-

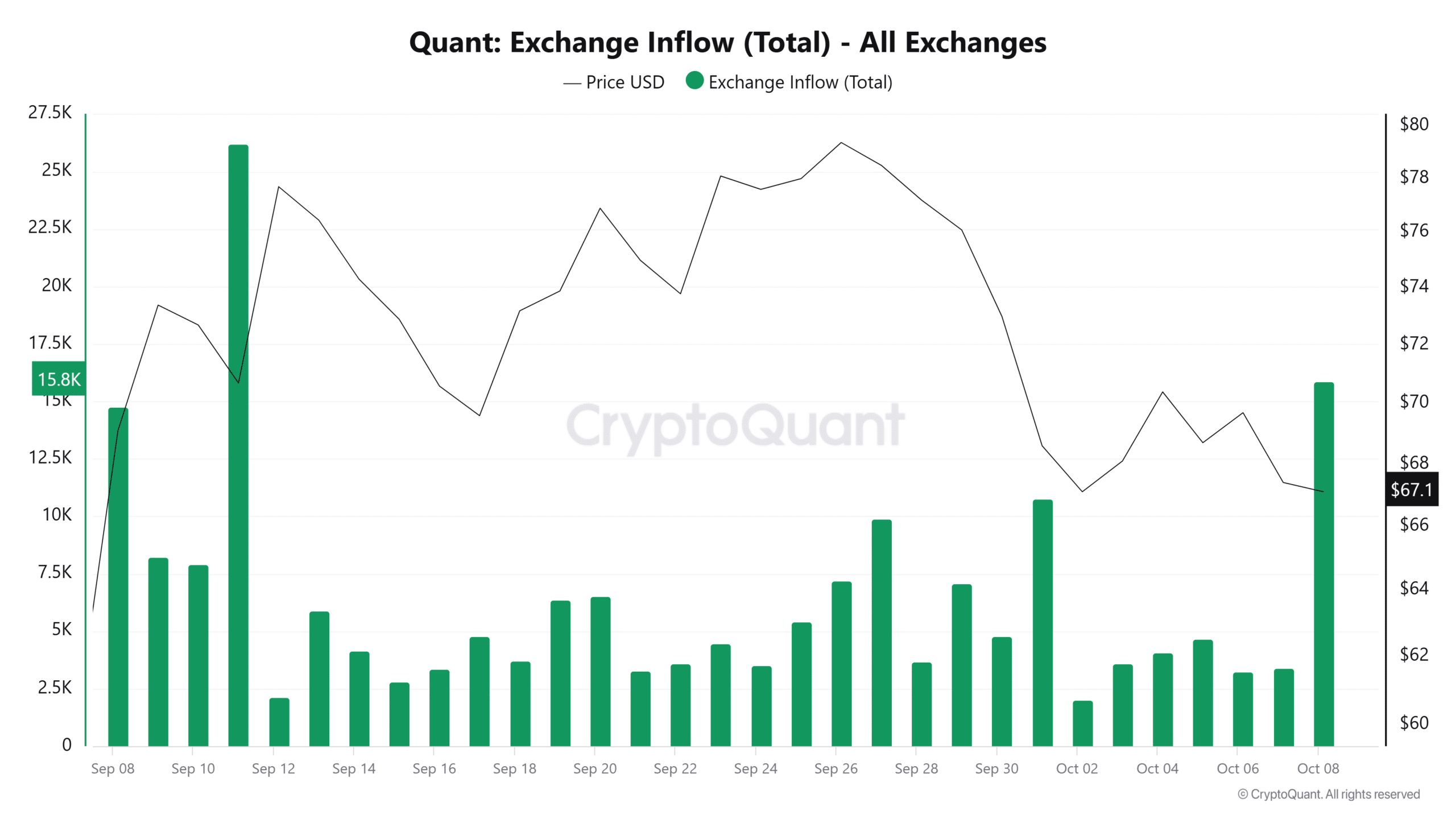

QNT’s exchange inflows have surged, suggesting that the selling pressure could increase.

The rising exchange inflows could increase the sell-side pressure and drop the price to test support at $57.

As a seasoned researcher with years of experience in the crypto market, I’ve seen my fair share of bull runs and bear markets. Observing Quant [QNT] currently trading at $67, it seems we might be witnessing another potential bearish phase. The 3% drop in 24 hours, coupled with a 10% decline in the last seven days, is concerning.

At the moment of reporting, Quant (QNT) was trading at $67 following a 3% decline over the past 24 hours. It’s worth noting that QNT has faced significant bearish influence, as it has decreased by almost 10% in the last seven days.

As I observe the market trends, it seems my portfolio’s recent dip coincides with a broader market movement. Specifically, this 24-hour decline appears to be linked to Bitcoin‘s [BTC] descent from around $64,000 to $62,000.

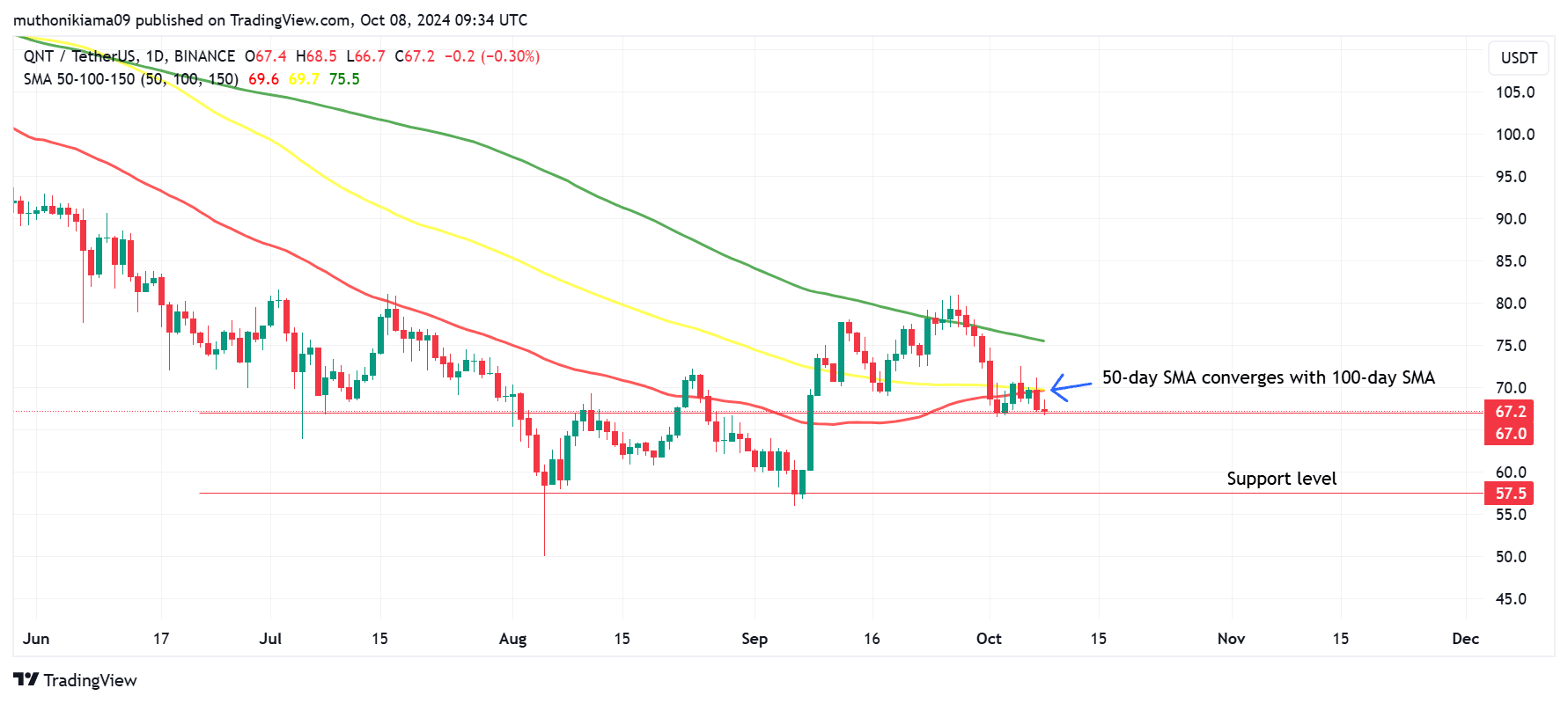

As a researcher, I’ve observed a significant decline in the price of Quant (QNT), which has now tested a crucial support level at around $67. This is a level that QNT has maintained above since mid-September. However, it’s important to note that QNT has been displaying lower highs recently, suggesting potential downward pressure.

This suggests that buying momentum was weakening, as sellers gained control.

If the value of QNT falls below its current resistance at $67, there’s potential for it to decrease to around $57. Historically, when this support level is breached, a downtrend, or ‘bearish phase’, has been observed.

Keep an eye on when the 50-day and 100-day moving averages meet. When the 50-day line climbs over the 100-day line (from below), this could indicate a robustly positive outlook for traders, often referred to as a bullish signal.

But should this cross-over not occur, it would validate the temporary negative outlook, causing the price to drop.

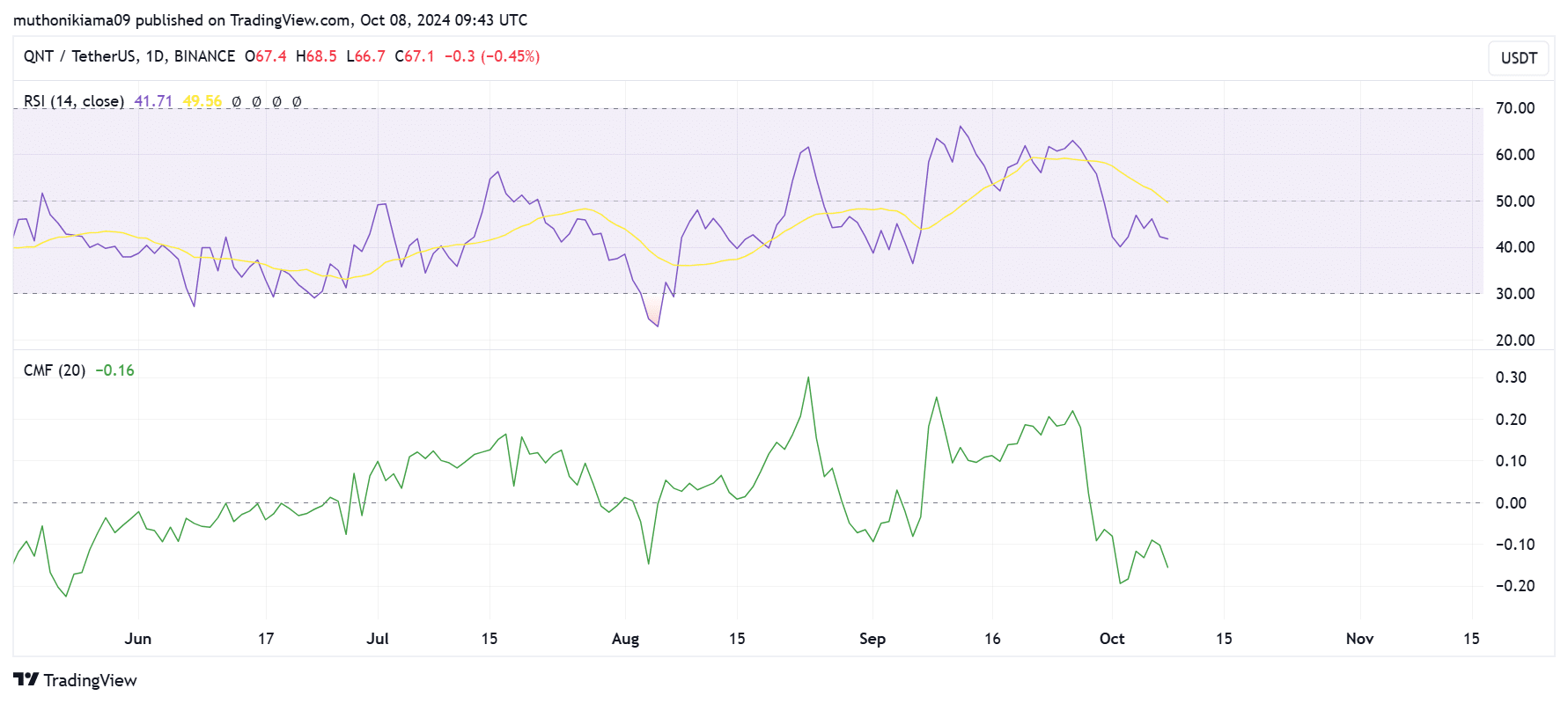

Buying activity is currently weak as the Chaikin Money Flow (CMF) is negative and dropping. This suggests money is flowing from QNT, showing selling pressure.

As a researcher, I’ve observed that the Relative Strength Index (RSI) has climbed to 41, indicating an intensifying downward momentum. This could potentially lead to a further decline in the price.

QNT exchange inflows spike

According to data from CryptoQuant, Quant’s exchange inflows have reached their second-highest point in the past month.

Currently, the number of QNT tokens deposited to exchanges has gone beyond 15,800 units, representing a more than fivefold rise compared to the previous day’s figures.

An uptick in incoming trades might cause a surge in supply for Quant, suggesting that traders are preparing to offload their holdings.

The information also demonstrated a decline in trust among QNT token holders towards the token, leading them with the option to sell in order to limit their potential losses.

Based on my years of trading experience, I can confidently say that if this situation unfolds as expected, it may lead to a decline in Quant’s price. The $67 support level could potentially break, causing the value to drop below it. I have seen similar scenarios play out before and know how important it is to keep a close eye on potential downward pressure when making investment decisions.

Read Quant’s [QNT] Price Prediction 2024–2025

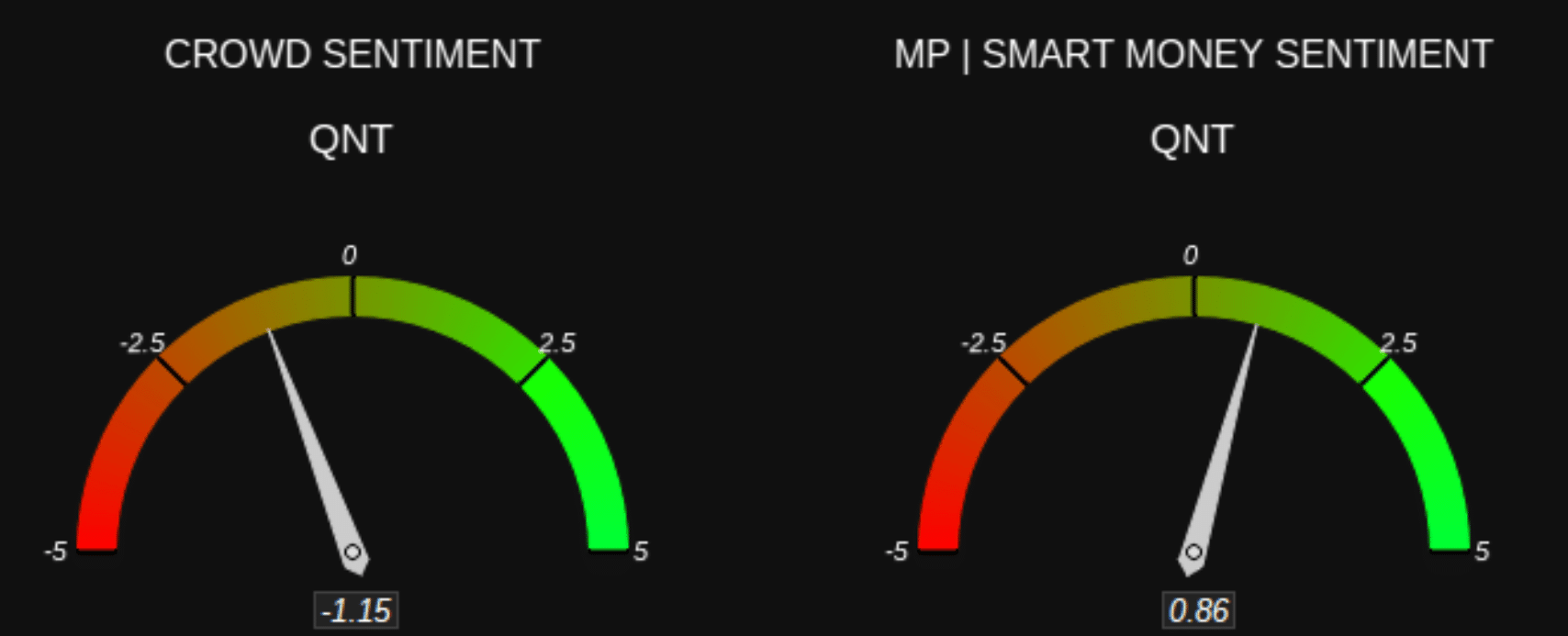

As pessimism towards the token grows, so do the increasing funds flowing into it. At the moment of reporting, Market Prophit indicates that the public is bearish about QNT, suggesting low faith in its price rebound.

From my perspective as an analyst, I’ve noticed a bullish sentiment among the savvy investors regarding QNT. This suggests a degree of market optimism towards this particular asset.

Read More

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Masters Toronto 2025: Everything You Need to Know

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- The Lowdown on Labubu: What to Know About the Viral Toy

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- Gold Rate Forecast

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

2024-10-08 17:44