-

QNT has gained 28% in seven days, with the price now approaching a three-month high.

Exchange netflow data showed that fewer traders were interested in selling despite the rally.

As a seasoned researcher with years of experience navigating the dynamic world of cryptocurrencies, I have seen my fair share of market fluctuations and trends. The current rally of Quant [QNT] has certainly caught my attention, with its impressive 28% gain over the past week and approaching a three-month high.

On Friday, the cryptocurrency market experienced a dip, with Bitcoin [BTC] finding it challenging to maintain prices above $58,000. However, even amid this downward trend, Quant [QNT] managed to climb more than 5%, trading at approximately $75 as of the press time.

This is its highest price in nearly three months.

Over the last week, Quant has stood out as a leading market performer, boasting a substantial increase of 28% by the time of this writing.

However, given the uncertainty across the broader market, will QNT’s rally progress?

On-chain data is positive

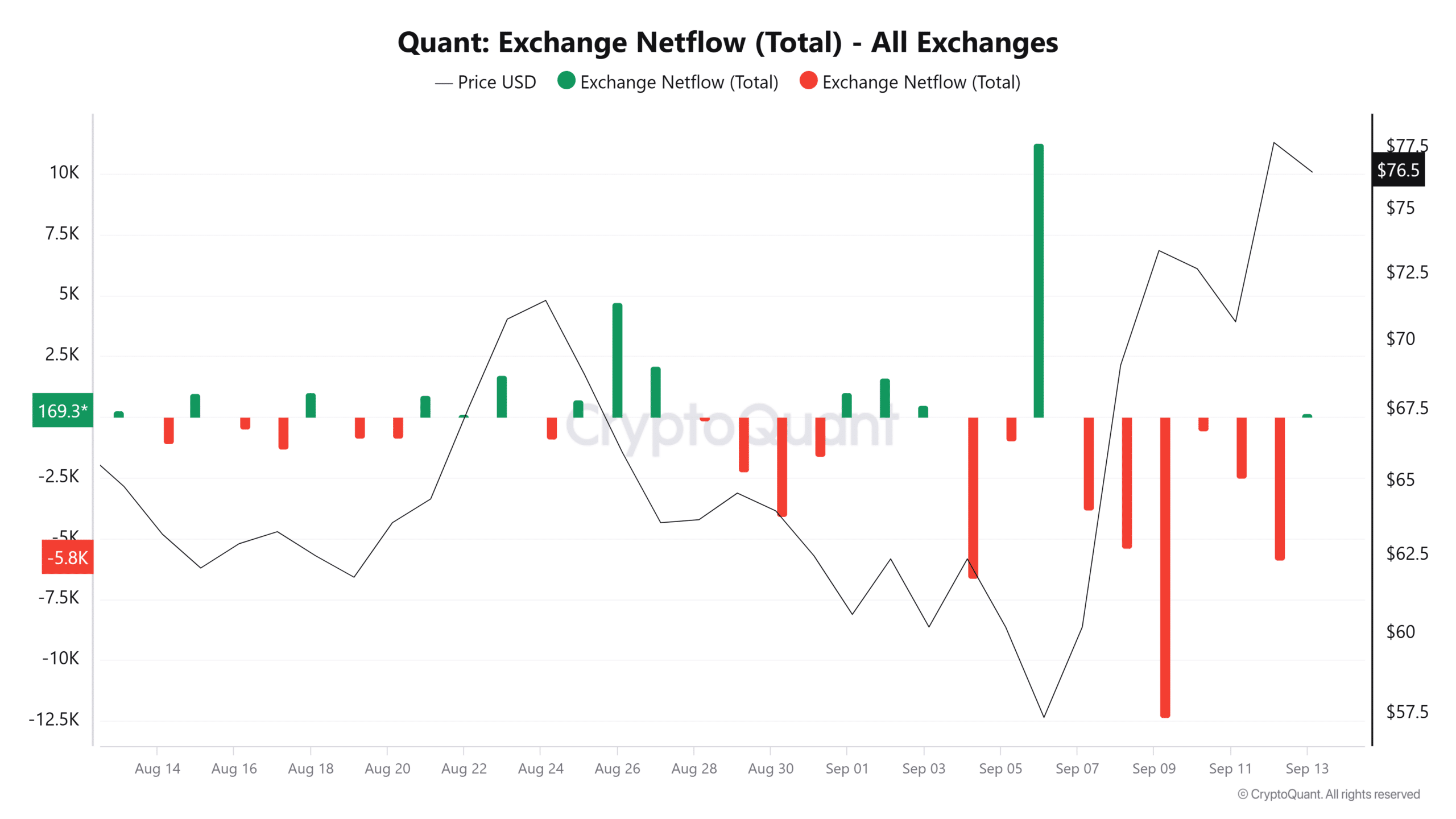

Information derived from the blockchain indicates a potential continuation of favorable conditions for Quant’s price. The trend shows that traders are removing QNT from exchanges at a faster pace compared to their deposits, according to data observed on CryptoQuant.

Starting on September 7th, over 30,000 QNT tokens have been withdrawn from exchanges, easing short-term selling pressure and further fueling the ongoing upward trend.

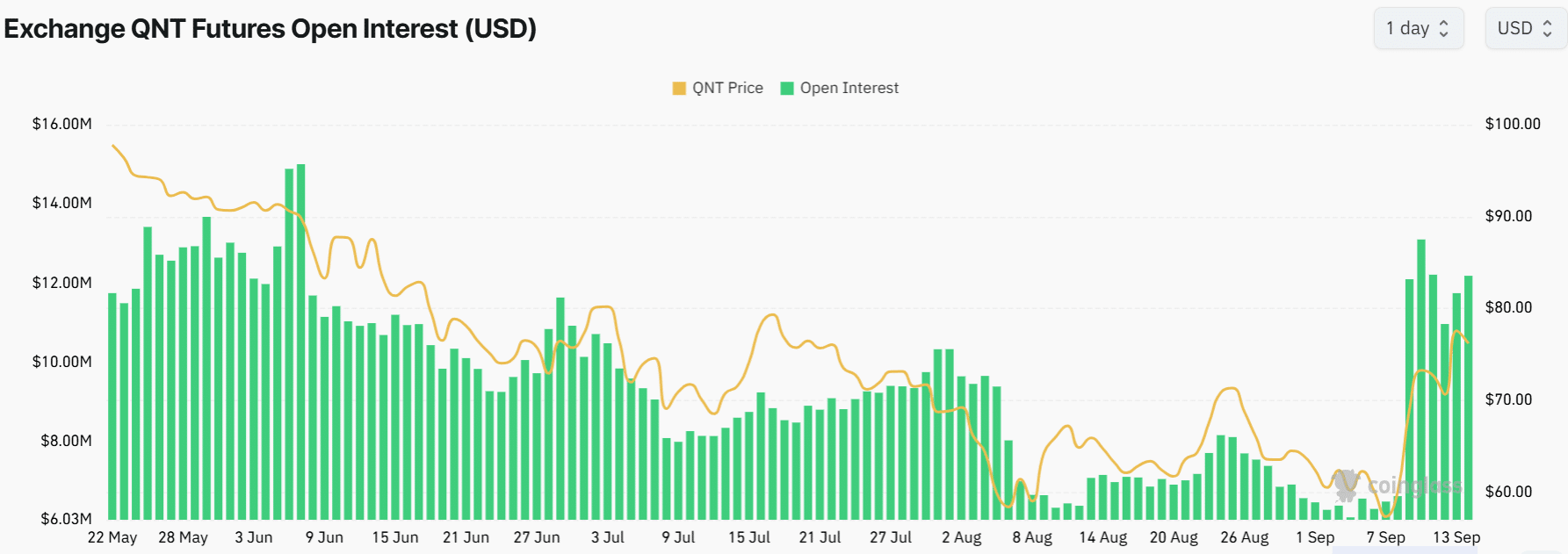

The derivatives market also indicated that traders were maintaining their positions on QNT. At press time, Open Interest had increased by 12% to $12 million.

In simpler terms, the price of Option Instrument (OI) reached its peak in June and has remained there. This is significant because as I write this, Funding Rates are positive, suggesting that most Futures traders have decided to purchase Quantum (QNT), indicating they believe it will increase in value.

Are traders still buying into the rally?

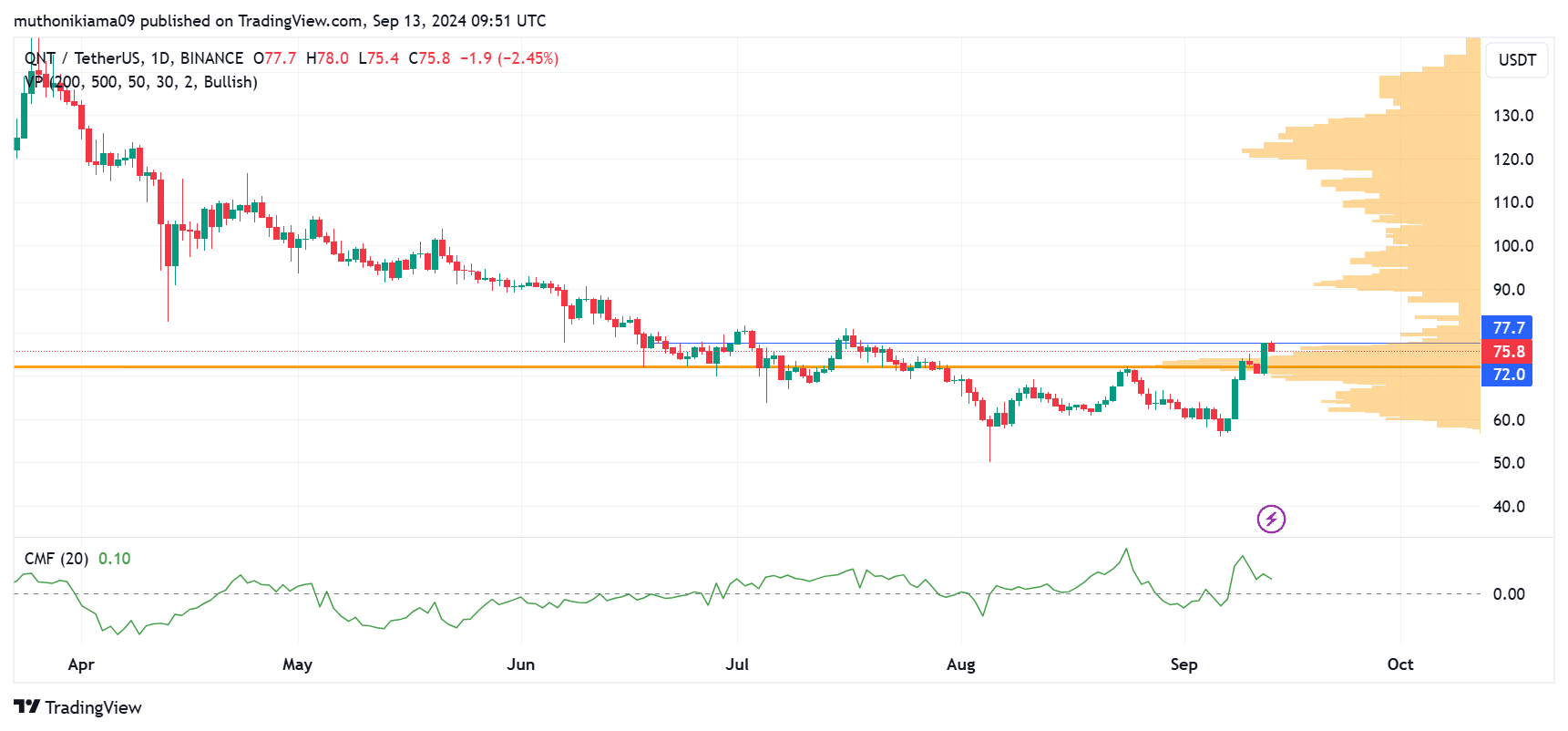

It seems like the strong upward trend might be losing some steam recently. However, the Chaikin Money Flow suggests that buyers have been controlling the market so far.

Yet, the trajectory of the CMF line seemed to indicate a potential change in market dynamics. The line appeared to lean towards the southern direction, implying that traders might be leaving the market, possibly indicating a withdrawal by buyers.

Quant’s rally is dependent on purchasing activity due to the widespread pessimism in the overall market. If buying momentum weakens, the upward trend may lose strength.

The analysis of volume profile data supported the argument that we were experiencing a cooling rally. It appears that buyers had reached their limit in the $71 to $73 price range, accounting for the recent spike in prices.

Yet, when QNT surpassed $75, fewer traders found it appealing to purchase. At $77, volumes noticeably dwindled, indicating that it functioned as a crucial barrier for further increases.

Read Quant’s [QNT] Price Prediction 2024–2025

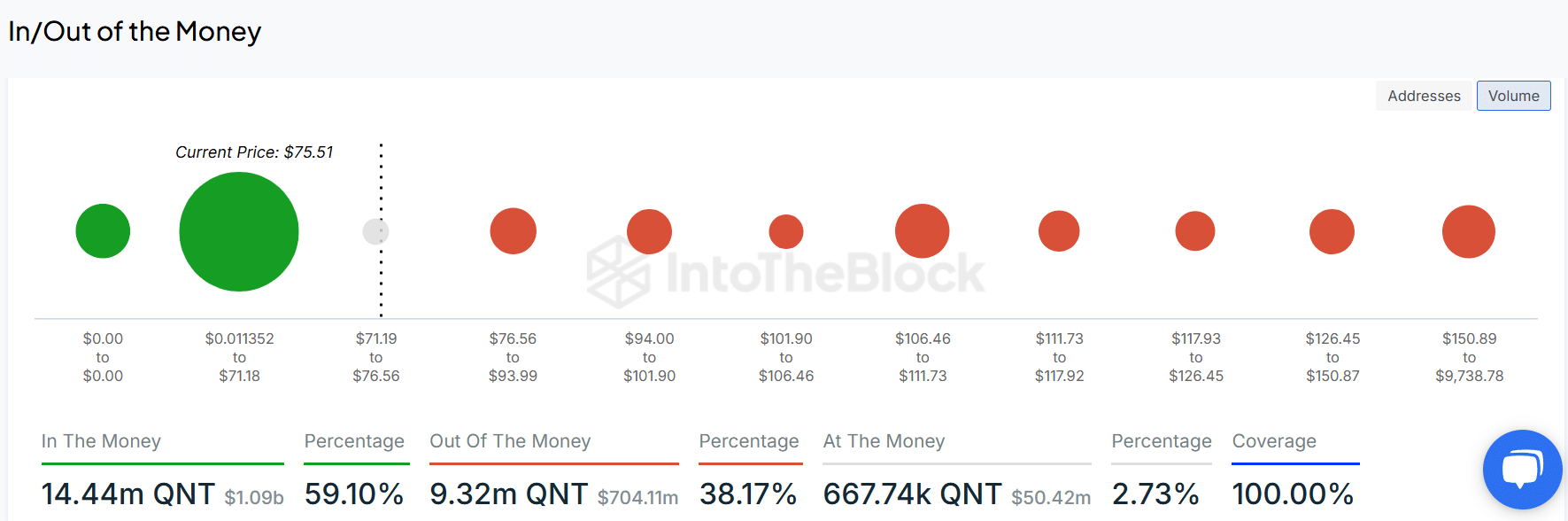

If QNT manages to surpass the $90 mark, it’s quite possible that a resurgence of an upward trend will occur, as this price point has shown signs of significant buying activity in the past.

According to information from IntoTheBlock, most QNT investors were experiencing losses as of the current moment. In an attempt to reduce their potential risks, these investors could decide to sell off their holdings. This mass selling could potentially undermine the upward trend and initiate a bearish turnaround.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

2024-09-14 06:15