-

RENDER price fell sharply on Monday to an intraday low near $5.30.

The RSI reading on the daily timeframe has ranged above 41 since 21st August.

As a seasoned analyst with over two decades of experience in financial markets, I’ve seen my fair share of market fluctuations and trends. Today, I find myself looking at RENDER‘s price action, which has been quite intriguing.

On October 8th (Monday), Bitcoin (BTC) saw a slight increase in value, peaking at $63,957 during the day as per CoinMarketCap records. However, it then switched direction. Notably, Bitcoin’s uptrend seemed to drag other cryptocurrencies like Bittensor [TAO] and Sui [SUI], causing them to record substantial gains of over 10% at the time of writing this statement.

Memecoins also broadly traded in the green, thriving on a trending, albeit far-fetched, narrative that the memecoin niche will fuel the next crypto market bull cycle.

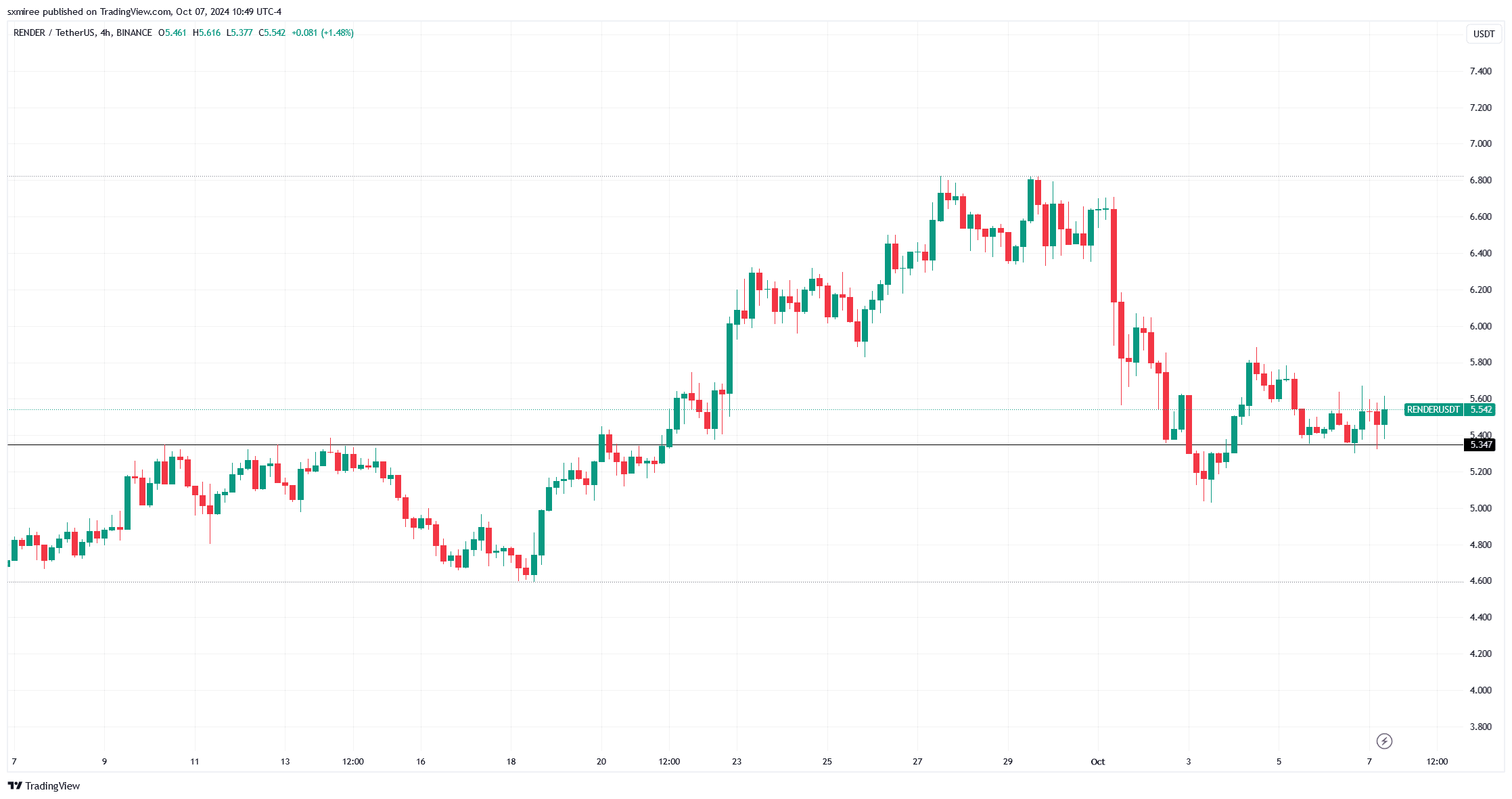

During the course of the day, Render, Kaspa, and Maker were among the top cryptocurrencies experiencing significant losses. The value of Render plummeted from $5.66 to a 24-hour low of $5.31 on Monday, making the support level at approximately $5.34 particularly noteworthy.

RENDER’s price struggle at key support

Over the last week, RENDER‘s value decreased by approximately 17%, reducing its yearly advance to 23%. The graph shows that RENDER has been facing challenges within the price range of $4.68 to $6.70, where it has been stuck for about two months.

4 hours ago on TradingView’s chart, the price of RENDER/USDT dropped below $5.30 for the first time since September 21st. However, it managed to bounce back and move above the critical level before the weekend began.

RENDER price retested the $5.40 support again today but had reclaimed higher ground at press time.

In simpler terms, this price level, matching up with the 50-day moving average displayed on the daily graph, holds importance because it served as a strong barrier to upward movement for aggressive investors around mid-September, acting more like a roadblock for them.

As a crypto investor, I found myself experiencing a surge in my RENDER holdings recently. The price of this digital asset climbed up to a monthly peak of $6.81, following a significant breakthrough over the resistance level on September 21st. This bullish move was quite encouraging!

RENDER/USDT technical weaknesses

According to Messari’s data, RENDER has seen a trading volume of approximately $2.65 billion over the past month, representing an increase of 18.43%. However, it’s worth noting that this figure is relatively lower compared to other AI-focused tokens like Bittensor’s TAO, which has experienced a growth in trading volume of around 170% during the same timeframe.

On a day-to-day basis, the cryptocurrency pair RENDER/USDT was transacting below its 20-day, 50-day, and 100-day exponential moving averages (EMAs), implying a potentially bearish outlook in the short to mid-term timeframe.

As a researcher, I’ve noticed that the daily Relative Strength Index (RSI) reading I’m observing hovers around 48, which indicates a neutral zone. This suggests that the buying support currently in play seems to be balancing out the selling pressure effectively.

Is your portfolio green? Check the Render Profit Calculator

In simple terms, a mix of certain technical factors, investor positions, and falling prices suggests that RENDER might experience some downward trend in the short run, indicating a somewhat pessimistic market forecast.

With no immediate triggers, the price movements of Render are likely to be significantly affected by the overall mood or trends in the larger market.

Read More

- The Weeknd Shocks Fans with Unforgettable Grammy Stage Comeback!

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Taylor Swift Denies Involvement as Legal Battle Explodes Between Blake Lively and Justin Baldoni

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Lilo & Stitch & Mission: Impossible 8 Set to Break Major Box Office Record

- Shundos in Pokemon Go Explained (And Why Players Want Them)

2024-10-08 08:07