-

RNDR’s recent bounce didn’t change the market structure bias.

Sellers still had leverage as of press time, but a key demand zone ($6-$7) could attract bulls.

As a seasoned crypto investor with a deep understanding of market structures and trends, I believe that RNDR‘s recent bounce didn’t significantly alter the bearish market structure bias. Sellers still held leverage, but a potential demand zone at $6-$7 could attract bulls if Bitcoin doesn’t incur further losses.

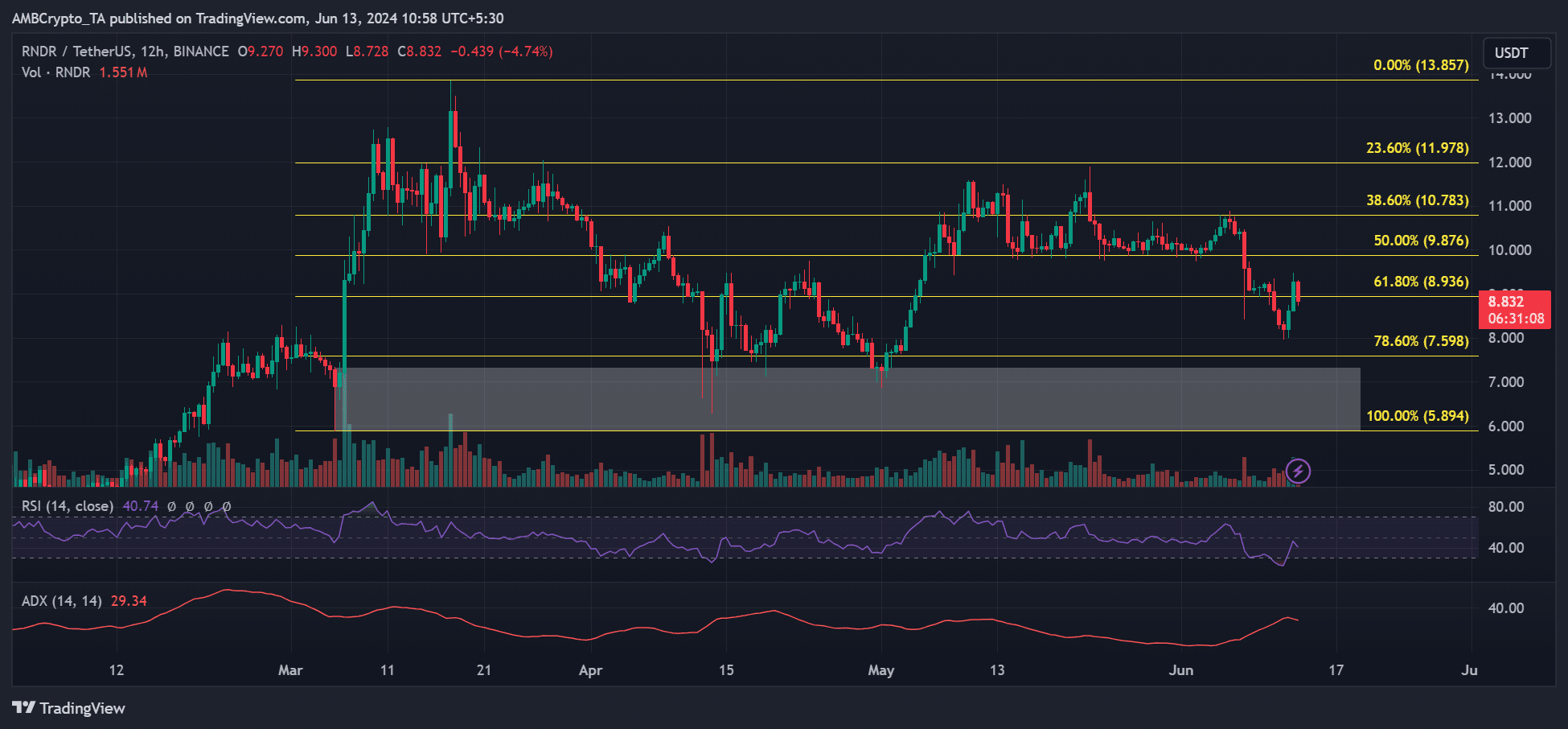

During the initial half of June, there was a surge in sellers on the Render (RNDR) marketplace, leading to a significant decrease in value for the decentralized GPU system’s token. The price has fallen by approximately 14%, ranging from a peak of $10.8 to a bottom of $7.95.

when will sellers decide to call it quits and exit their positions?

Render [RNDR] price prediction

At the moment of publication, the demand for RNDR fell short of the typical threshold (50), signaling a relatively weak market for this particular resource.

The ADX value, which measures trend strength, came in at around 25. This signifies a moderately strong trend, specifically a downward one, as evidenced by the progression of lower price points.

In this price range of around $6 to $7, denoted by the white markings, there was significant interest among buyers. This level managed to halt declines on four separate occasions and served as a potent buying zone or “order block,” having been established back in early May.

As an analyst, I would recommend that the RNDR zone could potentially draw in more bids if Bitcoin [BTC] avoids further losses. Should a potential reversal transpire, the next bullish targets for RNDR could be found at the 50% level, around $9.8, and the 38.6% level, approximately $10.7.

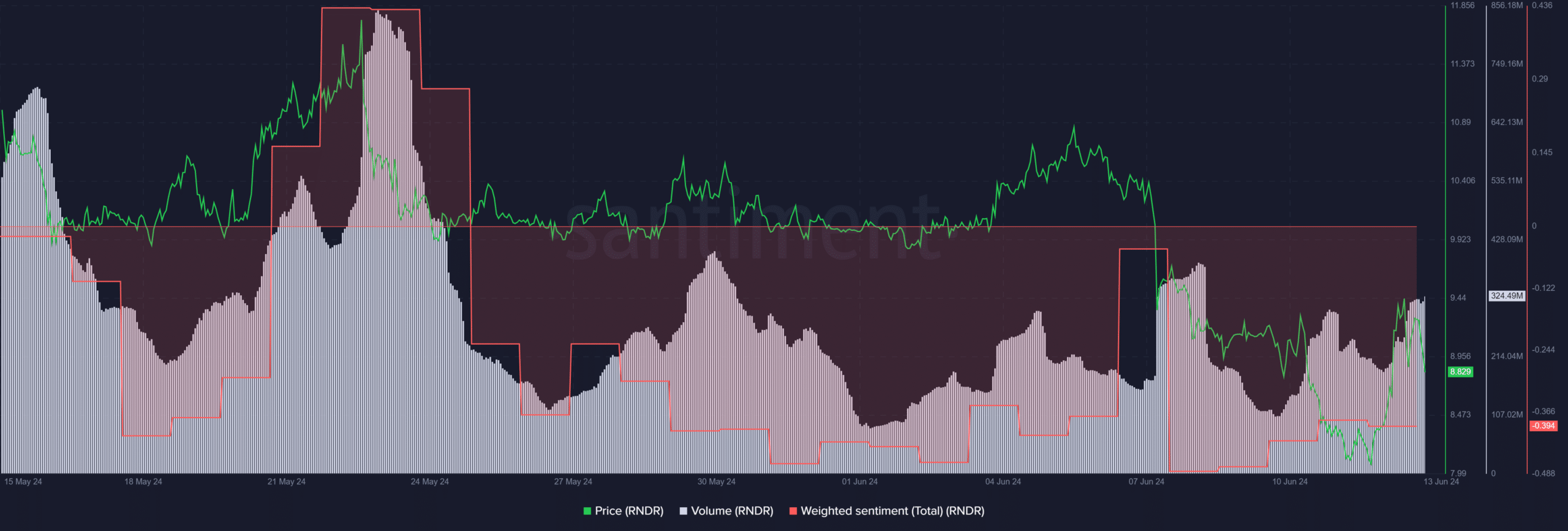

Market sentiment was negative

As a crypto investor, I’ve noticed an increase in on-chain volume for RNDR coins following the recent price bounce. This surge in trading activity could potentially fuel further recovery if the upward trend persists. Consequently, the future price movement of RNDR may depend heavily on Bitcoin’s next move.

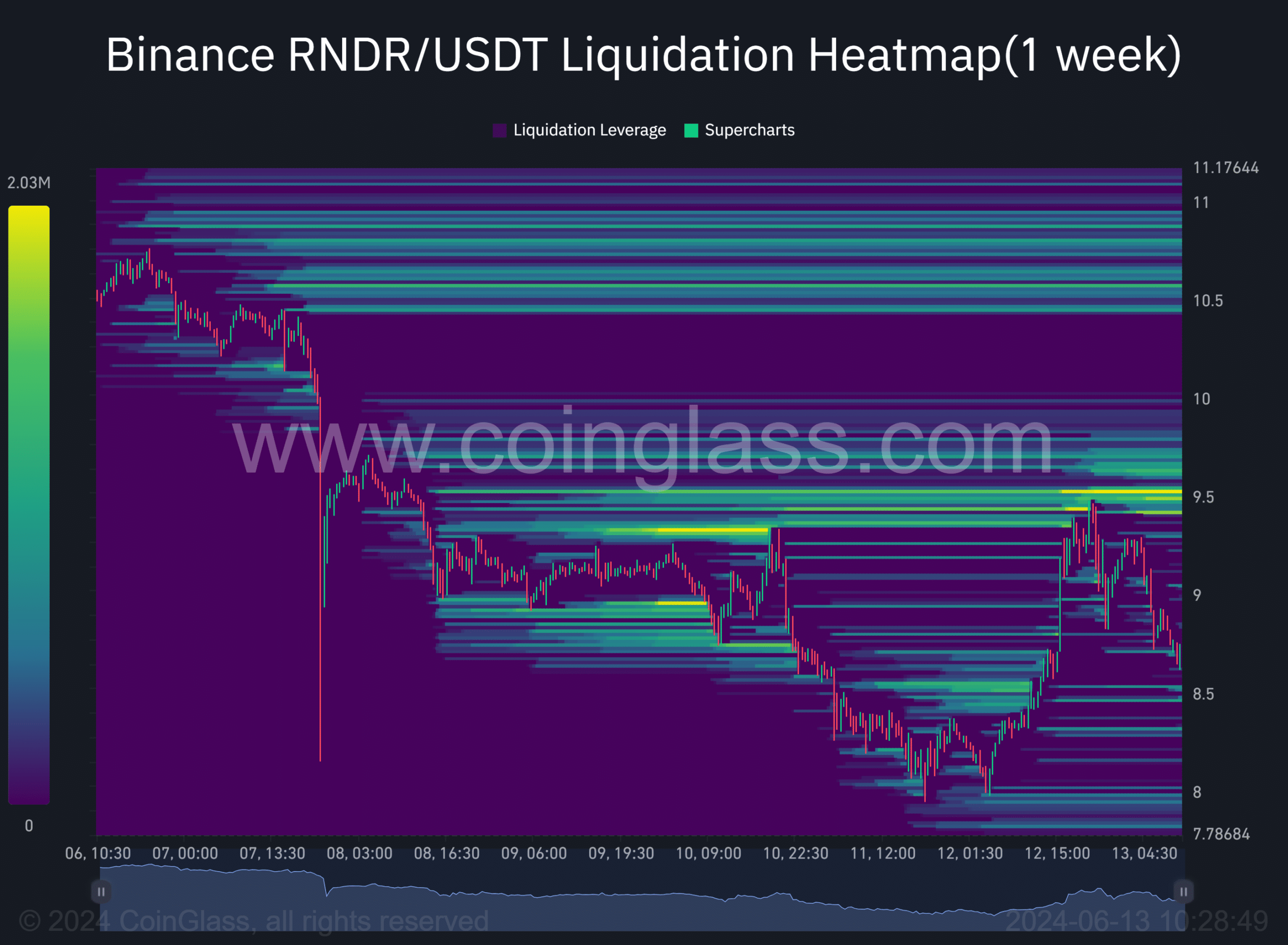

During this period, data from Coinglass showed that significant pools of liquidity existed at the prices of $9.5 and $10.5, as indicated by the orange marks.

In a typical situation, the price movement of RNDR often seeks out areas with high trading volume, or liquidity. If market conditions favor a bullish outlook, RNDR may rise and reach those levels as a result.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- SOL PREDICTION. SOL cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

2024-06-13 17:11