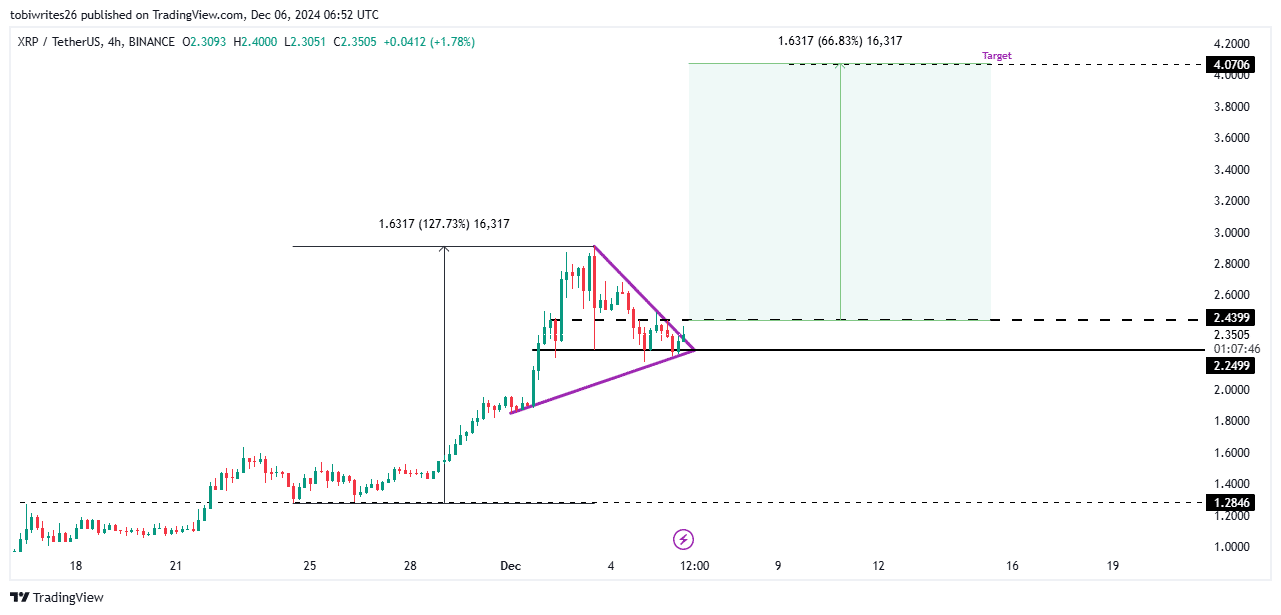

- XRP was trading above a key support zone within a defined consolidation channel, signaling the potential for an upward move.

- Technical indicators suggested that XRP’s next rally might not begin immediately, as the asset continues to stabilize.

As a seasoned researcher with years of experience navigating the cryptocurrency market, I find myself intrigued by XRP’s current position. After witnessing its impressive 334.27% surge last month, it’s now taking a well-deserved breather within a symmetrical triangle—a familiar consolidation pattern that often precedes significant moves.

Following an impressive 334.27% increase the preceding month, Ripple (XRP) has taken a break to stabilize inside a specific bandwidth. This period has led to a slight dip of 0.76%, an expected adjustment that analysts view as beneficial and healthy.

Despite the present dip, AMBCrypto indicates a high probability that XRP will surge to higher prices in the near future.

XRP push for a 66% gain—Here’s what to watch

Following the latest increase in value, XRP seems to be pausing to gather strength before potentially making another upward push – a possible sign of its next bullish trend.

At the moment, XRP is being traded inside a symmetrical triangle, which is a type of consolidation pattern created by the convergence of both supporting and resistant lines.

The rally continues undeterred, as the crucial support level at 2.2499 effectively holds off any substantial reversal. This key point has been instrumental in maintaining the asset’s stability during its period of consolidation.

Should the current trend in the coin’s price movement deviate, experts anticipate a potential increase of approximately 66.83%, taking the price up to around $4.0706. Once this level is reached, it’s forecasted that the buying demand might start to subside.

Is an XRP rally on the horizon?

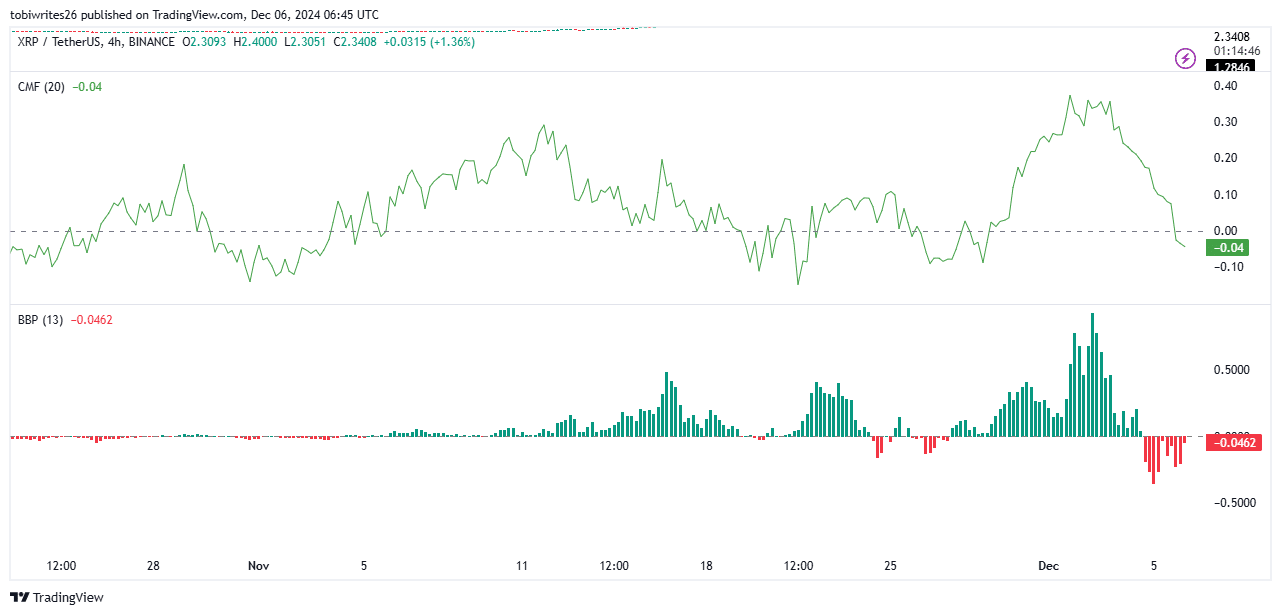

Technical indicators suggest that XRP’s anticipated breakout may not materialize in the short term.

The Chaikin Money Flow (CMF), a tool that evaluates the market’s mood by tracking money flowing into and out of stocks, recently showed a negative result. A value of -0.04 signifies that there’s not enough purchasing activity to maintain a positive trend, suggesting weak buying interest.

In a similar vein, the Bull-Bear Power Indicator, used to identify whether bulls or bears are in charge of the market, stayed below zero at -0.0462. This is demonstrated by a sequence of red bars, suggesting that bears currently hold the upper hand.

The indications here imply that the currency might not have enough power to rise and could potentially drop more since the bearish investors seem to be in control of the market.

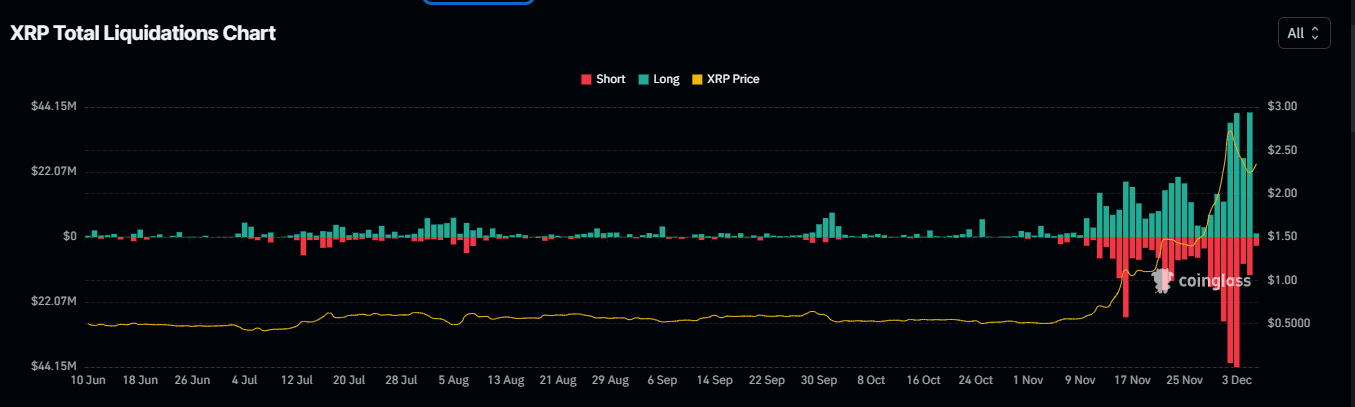

Long traders face heavy losses

Over the last day, many XRP traders have experienced a series of large sell-offs, leading to substantial losses for those who had hoped for a price increase.

The sum from the liquidation of all trades amounts to approximately $39.92 million, where long traders make up about $30.78 million of that amount. This significant disparity implies that the current market setup may not be favorable for a bullish trend.

Read Ripple’s [XRP] Price Prediction 2024–2025

If technical and blockchain signals don’t suggest a significant change, it seems that XRP’s advance towards $4 might keep pausing during the consolidation stage.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Flight Lands Safely After Dodging Departing Plane at Same Runway

- Elden Ring Nightreign Recluse guide and abilities explained

- Planet Coaster 2 Interview – Water Parks, Coaster Customization, PS5 Pro Enhancements, and More

2024-12-06 22:15