- Analyst believes altcoins might continue to underperform against Bitcoin as the market deviates from previous patterns

- Solana might be the reason why the altcoin market cap has not formed lower lows

As a seasoned analyst with over two decades of experience in the financial markets, I have seen my fair share of bull and bear cycles. The current performance of altcoins against Bitcoin is reminiscent of the dot-com bubble, where enthusiasm led to overvaluation followed by a harsh correction.

As a seasoned cryptocurrency investor with several years of experience under my belt, I have noticed a noticeable trend this year: altcoins have struggled to keep pace with Bitcoin (BTC). Among the top ten altcoins, only Binance Coin (BNB) and Toncoin (TON) have managed to surpass their previous highs. This observation is based on my personal investment portfolio and research into the crypto market. In my view, this underperformance of most altcoins against Bitcoin could be attributed to factors such as market sentiment, regulatory uncertainty, and the general dominance of BTC in the crypto space. However, it’s essential to keep a close eye on the market trends and potential opportunities that these altcoins may present in the future.

As stated by Andrew Kang, Partner at Mechanism Capital, it’s been observed that the market is deviating from its usual trends. Typically, when Bitcoin sets a new record high, other cryptocurrencies (altcoins) tend to follow suit. However, this didn’t occur for many altcoins earlier this year, even though Bitcoin had reached an all-time high of $73k on the charts.

“In each fresh financial cycle, we’d expect the total value of alternative cryptocurrencies (including ETH) to hit record levels. However, it seems that this trend isn’t materializing… Just because Bitcoin reaches new peaks doesn’t automatically imply that alternative coins will follow suit.”

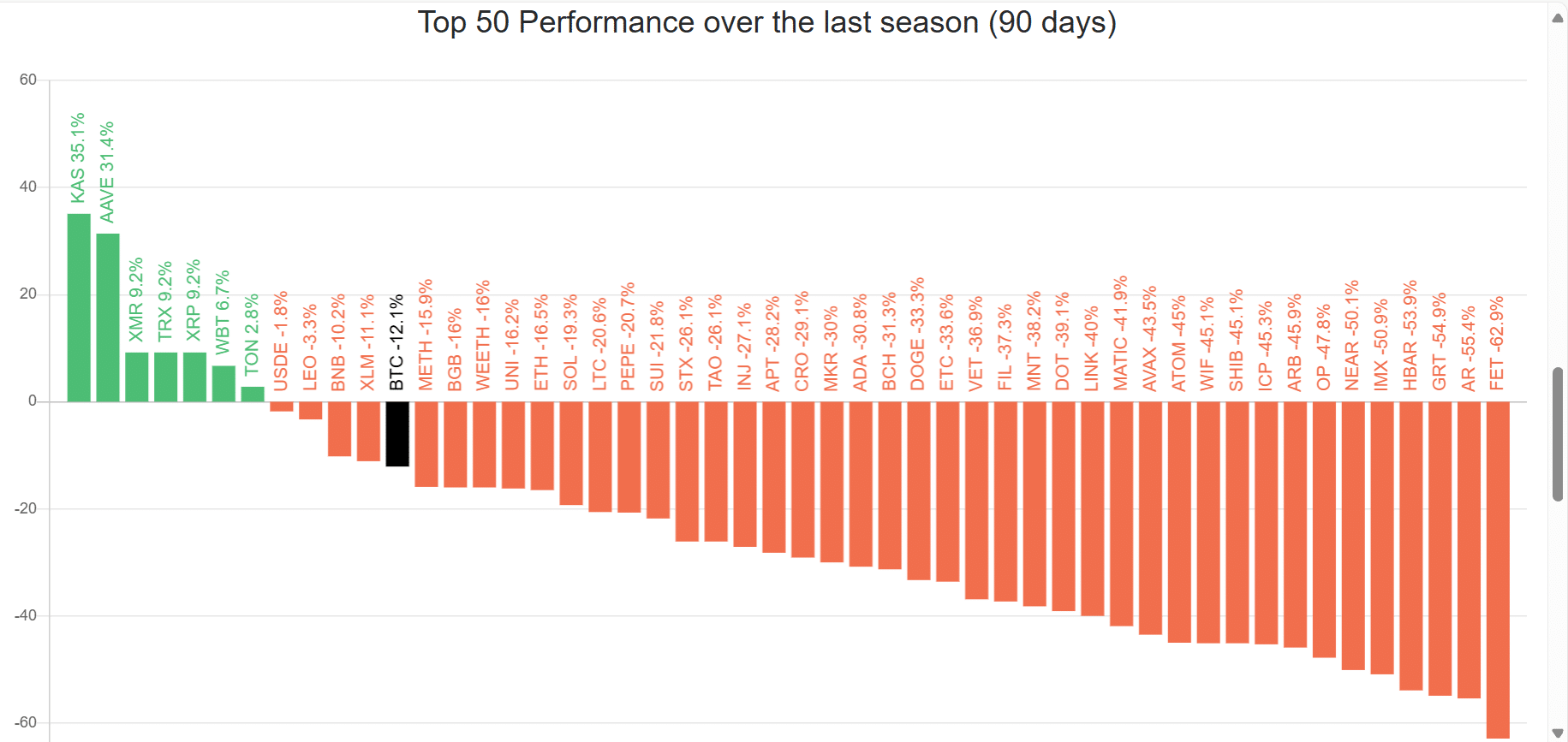

A look at data from Blockchain Center revealed that only 11 out of the top 50 altcoins outperformed Bitcoin over the last 90 days.

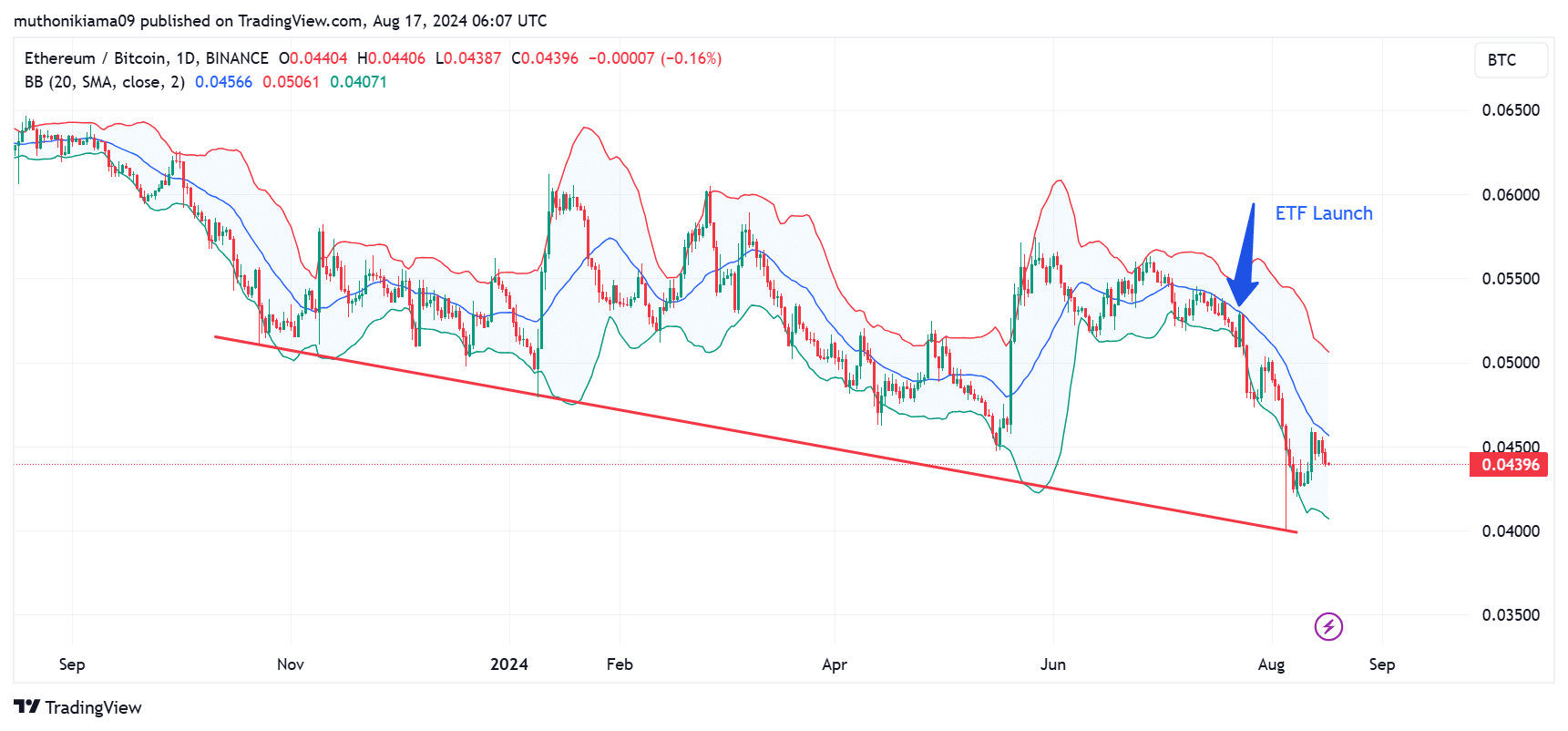

ETH forms yearly lows against Bitcoin

Based on his findings, Kang’s analysis is following the recent development where Ethereum reached its lowest point for the year relative to Bitcoin on August 9th. Moreover, if we examine the daily ETH/BTC chart, it shows that the largest alternative coin has been creating lower lows against Bitcoin since October of last year.

Additionally, as Ether exchange-traded funds (ETFs) began trading in July, Ethereum has consistently struggled to rebound from the midpoint of its Bollinger band, which is represented by the 20-day Simple Moving Average. This persistent struggle is yet another indication of Ethereum’s underperformance.

As per Kang’s prediction, it is expected that the price of altcoins may hit a low point around 2025, followed by a strong upward trend.

Solana is the safety net?

In other words, according to Kang, it’s worth noting that while the overall altcoin market cap is currently approximately $1 trillion, Solana (SOL) is thought to be the primary factor preventing this figure from reaching a new low in terms of chart trends, as suggested by Kang.

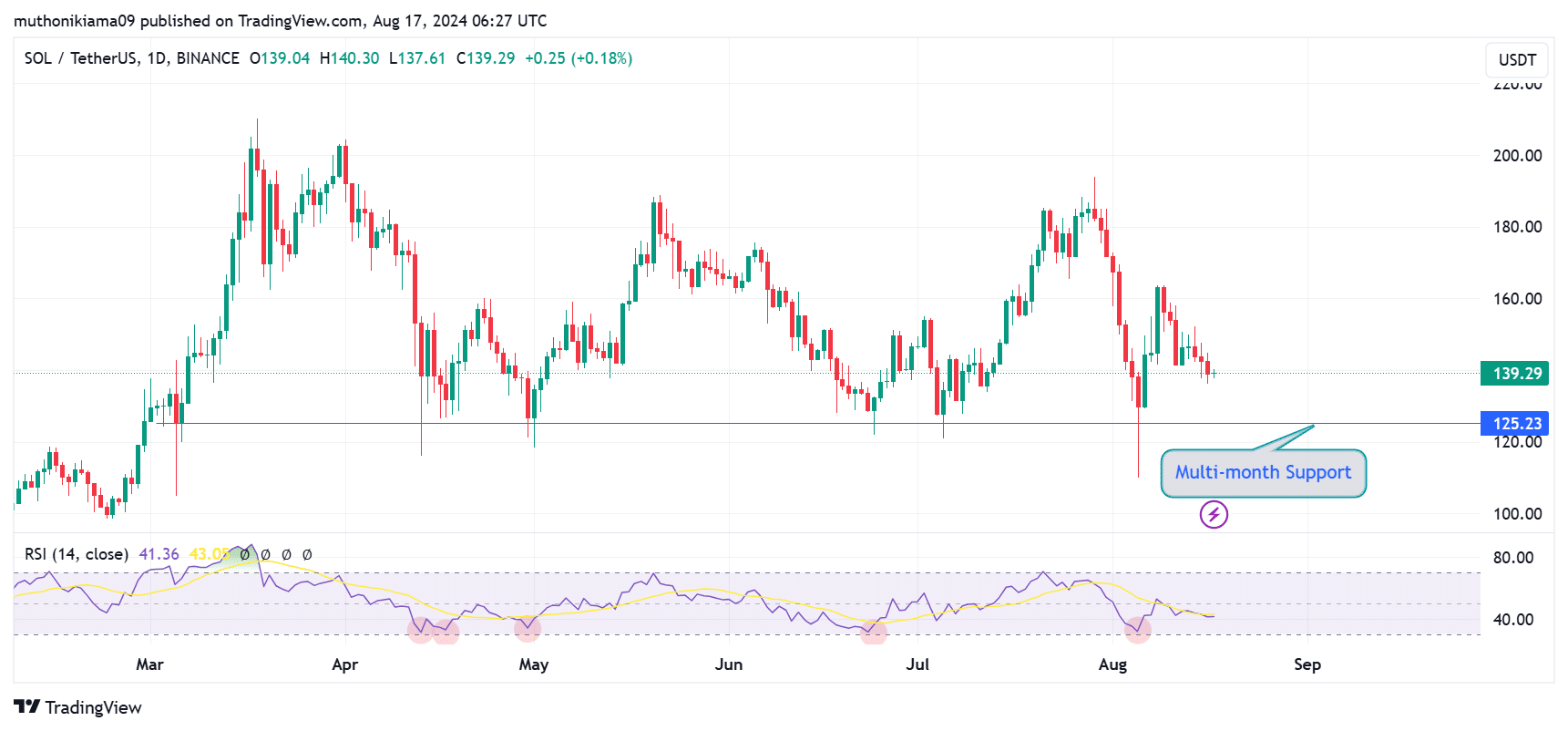

In fact, Solana has defended a multi-month support level at $125 since March 2024.

Keep an eye on the $125 mark, as it signifies a significant psychological price point where Solana (SOL) has managed to create a strong foundation, even under pressure that could otherwise lead to sharp decreases.

For quite some time now, the Relative Strength Index (RSI) of SOL has consistently remained above 30 since March, suggesting that it may not have been significantly oversold over a prolonged stretch.

As a seasoned investor with years of experience in the crypto market, I have learned to read trends carefully and make informed decisions based on them. In this particular case, the trend suggests that buyers are effectively minimizing significant downside risk for Solana (SOL). This strong support from the buying activity aligns with my thesis that Solana’s price is less likely to reach a lower low in the near future. I have seen similar patterns play out before and learned that when the market shows such strong support, it’s often an indication of a bullish outlook for the asset. This gives me confidence in my investment strategy and encourages me to hold onto my SOL positions.

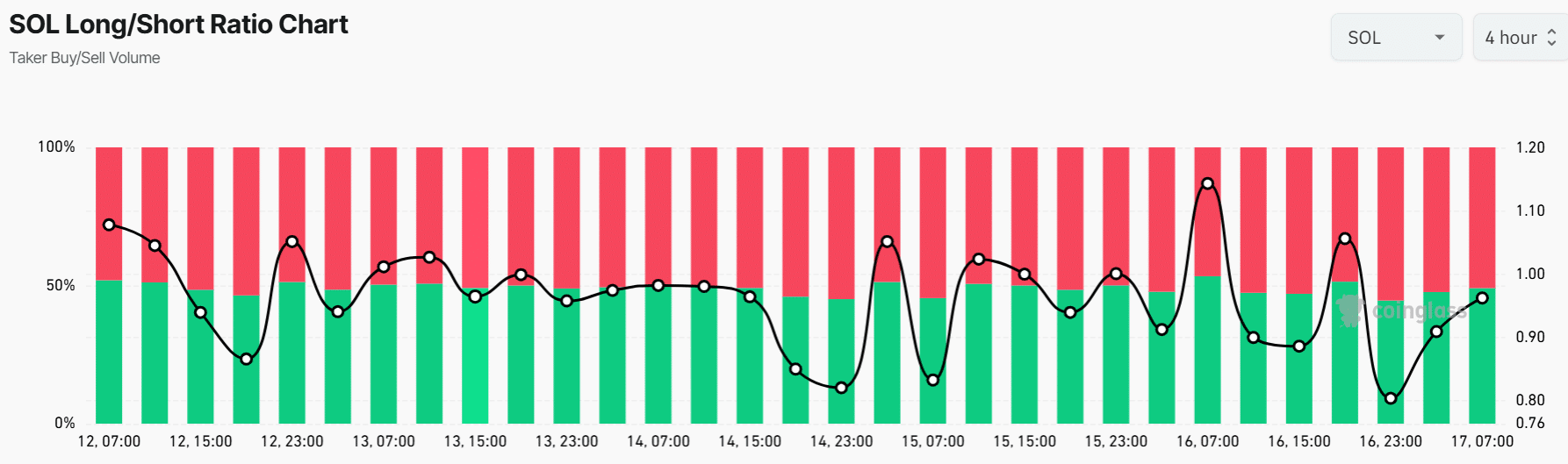

Furthermore, it appears that traders’ opinions on SOL in the Futures market are fairly evenly split. At the current moment, the number of open short positions for SOL slightly exceeds the number of open long positions, as indicated by a long/short ratio of 0.97.

Despite Solana’s efforts, it hasn’t managed to keep the altcoin market afloat. As we speak, the Altcoin Season Index stands at 22, indicating that Bitcoin is currently preferred over altcoins in the market.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-08-17 17:12