As a seasoned digital nomad who has tried countless financial platforms over the years, I must say that Revolut has made a lasting impression on me. When it comes to managing my finances, user experience is paramount, and Revolut delivers just that – a well-designed app with intuitive features for both crypto and traditional banking.

Over the past few years, Revolut has established itself as a powerful player in the digital banking service sector. However, one might wonder about the factors that ensure its safety, security, and reliability within the cryptocurrency industry. Here’s a possible rephrasing:

Indeed, finding an all-in-one crypto application is challenging, as many shady crypto apps are on the market. Luckily, we are here to discuss anything you must know about through this Revolut crypto review.

In this piece, we’ll cover a variety of topics related to Revolut’s cryptocurrency offerings, including their services, safety protocols, fees, features, and more. After reading, you’ll have the comprehensive understanding needed to begin using Revolut for your cryptocurrency banking needs.

Let’s get started!

Revolut Crypto Key Takeaways

Ease of Use and Smooth Navigation: The Revolut mobile application makes it effortless for users to handle their cryptocurrency holdings.

Versatile Crypto Options: This platform offers a range of cryptocurrencies, enabling you to expand your investment horizons.

Safety Measures and Oversight: Revolut uses strong security systems and follows regulations set by multiple financial institutions, guaranteeing the protection of your assets.

It’s important to verify if Revolut’s services are accessible in your specific area because they might not be offered everywhere.

What is Revolut?

Among digital banking options, Revolut stands out as a prominent choice, gaining significant attention in recent times alongside various other groundbreaking technologies. This surge in popularity can be attributed not only to its innovative nature but also to its robust cryptocurrency services, user-friendly interface, and stringent safety protocols.

As a dedicated researcher exploring the dynamic world of financial technology, I delved into the innovative platform known as Revolut, co-founded by Nik Storonsky and Vlad Yatsenko in 2015. This versatile service provider offers an array of solutions, spanning from conventional banking services to the cutting-edge realm of cryptocurrency trading.

One notable aspect of Revolut is that it empowers users to streamline their financial management efficiently. It simplifies the monitoring of expenditures, allows for the establishment of spending limits, and even offers an automated saving feature.

The app also offers a variety of investment options, including stocks, ETFs, and cryptocurrencies.

In essence, Revolut provides a hassle-free and budget-friendly platform for handling financial matters. Regardless of whether you aim to save funds, invest wisely, or explore different countries, this app has got you covered.

Revolut: A Comprehensive Overview

Revolut Details:

- Name: Revolut Ltd.;

- Founded: 2015;

- Headquarters: London, England.

Launch Date of Crypto Platform:

- Revolut launched its cryptocurrency trading platform in 2017.

Additional Features and Benefits:

- Instant Transfers: Revolut allows for fast and efficient transfers between your crypto and fiat wallets;

- Crypto Vaults: You can create separate vaults for different cryptocurrencies to organize your holdings better;

- Metal Cards: Revolut premium metal cards offer additional benefits, such as cashback on cryptocurrency purchases and exclusive perks;

- Crypto Rewards: Some Revolut plans offer cashback or other rewards on cryptocurrency purchases;

- Market Analysis: The app provides real-time market data, charts, and analysis to help you make informed trading decisions.

Important Considerations:

- Regulations Compliance: Revolut is regulated by various financial authorities, including the Financial Conduct Authority (FCA) in the UK, under the Money Laundering, Terrorist Financing and Transfer of Funds Regulations, and is licensed by the European Central Bank and is regulated by the Bank of Lithuania;

- Security: The platform employs advanced security measures to protect user funds, such as two-factor authentication and cold storage;

- Customer Support: Revolut offers 24/7 customer support to assist users with any questions or issues.

The Revolut Crypto Services

Revolut, recognized primarily for its banking solutions, has expanded its offerings to cater to cryptocurrency investors and traders as well. Consequently, Revolut now provides crypto-related services.

To ensure secure and reliable cryptocurrency transactions and services, the Revolut team developed a convenient mobile application. This application facilitates effortless cryptocurrency trading, boasting an intuitive design and enhanced security features for its users.

With more than 40 million users worldwide and managing over $15.5 billion in client savings, Revolut Bank has established itself as a reliable choice for those interested in cryptocurrencies. It offers a blend of conventional banking and investment solutions, catering to a wider array of financial requirements for its customers.

But let’s get into the details!

Revolut Crypto Features At-a-Glance

- Wide range of supported crypto assets;

- Buy, sell, deposit, and withdraw digital assets;

- Hold crypto assets;

- Easy transfer of crypto assets to other Revolut users;

- Pay for goods with crypto assets from your Revolut Card;

- Crypto staking;

- Revolut X – crypto exchange.

Keep in mind that certain cryptocurrency services on Revolut might only be accessible for Plus, Premium, Metal, and Ultra tier customers.

Revolut Crypto: In-Depth Features

To clarify, Revolut takes a leading role in catering to the needs of the cryptocurrency community. They provide a wide range of services, including purchasing, selling, and withdrawing cryptocurrencies. Additionally, they allow for transactions using their Revolut Card in crypto, offer crypto staking options, and much more.

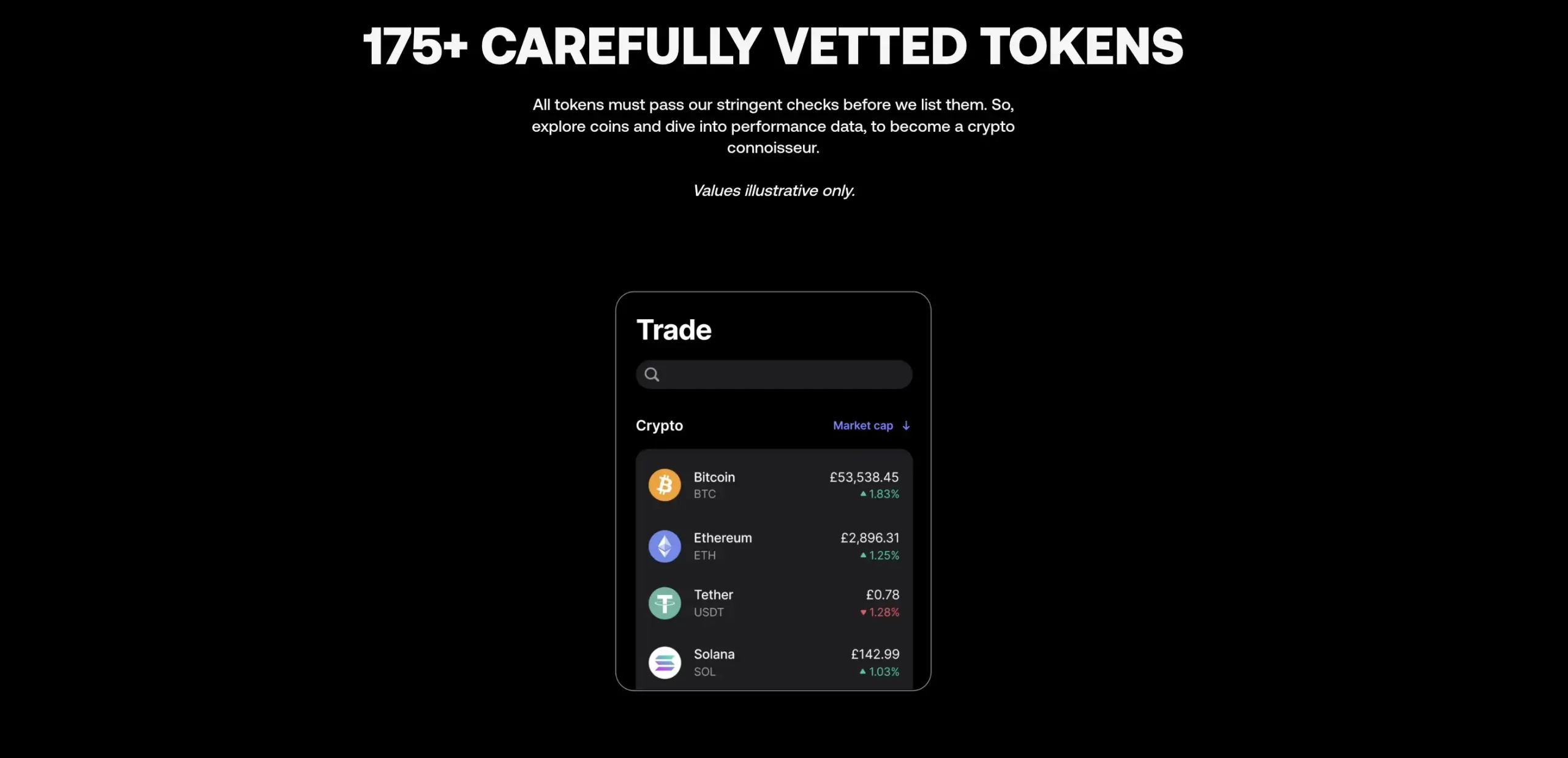

1. Wide Range of Supported Crypto Assets

In the context of Revolut Business, it’s important to note that you have the option to either purchase or swap your funds into Bitcoin (BTC), Ethereum (ETH), Solana (SOL), and several other widely used ERC-20 tokens.

-

Bitcoin (BTC);

Ethereum (ETH);

Solana (SOL);

Polygon (MATIC);

Polkadot (DOT);

Cardano (ADA);

Ripple (XRP) and *others.

*The entire list of supported cryptocurrencies is available on the Revolut official website.

2. Buy, Sell, Deposit, and Withdraw Digital Assets

The Buying Crypto Assets Process

If you’re a Revolut user looking to purchase cryptocurrency via the Revolut desktop version or mobile app, you have the option to utilize funds from your Revolut account, which may be either regular money or e-money, or use the existing crypto assets within your account.

Also, there are several ways to purchase cryptocurrencies:

- Buy Now option from your Revolut account;

- Set up an Auto Exchange, meaning you’ll buy crypto assets in the future;

- The Recurring Buy option to buy cryptos at regular intervals in the future;

- Buy multiple cryptos through a Collection of Crypto Assets;

- The Spare Change Round-up feature auto rounds up your Revolut Card purchase;

Selling Cryptos

Selling crypto assets through Revolut is easy, mainly when you can sell them at the exchange rate at the time, sell crypto assets for money, e-money, or your crypto asset pocket.

Depositing and Withdrawing Crypto Assets

If your location is suitable and you have a compatible plan, you can transfer cryptocurrencies from an outside digital wallet into your Revolut account.

As a crypto investor, I’m delighted to know that there are no fees associated with depositing cryptocurrencies in this platform. However, please remember that when withdrawing your funds, the fees might be imposed by your personal crypto wallet or the third-party service provider you’re using, as these transactions originate from their respective locations.

To find out about the cryptocurrencies you can receive, take a look at the ‘Receive’ segment of our platform. Keep in mind that any unsupported currencies received will be non-recoverable.

As a crypto investor with Revolut, I understand that my initial deposits may be securely stored in a unique digital wallet. Later, for enhanced safety and convenience, these funds are transferred to the primary account by Revolut.

In simpler terms, you have the option to add funds to your Revolut account using either cryptocurrency or traditional money (fiat). To proceed with the deposit, navigate to your Revolut app, press the “Add Funds” button, pick your preferred currency, decide on the payment method, and then input the amount you wish to deposit.

On some occasions, the fees associated with networks may vary. To guarantee smooth processing of your crypto deposits at Revolut and reduce potential fees, there might be a required minimum deposit amount for certain cryptocurrencies. Similarly, Revolut establishes minimum deposit amounts for specific digital currencies to maintain efficient handling and minimize network charges.

Please note that purchasing crypto assets directly in the app doesn’t count towards this minimum.

You can deposit as much cryptocurrency as you’d like without any restrictions. Nevertheless, the amount you can withdraw might be limited by Revolut, and this limit will be communicated to you prior to processing your request.

Additionally, when it comes to withdrawing funds from your Revolut account, whether it’s crypto or fiat, you have several options available for doing so.

Withdrawal Fees for ATM Use: Generally, you can withdraw money from ATMs, but the company establishes a monthly withdrawal limit according to your plan, ranging from £200 to £2,000. If you make a withdrawal exceeding this limit, a 2% fee will be charged on the transaction amount.

Keep in mind that certain limitations due to your geographical area may apply when transferring cryptocurrency to an outside digital wallet.

3. Holding Cryptocurrency

With Revolut’s crypto services, you transfer the legal ownership rights for your cryptocurrencies to them, yet you continue as the beneficiary or holder of the digital assets.

As a account holder, you hold full authority over your digital currencies, and Revolut will only execute actions like selling, transferring, or withdrawing these assets upon your explicit instructions. However, please note that you don’t have the ability to conduct transactions or move these assets directly on your own.

4. Transferring Cryptocurrencies

With Revolut, you can easily send cryptocurrencies and process customer deposits to users who are already part of our platform. This process, often referred to as an off-chain transfer, can be done conveniently through the Revolut app.

5. Spending Throughout the Revolut Card

Did you know that you can use the Revolut Card for everyday spending?

This feature is highly beneficial for numerous users, providing a sense of security, particularly during cryptocurrency transactions where Revolut swiftly changes your crypto holdings into the corresponding fiat currency to facilitate the transaction.

As a crypto investor, when it comes to making transactions, you’ll find that there’s an exchange rate applied at the point of transaction, and depending on your chosen subscription plan, additional crypto-related fees may also be applicable.

Once the conversion rate is done, your payments will be processed by the Revolut account.

If you ask for a refund from the merchant, it’ll get deposited into your Revolut account as regular money (fiat currency). If the transaction is still being processed and then gets reversed, the credit will be added back to your original cryptocurrency balance. Just remember that the value of cryptocurrencies can change over time.

6. Crypto Staking

All crypto enthusiasts who are in an eligible location may benefit from the Revolut staking option.

From my perspective as an analyst, I’d like to highlight that you might be familiar with the concept of crypto staking. Essentially, it involves actively contributing to the functioning of a blockchain system by validating transactions within a Proof-of-Stake network. In essence, you’re helping maintain the network’s integrity and security. As a token of appreciation for your efforts, you’ll receive rewards, making it a mutually beneficial arrangement.

Tokens Supported for Revolut Crypto Staking

7. The Revolut X – Cryptocurrency Dedicated Exchange

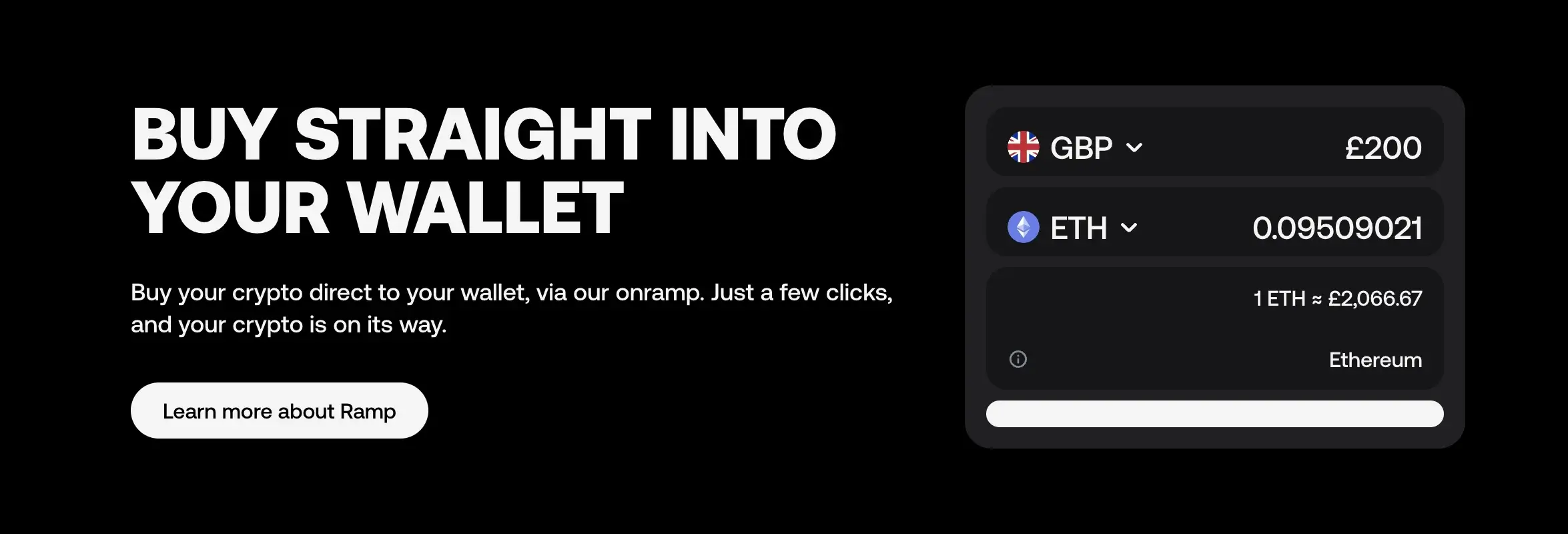

In May 2024, the digital banking platform, Revolut, rolled out its cryptocurrency trading service, Revolut X, designed for experienced traders. This is a distinct desktop application equipped with sophisticated crypto functionalities.

This platform provides analytical resources and lower charges, including a zero percent and 0.09% fee for maker trades. Users have the option to execute trades via limit orders, market orders, and reduced spreads.

Revolut X provides real-time trading, sophisticated analysis tools, and compatibility with TradingView graphs for individuals who hold accounts with Revolut’s standard service.

These resources offer crypto fans an understanding of market fluctuations, popularly traded coins, and rising assets. To utilize the services of Revolut X, it’s necessary to initially set up a primary Revolut account and subsequently install the application.

Launching Revolut X demonstrates Revolut’s commitment towards the cryptocurrency sector. This move comes after the unveiling of Revolut Ramp and collaboration with MetaMask, empowering users to instantly buy cryptocurrencies straight from their digital wallets.

Furthermore, it appears that the majority of Revolut’s users have favorable opinions towards its cryptocurrency services, user-friendly interface, and comprehensive customer service, as indicated by their Trust Pilot reviews.

Revolut Cryptocurrency Exchange Features

1. Swapping Crypto

If you want to swap cryptos so quickly, then the Revolut cryptocurrency exchange is the place to do it. You can exchange your cryptos for your favorite tokens in just a few moments.

2. Selling Digital Assets for Fiat Currency

It’s fair to highlight that the standout characteristic of this cryptocurrency exchange is its speedy conversion of cryptos into fiat currencies. Not only does it offer swift sales, but it also supports various fiat options, making it an efficient choice for cashing out your digital assets.

3. Multiple Order Types

Many traders and investors were taken aback to discover that Revolut’s trading platform accommodates various order types including market orders, stop orders, and limit orders.

Revolut Cryptocurrency Exchange Fees

- Crypto Purchase Fee: Standard accounts have a 1.49% crypto purchase fee.

- Spread: Revolut imposes a variable spread of 1%.

- Fair Usage Limit: While there is a fair usage limit, the additional fee for exceeding it is 0.5%.

Revolut Crypto Wallet: Features

With Revolut’s crypto wallet, users can securely store various digital currencies, effortlessly send them to others, exchange one cryptocurrency for another, track their investments, and even get notified when prices reach desired levels. Now, let’s delve into the security measures in place, the range of supported cryptos, and the associated service charges.

Revolut Wallet: Security

In the context of safeguarding your cryptocurrencies, the Revolut digital wallet employs multiple safety features by storing your investments in offline (cold) storage and shielding them from potential cyber hazards lurking on the internet.

Revolut Wallet: Supported Cryptocurrencies

As a savvy crypto investor, I find myself drawn to this cold storage wallet that accommodates more than 170 different digital assets, ranging from lesser-known gems to top-tier favorites. This versatility allows me to effortlessly broaden my investment horizon and effectively diversify my portfolio.

Revolut Wallet: Fees

It is essential to understand that you must cover the network fee whenever you want to send or receive money on Revolut. Also, you will be charged for withdrawals to an external wallet.

Revolut Crypto: User Experience

Nowadays, it’s essential that any digital item, no matter the category, prioritizes user experience. With this in mind, Revolut carefully designs an intuitive user experience for their product.

The Revolut Website

On the Revolut site, everything has been thoughtfully arranged with users in mind, but unfortunately, the site’s features aren’t accessible there. Instead, you’ll find yourself directed to the Revolut mobile application.

The Revolut Mobile App

Instead of being sent to a separate webpage, the site takes you directly to the Revolut application, allowing you to access all its in-app functionalities related to cryptocurrency, fiat currency, card administration, and beyond.

Using a user-friendly design and quick navigation to various in-app functions suitable for both individual and professional users, Revolut delivers a smooth cryptocurrency journey.

The Revolut Customer Support

When it comes to assisting customers, the support team provides access to helpful articles within a knowledge base, chatbot aid, and real-time live chat support directly within the application.

Revolut Crypto: Pros and Cons

Revolut Pros

- Easy to use with a simple user interface;

- Supports the most popular assets;

- Multiple payment methods;

- Multiple features, both crypto and non-crypto;

- High security and fully regulated;

- Store multiple cryptocurrencies.

Revolut Cons

- You aren’t the crypto holder;

- High fees;

- Mobile-only;

- Many restricted locations and countries.

Revolut Crypto FAQ

Is Revolut Good for Crypto?

The answer is… it depends. We wouldn’t recommend it due to its high trading fees. But if you’re looking for ease of use and convenience, Revolut is the way to go. Overall, avid crypto traders should look for other dedicated exchanges.

Can I Buy USDT on Revolut?

You can buy, hold, or sell Tether directly in-app Revolut.

Can I Sell Crypto from Revolut?

With both fresh and returning users, Revolut offers the ability to purchase and trade more than 170 digital assets, encompassing cryptocurrencies like Bitcoin, Ethereum, Polygon, Solana, Dogecoin, as well as numerous additional options.

Can I Transfer Crypto from Binance to Revolut?

Absolutely! You’re able to move both cryptocurrencies and traditional money (fiat) from Binance to Revolut. Just remember to verify if your selected assets are compatible with Revolut first. After that, grab your Revolut deposit address, log into your Binance account, and carry out the process of transferring digital assets.

How to Send Crypto from Coinbase to Revolut?

As a researcher exploring cryptocurrency transactions, I would advise you to follow these steps: Choose the cryptocurrency you want to transfer from your Coinbase account. Retrieve your Revolut wallet address and then proceed to log into your Coinbase account to initiate the transfer. Noteworthy is that Revolut accepts deposits from reputable major crypto services such as Coinbase, Binance, Kraken, Bitstamp, Etoro, and more.

Final Thoughts

Revolut stands out as a significant figure in the realm of digital banking and cryptocurrencies, providing a wide array of financial tools for its users.

When using this platform to buy, sell, or hold cryptocurrencies, remember to take into account the fees involved and any restrictions that may apply.

Choosing Revolut for your cryptocurrency requirements might be suitable depending on your personal tastes and goals. But if minimizing costs is a top priority or you need sophisticated trading tools, it’s worth looking into alternative platforms as well.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- PI PREDICTION. PI cryptocurrency

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- SOL PREDICTION. SOL cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- Dragon Ball Z: Kakarot DLC ‘DAIMA: Adventure Through the Demon Realm – Part 1’ launches between July and September 2025, ‘Part 2’ between January and March 2026

2024-09-06 13:15