- USDT controlled over 70% of the total stablecoin in circulation.

- Recently, there has been more inflow showing buying sentiment.

As an analyst with over two decades of experience in the financial markets, I have seen many bull runs and bear markets come and go. However, the current surge in Bitcoin’s price, driven by the inflow of stablecoins into exchanges, is a phenomenon that has piqued my interest.

The cost of a single Bitcoin (BTC) kept climbing, approaching the significant level of around $100,000.

The main cause propelling this increase is a substantial entry of stablecoins into trading platforms, which frequently indicates an approaching demand for purchasing.

Gaining further understanding about the number of active Bitcoin addresses and transactions between exchanges offers a complete perspective on the market forces driving this surge.

Stablecoin inflows indicate high buying interest

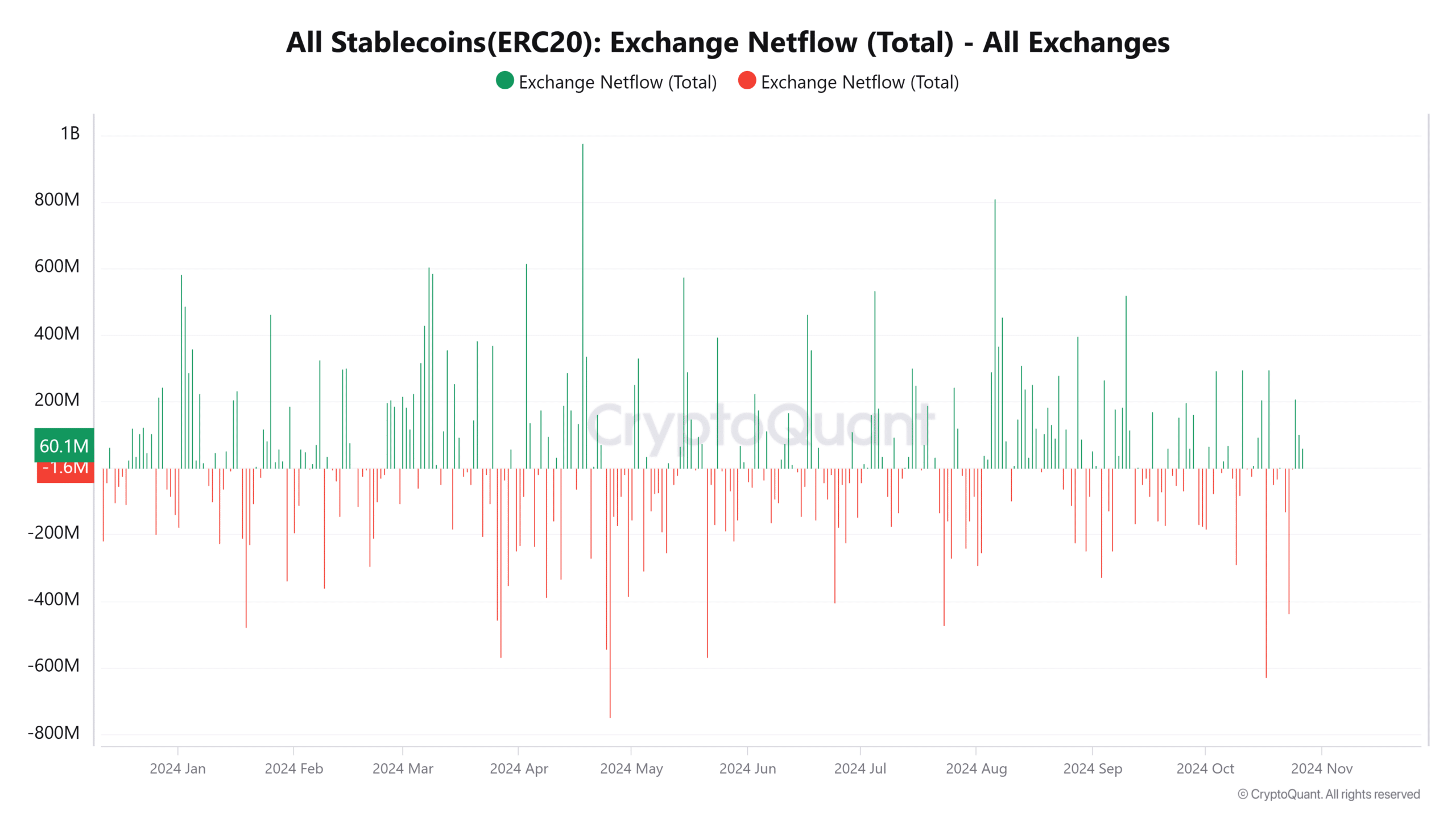

Examining the flow chart for stablecoin trades on CryptoQuant has shown a steady increase in the deposit of stablecoins, notably over the past few weeks.

This pattern indicates that investors might be gearing up to buy Bitcoin, since stablecoins often serve as the main entry point for cryptocurrency transactions.

Currently, we’re observing a substantial influx of over $213 million, which suggests increased market engagement.

Active addresses surge as network activity increases

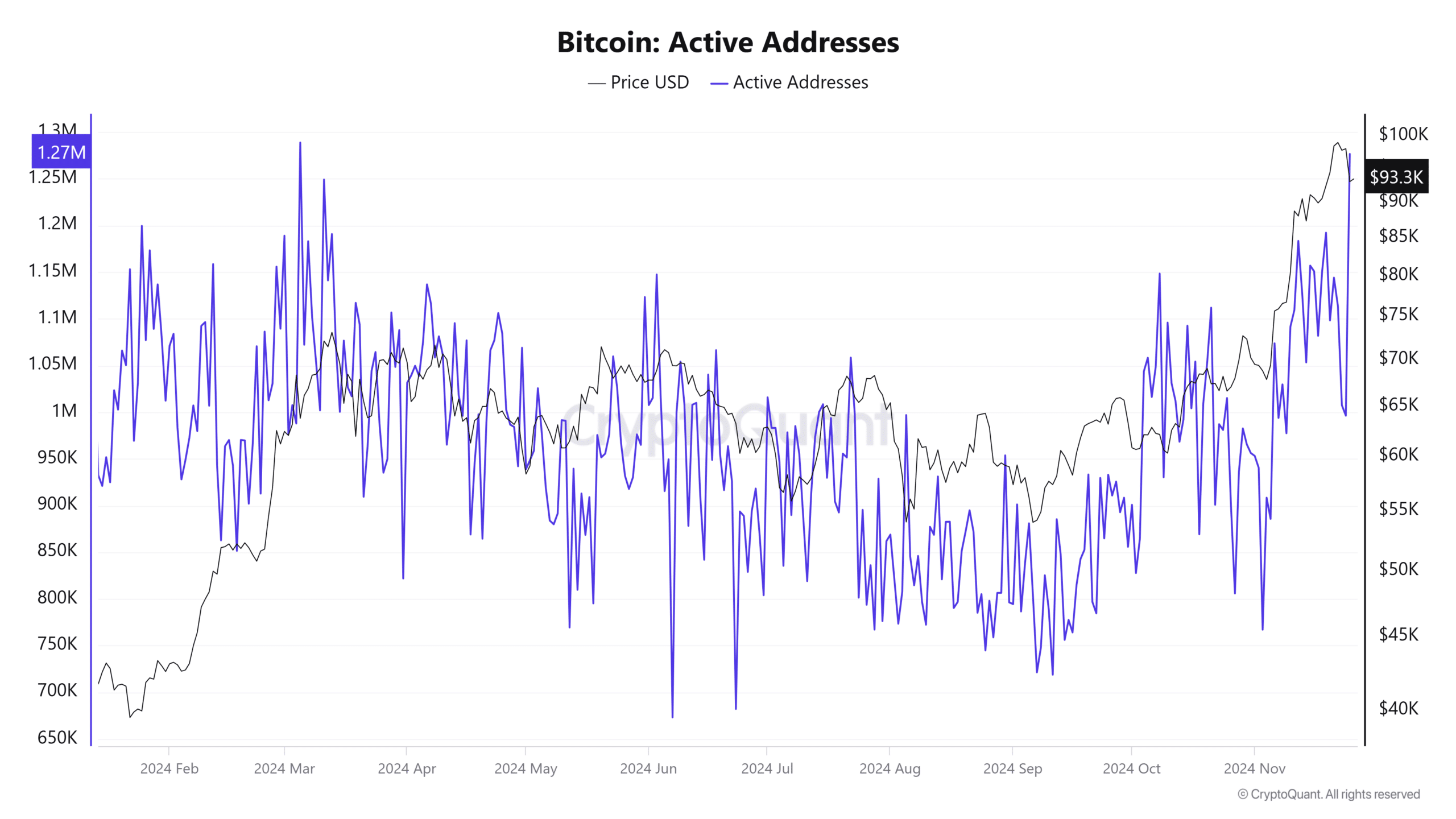

The number of actively used Bitcoin addresses, serving as an indicator for network activity and usage, has consistently increased along with its value and the influx of stablecoins.

An examination of the current active addresses reveals a surge to approximately 1.27 million. This is the highest number since March, suggesting growing involvement within the network.

This growth in active addresses suggests heightened investor interest. It aligns with historical patterns of price increases during periods of heightened network activity.

Moreover, Bitcoin’s exchange netflow data tells a conflicting story. On one hand, the overall inflows suggest heightened trading action, but on the other hand, outflows are increasing too, which signifies accumulation and lessening selling pressure.

The equilibrium is helping Bitcoin gradually ascend towards $100,000. At present, the net flow shows a deficit of more than 5,000 units.

Purchasing power on the rise?

Analyzing the technical side of Bitcoin’s pricing reveals significant Fibonacci retracement points at approximately $80,450 and $74,455. These areas could potentially serve as support spots should a price drop occur.

As a researcher, I can affirm that the Parabolic SAR supported the upward trend, while the Moving Averages served as a robust foundation for further price growth.

With increasing volume and consistent higher lows, Bitcoin’s rally remains well-supported.

Read Bitcoin’s [BTC] Price Prediction 2024-25

Furthermore, the Stablecoin Supply Ratio (SSR) of Bitcoin stayed relatively low at 10.42, suggesting that Bitcoin’s supply is being strongly counterbalanced by its purchasing power.

The stablecoin metrics and other key indicators show that shows that stablecoins will play a key role in Bitcoin’s attempt to reach $100,000.

Read More

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

2024-11-27 04:08