-

Debate between Ripple’s David Schwartz and Cardano’s Charles Hoskinson over Ethereum’s regulatory influence.

‘ETHgate’ controversy questions SEC’s favoritism towards Ethereum.

As a long-term crypto investor with a keen interest in the regulatory landscape, I find myself closely following the ongoing debate between Ripple’s David Schwartz and Cardano’s Charles Hoskinson regarding Ethereum’s influence on regulatory decisions. The accusations of favoritism towards Ethereum by the SEC have raised valid concerns, especially given the history of the ‘ETHgate’ controversy.

As a researcher studying the dynamic world of cryptocurrencies, I recently came across an intriguing exchange between two influential figures – David Schwartz, the CTO of Ripple, and Charles Hoskinson, a co-founder of Cardano (ADA). The debate they initiated surrounding Ripple’s XRP token has generated quite a stir in the community.

The intense debate explored claims of potential collusion regarding the regulatory crackdown on XRP, which some believe is orchestrated by the Ethereum [ETH] community.

As an analyst, I’d recount the situation by saying: The controversy arose when I, Hoskinson, was confronted with allegations that certain individuals from the Ethereum community had exerted influence over the rule-making process regarding Ripple (XRP).

As a researcher observing recent developments, I’ve noticed an intriguing shift that has sparked curiosity: The Securities and Exchange Commission (SEC) seems to be taking an unanticipated approach towards Ethereum. This move, subtly suggesting preferential treatment, has certainly piqued the interest of many in the crypto community.

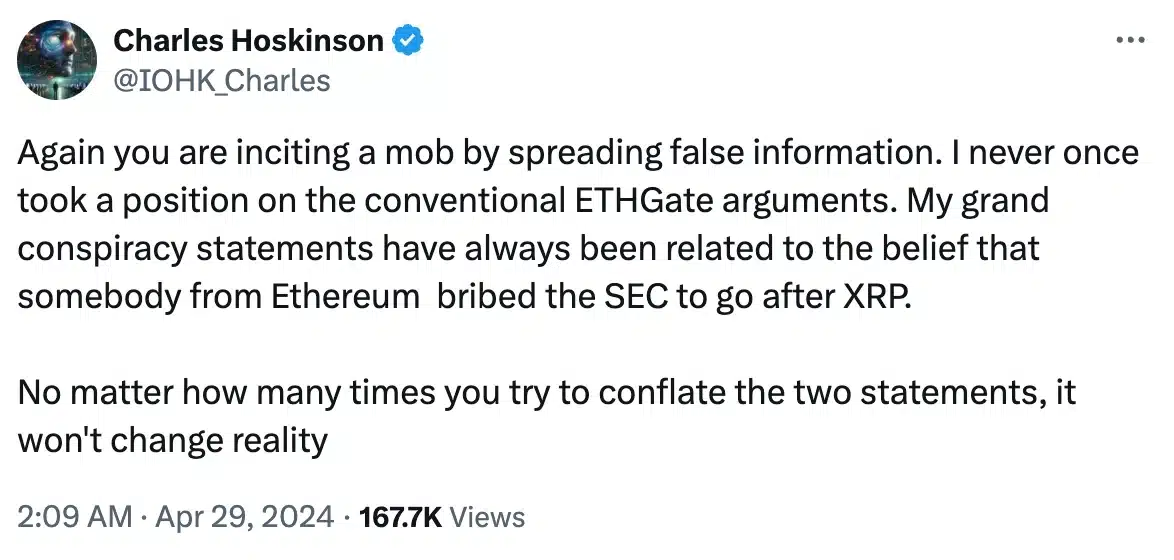

Instead of “Hoskinson firmly rejected these allegations as unfounded conspiracy theories, emphasizing the lack of solid proof for such claims,” you could also say: Hoskinson strongly refuted these accusations, arguing that there is no substantial evidence to back up such theories.

The clash of words

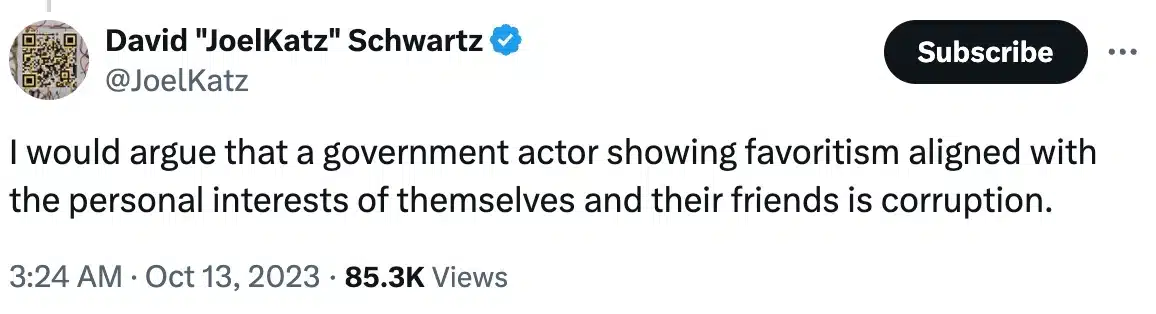

Instead, Schwartz countered Hinman’s statements and raised concerns about possible financial ties between him and Ethereum.

He said,

As a crypto investor, I’m pondering over Hinman’s role in Ethereum. Was he not deeply involved? Did he lack a financial stake in it? Did he step back? Or was his lack of involvement or financial interest not significant in this context?

Needless to say, Hoskinson, accused Schwartz of spreading false information.

Voicing his apprehension on the same, Steven Nerayoff, former Ethereum adviser, noted,

“There’s a good chance Ethereum didn’t have to offer bribes to the SEC, as Joel Katz pointed out the alignment of interests among the parties. However, it’s hard to believe there’s no connection between the SEC’s disparate treatments of Ethereum and Ripple.”

Previous instances

Well, this isn’t the first time such a debate has happened.

Previously, Schwartz and Hoskinson had disagreed over the meaning of statements made by the ex-SEC officer, William Hinman, leading to the ongoing dispute referred to as the ‘ETHgate’ controversy.

The discussion revolves around the accusation that Ethereum has impacted the regulatory rulings regarding Ripple’s XRP.

The comments that were made set the stage for the ongoing disagreement between Ethereum and Ripple, raising the query: What potential impact will the “ETHgate” controversy have on cryptocurrency regulations?

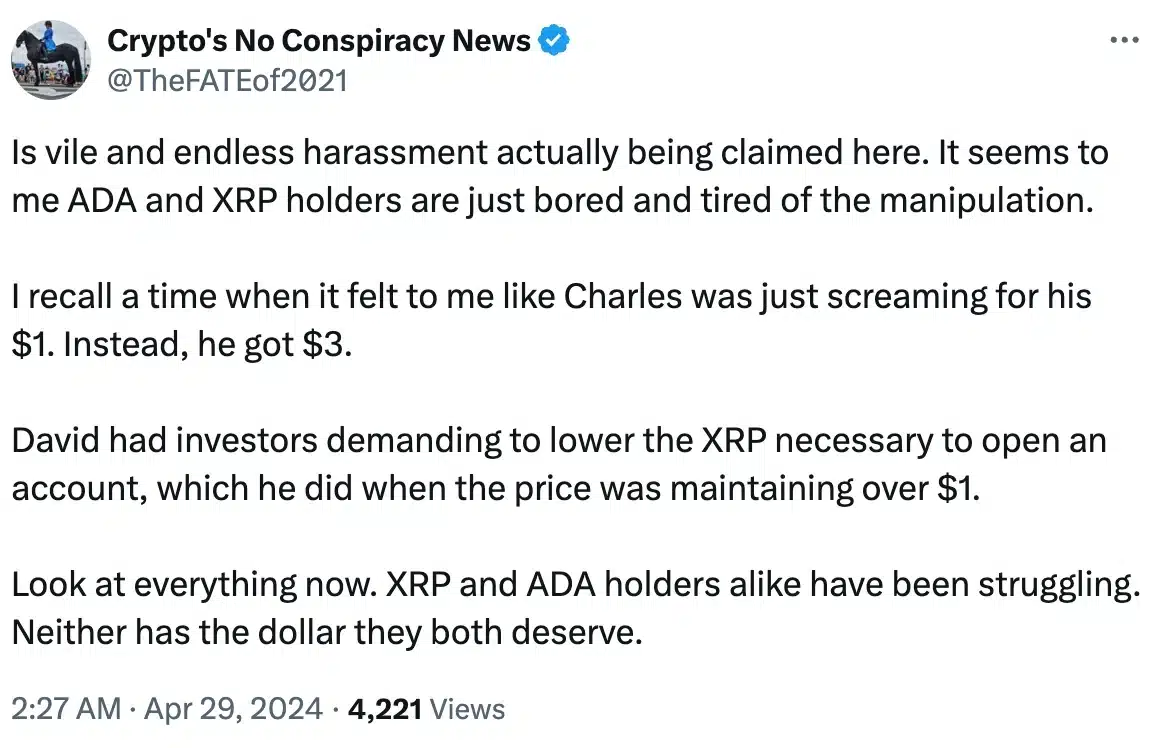

Echoing similar sentiments, an X user, @TheFATEof2021, noted,

Altcoins price

As an analyst, I’ve observed that even with the persistent disagreements, the price behavior of XRP and Ada have remained unaffected thus far.

In my analysis as of the most recent data, XRP has witnessed a rise of 2.15%, whereas ADA has undergone a growth of 1.08%. Contrastingly, Ethereum appears to be trending bearishly, experiencing a decline of 0.32% over the last 24 hours.

Despite the ongoing uncertainty regarding the resolution of this dispute, the possible consequences for the future development of cryptocurrencies have yet to be determined.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- Peter Facinelli Reveals Surprising Parenting Lessons from His New Movie

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Sacha Baron Cohen and Isla Fisher’s Love Story: From Engagement to Divorce

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-04-30 14:47