- Whale transactions saw a notable increase, hinting at potential institutional interest.

- The positive sentiment around Render indicates growing optimism, which might translate to higher demand.

As a seasoned researcher with extensive experience in analyzing cryptocurrency markets, I have observed that whale transactions are often indicative of institutional interest. The recent surge in large-value Render (RNDR) transactions suggests that this trend may be playing out for the distributed GPU rendering system’s native token.

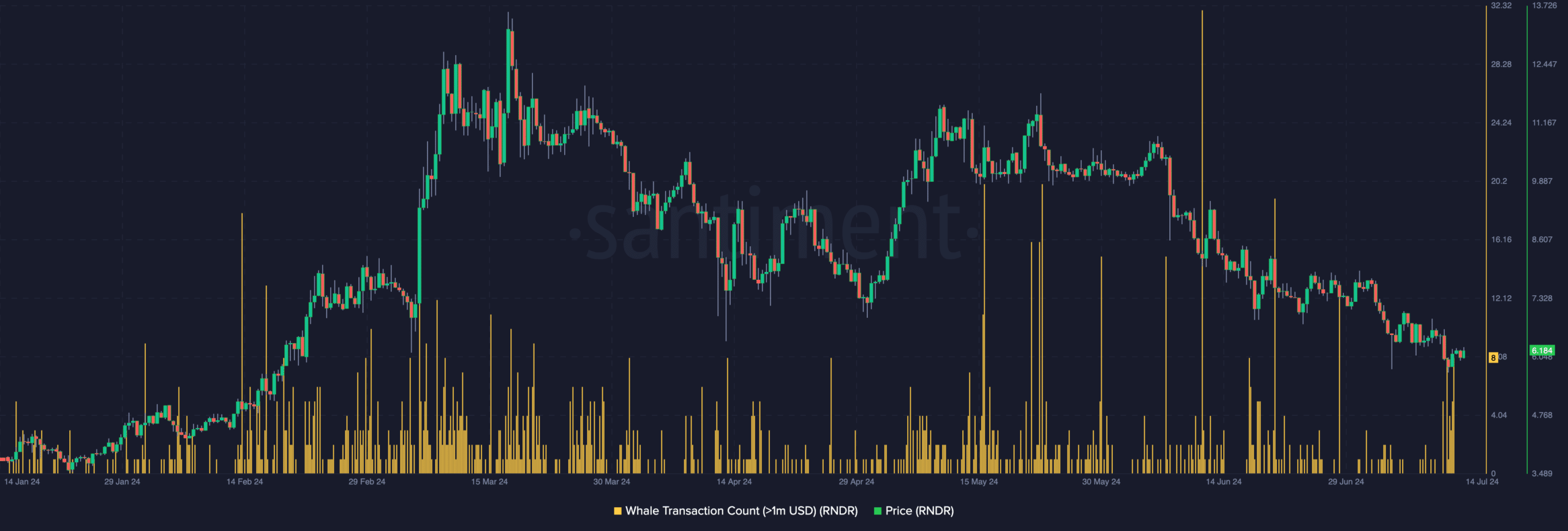

The native token of the decentralized GPU rendering platform, RNDR (Render), experienced a notable surge in large-scale transactions. Specifically, as reported by Santiment, there was a significant uptick in transactions worth $1 million or more on July 14th.

When the number of institutional transactions rises, it’s a sign of significant institutional demand for the token. Keep an eye on the price response to this news, as the actions of major investors, or “whales,” can significantly impact the token’s price trend.

Should the demand from whale investors rise, it’s likely that the price will surge. Conversely, if they decide to sell some of their holdings, the price could decrease.

Crypto big wigs are buying more RNDR

When it comes to Render, observe how price hikes correspond with rising transaction values, as depicted in the following graph. For instance, refer to March and May on the chart, where you’ll notice a comparable trend unfolding.

Based on current market trends, it’s possible that the price of RNDR may shift from a downtrend to an uptrend. The coin is currently priced at $6.20.

The last 24 hours saw a decrease of 8.85% in the metric. Yet, rendering network activity presented data favorable to the bullish argument.

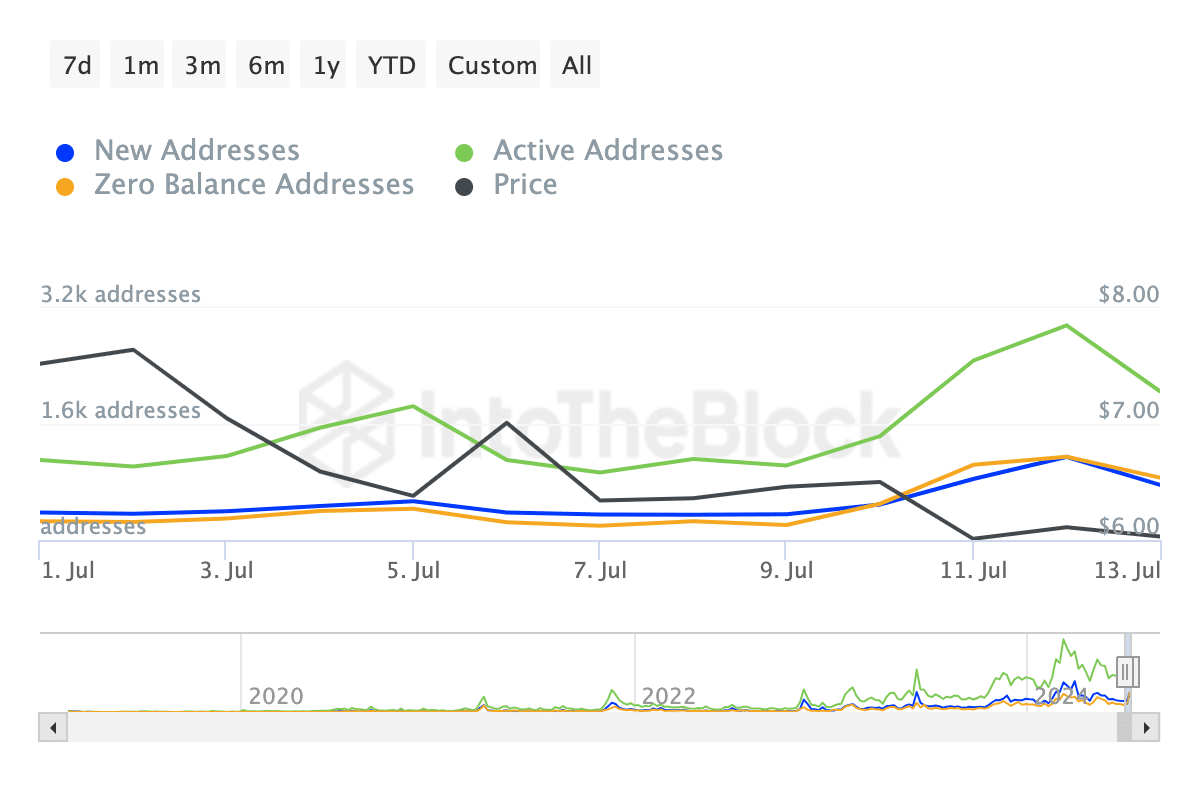

As a crypto investor, I’ve noticed some striking numbers according to IntoTheBlock’s latest report. In just the past week, network activity has surged, with active addresses – a metric representing unique users – soaring by an impressive 100%.

The number of new addresses, indicating the entry of first-time participants, rose by a substantial 86.09%. Additionally, AMBCrypto reported a growth in the count of zero-balance addresses.

If these metrics keep rising, they may signal a price surge for RNDR, potentially pushing it up to $7.05 in the near future.

Bullish sentiment aims to drive price higher

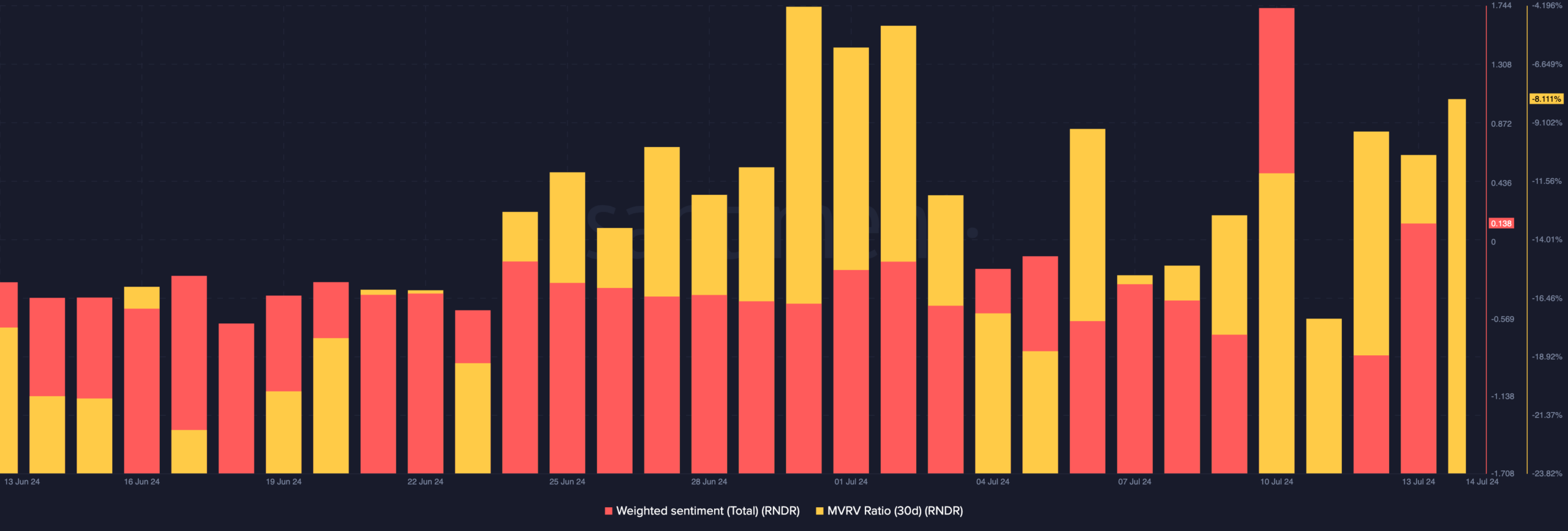

Additionally, AMBCrypto analyzed the public perception towards the token based on data from Santiment. The weighted sentiment score for Render is now showing a positive trend.

The analysis of Weighted Sentiment reveals whether the general public expresses more favorable or unfavorable views towards a project on the internet. A large volume of negative sentiments suggests a predominance of critical opinions.

When the market holds a favorable outlook, it implies an abundance of optimistic views. This situation could potentially boost the asset’s price if the positive sentiment persists. The increased optimism may lead to heightened interest and subsequent demand for the Render native token.

During this period, Render’s Market Value to Realized Value (MVRV) ratio stood at a level of -8.11%. This ratio compares a token’s market value with its realized value to determine if it is currently under or overvalued based on its profitability in the market.

Is your portfolio green? Check the Render Profit Calculator

In the majority of situations, a negative interpretation indicates that a cryptocurrency is likely underpriced. On the other hand, a value approaching 100% suggests that it may be overvalued.

Based on the present market situation, RNDR may be underpriced. Consequently, a significant jump in its value could occur.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- New Mickey 17 Trailer Highlights Robert Pattinson in the Sci-Fi “Masterpiece”

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

2024-07-15 08:07