- Render transactions exceeding $100,000 surged from 164,000 to 852,000 in two days.

- This rise has coincided with a resumption of buying activity, as the CMF shows.

As a crypto investor, I’m currently seeing Render (RNDR) trading at $8.73, an increase of 3% over the past 24 hours. This impressive rise has pushed its weekly growth to 29%, placing it among the top performers in the AI and Big Data coin sector, according to CoinMarketCap.

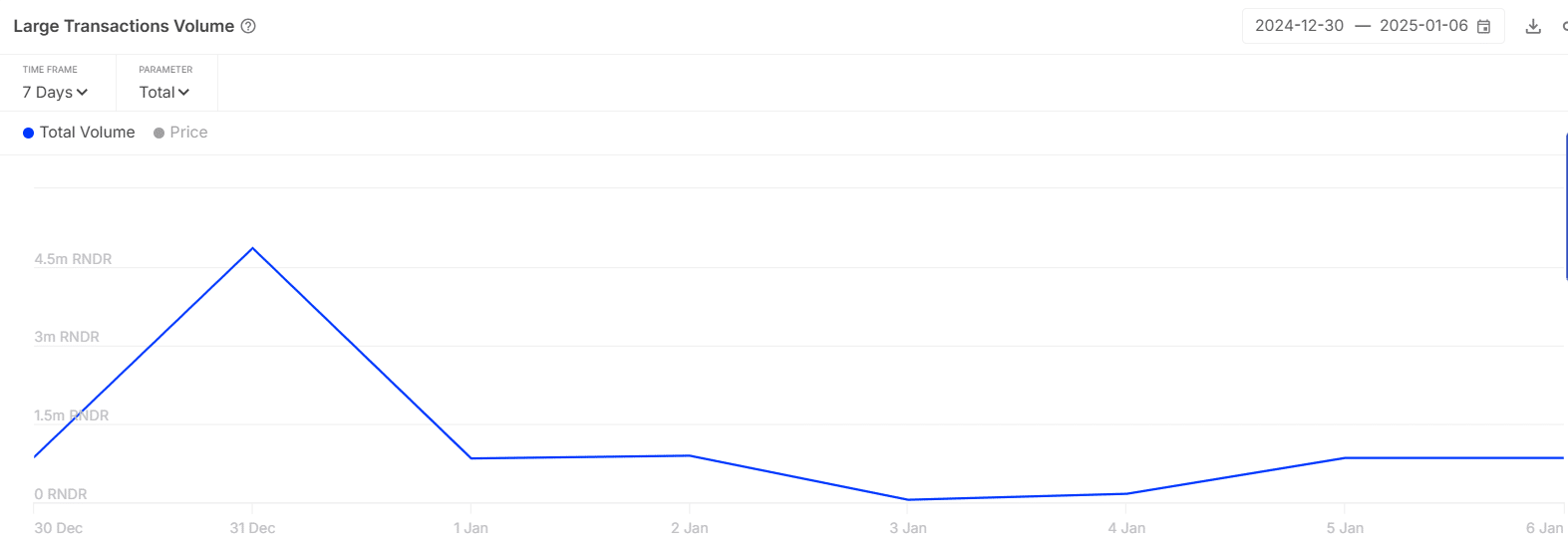

It appears that these substantial increases in value are drawing considerable interest from numerous large entities. As reported by IntoTheBlock, transactions valued over $100,000 have significantly increased by more than 400% within just two days, rising from approximately 164,000 RNDR to a staggering 852,000 RNDR.

Approximately three-quarters of Render’s entire stockpile consists of whales. Consequently, once these massive accounts start trading, it will undoubtedly influence the price swings.

The increase in big addresses has likewise been accompanied by a positive trend for RNDR, as suggested by its one-day graph.

Render’s buying activity resumes

On Render’s daily chart, there was a significant increase in buying momentum as indicated by the Chaikin Money Flow (CMF), which moved into a positive zone. This spike in buying pressure suggested that buying actions had reached their highest level in almost three weeks.

The temporary trend of the Render token turned optimistic following its breakthrough of the resistance level at the 50-day Simple Moving Average (SMA), which was at $8.22.

A continuation of this uptrend could see RNDR target the 2.618 Fibonacci level at $13.77.

As an analyst, I would advise keeping an eye on the 150-day Simple Moving Average (SMA), currently at $6.31, as a potential support level. A fall below this point might suggest a weakening of the overall bullish trend we’ve been observing.

So long as Render’s stock price stays above both its short-term and long-term average prices, it suggests that the overall trend is still upward. In other words, the positive momentum is likely to persist.

Rising MVRV suggests…

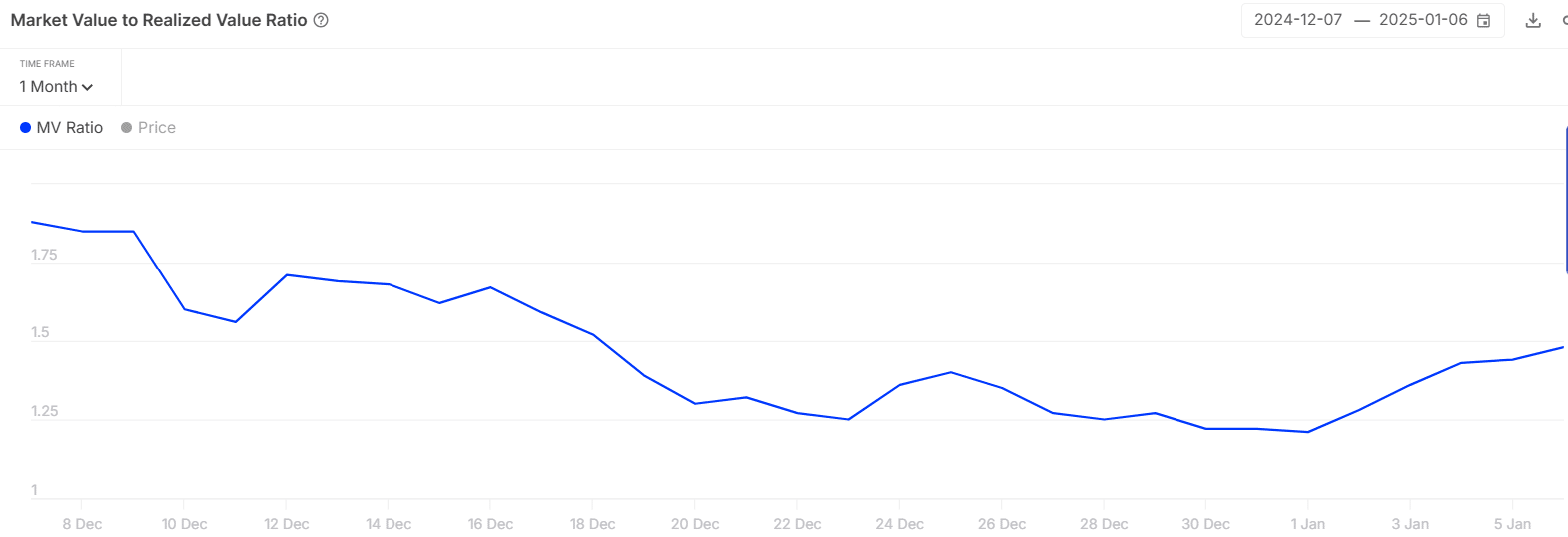

The Rendered Market Value to Realized Value (MVRV) ratio has spiked to its peak in the past three weeks, indicating a significant increase in profits for holders and suggesting a positive, or bullish, trend.

Even though it has increased, the MVRV (Market Value to Realized Value) ratio remains lower than its monthly peak, suggesting that Render may not be overvalued at this point. Consequently, despite a substantial 29% surge in one week, there is potential for RNDR to continue growing.

A Multivariate Value to Realized Value (MVRV) ratio of 1.48 implies that RNDR might be starting its bull market phase, thereby reinforcing the idea that it will maintain an upward trend.

Realistic or not, here’s RNDR’s market cap in BTC’s terms

Render’s Open Interest surges

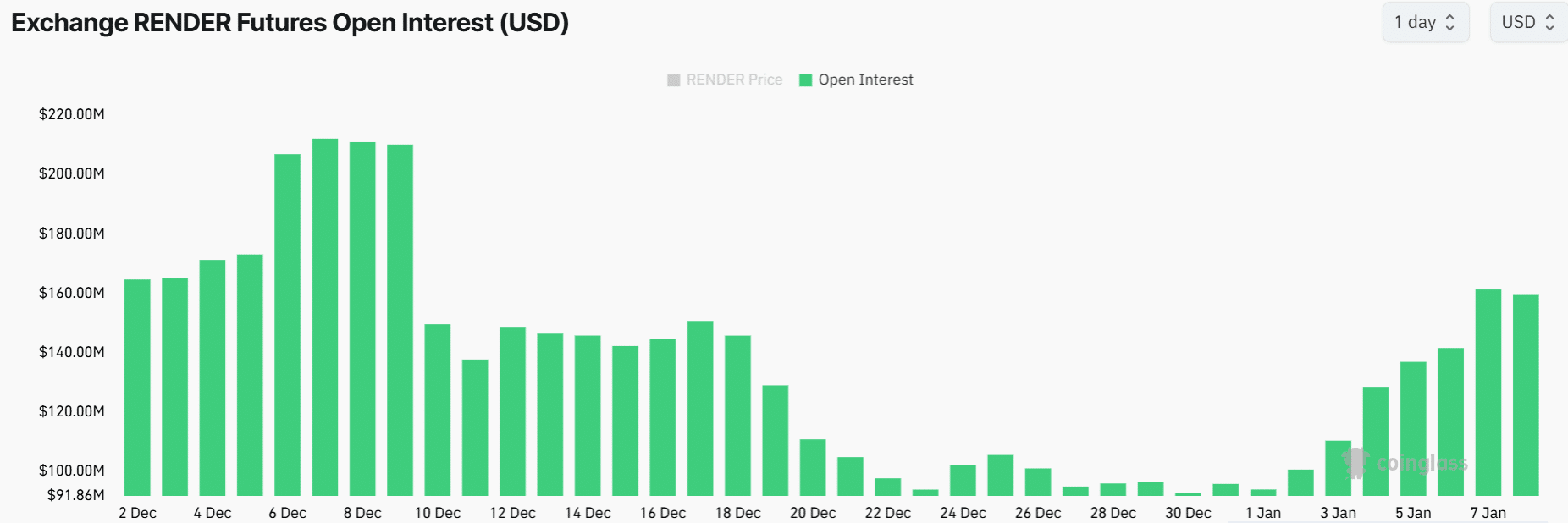

Over the past few weeks, there’s been a noticeable surge in the amount of Open Interest held by Renders. As we speak, this figure stands at approximately $161 million, which is its highest point in almost a month.

As a researcher, I’ve observed an upward trend in the Open Interest (OI) along with a price hike for RNDR. This suggests a surge of bullish sentiment and strong conviction among traders, as they appear to be aggressively investing in new positions. Consequently, this could lead to increased volatility in the price movements of RNDR.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2025-01-07 22:47