-

XRP saw a shift in the weighted sentiment that could help the bulls gain traction

The asset was undervalued but organic demand and user activity were also in decline

As a researcher with extensive experience in the cryptocurrency market, I have closely monitored XRP‘s recent price action and on-chain metrics. The shift in weighted sentiment towards the asset could indeed help the bulls gain traction, but the situation is far from ideal.

Ripple‘s digital token XRP has been labeled as a “zombie token” by some critics and accused of having an inflated value. However, on the 27th of April, there was a significant withdrawal of XRP from cryptocurrency exchanges, potentially indicating that investors are stockpiling it.

Despite the persistent decrease in the token’s price, analysis indicated that several crucial on-chain indicators were worsening. The question remains: Will buyers be able to thwart another onslaught of sellers?

Growth metrics continued their descent

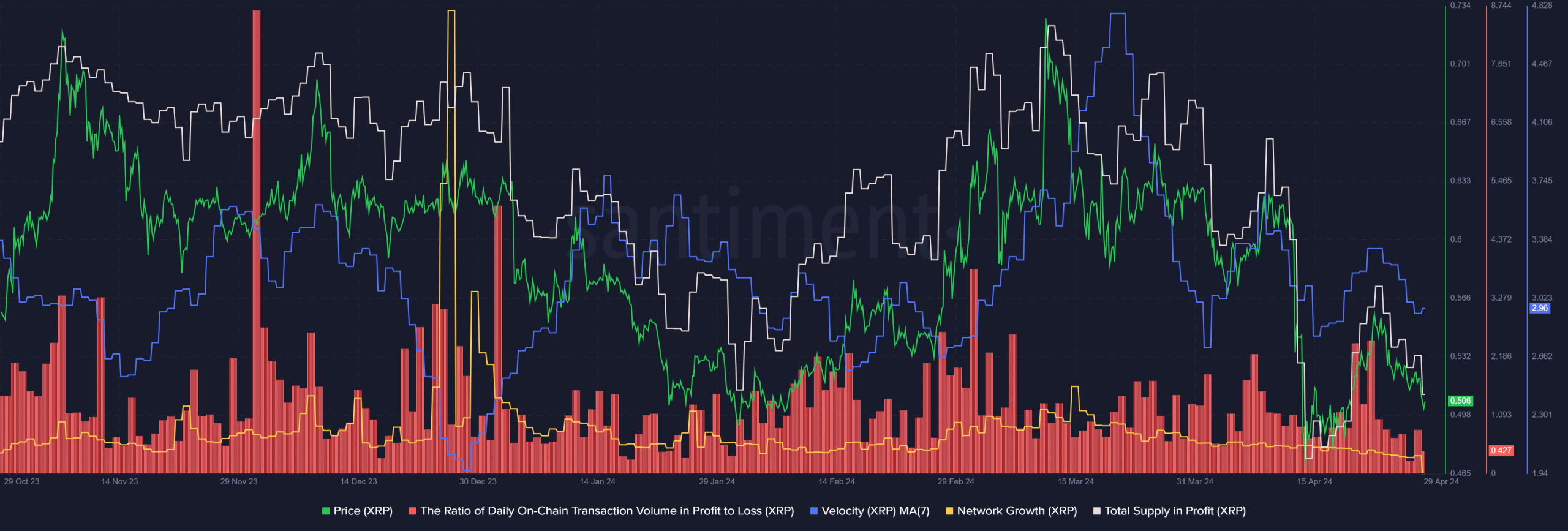

As a researcher studying the cryptocurrency market trends, I’ve observed that the daily velocity of XRP has been decreasing since mid-March. This metric reflects the average number of times a single XRP token is transferred between different digital wallets every day. The higher the value, the more active the token was in terms of transactions within a given timeframe.

The data indicates a decrease in user engagement and transactions. Additionally, the network expansion, represented by the daily creation of new addresses, has been on a downward trend as well.

New users’ interest in acquiring the token has waned, resulting in a decrease in new demand. Meanwhile, transaction activity and prices have both shown signs of decline. Furthermore, the ratio of profitable transactions, which peaked at $0.57 on the 22nd of April, has been decreasing as well.

What are the chances of a recovery?

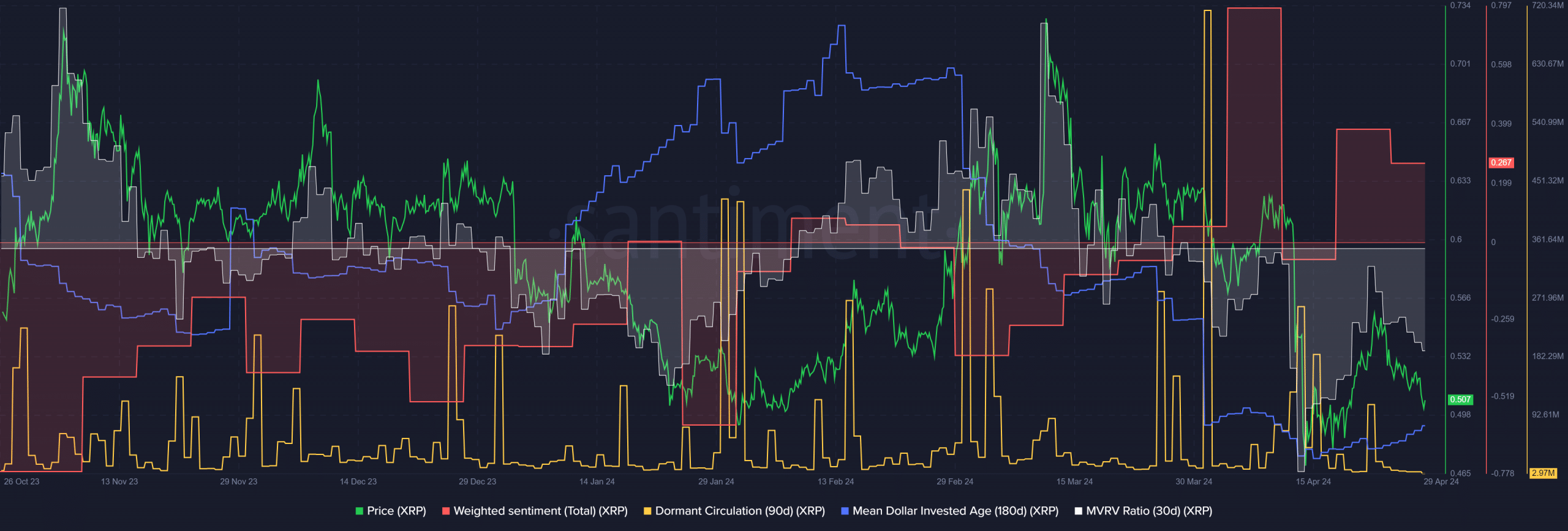

As a researcher studying market data, I’ve noticed an intriguing development regarding a specific asset’s 30-day MVRR (Moving Average Value Realized) ratio. Over the last fortnight, this indicator displayed a negative reading. This finding implies that the short-term value of the asset was significantly undervalued based on previous transaction prices.

To achieve a significant rally above $0.7 for XRP, bulls may need to sustain their efforts for an extended period, likely several weeks or even months.

Read Ripple’s [XRP] Profit Calculator 2024-25

As an analyst, I’m pleased to report that XRP‘s weekly sentiment, factoring in the weight of various opinions, turned positive once more. Furthermore, there was a noticeable decrease in the circulating XRP that had been inactive for the previous two weeks.

A notable increase in selling activity was absent, implying that a significant wave of sellers may still be holding back.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Gold Rate Forecast

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Despite Bitcoin’s $64K surprise, some major concerns persist

- Solo Leveling Arise Tawata Kanae Guide

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- Jack Dorsey’s Block to use 10% of Bitcoin profit to buy BTC every month

- Elden Ring Nightreign Recluse guide and abilities explained

2024-04-30 04:07