- SAFE has surged 76% in 24 hours, breaking out of a multi-month downtrend with strong volume.

- Social dominance has risen sharply, but overbought indicators and price divergence suggest caution.

As a seasoned crypto investor who’s been through the rollercoaster ride of the digital asset market, I must admit that seeing SAFE surge 76% in just 24 hours is quite exhilarating! After experiencing the agony of its multi-month downtrend, it’s refreshing to see the price break out and gain momentum.

In an impressive surge, the value of Safe [SAFE] has significantly risen, escaping its prolonged decline and leaping more than 76% within a single day. As we speak, SAFE is being traded at $1.66, reflecting a marked boost in investor trust.

Furthermore, the market capitalization has increased by a significant 76.69% to reach a staggering $770.48 million. This surge suggests a substantial increase in its valuation. Moreover, the trading volume has skyrocketed by an impressive 9981.24%, suggesting a strong interest in the token due to its recent performance.

These figures highlight the strength behind the current breakout. However, traders are now asking whether Safe can maintain this rapid growth or if a pullback is looming.

Breaking the downtrend: What happens next?

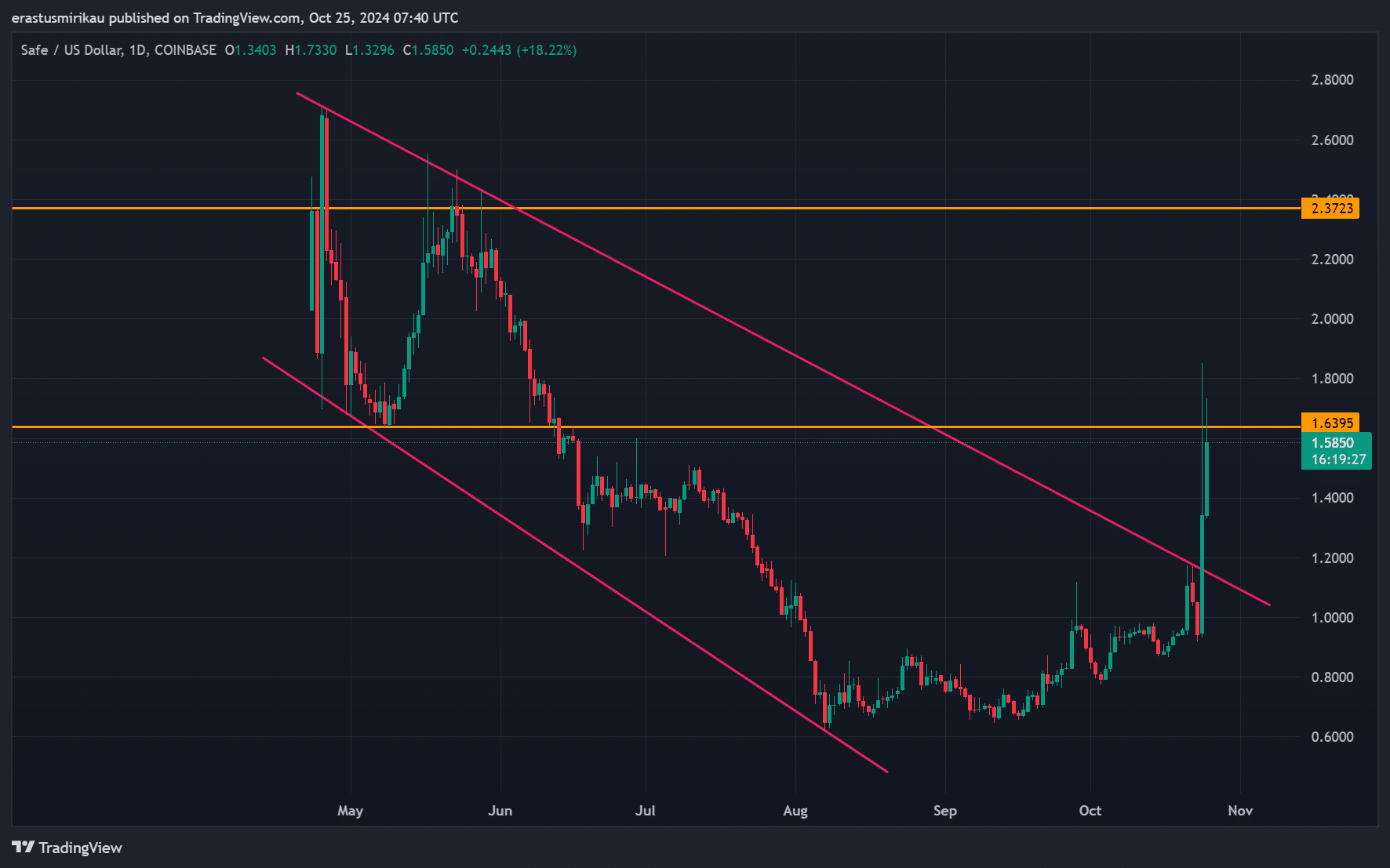

As a researcher, I’ve noticed that the price trend for safety has been prolonged and sluggish, forming a descending channel since the start of this year. However, recent developments show a breakout from this pattern, suggesting a potential bullish turnaround.

At present, SAFE surpasses $1.63, a significant point that used to function as a barrier for price increase. As a result, this figure now serves as a crucial point of support that traders will keep a close eye on.

As a researcher, I’m observing that the key challenge ahead for SAFE’s continued rally is at the significant resistance level of $2.37. Should it manage to surpass this mark, it could indicate even greater upward momentum. Maintaining the $1.63 support level would suggest that the bulls are still dominating the market dynamics.

Technical indicators: RSI and MACD flash caution

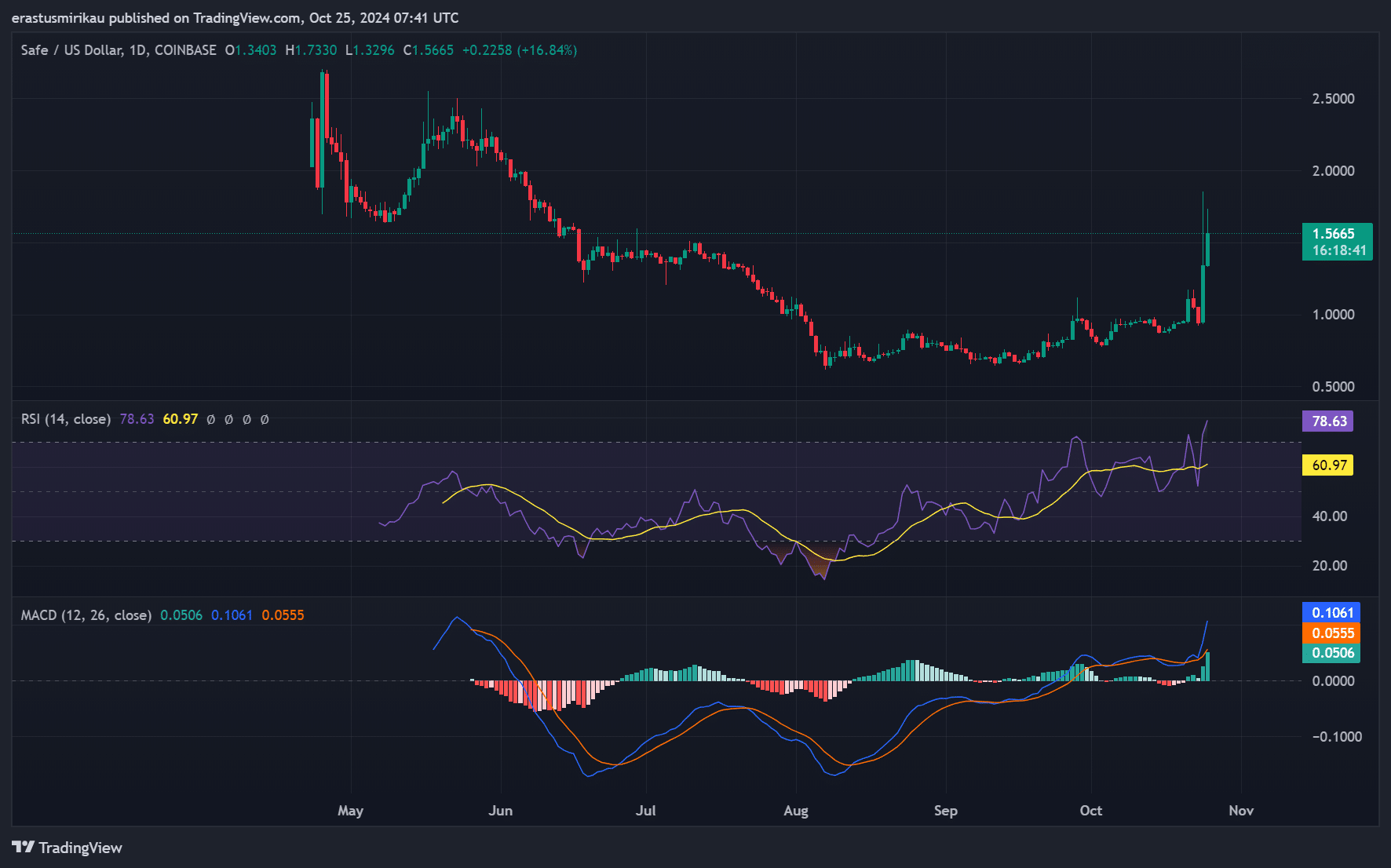

Although the surge looks hopeful, some technical signals advise us to tread carefully as we proceed. At present, the Relative Strength Index (RSI) stands at 78.63, indicating that the market is overextended and may need correction.

Therefore, SAFE may be due for a period of consolidation or even a short-term pullback.

Additionally, the MACD (Moving Average Convergence Divergence) has moved into a bullish region, and its signal line is supporting the ongoing positive trend. Yet, the intensity of this progression might suggest a possible pause or slowdown prior to the next rise.

Price DAA Divergence

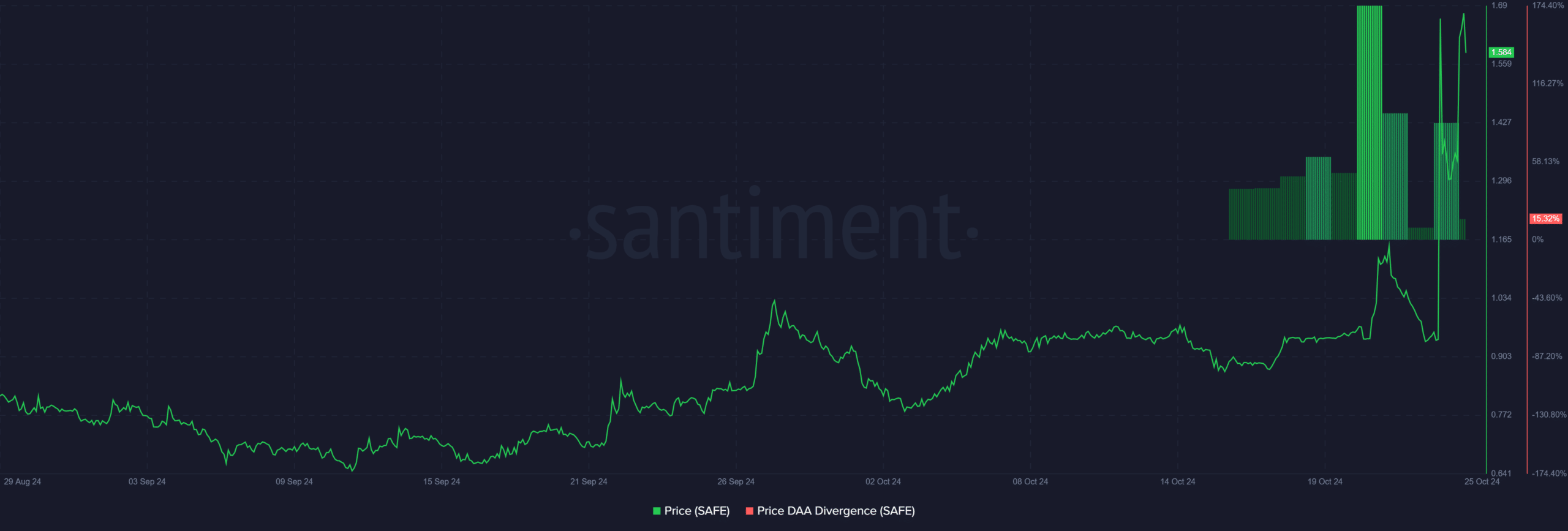

The Price DAA Divergence reveals a 15.32% gap between SAFE’s price surge and its network activity. While the price has increased significantly, daily active addresses have not risen proportionally.

The divergence indicates that the price movement could be speculative, driven by short-term traders rather than consistent network growth. This calls for caution, as a lack of organic network activity can sometimes result in a price correction.

SAFE social dominance spikes

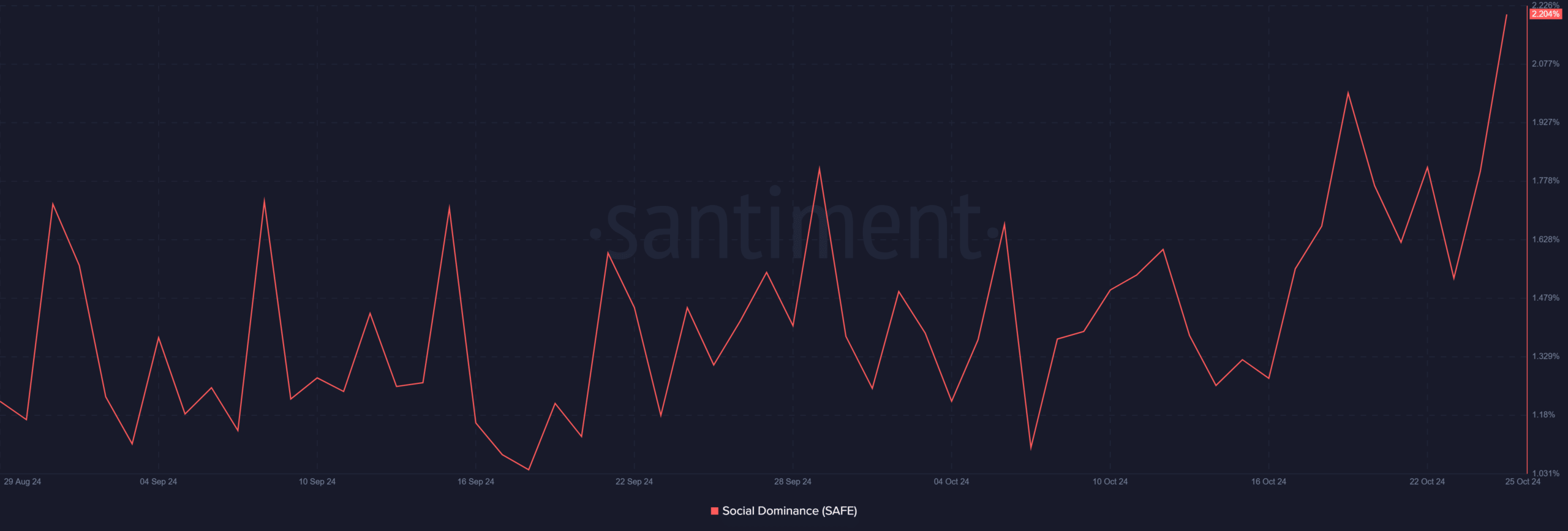

1) Social dominance has risen significantly to 2.204%, marking a noticeable upswing compared to previous rates. This surge, in turn, indicates that the topic of SAFE is garnering considerable attention on social media sites, which can frequently signal heightened market volatility and price fluctuations.

On the other hand, swift increases in social dominance not necessarily lead to lasting development and may indicate temporary, speculative attention.

Is SAFE poised to hit $2.37?

Given the significant increase in trading activity and the noticeable break free from a prolonged decline, it’s expected that the price of SAFE could reach the resistance level at $2.37 shortly.

The bullish momentum remains intact, supported by heightened social interest and technical indicators, despite overbought conditions. Therefore, unless a major pullback occurs, SAFE is well-positioned to test the $2.37 mark in the near term.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- How to Get to Frostcrag Spire in Oblivion Remastered

- ANKR PREDICTION. ANKR cryptocurrency

- Quick Guide: Finding Garlic in Oblivion Remastered

- Isabella Strahan Shares Health Journey Update After Finishing Chemo

- DOOM: The Dark Ages Debuts on Top of Weekly Retail UK Charts

- This School Girl Street Fighter 6 Anime Could Be the Hottest New Series of the Year

- LINK PREDICTION. LINK cryptocurrency

- K-Pop Idols

2024-10-26 03:04