- Render gained bullish momentum after testing a key support level within a symmetrical triangle.

- Whale activity and active addresses surged, signaling growing market interest.

As a seasoned analyst with years of experience navigating volatile markets, I find myself increasingly optimistic about Render (RNDR) at this juncture. The symmetrical triangle consolidation pattern we’re witnessing is often a precursor to significant price action, and the signs are pointing firmly towards a bullish breakout.

At the moment, I find myself observing RNDR holding steady within a symmetrical triangle formation. This geometric pattern often hints at heightened market volatility in the near future.

As the altcoin approaches a crucial support point, investors are closely monitoring its upcoming direction.

The altcoin market sentiment is leaning bullish, and indicators are pointing upward.

Generally speaking, a symmetrical triangle often indicates potential price movements in either direction, contingent upon the overall market situation.

At present, it looks like Render could be building up positive energy, hinting at a potential surge in its value, possibly leading to a rise above its current levels.

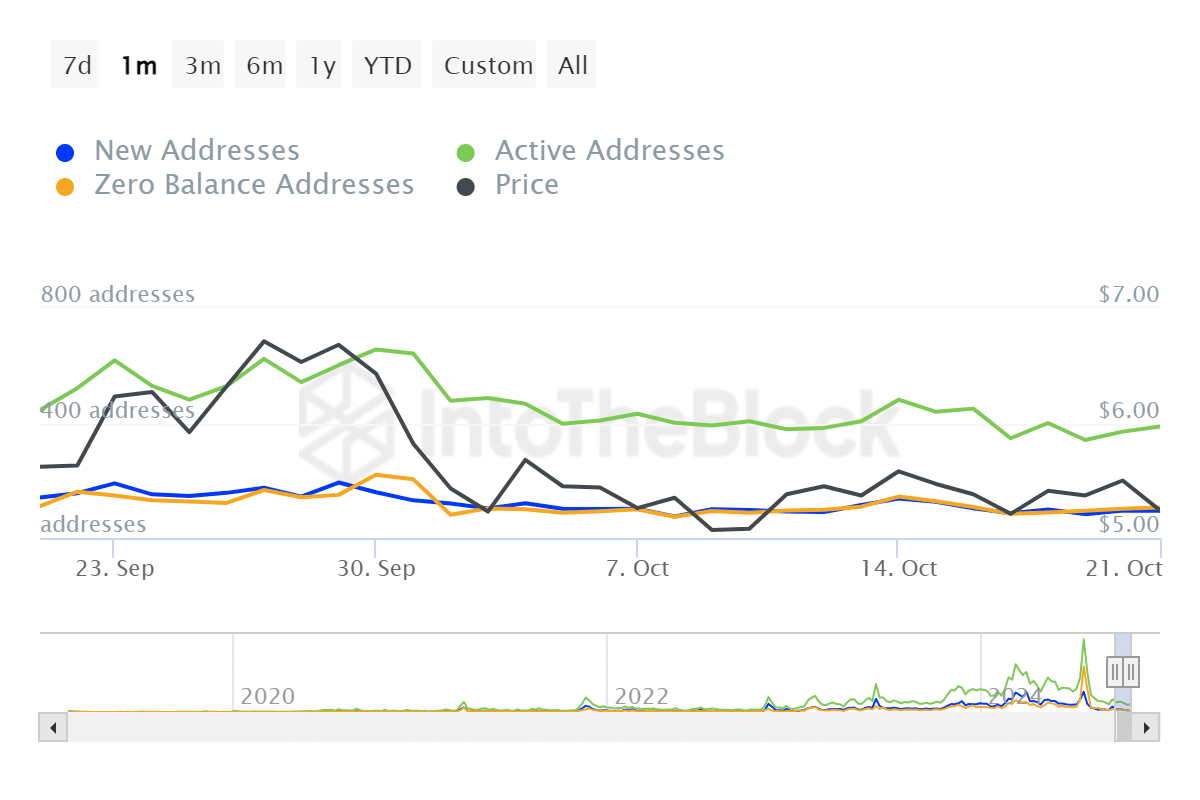

Active addresses surge by 10%

Based on AMBCrypto’s assessment, a robust argument for the bullish outlook can be bolstered by the fact that there has been a 10% rise in active user accounts.

As the number of actively used addresses tends to rise, it typically suggests increased user engagement, a condition that can frequently precede price fluctuations.

The rise in activity might imply that a greater number of users or market players are engaged on the Render network. Typically, this trend is linked with heightened market trust.

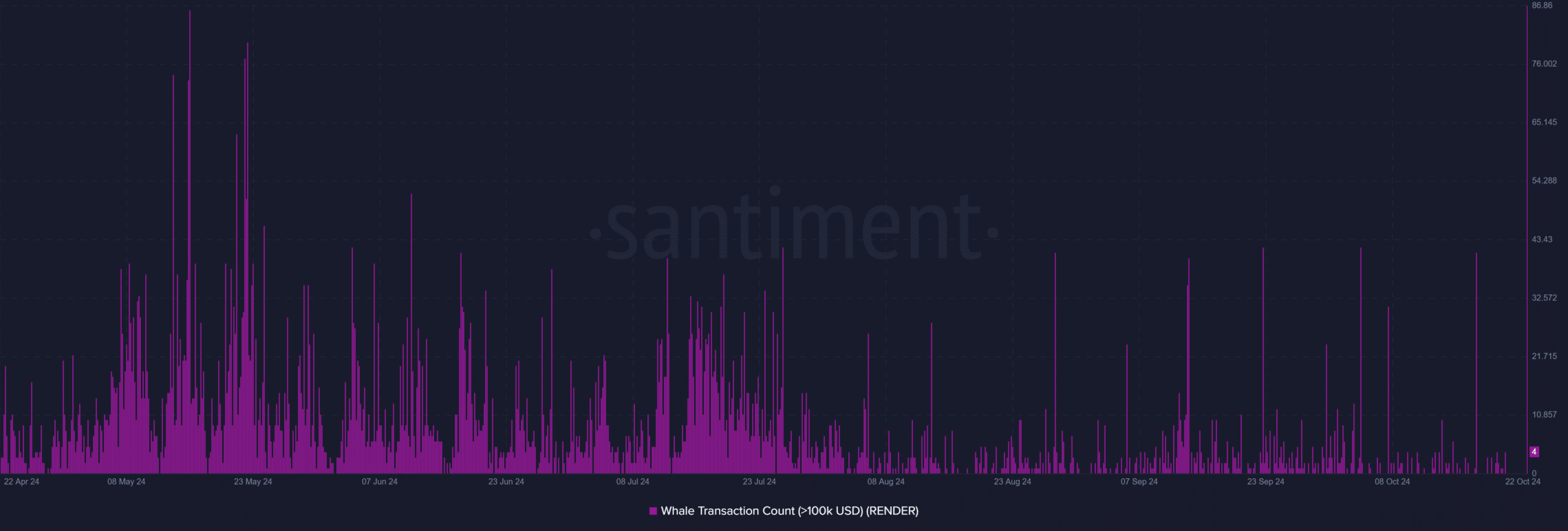

Major players enter the market

Furthermore, the heightened trading action also includes a substantial 84% rise in large-scale altcoin transactions, as indicated by data from Santiment.

In simpler terms, whale activities (large-scale transactions by significant investors) can significantly impact financial markets, and an uptick in their activity could indicate a potential major price change approaching.

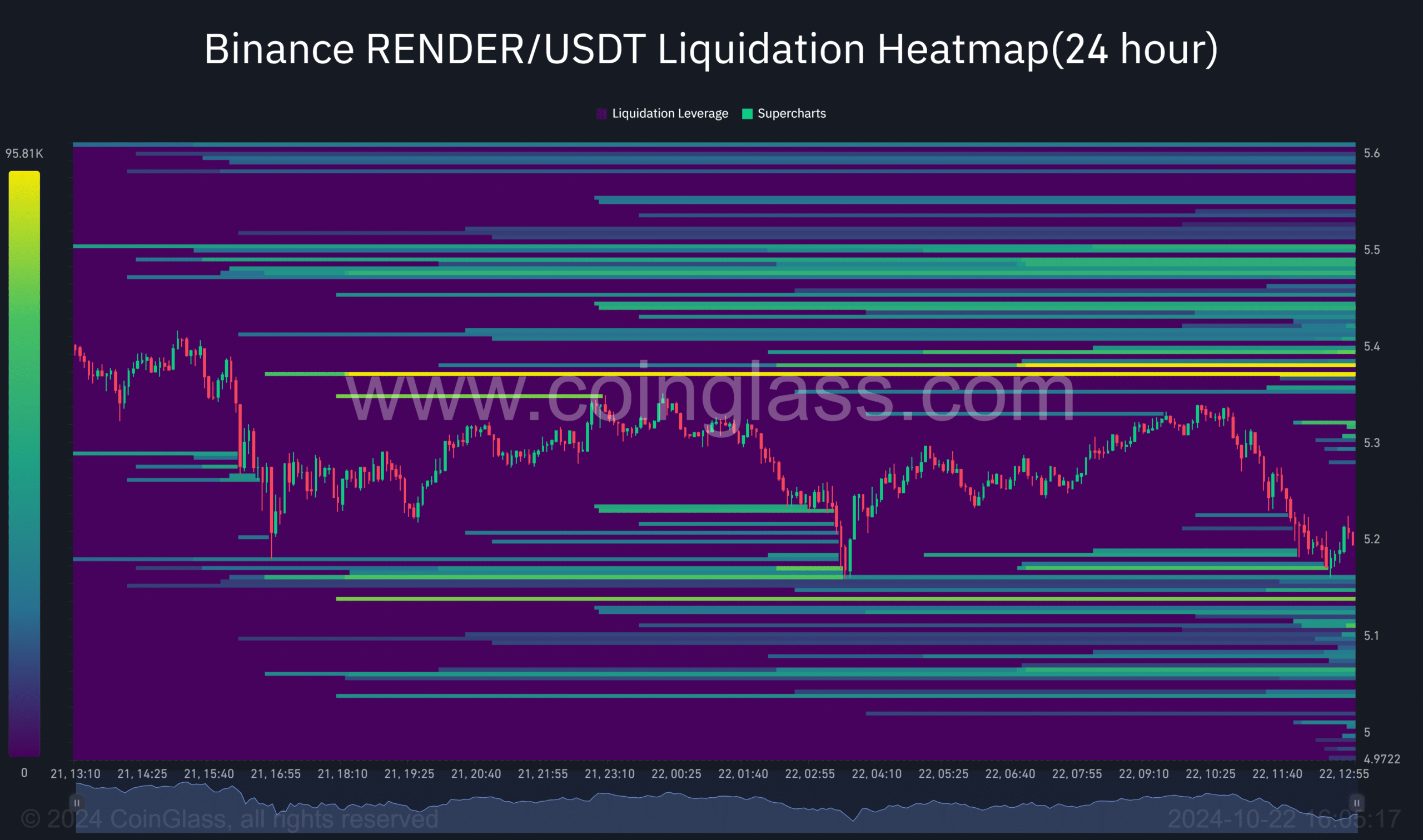

Render bullish bias adds confidence

As confidence continues to rise, this situation seems to favor buyers (bullish), with significant reserves ready for purchase at prices above the current market value. These reserves might function like a magnetic force, potentially drawing Render’s price upward.

This could also add more fuel to the ongoing bullish run.

Read Render’s [RNDR] Price Prediction 2024–2025

At the current moment, the price is organized in a well-balanced triangular formation, fueled by increasing active user addresses and whale transactions. This trend suggests a strengthening bullish trend.

With a positive liquidation heatmap as the background, Render could be poised for a major breakout.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-10-23 09:43