- Raydium surpassed Ethereum in 24-hour fees, generating $3.4 million.

- Its TVL also reached $1.7 billion, marking its highest in almost three years.

As a researcher with years of experience in the crypto space, I’ve witnessed many ups and downs, but the recent performance of Raydium [RAY] has been nothing short of remarkable. The fact that it briefly surpassed Ethereum in 24-hour fees is a testament to its growing network usage and the potential it holds.

As an analyst, I’ve noticed some intriguing developments recently. Raydium [RAY], the Solana-based decentralized exchange (DEX), has been garnering attention due to its impressive feat of overtaking Ethereum in terms of fees generated within a 24-hour period. This surge in activity underscores a significant increase in network usage, which seems to be part of an emerging trend. Consequently, the price movement of its native token has also been on an upward trajectory in recent days.

Raydium surpasses Ethereum in 24-hour fees

Temporarily, Raydium surpassed Ethereum in terms of collected fees, which is remarkable given Ethereum’s large-scale network and influence within its ecosystem.

As a crypto investor, I was quite intrigued when I learned that the 24-hour fees on Raydium had skyrocketed to around $3.4 million, outpacing Ethereum’s $3.3 million during that same period. This data, as reported by DefiLlama, underscores the growing significance and potential of Raydium in the DeFi landscape.

Currently, Ethereum is back on top in terms of fees generated, with approximately $3.7 million compared to Raydium’s $2.8 million. Yet, it’s worth mentioning that for a brief moment, Raydium managed to outpace Ethereum in this area.

A comparison of their 7-day fee trends shows Ethereum still far ahead with $34 million, while Raydium comes in at $18.2 million. Nevertheless, Raydium’s rise is significant, considering the two platforms’ relative size and TVL (Total Value Locked).

Raydium’s volume and TVL continue to rise

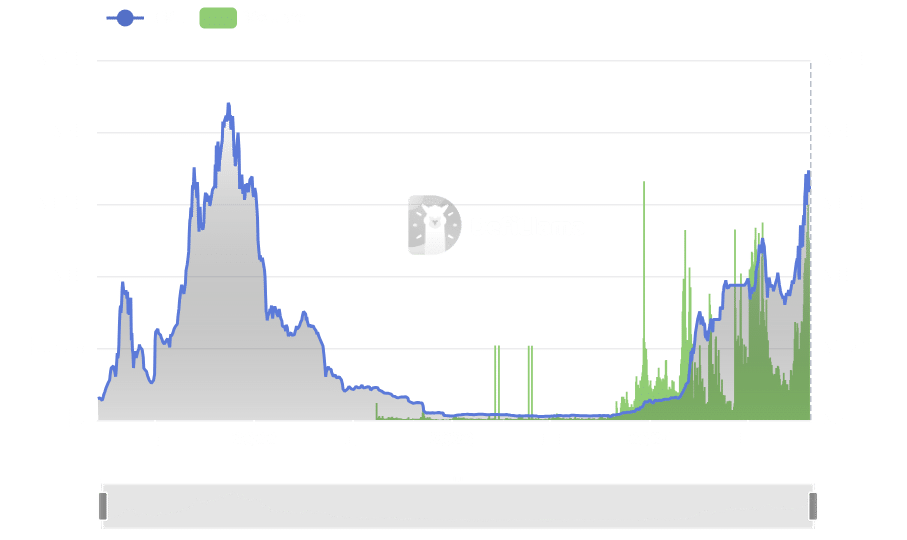

Examining the pattern of fees on the Raydium network reveals a significant surge over the past few days, suggesting heightened transactional activity. Furthermore, an in-depth examination of its trading volume corroborates this finding, as the platform has experienced remarkable expansion.

Raydium’s trading volume remained under the $1 billion mark since August, but it started to increase significantly around the 10th of October. By the 13th, it surpassed the $1 billion threshold, and by the 20th, it was close to reaching $1.5 billion.

Currently, Raydium’s total value is approximately 1.2 billion dollars. Moreover, its Total Value Locked (TVL) has experienced a substantial increase, reaching a peak of about 1.7 billion dollars on October 21st – the highest in nearly three years – before slightly decreasing to 1.6 billion dollars at the present moment.

RAY’s price remains bullish

Raydium’s RAY token has seen a robust upward momentum in recent weeks. At the moment, it is being traded at approximately $2.587, though there’s been a minor dip of 1.45% in its value.

Nevertheless, it persists in trading over its 50-day and 200-day moving averages, implying persistent bullish energy.

In simpler terms, the Chaikin Money Flow (CMF) stands at 0.24, indicating robust buying activity and an increase in funds flowing into RAY. This accumulation of funds appears to be fueling the recent rise in its stock prices.

Additionally, the token surpassed a crucial resistance point approximately at $1.75, bolstered by a “golden cross” event, in which the 50-day and 200-day moving averages intersected, offering additional bullish validation.

Realistic or not, here’s RAY market cap in BTC’s terms

In summary, Raydium’s momentum seems robust, but today’s minor dip might signal a phase of consolidation preceding another possible price increase.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Florence Pugh’s Bold Shoulder Look Is Turning Heads Again—Are Deltoids the New Red Carpet Accessory?

- How to Get to Frostcrag Spire in Oblivion Remastered

- How Michael Saylor Plans to Create a Bitcoin Empire Bigger Than Your Wildest Dreams

- Disney Quietly Removes Major DEI Initiatives from SEC Filing

- Unforgettable Deaths in Middle-earth: Lord of the Rings’ Most Memorable Kills Ranked

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- BLUR PREDICTION. BLUR cryptocurrency

2024-10-23 17:12