- Confirmed retracement and breakout above $6.67 set RNDR on a bullish path, targeting $12.05

- Market sentiment strengthened as Open Interest rose, despite declining daily active addresses

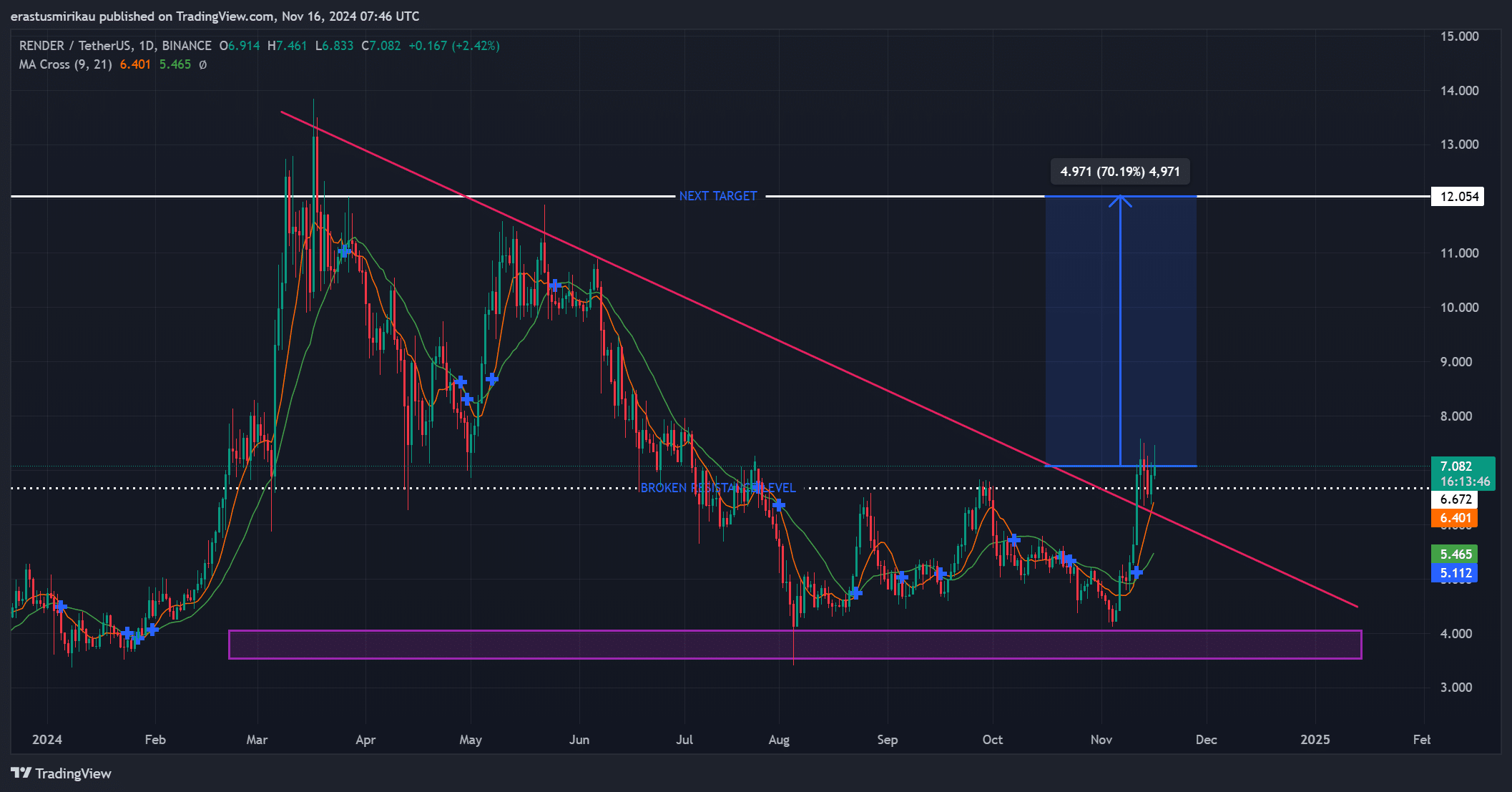

As a seasoned crypto investor with battle scars from more than a few market cycles, I’ve seen my fair share of bull runs and bear markets. The recent breakout by Render [RNDR] has certainly caught my attention. Having closely monitored its retracement and subsequent breakout above $6.67, I find myself optimistic about its potential to reach $12.05 – a move that would represent a significant gain for those who’ve held onto their RNDR through the downtrend.

As a researcher, I’ve observed a notable rise in the value of RNDR, which has sparked considerable interest among traders. This upward trend is particularly noteworthy due to its successful breach of crucial resistance levels, a strong indication that the bullish sentiment is regaining traction.

As a crypto investor, I’m excited to see that RNDR is currently trading at $7.08, marking a significant 5.23% increase over the past 24 hours. This surge comes after a confirmed pullback in the daily chart, which suggests that its extended downtrend might be concluding.

Considering that reaching the future goal of $12.05 could offer a possible 70% increase, one might wonder if the current market trend supports such optimism.

Retracement drives breakout beyond resistance

RNDR broke free from the downward trendline that had restricted its growth for quite some time. Following a strong rebound at a key support area around $4.00, the token experienced a surge in positive price action, which was primarily driven by steady buying activity.

Surpassing the significant barrier at $6.67, the price movement suggests a correction has taken place and sets the stage for a fresh upward trend. This implies that RNDR could potentially push towards $12.05 over the next few days, possibly aiming to exceed even higher prices in the near future.

Nevertheless, issues persist since a simple breakdown and subsequent rebound does not ensure continuous growth for RNDR. The significant resistance at $12.05, an area historically fortified by strong selling forces, will be crucial in assessing the resilience of RNDR’s upward trend.

Render’s technical indicators reveal growing strength

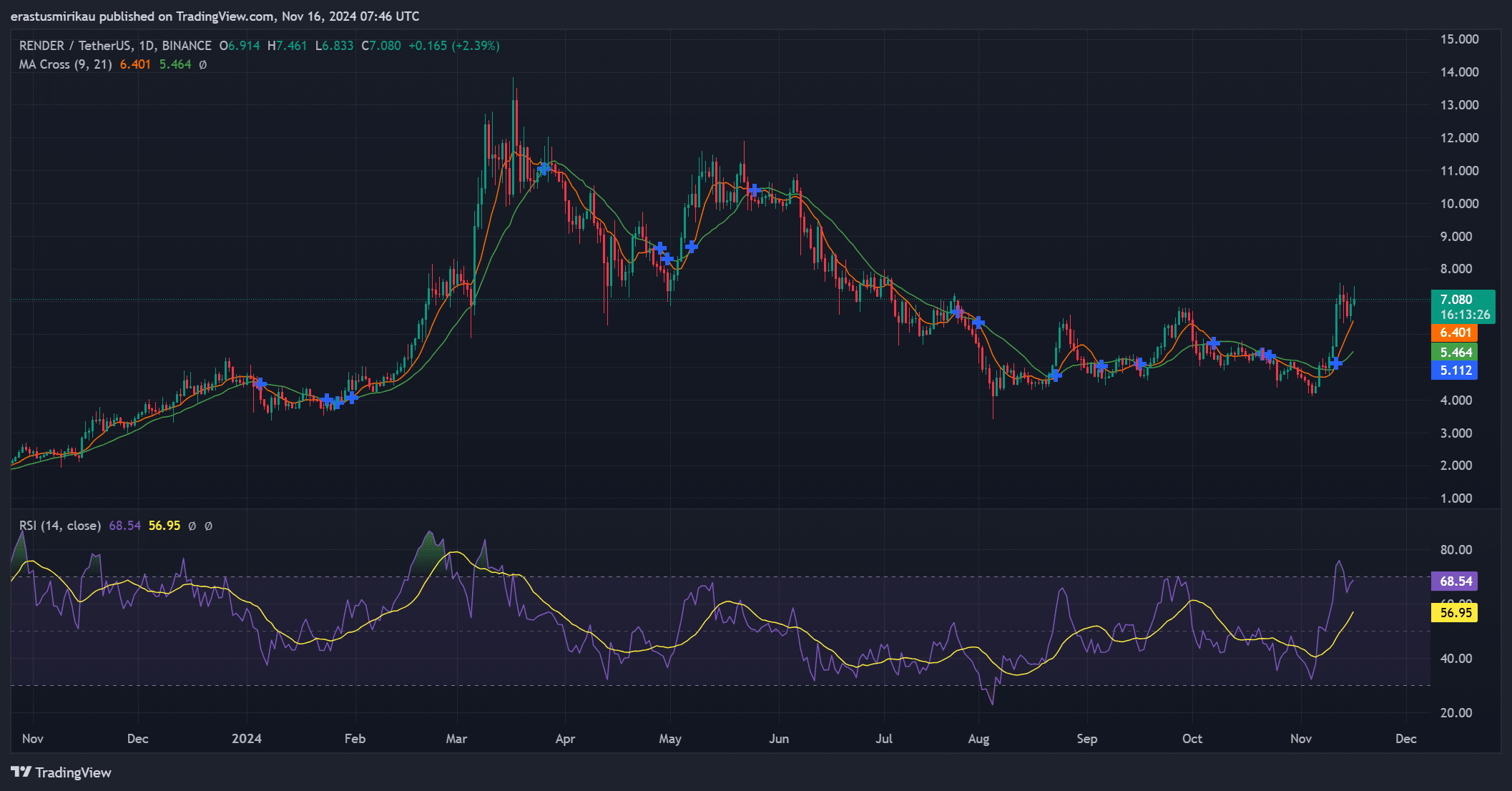

The extra evidence for hopefulness came from the technical indicators. Lately, the 9-day and 21-day moving averages have intersected – a distinct sign suggesting a rise in bullish energy.

As I’m currently analyzing, it’s worth noting that the Relative Strength Index (RSI) stands at 68.54. This suggests robust buying activity, yet we’re approaching overbought territory. This could potentially signal a short-term pause or consolidation phase before any further significant upward momentum.

Moreover, the increase in trading volumes aligned with the price surge on the graphs, suggesting a persistent market movement for RNDR. The high volume during the uptrend indicates robust investor interest, which may continue to drive RNDR towards its next objective.

On-chain data hints at caution

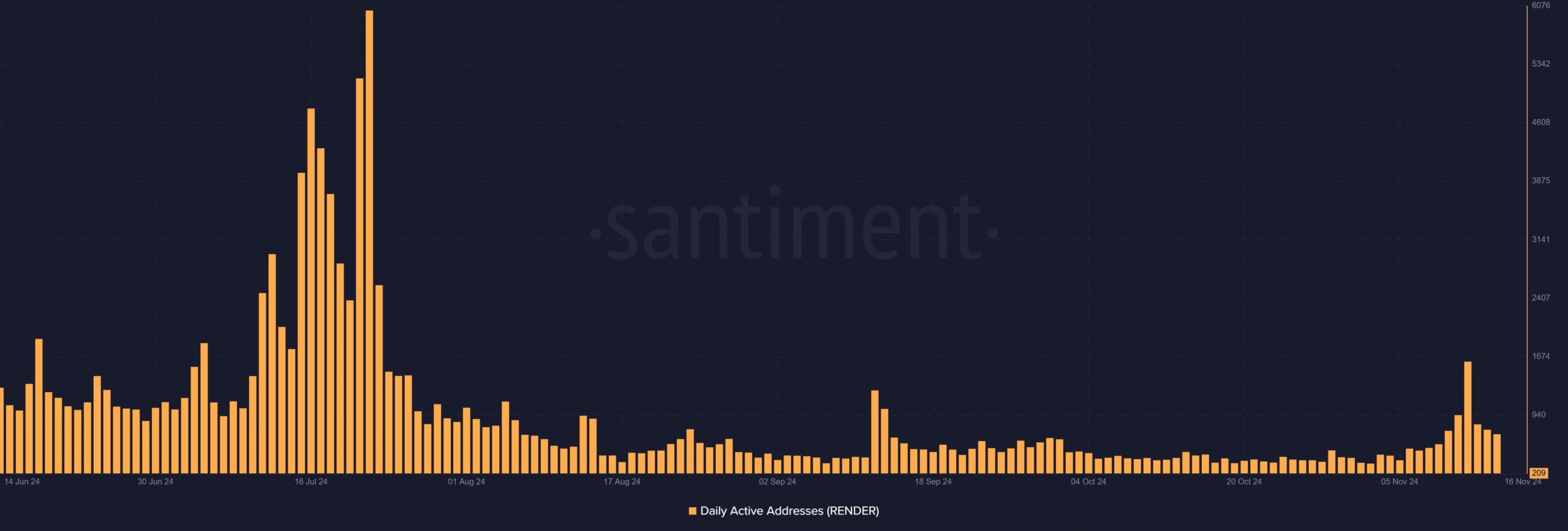

Regarding the market’s uptrend, it’s worth noting that the number of daily active users has significantly decreased as per on-chain analysis. This drop, from 703 to 209, suggests a potential decline in user involvement.

It’s clear that this rise in price has sparked doubts as to whether it’s solely due to speculation. Yet, a decrease in active users typically aligns with price stabilization and might not significantly impact the long-term outlook.

Growing market metrics

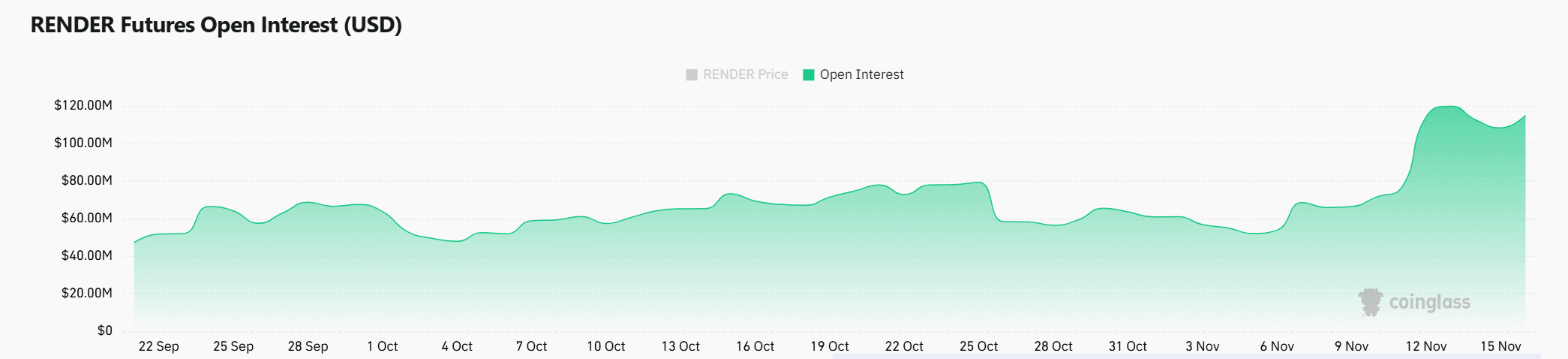

Ultimately, there’s been a substantial enhancement in traders’ optimism, evident in a 9.79% surge in Open Interest (OI), equating to approximately $121.79 million.

It seems as though this increase indicates that a larger number of investors are preparing for RNDR’s significant upcoming shift. Consequently, the harmony between investor opinions and market trends lends credence to the possibility of continued growth.

Read Render’s [RNDR] Price Prediction 2024–2025

In the end, RNDR surpassing $6.67 signified a bullish reversal, backed by both technical indicators and market optimism, suggesting a possible rise to around $12.05.

As I analyze the current trends, although the decrease in actively used addresses does call for some caution, the broader perspective continues to look promising. Thus, it seems that RNDR might maintain its upward momentum, provided there are no unforeseen changes in the market dynamics.

Read More

2024-11-16 22:16