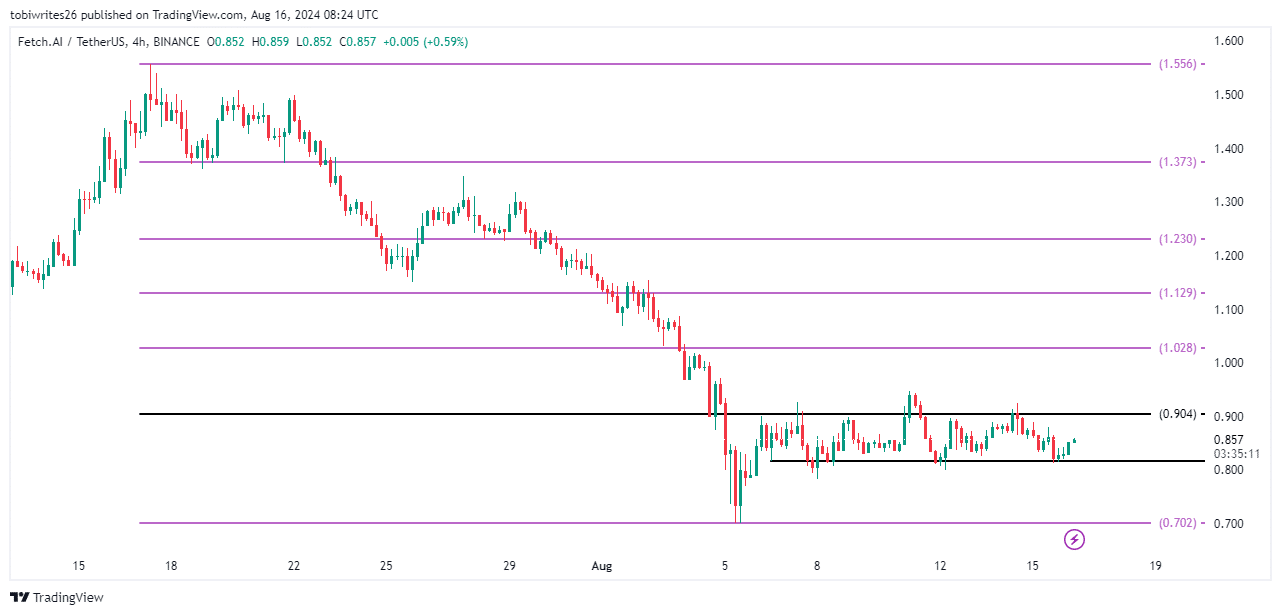

- Analysis of FET’s 4-hour chart revealed that its accumulation phase began on 6 August

- Indicators and on-chain metrics pointed to bearish dominance over the altcoin

As a seasoned analyst with years of experience observing and deciphering the cryptocurrency market, I have seen numerous phases that dictate the direction of various digital assets. In this particular case, FET seems to be stuck in an accumulation phase, which is neither here nor there for its price movement.

Regardless of its hard work, FET has yet to completely bounce back from the general market slump and continues to be trapped in an accumulation stage. The strategies it adopts to navigate this situation will significantly influence its near-term trajectory as seen on price graphs.

In my analysis, during this particular phase, the price of FET seems to be holding steady rather than experiencing significant increases or dramatic decreases. As I type this, FET is trading at approximately $0.839, and over the past week, it has seen a minor decrease of about 1%. Additionally, its market cap has dipped by around 3%.

Given the current situation at FET’s press time, the big question that arises is whether it will experience a surge or a dip. To shed light on this possibility, AMBCrypto examined several indicators to predict these likely scenarios.

Understanding FET’s accumulation phase

A build-up stage is characterized by clearly outlined barriers, which function as limits, prohibiting the price from surging beyond these levels, either upward or downward. Typically, this phase comes before a decisive breakout in one direction, triggered by a significant imbalance between demand and supply forces.

By examining Fibonacci retracement levels to identify possible areas of support and resistance, AMBCrypto can make an educated guess about FET’s upcoming direction. Nevertheless, these predictions rely on the balance between the number of buyers and sellers in the market.

If there is a surge in demand or imbalance, it’s possible that FET could increase to around $1.028. Conversely, if selling activity becomes strong, FET could potentially drop to about $0.702.

Decline to $0.7 appears more imminent for FET

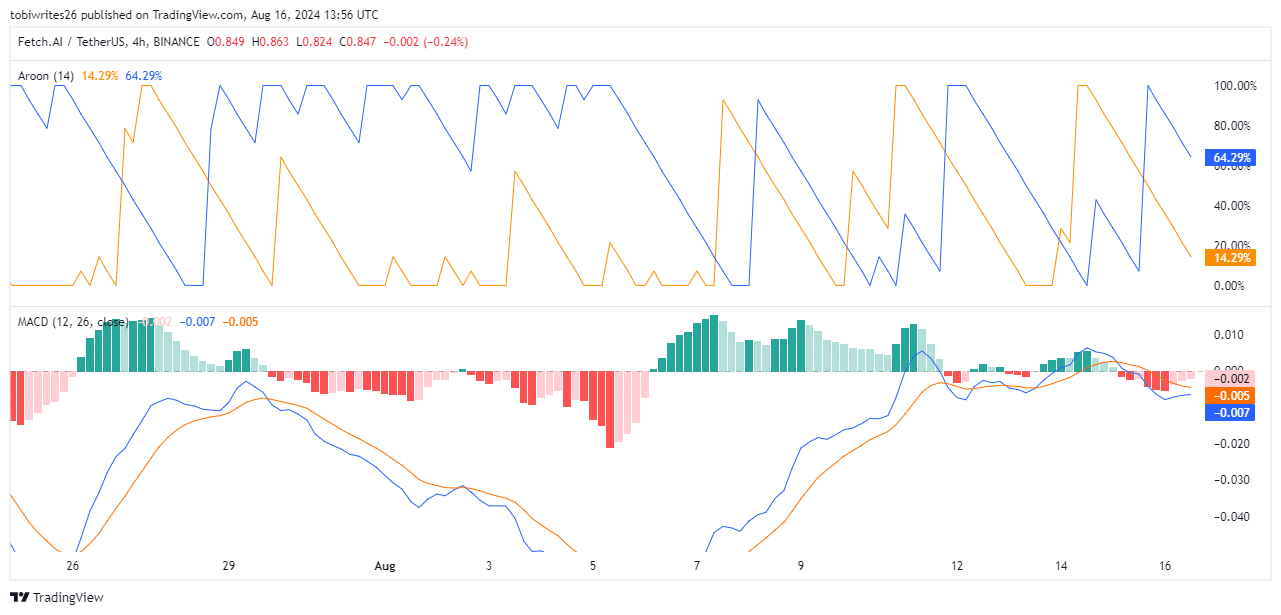

Based on the analysis of the Aroon Indicator and Moving Average Convergence Divergence (MACD), AMBCrypto anticipates a potential drop in value, possibly down to around $0.7.

As a market analyst, I employ the Aroon indicator in my analysis, which comprises two lines: Aroon Up, representing the elapsed time since the highest price, and Aroon Down, indicating the duration since the lowest price. When the Aroon Up line (orange) surpasses the Aroon Down line (blue), it suggests an uptrend in the market. Conversely, a higher Aroon Down line signals a downtrend.

As a crypto investor, when I analyze FET, I notice that the Aroon Down is currently higher than the Aroon Up. This trend might be a sign that bearish sentiments could soon dominate the market, which could potentially impact my investment decisions.

Moreover, at the current moment, the MACD (Moving Average Convergence Divergence), a tool that calculates the gap between two moving averages, showed a negative value. This tended to support the existing pessimistic sentiment surrounding the altcoin as well.

The use of both Aroon and MACD indicators suggested that FET might experience a decrease, as there seemed to be an increase in selling activity.

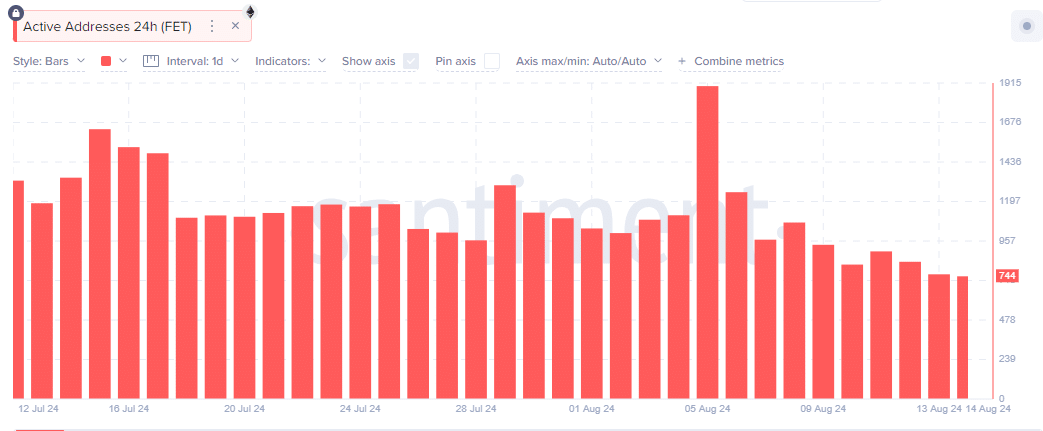

FET’s daily active addresses fall

When the number of daily active addresses for a token decreases, it usually means less trading and engagement, which often results in a downward trend on price graphs. For instance, recent data from Santiment shows a persistent decrease in FET’s daily active addresses over the past 24 hours – an indication of waning market curiosity.

When the number of active participants decreases, it’s usually because they’ve lost interest. This decline in interest among retail traders could lead to a temporary drop in the value of FET.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Bitcoin’s Golden Cross: A Recipe for Disaster or Just Another Day in Crypto Paradise?

2024-08-17 00:39