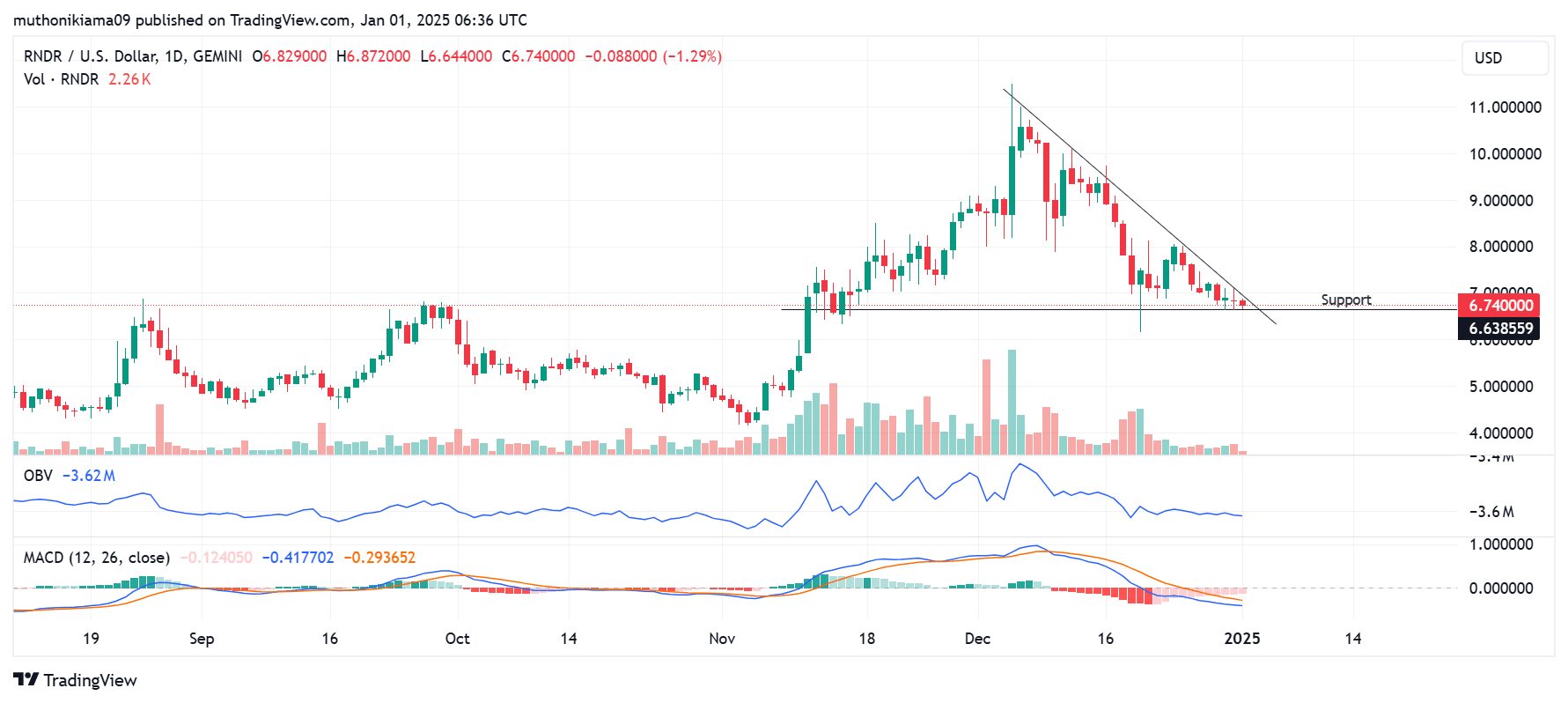

- Render was trading within a descending triangle pattern on its one-day chart, indicating it was in a clear downtrend.

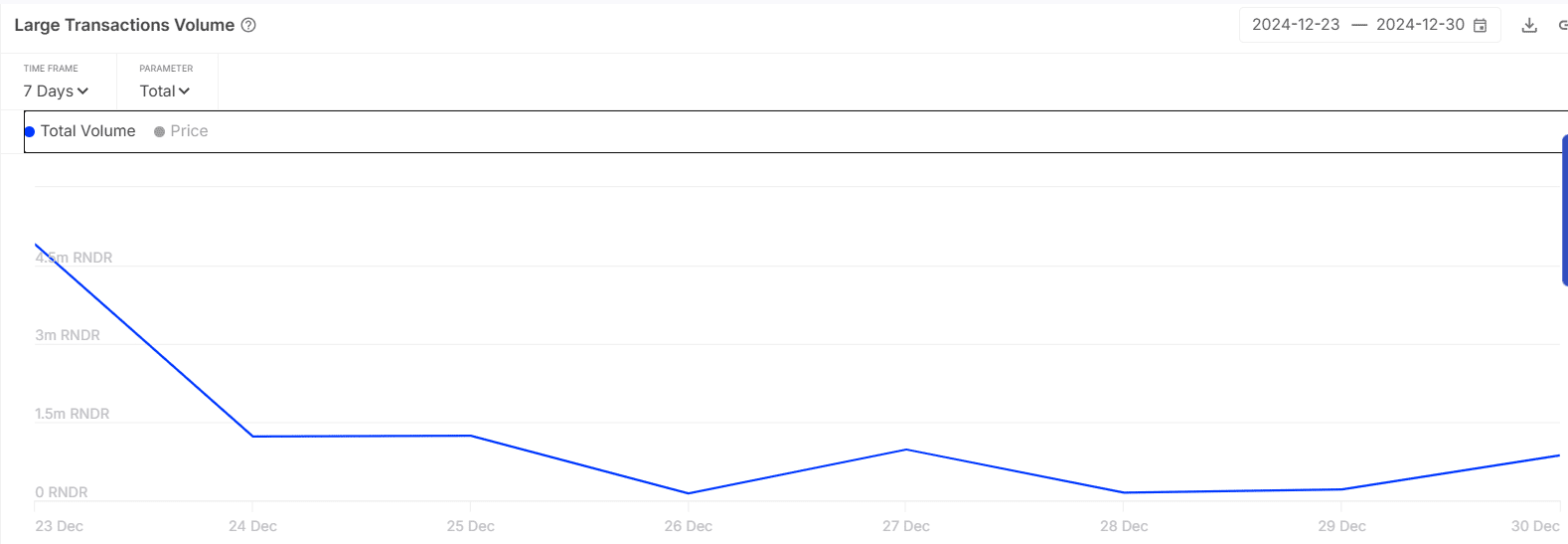

- Whale activity also increased, with transactions exceeding $100,000 increasing from 148,460 to 866,180 tokens.

As a seasoned crypto investor with a knack for deciphering market trends, I find myself intrigued by Render (RNDR) at this juncture. The descending triangle pattern on its one-day chart is a clear red flag, signaling a downtrend that has been confirmed by the On-Balance-Volume (OBV) indicator’s drop. However, the Moving Average Convergence Divergence (MACD) line suggests that the bearish momentum might be weakening, hinting at potential price consolidation.

The spike in whale activity is a double-edged sword. On one hand, it could lead to increased volatility, which might not be favorable for short-term investors like myself. On the other hand, if these whales are indeed buying, it could provide a much-needed boost to RNDR’s price. But let’s not forget that whales control 76% of the total RNDR supply, so their activity can have a significant impact on the market.

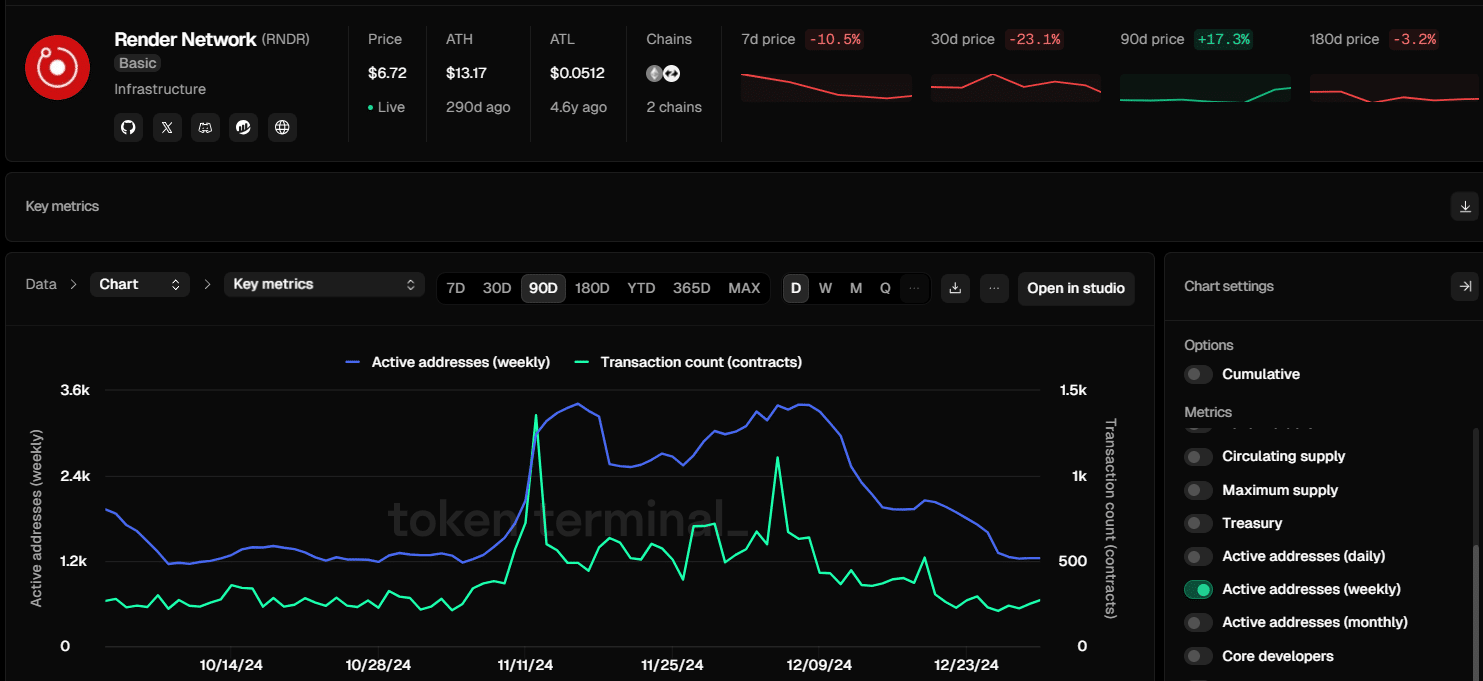

The declining network activity is another concern. If Render fails to attract new users and maintain its current user base, it could hinder RNDR’s recovery from bearish trends. However, if we see a surge in usage on the Render network, it could potentially drive buyer interest and increase market participation.

In conclusion, while I remain cautiously optimistic about Render’s potential recovery in 2025, I would advise fellow investors to tread carefully given the current bearish trends. As they say, “Buy the rumor, sell the news,” so let’s hope that any positive news about RNDR doesn’t lead to a sell-off! After all, crypto investing is like riding a roller coaster – it’s all about holding on tight and enjoying the ride.

At the moment of reporting, RNDR was priced at $6.73, experiencing a minor 0.58% decrease over the past 24 hours. Additionally, trading volume decreased by approximately 24%, according to CoinMarketCap, suggesting less market activity.

2024 saw a 51% increase for Render, but the long-term forecast indicates potential bearish tendencies which might cause a decrease in RNDR’s value as we move into 2025.

Render’s descending triangle pattern

On its one-day chart, Render appeared to be moving inside a descending triangle formation, suggesting a noticeable downward trend.

Moreover, the On-Balance-Volume (OBV) index was decreasing, suggesting that the downward trend was caused by increased selling over buying. If buyers continue to show reluctance, this could impede any chances of a market recovery.

The MACD line, a tool that shows market momentum, was moving below the signal line, signaling a downward trend. Yet, the histogram bars are hinting at a decline in the strength of this downtrend, potentially leading to a period of price stabilization.

Notable points to keep an eye on are the potential support at $6.60. If Render dips beneath this point, it might lead to additional falls. On the flip side, $7 appears to be quite robust as resistance, and breaching this level could potentially indicate a bullish turnaround.

Whale activity spikes

Despite a general downturn in market sentiment, large investors known as “Render whales” are showing renewed activity. As per IntoTheBlock’s data, transactions valued at over $100,000 have noticeably surged in the past two days, jumping from 148,460 RNDR to 866,180 RNDR.

Although this rise doesn’t guarantee that whales are purchasing, it might lead to heightened price fluctuations due to the fact that whales control approximately 76% of the entire RNDR stockpile.

Based on my years of trading experience, I’ve noticed that whale activity can be a strong indicator of market movements. Recently, I’ve observed that whale activity remains at relatively low levels compared to their weekly highs. However, this doesn’t mean we should disregard it entirely. A sudden spike in buying or selling activity by these large players could potentially lead to significant price changes. As a seasoned trader, I always keep an eye on such developments and adjust my strategies accordingly to take advantage of any potential opportunities that may arise.

Falling network activity could fuel a downtrend

As someone who has closely followed the cryptocurrency market for several years now, I have to say that the recent decline in activity on the Render network is quite concerning. Having seen similar patterns before in other networks, my intuition tells me that this could indicate a larger trend that might affect the long-term success of the project. The fact that the number of active weekly addresses on the network is approaching a two-month low after dropping by 50% in December 2024 is particularly troubling, as it suggests a loss of user interest and engagement. This decline could potentially signal a shift in investor sentiment or a lack of confidence in the project’s future prospects. As someone who has witnessed the ups and downs of this market firsthand, I would urge investors to exercise caution and closely monitor the situation before making any investment decisions.

Conversely, it appears that the number of transactions on the network has decreased to approximately 270, implying a reduction in usage by its users.

As a crypto investor in RNDR tokens, I can’t help but wonder about the future of the Render network. If it struggles to bring on new users, this potential lack of growth might hinder the token’s capacity to bounce back from downward market trends.

Can Render recover from bearish trends in 2025?

In 2025, Recovery of Render may depend on two significant factors: purchasing actions and network involvement. Should purchasers re-engage and counterbalance the selling force, it could indicate a positive outlook for RNDR.

Read Render’s [RNDR] Price Prediction 2024–2025

Based on my experience working in the tech industry, I have noticed that when there is a surge in usage of a particular technology or platform, it tends to pique the interest of potential buyers and stimulate greater market participation. For instance, when a new smartphone model with advanced features gets released, people start talking about it, reviewing it, and eventually buying it, which leads to increased sales and market buzz. Similarly, if the Render network experiences a spike in usage, I believe this could also trigger buyer curiosity and encourage more players to join the market, leading to an overall growth in participation and engagement.

Read More

2025-01-02 02:16