-

Fidelity eclipsed Grayscale in BTC ETF outflows on the 1st of May.

BlackRock’s IBIT saw its first outflow as BTC struggled to reclaim $60K.

As a seasoned crypto investor with a keen interest in BTC ETFs, I’ve witnessed firsthand how the market dynamics have shifted over the past few days. The recent outflows from US Bitcoin ETFs, particularly Fidelity and Grayscale, have left me feeling uneasy about the current state of the market.

⚠️ Market Meltdown? EUR/USD Braces for Trump Tariff Fallout!

Explosive analysis shows why EUR/USD could face extreme moves ahead!

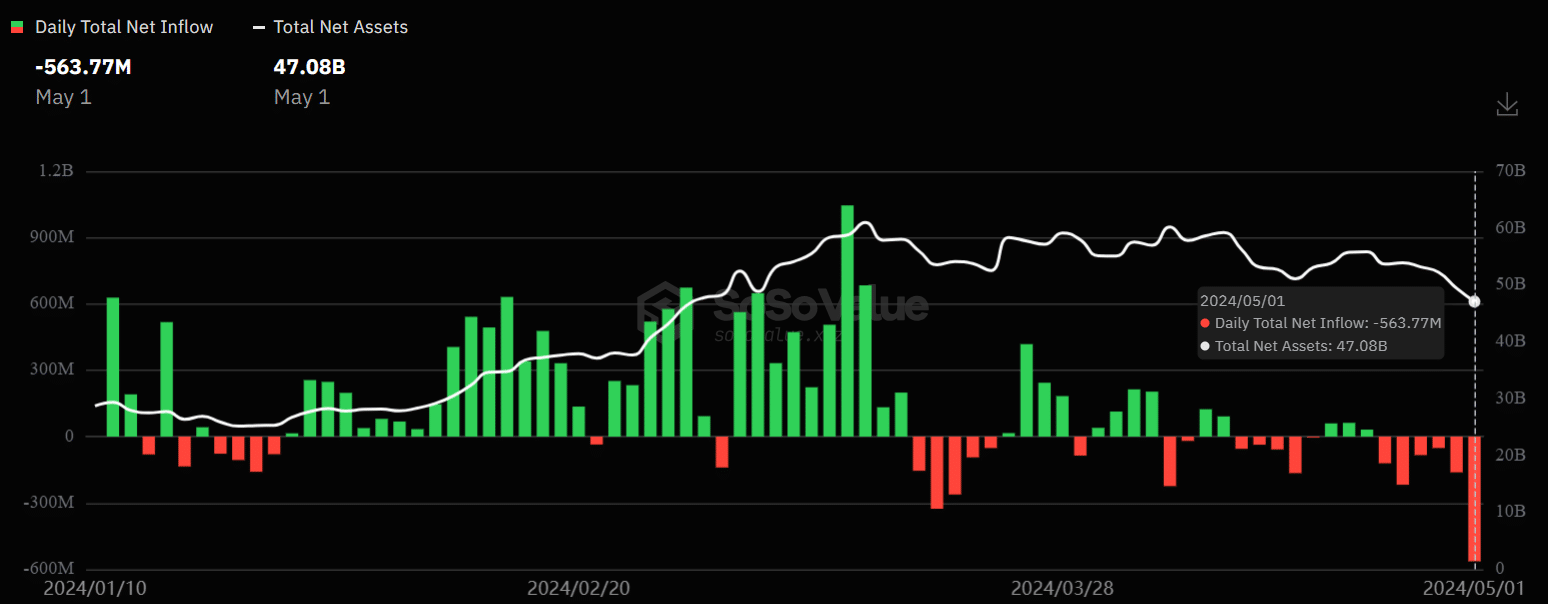

View Urgent ForecastThe turbulence in Bitcoin‘s (BTC) second quarter shows no signs of abating based on recent data from Sovo Value. Specifically, United States Bitcoin Exchange-Traded Funds (ETFs) experienced significant outflows totaling $563.7 million on May 1st.

As an analyst, I was taken aback by the shift in trends from Grayscale’s GBTC having the most outflows in the past to being surpassed by Fidelity’s FBTC in terms of leading the outflows.

BlackRock’s first outflow as Fidelity loses 2% of its BTC ETF assets

Among the $563.7 million in total withdrawals, Fidelity’s FBTC accounted for the largest portion with a withdrawal amounting to $191.1 million, according to Farside’s data.

Grayscale’s GBTC recorded the second-largest daily outflow on 1 May, worth $167.4 million.

As a researcher studying the ETF market, I’ve observed some noteworthy trends. Specifically, Bloomberg ETF analysts have highlighted significant daily outflows from Fidelity’s ETF offerings. These withdrawals amounted to nearly 2% of the total assets under management in their ETF portfolio.

“Gosh, although it only represents about 2% of the ETF’s total assets, this significant amount poses a substantial impact on Fidelity, as all of these affected assets are causing quite a commotion today.”

BlackRock’s IBIT experienced a setback with its first withdrawal of $36.9 million following a five-day halt in new investments.

Reacting to IBIT’s first outflow, Bloomberg analyst James Seyffart noted,

“Ruff day to be a #bitcoin ETF.”

As a crypto investor, I can tell you that the latest Federal Reserve rate decision did little to boost my confidence in the market. Despite their decision to keep interest rates unchanged, Bitcoin remained stubbornly below the $60,000 mark for me and many other investors.

Based on the analysis of financial commentator Peter Schiff, Bitcoin (BTC) may fall to the price level of $54,000 if it fails to hold above the current support at $60,000.

“Notice on this shorter-term #Bitcoin chart that $60K, which was support, has become resistance.”

Read More

- Masters Toronto 2025: Everything You Need to Know

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Street Fighter 6 Game-Key Card on Switch 2 is Considered to be a Digital Copy by Capcom

- Gold Rate Forecast

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- The Lowdown on Labubu: What to Know About the Viral Toy

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Mario Kart World Sold More Than 780,000 Physical Copies in Japan in First Three Days

2024-05-02 14:47