- Smart money has flipped bullish on Quant after the token formed a double-top pattern on its four-hour chart.

- If buyers remain active, QNT could rally to $128.

As a seasoned analyst with over two decades of trading under my belt, I’ve seen my fair share of market patterns and trends. The recent bullish flip on Quant [QNT] has caught my attention, especially considering the bearish sentiment among retail investors.

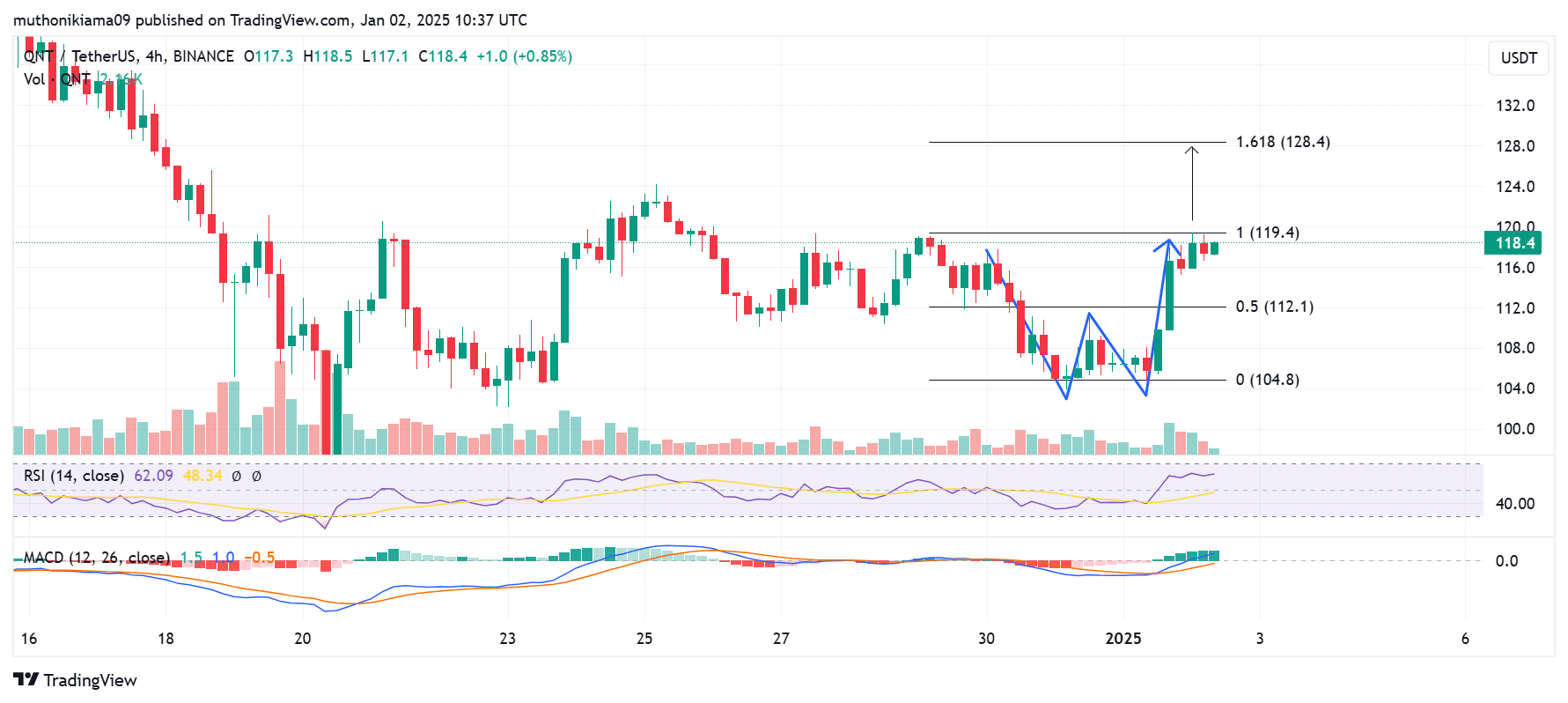

Looking at Quant’s four-hour chart, it appears we’re witnessing a classic W pattern, a strong indication of an upcoming uptrend. If buyers maintain their activity, we could potentially see QNT rally to $128. However, it’s important to keep an eye on the resistance at $119, which is proving to be a formidable obstacle.

The Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD) are both pointing towards a bullish outlook. The rising RSI indicates higher buying pressure, while the MACD line’s bullish crossover and shortening histogram bars suggest that buyers are reentering the market.

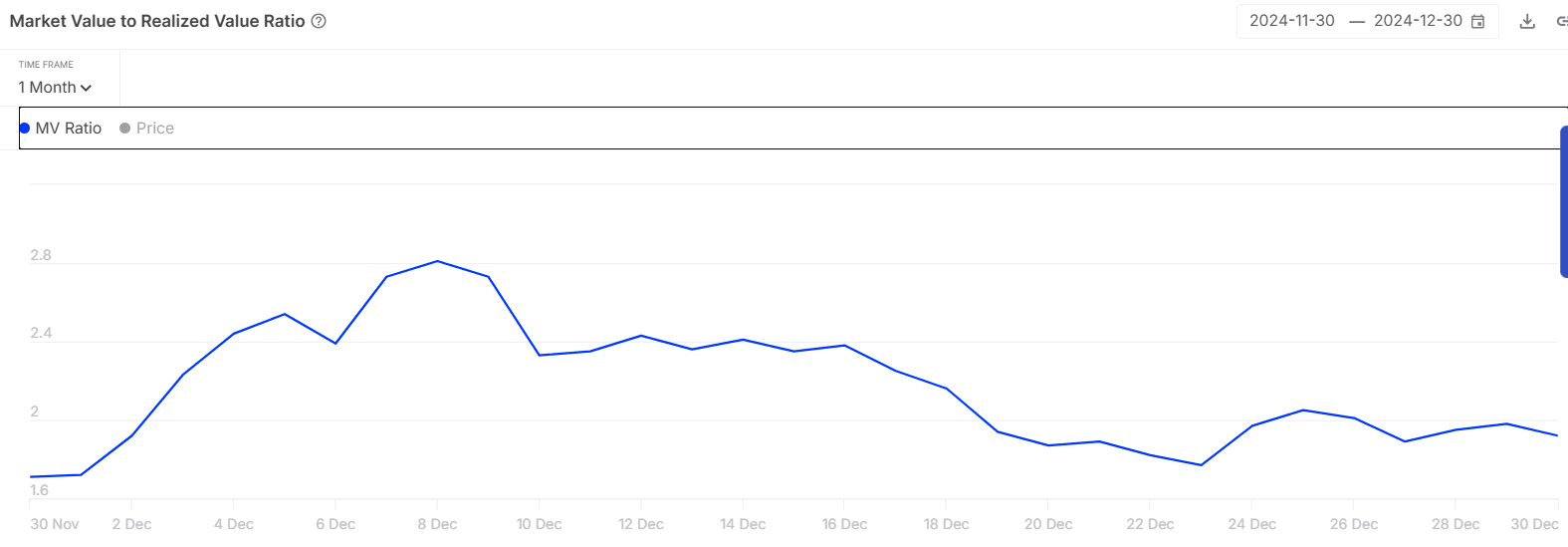

However, it’s not all sunshine and roses. Quant’s Market Value to Realized Value (MVRV) ratio has seen a significant decline, indicating that QNT holders have become less profitable. This could potentially lead to increased selling pressure if these wallets decide to sell to minimize losses.

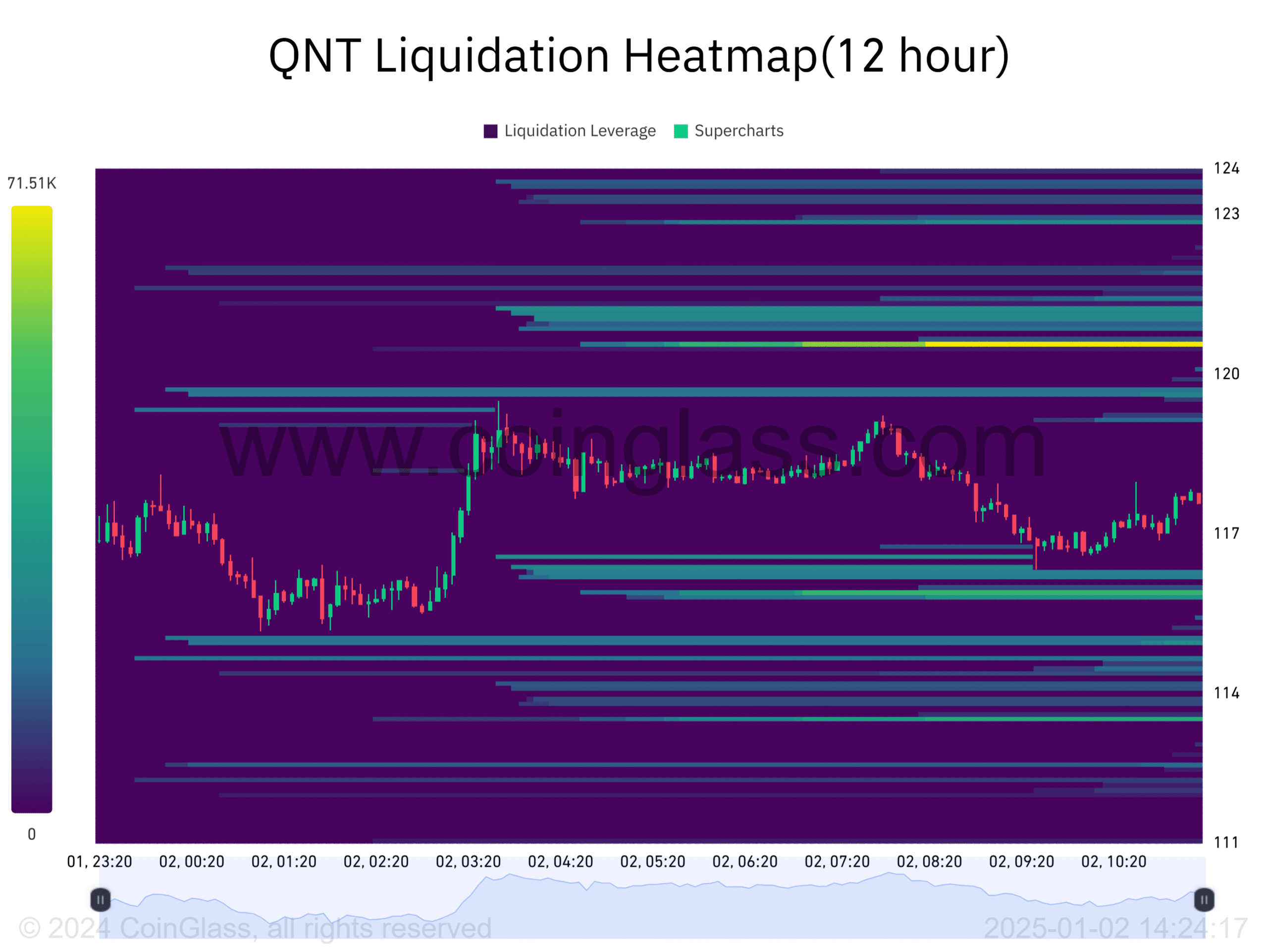

In the end, as they say in trading, “the market can stay irrational longer than you can stay solvent.” So, let’s keep our eyes on that $120 liquidation cluster – it could be a wild ride!

At the moment, Quant (QNT) was priced at approximately $117 following a more than 10% rise over the past day. The trading volume also experienced a significant boost by 53%, reaching around $30 million according to CoinMarketCap. Consequently, the market capitalization of QNT soared to over $1.41 billion.

Despite the general pessimism, shrewd investors have become optimistic about QNT, according to Market Prophit. However, the public or individual investor opinion remains negative.

One possible factor contributing to the optimistic viewpoint among seasoned investors might stem from their upbeat perspective on Quant’s shorter-term price chart, which they find encouraging.

QNT readies for a rally to $128

As a researcher, examining Quant’s four-hour chart, I noticed that the altcoin appeared to have formed a ‘W’ pattern. Historically, this pattern can suggest a potential uptrend in the near future.

Furthermore, the token broke through the resistance level of this pattern, indicating a surge driven by substantial trading activity, which points towards a bullish trend.

From my experience as a seasoned cryptocurrency trader, I have noticed that resistance levels can be formidable obstacles for any altcoin, including Quant (QNT). At the moment, QNT is encountering significant resistance at its second peak of $119. However, if this level can be flipped, it could signal a potential rally towards the mid-December levels, which lie around $128. I’ve seen similar situations before where a successful flip has led to impressive gains in the cryptocurrency market. So, while there are no guarantees in this volatile market, if QNT manages to break through that resistance level at $119, it could be an exciting opportunity for those who believe in its potential.

As a seasoned trader with years of experience under my belt, I can confidently say that the Relative Strength Index (RSI) is a reliable tool for gauging market momentum. In this particular instance, when I observed an RSI value of 62, signifying stronger buying pressure than selling pressure at the time, it served as a bullish confirmation for my thesis. This means that the asset in question was showing signs of upward movement, and as a result, I decided to invest accordingly based on this favorable market condition. The RSI is a valuable indicator for traders like myself who seek to make informed decisions and navigate the ever-changing financial markets with greater certainty.

This indicator was also trending upwards, which pointed towards rising buyer interest.

The MACD line, which had previously turned positive and crossed over itself, indicated a bullish trend.

The shrinking MACD histogram bars suggested strongly that investors were returning to the market, potentially leading to a successful breach of the resistance level at $128.

Is a declining MVRV good for price?

The Quant’s Market Value to Realized Value (MVRV) ratio has experienced a significant drop over the past month, falling from 2.81 to 1.92 during that period.

The drop in MVRV indicates that Quantum (QNT) holders have experienced a decrease in their profitability. Specifically, during this timeframe, the percentage of wallets yielding a profit dropped significantly from 85% to 39%.

This decrease might imply that QNT isn’t on the verge of overvaluation. However, if these wallets decide to sell to cut their losses, it could lead to an increase in selling intensity.

A decline in profitability could result in a bearish sentiment.

Read Quant’s [QNT] Price Prediction 2025–2026

Key level to watch

Quant’s heatmap revealed a concentration of liquidations occurring around the $120 mark. If vulnerable traders opt to exit their positions as prices increase, this level might attract further sell-offs, acting like a magnet zone.

If Quantum Computing (QNT) increases in value and positions opened at $120 get closed due to market conditions, it might trigger a “short squeeze.” During this event, short sellers who had bet against QNT may feel compelled to buy shares to limit their losses, thereby causing an increase in demand. This rise in demand could potentially initiate an upward trend for Quantum Computing.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- Katy Perry Shares NSFW Confession on Orlando Bloom’s “Magic Stick”

- Quick Guide: Finding Garlic in Oblivion Remastered

- How to Get to Frostcrag Spire in Oblivion Remastered

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- BLUR PREDICTION. BLUR cryptocurrency

2025-01-03 01:12