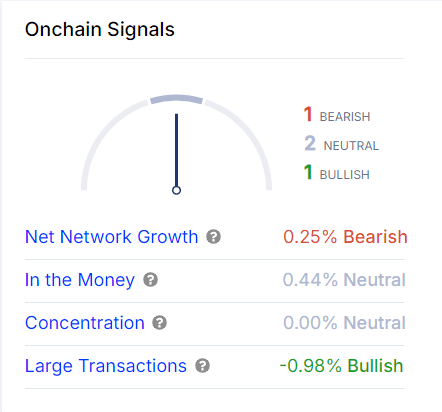

According to on-chain data, Quant (QNT) shows a somewhat ambiguous image. The net expansion of the network showed a faint bearish trend, decreasing by 0.25%. This suggests that there has been a slight decrease in the number of new users entering the network.

Nevertheless, significant trades indicate a rise in optimistic behavior, as there was a 0.98% growth observed, hinting at whales and institutional investors amassing QNT. This potentially sets up pressure for an uptrend in the immediate future.

Conversely, the “in-the-money” indicator stands at a balanced 0.44%, suggesting that the majority of current owners neither have substantial gains nor losses.

Additionally, the concentration of holdings stays unchanged, reinforcing a stable outlook.

What can fuel further growth?

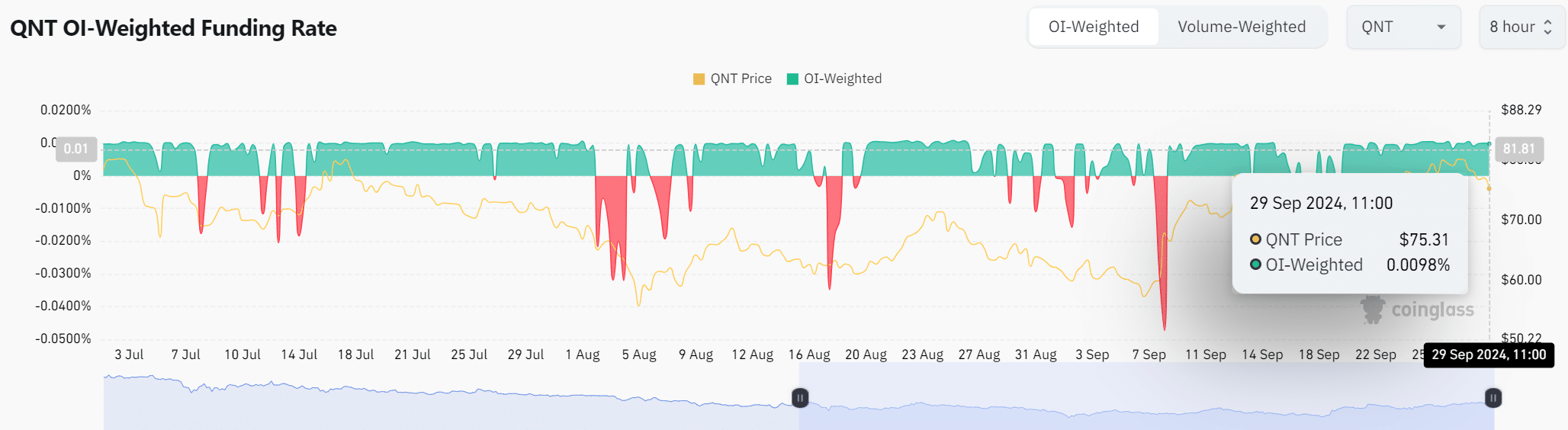

On the 29th of September, the Percentage Funding Rate for QNT‘s OI-Weighted showed a small upward movement, amounting to 0.0098%.

This small increase indicates increasing confidence from those holding long positions, which could lead futures traders to boost the price of QNT temporarily in the near future.

Read Quant’s [QNT] price prediction 2023–2024

Should the Enhanced Index-Weighed Fee Rate persistently strengthen, it might trigger a positive trend in the market, fueled primarily by derivative transactions.

As QNT demonstrates promising growth, it’s crucial that it holds its current support at around $75. Over the coming trading periods, we’ll see if QNT manages to surpass its resistance at $85 or if it will enter a period of further stabilization instead.

Read More

2024-09-30 11:04