- Quant’s breakout from a descending wedge and 28% surge signaled bullish momentum, targeting $103.20.

- Market sentiment improved as exchange reserves dropped.

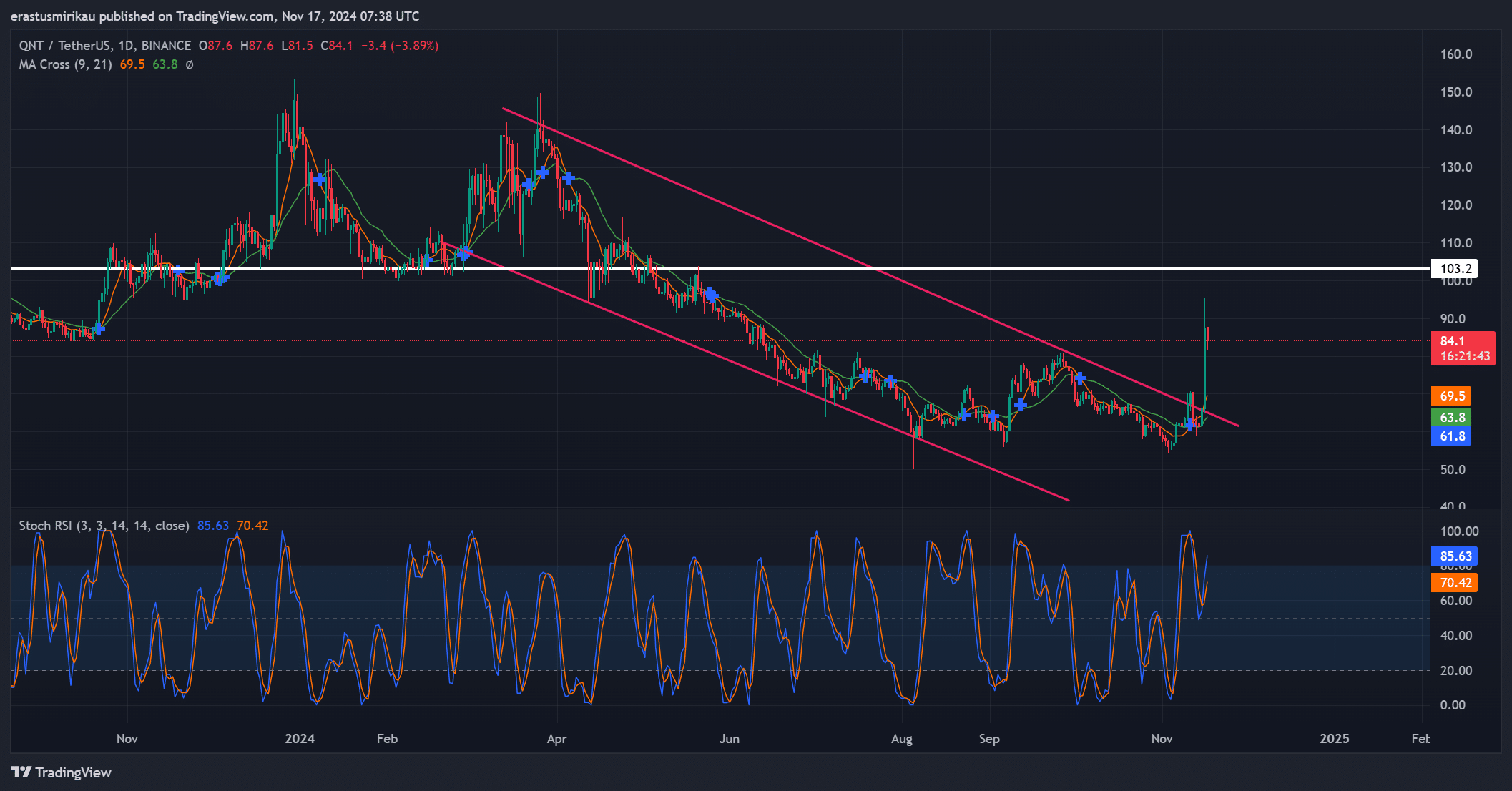

As a seasoned crypto investor with a knack for spotting trends, I’ve been closely monitoring Quant [QNT]. Its breakout from a descending wedge and 28% surge have certainly caught my attention. The bullish momentum is palpable, with the price targeting $103.20. However, as we all know in crypto, nothing is certain until the price breaks that resistance!

In just the past day, Quant (QNT) has captured attention by surging an impressive 28%, currently trading at $83.76 per token as of the latest reporting.

This sudden increase brought about a staggering 523% rise in trading activity, significantly elevating the market value to more than one billion dollars. Despite cryptocurrency markets displaying varying patterns, Quantum’s price movement was picking up speed.

The question now is whether this breakout marks the beginning of a sustained bull run.

Quant: What’s driving the rally?

The sudden surge of QNT, following its extended downtrend within a descending triangle formation, may indicate a change in the overall market opinion or attitude.

Historically, such price surges have signaled the beginning of upward market movements, and Quant (QNT) seemed to be moving in this direction. Yet, a significant hurdle at approximately $103.20 stood as potential resistance.

Moving beyond the current level might spark increased buying interest, whereas being denied could result in a return to test support levels around $70 again.

At the moment, technical indicators show a strong bullish trend. Specifically, the Stochastic Relative Strength Index (RSI) stood at 85.63, signaling that the market is overbought. This suggests intense buying activity, yet it also hints at potential short-term corrections as the market might need to correct itself in the near future.

Additionally, the crossover of the Moving Averages at $69.50 and $63.80 suggests a bullish trend, since the short-term MA (9 days) is now riding above the long-term MA (21 days).

These metrics underscores strengthening momentum, but caution remains necessary after such rapid gains.

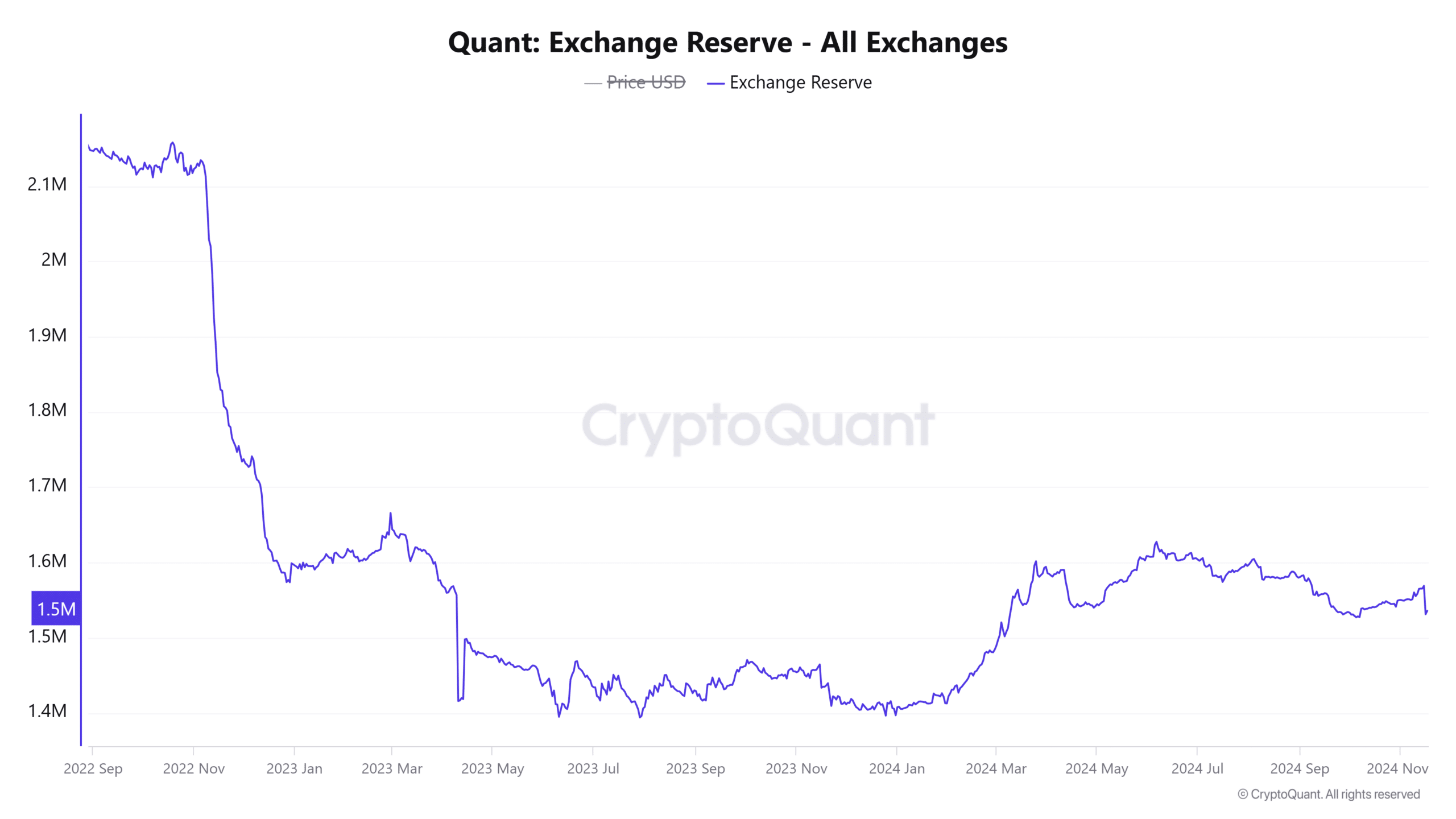

QNT exchange reserves: A key bullish signal

In the past day, the amount of reserves held on exchanges has dropped by about 2.27%. Currently, there are approximately 1.5357 million tokens in these reserves. A decrease in available tokens on exchanges usually means less pressure to sell and suggests growing confidence among investors.

Consequently, when there’s less Quantity (QNT) readily available for purchase, it enhances the possibility of a price increase, as long as demand continues to be strong.

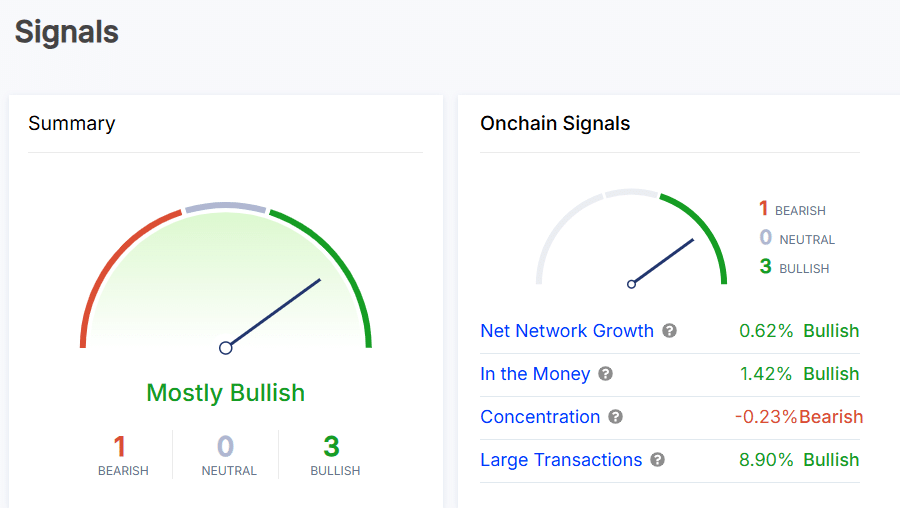

On-chain signals indicate growing confidence

The on-chain data also underscored the robust standing of QNT, as there was a significant increase of 8.90% in large transactions, and the net network expansion grew by 0.62%. This suggests a rise in adoption and activity among prominent investors.

42% of Quantum (QNT) wallets have become profitable, indicating increased profitability. The decline in concentration among large holders was minimal (-0.23%). Overall, the general feeling about Quantum remains optimistic.

Read Quant’s [QNT] Price Prediction 2024–2025

Will QNT sustain its bullish momentum?

Quant’s rise above its falling trendline, coupled with a 28% price jump and a massive 523% spike in trading activity, strongly indicated a powerful uptrend.

Yet, the barrier at $103.20 proved to be significant. If Quantum Computing (QNT) manages to surpass this point in the near future, it could signal a more extensive bullish reversal and possibly trigger additional growth.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

2024-11-18 04:08