- Render surged by 40.16% to a nine-month high over the past day.

- Market indicators suggested that the altcoin could hit a new ATH.

As a seasoned analyst with over two decades of market experience under my belt, I find myself intrigued by Render’s [RNDR] recent surge to a nine-month high. The 40.16% increase over the past day is a clear sign that this altcoin might be on the brink of hitting a new ATH.

In the last day, RNDR (Render) has seen a significant surge and reached a peak of $11.853 – its highest point in the past nine months. This impressive rise amounts to a 40.16% hike during this timeframe.

As an analyst, I observed a remarkable surge in the trading activities of this altcoin, as the volume skyrocketed by approximately 244.93%, reaching a whopping $4.23 billion. Concurrently, the market capitalization soared beyond the $5 billion threshold.

In this stretch, Render managed to exceed Bitcoin‘s performance even after Bitcoin reached the $100K threshold. Compared to other AI-related coins, Internet Computer Protocol saw a decrease of 2.08%, Bittensor fell by 5.23%, while NEAR Protocol experienced a rise of 2.7%.

In contrast, other significant cryptocurrencies such as Ripple (XRP) experienced a drop of 9.71%, Solana (SOL) saw a decrease of 0.70%, while Ethereum (ETH) showed an increase of 4.6%.

Given that Render is currently experiencing an impressive surge in popularity, the query arises: will this altcoin be able to maintain its upward trajectory?

Can Render sustain the rally?

As per AMBCrypto’s evaluation, Render is presently showing signs of optimistic market movement, backed by a robust uptrend.

It appears that AMBCrypto detected a surge in optimistic attitudes and new investors joining the market. Consequently, as per Coinglass data, the Open Interest (OI) for Render has skyrocketed to a record-breaking peak of $173.08 million over the last 24 hours.

As a crypto investor, when Open Interest (OI) increases, I can interpret it as more traders are entering the market by establishing fresh positions, while those who already have positions are maintaining their trades.

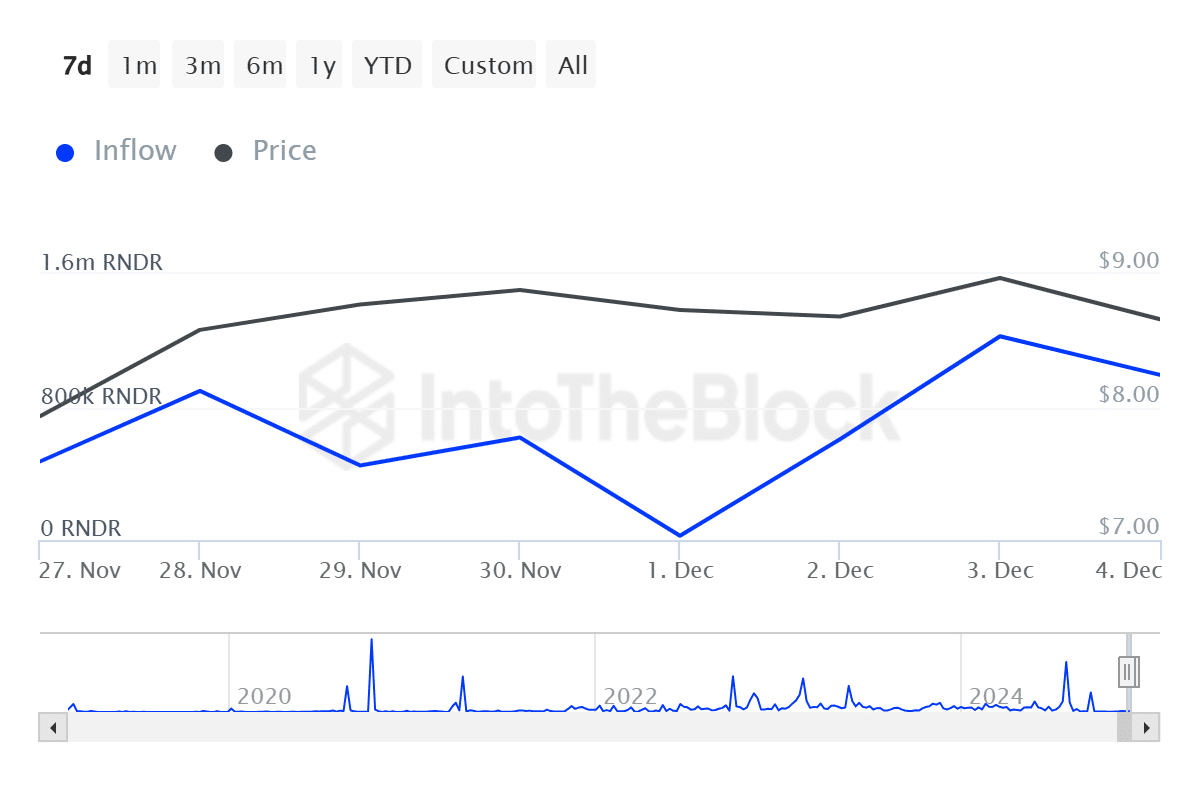

Moreover, there’s been a massive increase of over 4600 times in investments from significant investors, growing from an initial 26,020 to a peak of 1,230,000 since December 1st.

This increase indicates that whales are likely adding more funds to their holdings via acquisitions. As a result, it’s reasonable to assume that the growing number of open positions is primarily influenced by these whales, who are currently substantially increasing trading activity by buying altcoins.

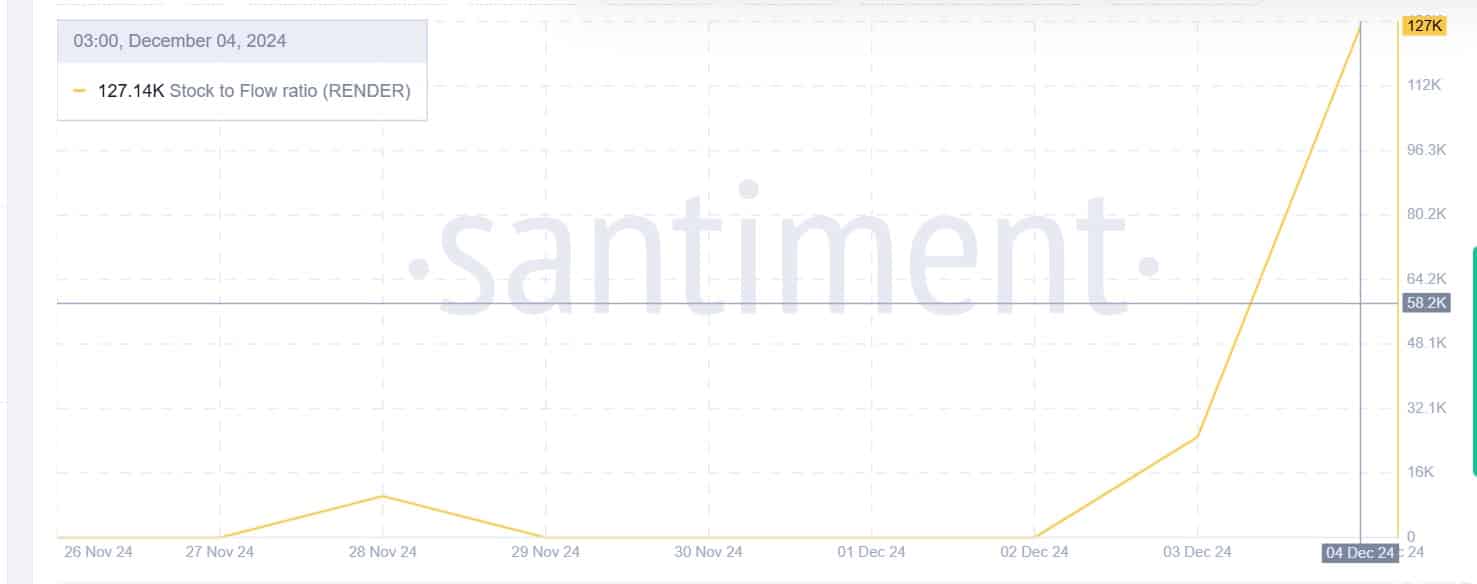

Over the last week, Render’s Stock-to-Flow ratio has significantly increased from 0 to 127,140. This substantial rise suggests that the altcoin has transitioned from an oversupply state to a state of scarcity. Given this shift towards scarcity, demand for the coin is likely to increase, thereby driving up its value.

Generally, increased scarcity raises demand, which often leads to higher prices.

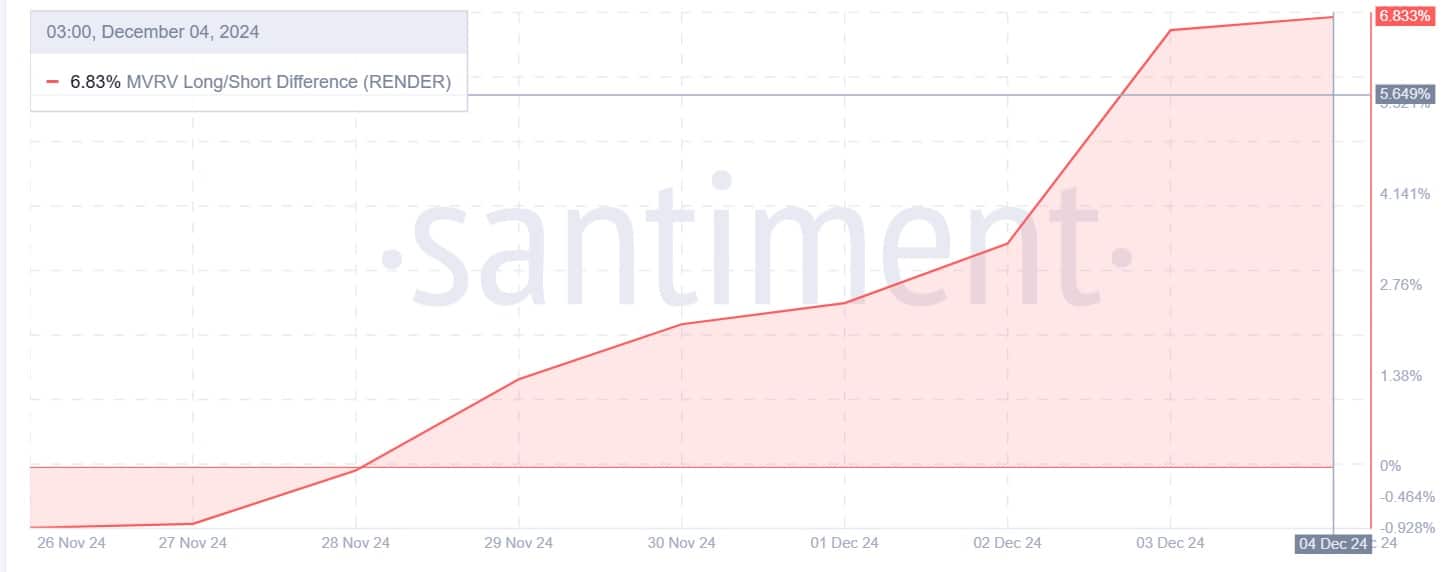

To put it simply, Render’s MVRV Long/Short Gap has been steadily climbing over the last week, moving from 0.04% to 6.83%. This spike suggests that long-term holders are seeing substantial profit growth, while still maintaining a positive outlook on the potential of this altcoin.

Read Render’s [RNDR] Price Prediction 2024–2025

To summarize, Render’s current outlook is optimistic, suggesting potential for more increases in its value.

Given the present situation, it’s expected that Render may face some opposition approximately at the price point of $12.095. Beyond this point, resistance lessens significantly, suggesting that the altcoin might achieve a fresh record high.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- Rick and Morty Season 8: Release Date SHOCK!

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

2024-12-06 05:11