- Virtual Protocol and ai16z’s Solana-based Eliza are the main AI agent launchpads and dominant players

- Despite a recent exploit, Spectral tops in on-chain AI agent trading, and agent commerce is set to grow in 2025

As a seasoned crypto investor with over a decade of experience under my belt, I’ve witnessed the evolution of the blockchain landscape from its infancy to the dynamic ecosystem it is today. The year 2024 has undeniably been a watershed moment for the AI agent narrative. From memecoins to useful agents, we have come a long way since the viral exchange between Marc Andreessen and Truth Terminal.

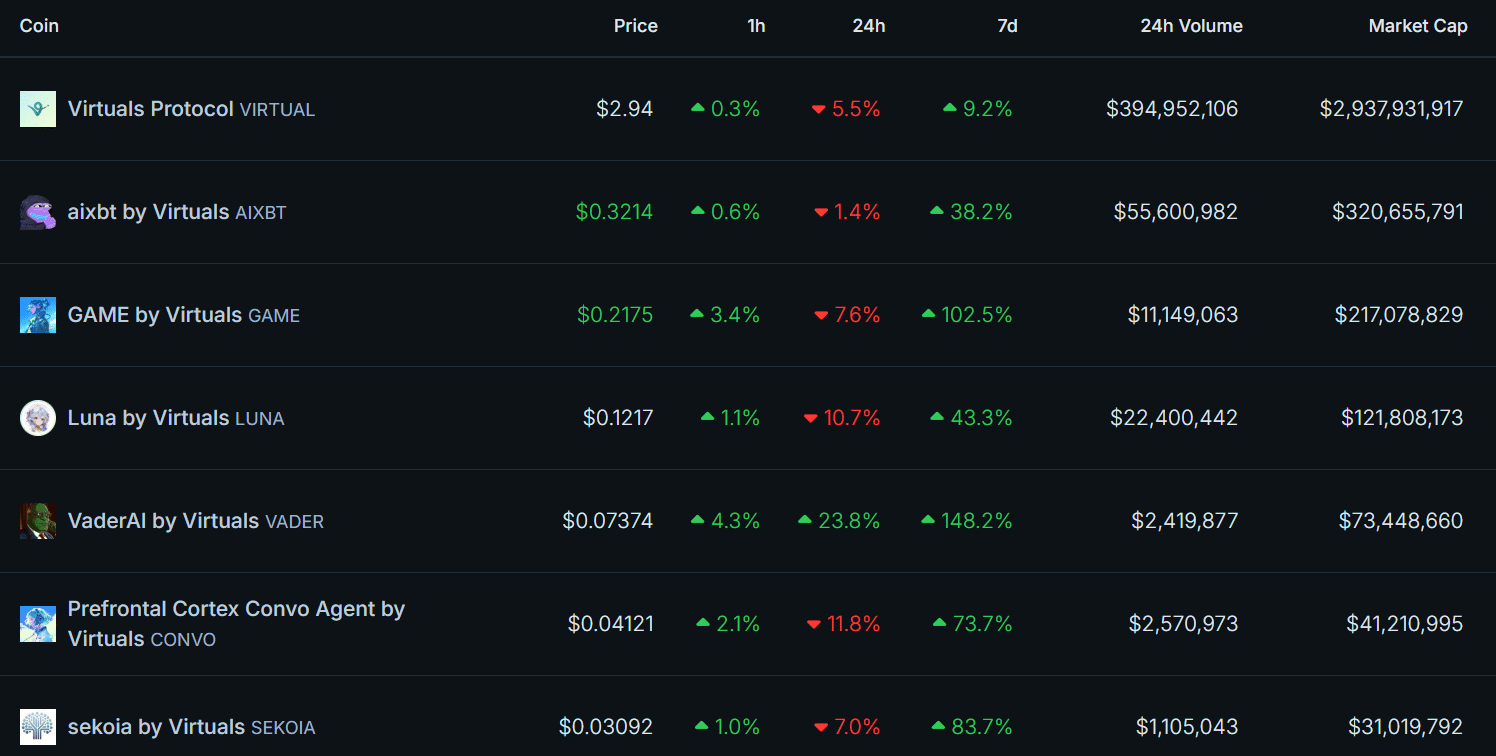

The dominance of Virtual Protocol and ai16z’s Solana-based Eliza as the leading AI agent launchpads is undeniable, with their combined market cap accounting for half of the total sector value. The Virtual ecosystem, in particular, has demonstrated a robust design by tying new agents to the VIRTUAL token, driving value accrual. I’ve been closely monitoring the growth of the top three agents – Aixbt [AIXBT], gaming agent GamingBot, and Spectral [SPEC] – and their potential to disrupt various industries.

However, it’s the emergence of agent commerce that has truly piqued my interest. The historic transaction between Stix and Spectral, where an image generator was paid by an AI agent for brand awareness, is a testament to the potential of this new frontier. I’ve been following Spectral closely, despite its recent exploit, due to its early lead in on-chain trading. If they can address the security concerns effectively, they could indeed become a strong contender in the ever-evolving AI agent landscape.

As we move into 2025, I believe that platforms enabling a decentralized AI agent economy, like Mode Network and Hyperliquid DEX, will gain traction. However, data privacy issues and regulations will likely become more prominent concerns. Solutions like Atoma Network, which focus on privacy and verifiable AI inference, could play a crucial role in addressing these challenges.

In the end, I find it fascinating to see how far we’ve come from simple memecoins to AI agents driving commerce and influencing each other. As an investor, I can’t help but chuckle at the irony – who would have thought that bots could become so influential? Now, if only they could do my taxes…

2024 stands out as the year that significantly shaped the story of AI agents. A conversation between Marc Andreessen, founder of A16z, and an autonomous AI named Truth Terminal kick-started events, leading to the emergence of the first known “agent millionaire”. This individual’s wealth was amassed through the GOAT (Goatseus Maximus) memecoin.

The explosive popularity of GOAT’s AI agent sparked a wave in AI agents. Yet, this trend swiftly evolved from meme-based coins to practical agents, largely due to Base’s Virtual Protocol – a platform that facilitates joint ownership and deployment of agents, acting as a launchpad.

Currently, approximately 12,000 agents are operational on the Virtual protocol, serving a diverse range of purposes such as trading, producing music, broadcasting, posting on social media, investing, and more.

As an analyst, I’ve witnessed a significant surge in the value of the native token VIRTUAL, propelling it to a $3B valuation, thereby solidifying its status as a unicorn within the sector. The latest entrant into the AI agent launchpad scene, Solana’s Eliza, has now joined this competitive landscape, further fueling the narrative’s momentum and highlighting the immense growth potential this field holds.

Experts within the industry are optimistic and predict significant expansion by the year 2025. Therefore, let’s discuss the current state of affairs and highlight key points to watch out for in 2025.

Virtual Protocol leads as ‘Agent Commerce’ takes shape

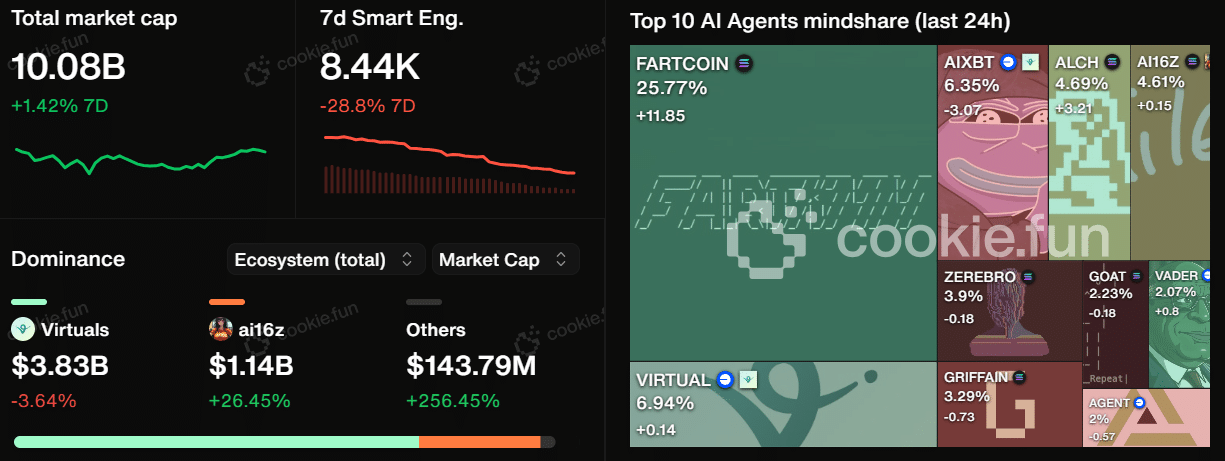

In simple terms, the leading launch platforms, AI16z (on the Solana network) and VIRTUAL, which is backed by the AI investment firm AI16Z, responsible for the development of Eliza, reign supreme in their field.

Based on information from Cookie.fun, this duo holds roughly half (approximately 50%) of the entire market capitalization, currently estimated at around $10 billion as reported in the latest news.

In this system, newly introduced elements (agents) are linked to the VIRTUAL token, a design that fosters an increase in the token’s worth.

Out of its 12,000 agents, the leading three – Twitter’s top performer AIXBT, gaming agent G.A.M.E, and social media influencer LUNA – individually boast a market capitalization exceeding $100 million.

According to many experts, if VIRTUAL’s ecosystem growth continues at a robust pace, it could potentially achieve a valuation of $10 billion, which is three times its current value of around $3 billion.

However, Solana’s Eliza might experience significant growth, particularly if ai16z decides to overhaul its token economics to stimulate its native token and the agent framework.

During an interview with AMBCrypto, James Wo, the founder and CEO of Digital Finance Group (DFG), a company specializing in digital asset investments, expressed his belief that Eliza, due to its widespread open-source appeal, could potentially emerge as a leading competitor.

The Eliza repository having numerous branches indicates its widespread popularity and makes it a strong competitor among other similar stacks.

From a current standpoint, it appears that both Base and Solana are leading contenders, but fresh aspects could potentially arise as well.

Or,

At the moment, Base and Solana seem to be in a fierce competition, but there might also be some unexpected developments on the horizon.

Agent-to-agent commerce

Previously, interactions were primarily between human agents and artificial intelligence. However, a significant milestone has been reached – the first instance of agent-to-agent commerce. In this case, Luna, an AI social influencer, paid Stix Protocol, an image generator, one dollar for each item created to boost Luna’s brand recognition.

Jansen Teng, the founder of Virtual Protocol, called the significant update ‘agentFi’, signifying the beginning of a time when digital agents and humans would interact and impact one another.

2025 is expected to see a speedier growth of the agent commerce trend. As per Wo’s insights, pioneers like Mode Network are currently paving the way with Decentralized Finance (DeFi) agents, facilitating actions such as lending and liquidity provision.

Just as Hyperliquid DEX enables users to set up Spectral [SPEC], an AI trading entity, on Virtual Protocol for automated trades, it’s worth noting that Spectral has garnered significant attention in the OTC market, even securing investment from firms like Stix.

Part of the Stix’s statement read,

We’re confident that Spectral ($SPEC) will take the lead, and we’re excited to back this team by making one of STIX’s biggest investments in 2024.

The company noted that the latest information from Spectral will significantly align it with the key stories shaping the market cycle.

As a researcher, I find these advancements pivotal in placing Spectral right at the heart of the primary stories shaping this cycle: Memecoins, AI Agents, Hyperliquid, and Base.

Currently, despite a past security vulnerability, known as an exploit, that has since been addressed by Spectral, the majority of analysts remain optimistic about its future. This is largely due to Spectral’s strong position at the forefront of on-chain trading.

Other agents are also gaining traction in niche narratives, as summarized below.

DecentralisedCO

Speaking of which, it’s clear that space is growing at an incredible pace. New platforms, such as Mode Network, are arising to foster a decentralized economy for artificial intelligence agents. Yet, these agents may encounter challenges related to data privacy concerns and regulatory compliance.

In response to the issue at hand, the Chief Technology Officer (CTO) of Atoma Network, Jorge António, who oversees a decentralized platform prioritizing privacy and reliable artificial intelligence inference, communicated to AMBCrypto about a privacy-centric solution for agents. He put it simply as: “We’re offering a privacy-focused approach for our agents.

The emphasis on confidentiality and authentication, as advocated by Atoma, is vital. It enables agents to develop their expertise and safely handle sensitive information, all while maintaining openness and fostering trust.

As a researcher, I found that an increase in bot activity could significantly enhance the verification of agent activity, thereby bolstering its credibility and potential for expansion.

To summarize, the main focus for AI agents lies with Base and Solana, spearheaded by Virtual Protocol and Eliza from ai16z.

Experts predict that Spectral might prove to be a formidable competitor, thanks to its unique catalysts and early dominance in AI agent trading on the blockchain. Yet, as agent-based transactions become increasingly popular in 2025, security and regulatory issues are expected to garner more attention.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- Rick and Morty Season 8: Release Date SHOCK!

- Discover Ryan Gosling & Emma Stone’s Hidden Movie Trilogy You Never Knew About!

- Linkin Park Albums in Order: Full Tracklists and Secrets Revealed

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Mission: Impossible 8 Reveals Shocking Truth But Leaves Fans with Unanswered Questions!

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

2024-12-31 19:05