-

RNDR experienced a 13% fall in the last seven days.

Market sentiment showed optimism even though the prices have been declining.

As a researcher, I’ve been closely monitoring the recent developments of RNDR (Render Network), and the last seven days have shown a significant downturn with a 13% decline and a further 1.62% drop in just 24 hours. This bearish trend has resulted in a substantial decrease in trading volume and market capitalization, indicating a lack of investor confidence in the short term.

Render [RNDR] has experienced a 13 % decline in the last seven days and 1.62% in 24 hrs.

I’ve analyzed the data from the past 24 hours and found that the trading volume has significantly decreased, leading to a 52% decline according to CoinMarketCap. Additionally, RNDR‘s market capitalization dropped by 1.52%, resulting in a current value of approximately $3.08 billion.

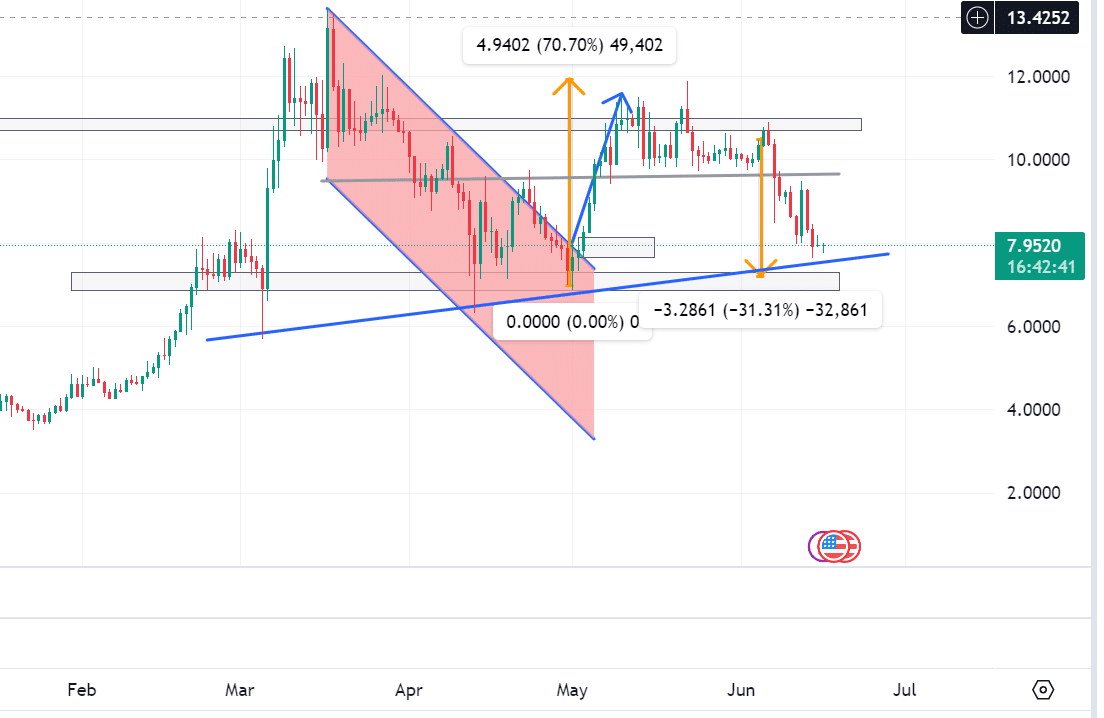

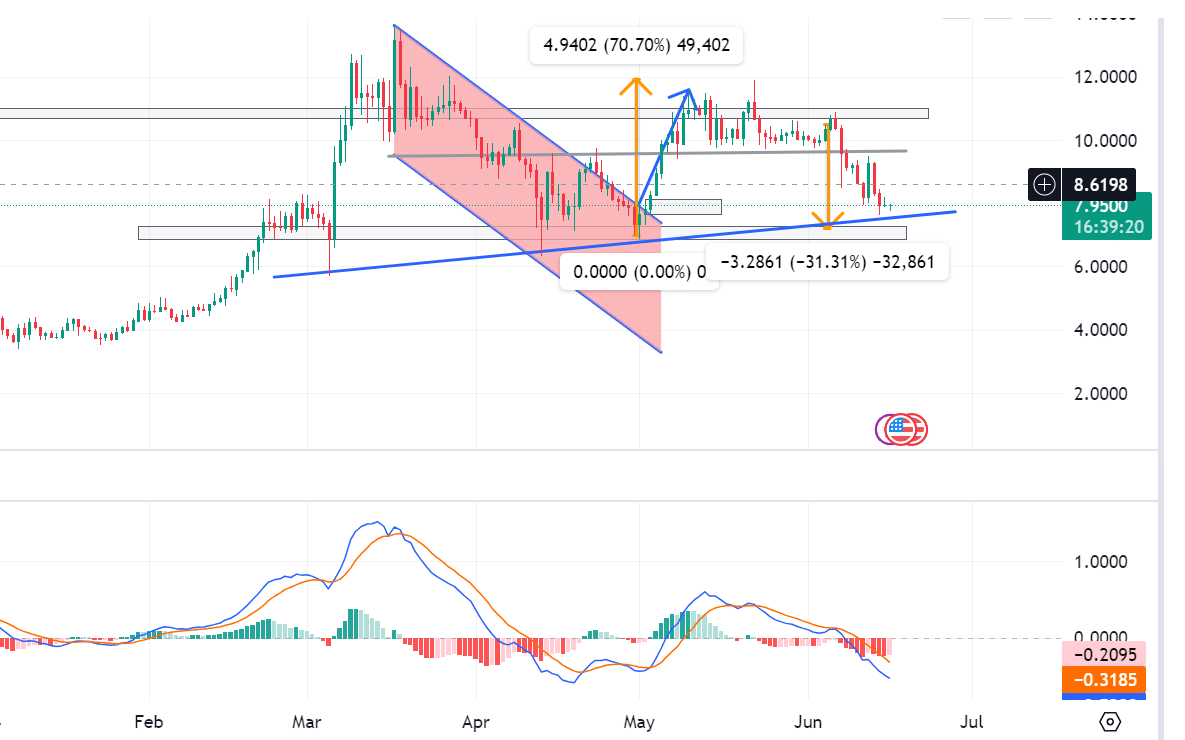

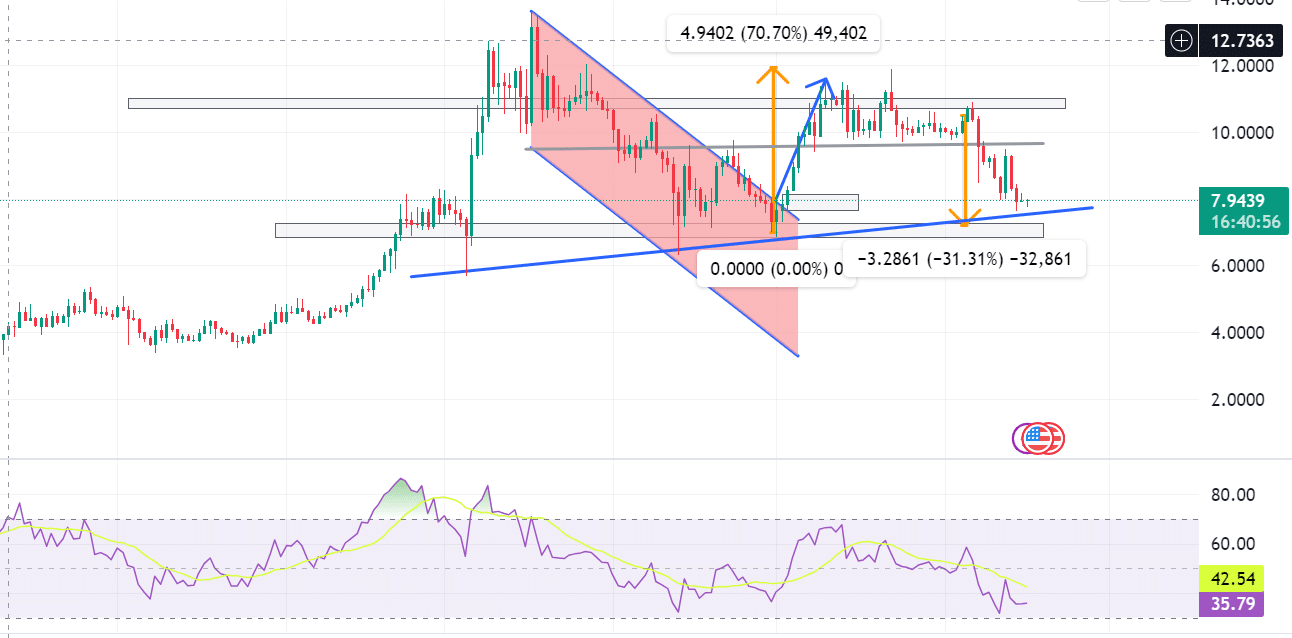

As a researcher, I’ve examined the price trends of RNDR according to AMBCrypto’s analysis. The token saw a significant 31% drop in value since June 3rd. Initially priced at $10, its downward trajectory has been predominantly bearish throughout the month.

With a resistance level of around $9, it’s trading at $7.9 while trying to retest.

If the price reaches the $7.2 support level for a retest, it’s likely that an uptrend will resume. Conversely, should it break below this level, a potential downtrend toward $5.2 may ensue.

Market outlook

Following its all-time high of $13 in March, the market mood shifted negatively. Over the past two months, it has seen a downturn, with June being particularly low during this timeframe.

Despite the attempts to break out, it has failed to reverse to a bullish trend.

At the moment when the news was published, the MACD (Moving Average Convergence Divergence) indicator mirrored the prevailing market mood. Specifically, RNDR‘s MACD stood at -0.32, suggesting that the negative trend in the market was set to persist further.

Render: Optimism in long term?

As a market analyst, I’d note that when I observed the markets, the Relative Strength Index (RSI) stood at 35. This signified a neutral position for the market, implying uncertainty and potential indecision.

In simpler terms, the market attitude indicated a lack of faith among investors regarding short-term opportunities, while there was more optimism towards long-term investments.

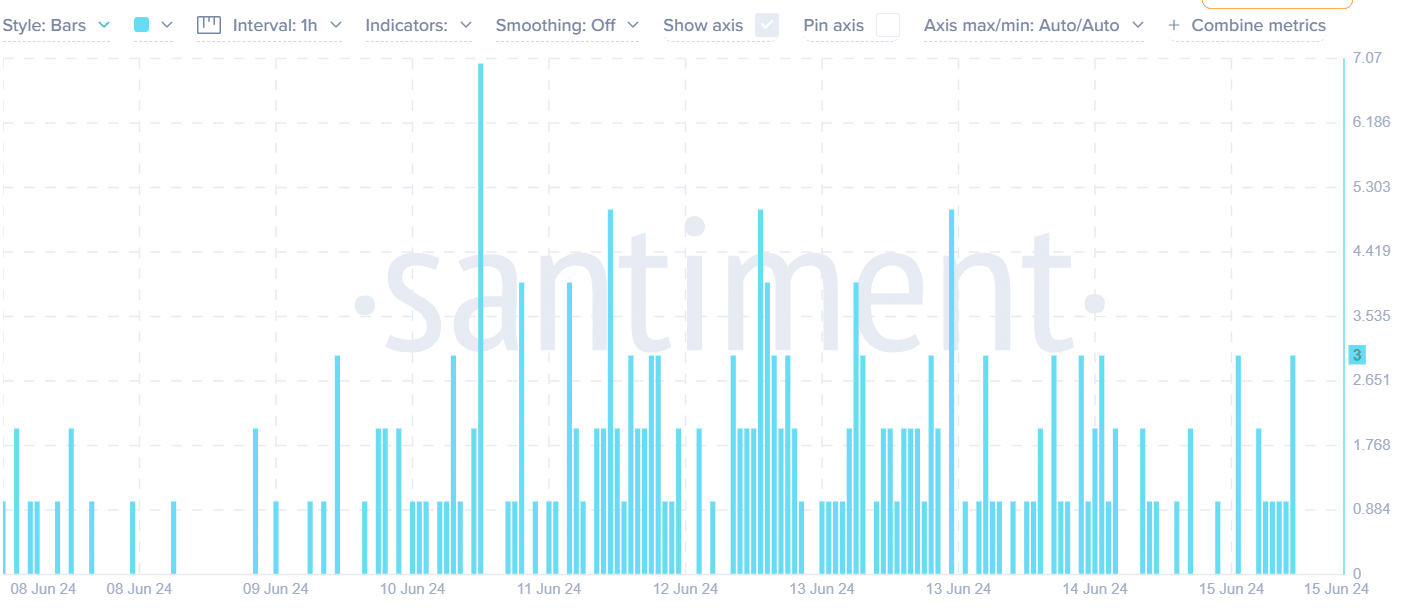

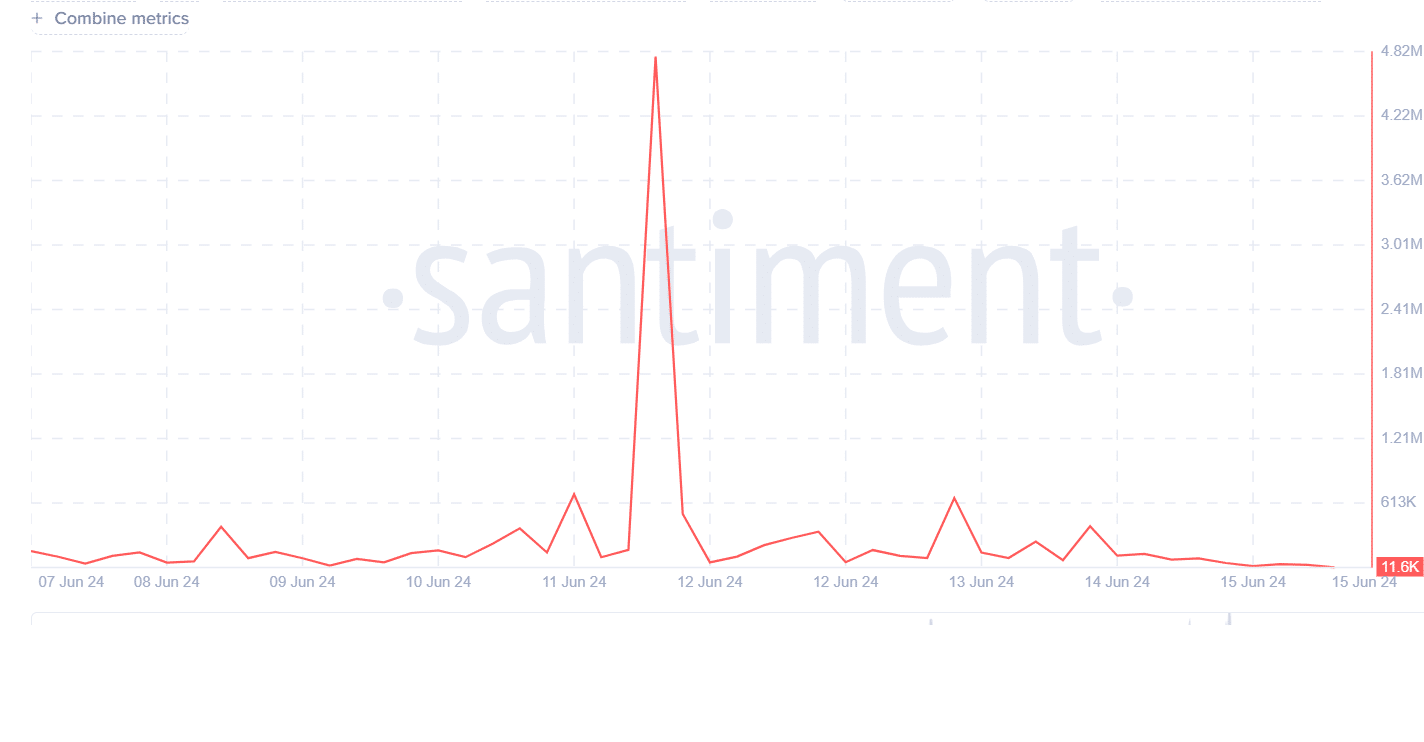

As a crypto investor observing the market trends, I’ve noticed that according to Santiment, RNDR has seen moderate to low social media buzz. This indicates a decreased level of public interest and engagement within the community surrounding this cryptocurrency.

This implied a possible reversal in prices as markets went against public anticipation.

Read Render’s [RNDR] Price Prediction 2024-2025

Based on Santiment’s analysis of Exchange inflows, RNDR has seen relatively low amounts of coins moving into exchanges. Usually, a decrease in exchange inflows implies that there is less selling activity, suggesting that investors hold a positive outlook and are more inclined towards long-term investment strategies.

Although the prices are still decreasing, there’s a sense in the market that a shift to an upward trend may occur at some point.

Read More

- Gold Rate Forecast

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- PI PREDICTION. PI cryptocurrency

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Rick and Morty Season 8: Release Date SHOCK!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-06-17 04:07