- Raydium, like a stubborn mule, held its ground amidst the price tussle.

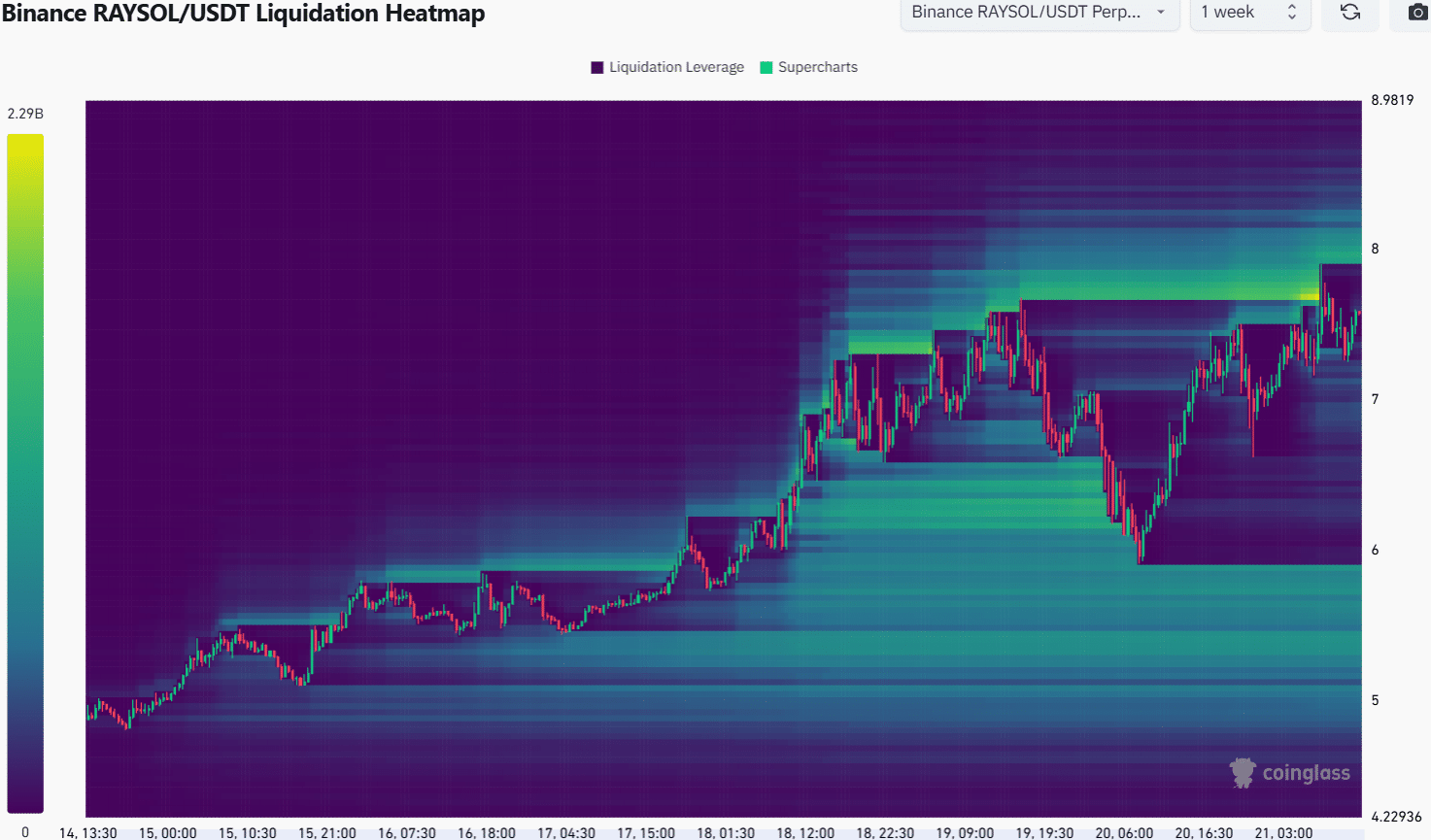

- The short-term bullish target? A cozy little nook between $8 and $8.2, of course!

In a tale as old as time, Raydium [RAY] strutted its stuff, boasting a whopping 62% gain over the past eight days. The rise of Official Trump [TRUMP] on the Solana [SOL] chain might have given RAY a little nudge, but let’s be honest, this rally had its boots on before the TRUMP meme coin even made its grand entrance. 🎩

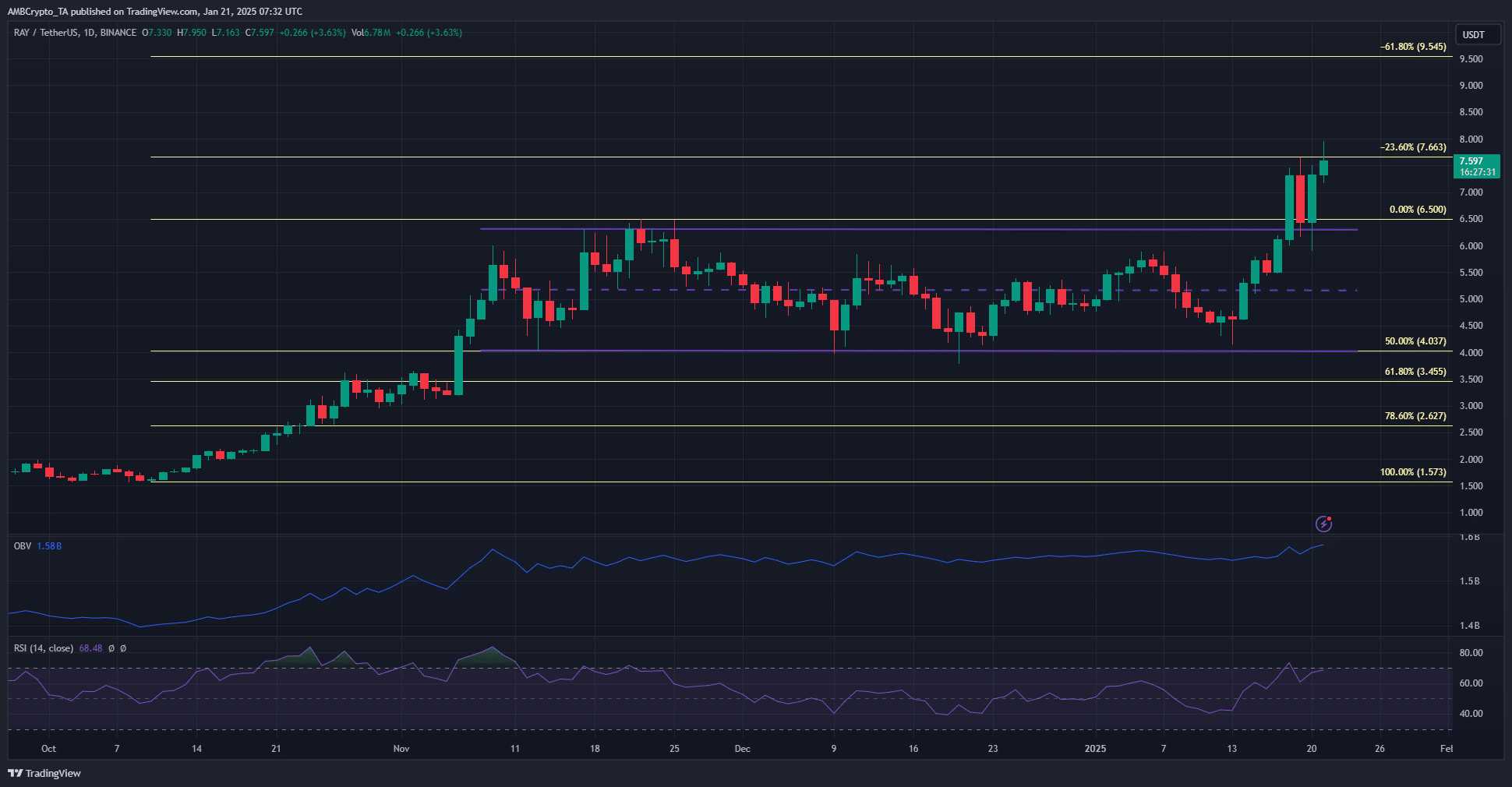

Since the crisp days of November, RAY had been playing a game of hopscotch, bouncing between $4.02 and $6.3. But on the 18th of January, it decided to break free from its range, retesting those highs like a kid testing the waters before diving in.

Raydium Breaks Free: Ready to Soar or Just Stretch? 🚀

The charts were singing a merry tune, reflecting the strong demand for Raydium. Over the past two months, despite its range-bound antics, the OBV was on an upward trend, like a determined tortoise in a race. Steady buying pressure? You bet your bottom dollar! 💪

And when the breakout finally happened, it was like a party with high trading volume—everyone was invited! The Fibonacci levels were drawn up like a map to buried treasure, showing that RAY bulls had their eyes set on $7.66 and $9.54. The daily RSI was above 60, flaunting its strong bullish momentum like a peacock in full display.

With all this buying pressure, it seemed RAY was gearing up for a jaunt toward $9.54 in the days to come. 🏃♂️💨

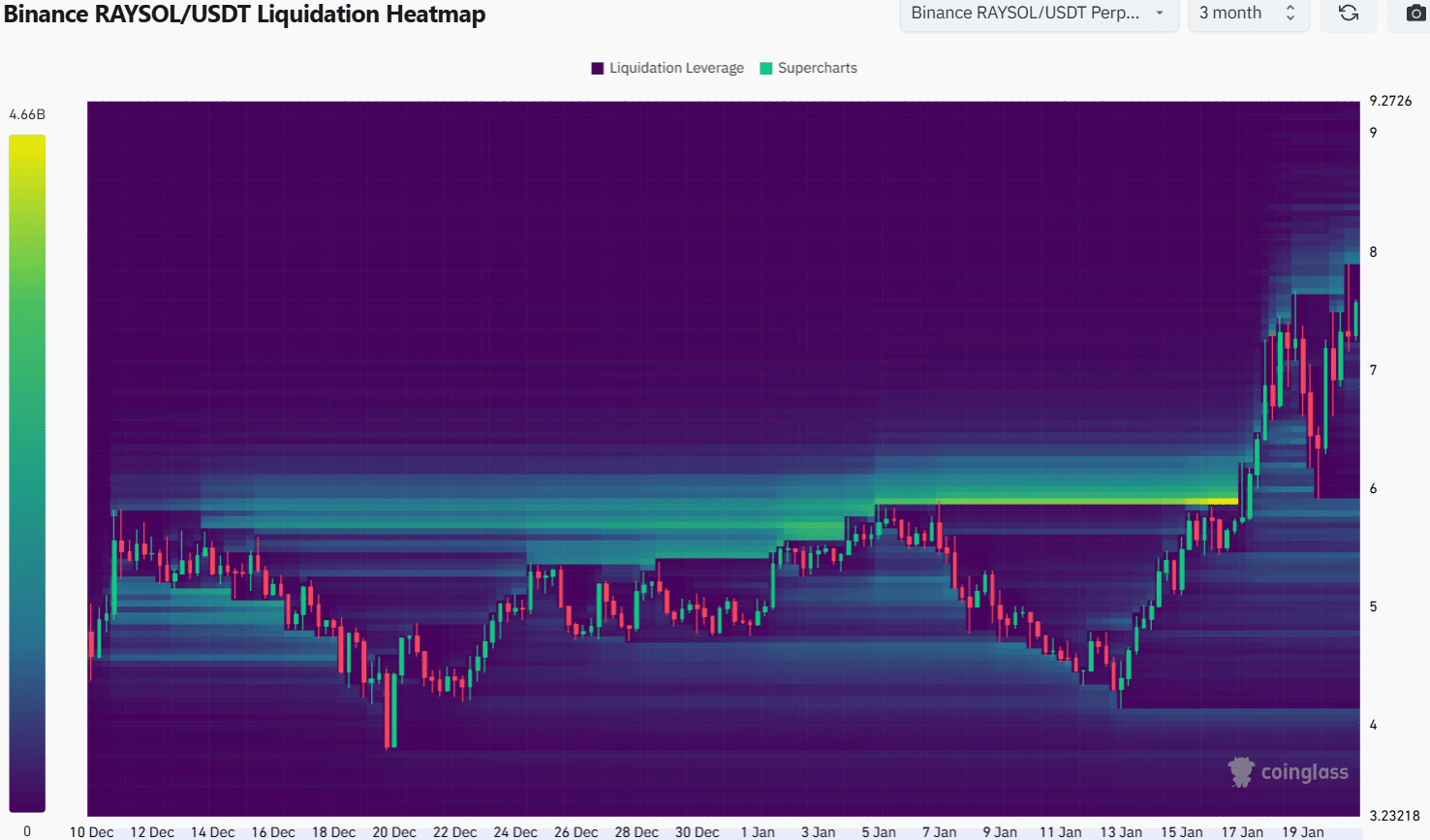

The 3-month liquidation heatmap was like a treasure map, revealing a pocket of liquidity at $8 and another at $7.12. Below that, $7 was practically waving a flag, saying, “Come on down!”

Since the recent move had already given a friendly nod to the range highs at $6.3, another dip to $7.12 seemed as likely as a cat taking a bath—unlikely, to say the least.

Instead, a jaunt toward $8 followed by a little dance around the $7-$7.1 region seemed more on the cards. 🕺

The 1-week liquidation heatmap also pointed to the $8 liquidity pocket, making it clear that the $7.93-$8.21 range was like a crowded bar on a Friday night—lots of liquidation levels ready to pull RAY prices in.

Read Raydium’s [RAY] Price Prediction 2025-26—if you dare! 📈

To the south, the $7.12 and $6.96 levels were looking a bit dim, like a forgotten corner of a dusty attic. Fewer liquidation levels meant less excitement.

A move to $8 followed by a few days of consolidation could build up long liquidation levels to the south, which Raydium prices could later sweep away like crumbs after a feast. 🍽️

Read More

- Solo Leveling Season 3: What You NEED to Know!

- OM PREDICTION. OM cryptocurrency

- Rachel Zegler Claps Back at Critics While Ignoring Snow White Controversies!

- Captain America: Brave New World’s Shocking Leader Design Change Explained!

- Oblivion Remastered: The Ultimate Race Guide & Tier List

- Oshi no Ko Season 3: Release Date, Cast, and What to Expect!

- Gold Rate Forecast

- Meta launches ‘most capable openly available LLM to date’ rivalling GPT and Claude

- How to Get to Frostcrag Spire in Oblivion Remastered

- Fantastic Four: First Steps Cast’s Surprising Best Roles and Streaming Guides!

2025-01-22 00:07