-

Ripple’s support for tokenized T-bills could have broad implications

XRP remained unaffected by the update as expected

As a seasoned analyst with over two decades of experience in the financial sector, I find the recent development by OpenEden to tokenize U.S. Treasury Bills (T-bills) on the XRP Ledger (XRPL) nothing short of groundbreaking. This move signifies a pivotal step towards blurring the lines between traditional finance and decentralized finance (DeFi), opening up a plethora of opportunities for investors and institutions alike.

OpenEden, a well-known tokenization platform, is preparing to make U.S. Treasury Bills (T-bills) available on the XRP Ledger (XRPL) for the first time. This major advancement signifies an important milestone in increasing institutional involvement in the decentralized finance (DeFi) sector and continues the trend of converting real-world assets into digital form.

Transitioning T-bills onto the XRPL is predicted to create a link between conventional finance and DeFi, providing novel investment possibilities for both individual investors and financial institutions.

As a seasoned investor with years of experience navigating the traditional financial markets, I can confidently say that this new development is poised to revolutionize the way we invest in T-bills. Having faced challenges such as limited accessibility, lack of transparency, and inefficiencies in the past, I am excited about the potential benefits this innovation brings. By harnessing the power of blockchain technology, investors like myself will now be able to effortlessly purchase and trade T-bills with increased liquidity, transparency, and efficiency. Moreover, the immutable and transparent nature of blockchain records ensures greater trust and security in our investments. This is a game-changer, and I eagerly anticipate witnessing its positive impact on my own investment portfolio and the broader financial landscape.

According to Jeremy Ng, Co-founder of OpenEden,

…”Buyers can create our TBILL tokens using stablecoins such as Ripple USD, once it becomes available later in the year.”

Beyond that, Ripple Labs has pledged to invest $10 million in OpenEden’s T-bill tokens. Moreover, the blockchain company intends to commit additional funds to tokenized T-bills issued by other parties, indicating a wider dedication towards merging conventional financial tools with blockchain technology.

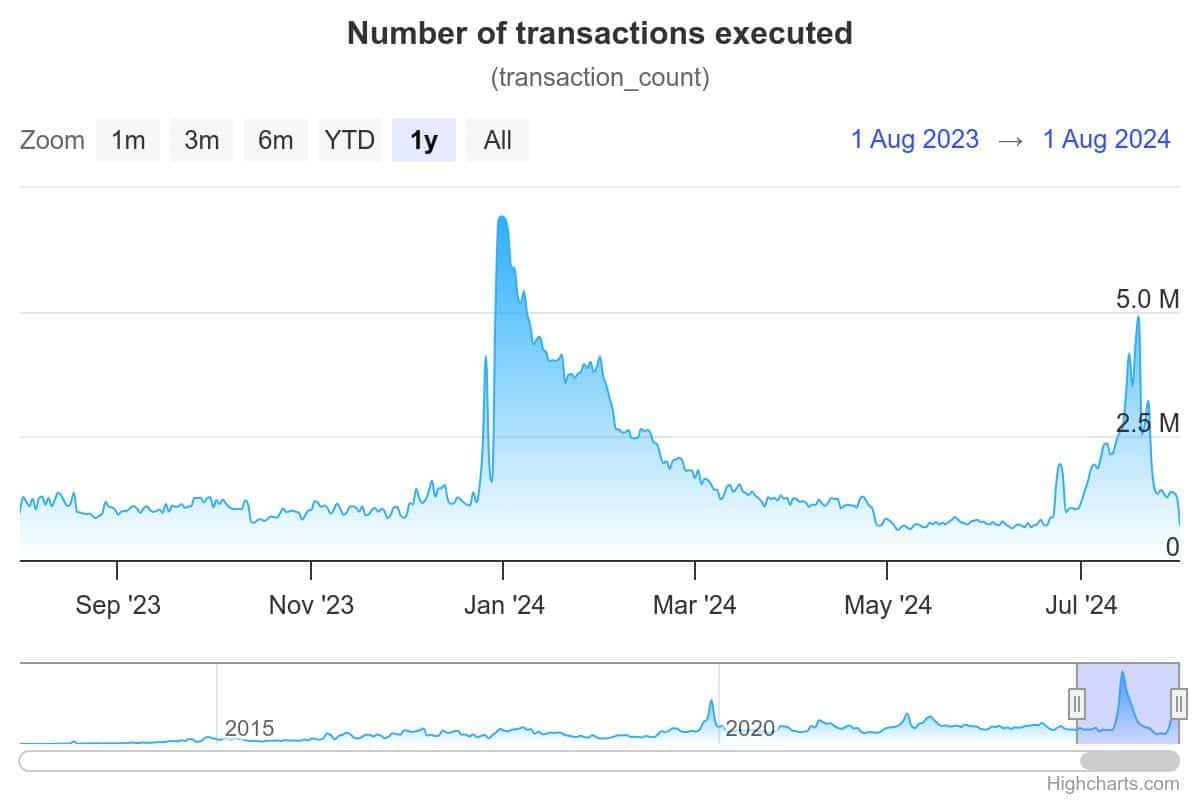

As a researcher, I find myself observing an intriguing development: Within just a few weeks, we’ve reached unprecedented transaction levels on the XRPL platform. This momentum is further propelled by the upcoming introduction of tokenized T-bills.

For example, just a few weeks back, the number of transactions on the ledger approached 5 million, mainly due to an increase in micropayment transactions. This spike highlighted the increasing use and acceptance of the XRPL for various financial operations, further strengthening its status as a resilient and scalable blockchain network.

It’s worth pointing out though that at press time, figures for the same had fallen dramatically, with the no. of transactions executed now down to just over 1.3M.

XRPL, which first emerged in 2012, has experienced significant growth and development, becoming one of the leading and widely adopted blockchain systems. Initially, its purpose was to facilitate quick, low-cost international transactions. However, as time passed, it broadened its functionalities to accommodate various financial services such as decentralized trading, token creation, and smart contracts.

Supported by Ripple Labs and the increasing acceptance of XRP Ledger (XRPL), this upgrade will likely foster more creativity and expansion within the blockchain community.

As a researcher, I must emphasize that while Ripple Labs’ actions have a significant association with XRP, it doesn’t necessarily mean that XRP will be drastically impacted by updates like this one. In fact, at the moment of writing, the altcoin has dipped 3% in the past 24 hours, contrary to its steady growth trend over the recent weeks.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- LPT PREDICTION. LPT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Solo Leveling Arise Tawata Kanae Guide

2024-08-01 23:37