- Raydium delivers impressive price action driven by robust ecosystem demand.

- Raydium volume sets new record high and TVL soars close to its ATH.

As a seasoned researcher with extensive experience in the crypto space, I must admit that Raydium [RAY] has caught my attention recently. The Solana DEX has been quietly building momentum under the radar, and its performance metrics are nothing short of impressive.

As a researcher delving into the world of cryptocurrencies, I’ve noticed an intriguing development with Raydium [RAY]. Though it may not be grabbing headlines, there’s been quite a buzz beneath the surface. The Solana Decentralized Exchange (DEX) has been steadily growing in popularity, and this trend is clearly reflected in various performance indicators. One such indicator is its native token, RAY, which has seen significant attention.

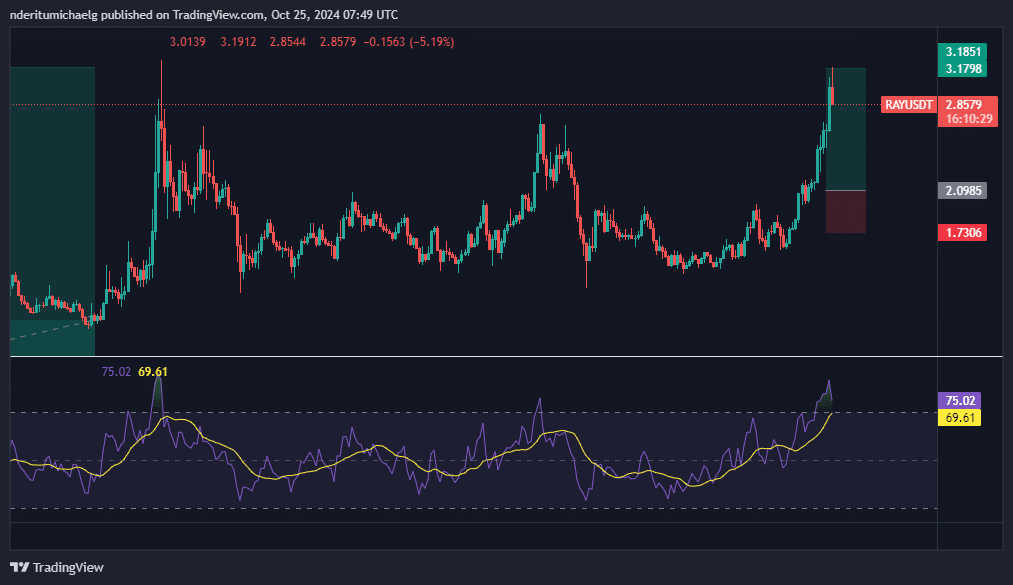

RAY peaked at $3.19 in the last 24 hours after achieving an impressive bullish performance. It rallied by 51% in the last 7 days, earning it a spot in the list of top weekly gainers among the mainstream cryptocurrencies.

This upside also allowed it to achieve a 1,637% gain year over year.

At the current moment, RAY’s price dropped back to $2.85, suggesting significant selling due to profit-taking. This isn’t surprising as the price had nearly reached its 2024 high, which currently serves as a challenging area for further advancement.

It was also deeply overbought, hence was due for a retracement.

Aggressive Raydium utility behind RAY’s demand?

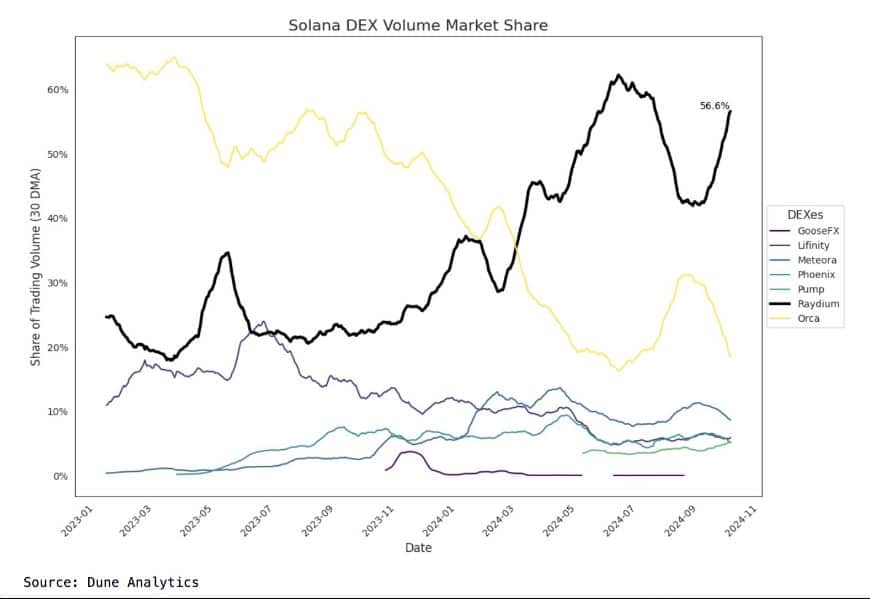

As an analyst, I can confidently say that my analysis supports a bullish outlook for RAY, as its strong performance underscores the robust demand for this asset. The primary force driving this growth has been the expansion of the Raydium ecosystem. Since April, RAY has maintained its position as the leading DEX in the market. Currently, it commands over 50% of the total DEX volume within the Solana ecosystem, demonstrating its dominant presence and influence.

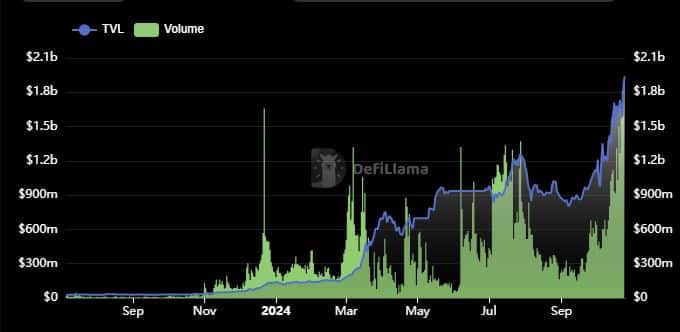

The surge in Raydium volume and ATH emphasize the aggressive resurgence of activity within the DEX.

Raydium’s increasing dominance within the Solana system is evident from the large transaction volumes it has processed this year. The cryptocurrency market has been experiencing a surge and this has led to a resurgence in the decentralized finance (DeFi) ecosystem of Solana, similar to what was observed during the first half of 2024.

Over the past while, there’s been a significant surge in activity within Raydium, as its daily trading volume hit an all-time high of $1.81 billion on October 23rd. To put that into context, this represents a staggering 1,083.66% increase compared to its lowest 2-month volume, which was recorded in mid-September.

This week, Raydium didn’t just hit a fresh daily trading volume record to celebrate; its Total Value Locked (TVL) also reached a staggering new peak of $1.93 billion on October 25, 2024.

Nevertheless, the recent surge didn’t quite reach the all-time high, but it nearly matched it. On November 15th, Raydium’s Total Value Locked (TVL) peaked at a record high of $2.21 billion.

Realistic or not, here’s RAY market cap in BTC’s terms

What implications could this have for Raydium, considering its native token going forward? Holding a dominant position might lead to increased demand and utility as the bull market gains speed.

At the current moment, RAY’s price might indicate it’s ripe for further recovery, as it is currently trading below its historical peak.

Read More

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- There is no Forza Horizon 6 this year, but Phil Spencer did tease it for the Xbox 25th anniversary in 2026

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Masters Toronto 2025: Everything You Need to Know

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Microsoft Has Essentially Cancelled Development of its Own Xbox Handheld – Rumour

- The Lowdown on Labubu: What to Know About the Viral Toy

2024-10-25 21:11