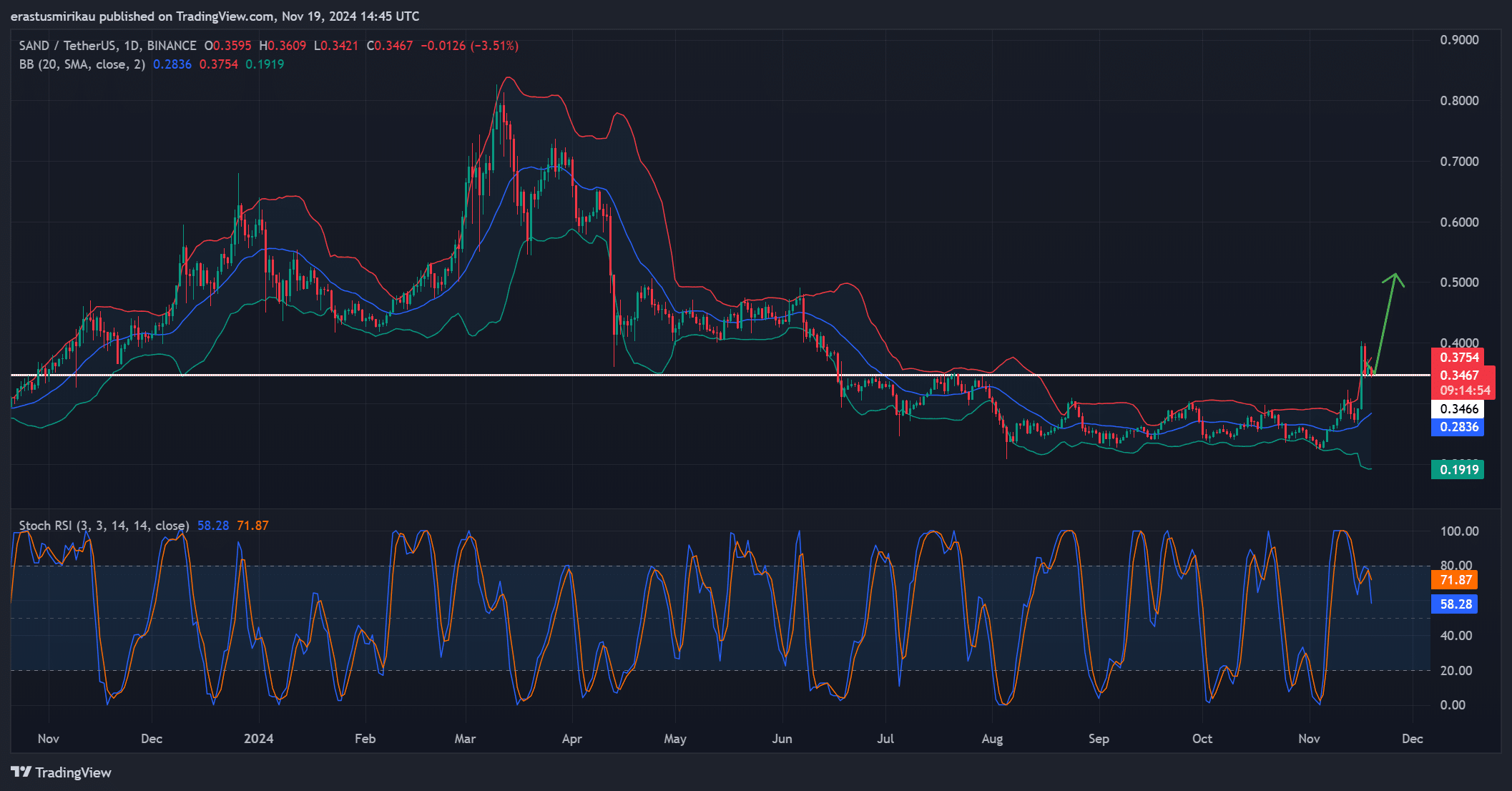

- SAND seemed to be consolidating below its $0.375 resistance, with the RSI at 71.87

- Bullish on-chain metrics included a 13.10% hike in large transaction growth

As a seasoned analyst with years of experience navigating the complex and ever-changing crypto market, I find myself intrigued by The Sandbox (SAND) at this juncture. SAND has been tangoing around its critical resistance level at $0.375, displaying signs of consolidation but also hinting at a potential breakout.

In the past 13 hours, there’s been increased action in The Sandbox (SAND), with approximately 9.04 million SAND tokens ($3.28 million) being transferred to Binance. This adds to the total of 19.05 million SAND tokens ($5.9 million) deposited over the past 26 days. Currently, at the time of this writing, each SAND token is valued at $0.3465, marking a 2.20% drop compared to its price 24 hours ago.

It appears that optimistic on-chain indicators and crucial technical milestones hint at the possibility of a substantial price shift approaching.

SAND testing critical resistance levels

The cost of SAND has been holding steady around a significant barrier at approximately $0.375, an area that’s often crucial in the past. With Bollinger Bands narrowing, this suggests less volatility and possibly an upcoming breakout. If the price manages to close above $0.375, it might trigger a surge towards $0.50. However, if the support at $0.375 doesn’t hold, we could see the price drop back down to $0.34 as a safety net.

Currently, the Stochastic RSI stands at 71.87, suggesting that SAND is nearing overbought territory. A possible downward crossover might result in a short-term price dip, offering traders a chance to jump back in before another effort to breach the resistance level. As such, the upcoming trading sessions will be crucial in predicting where SAND’s trend is heading.

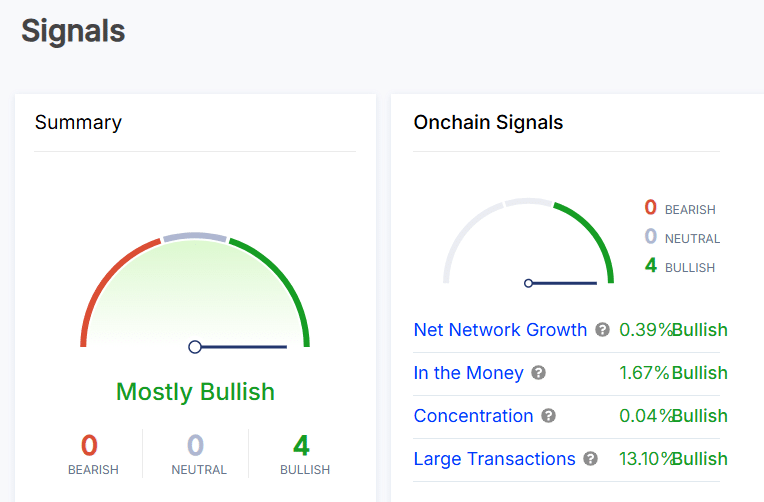

SAND’s bullish on-chain signals inspire confidence

Despite some dips in price, there’s still optimism for SAND as on-chain indicators show positive signs. For instance, the network’s growth expanded by 0.39%, indicating a consistent increase in user adoption. Furthermore, about 1.67% of SAND holders were profiting at that moment, demonstrating profitable positions despite the recent price decline.

The increase in concentration, as indicated by the metric, was a slight 0.04%, suggesting a well-balanced distribution of tokens between major holders and smaller investors.

Simultaneously, there was a significant increase of 13.10% in large transactions, indicating a rising curiosity among institutional investors and wealthy individuals. This trend might boost faith in the altcoin’s future prospects and potentially set the stage for more robust growth.

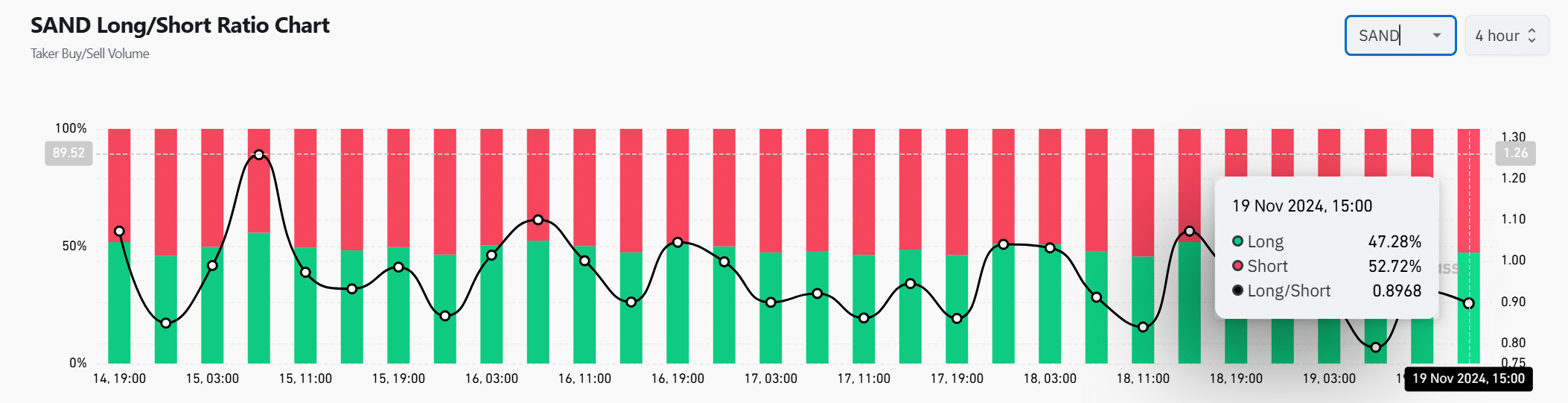

Short bias reveals contrarian opportunity

Currently, it’s been found that approximately 52.72% of traders have taken short positions, while about 47.28% are holding long positions. The total ratio between these two groups stands at 0.8968, indicating a slight predominance of traders opting for short positions over long ones.

Under these circumstances, there seems to be a somewhat pessimistic outlook, but such situations can provide chances for a short squeeze. Should SAND manage to surpass its resistance level, it might trigger rapid liquidation of short positions, potentially fueling an upward price surge.

Realistic or not, here’s SAND market cap in BTC’s terms

Is the altcoin ready for a breakout?

Based on the positive on-chain indicators and technical arrangements for The Sandbox, it seems more probable that we might witness a surge beyond $0.375.

Based on the signals from the Stochastic RSI, there might be a short-term pullback ahead. However, robust on-chain indicators and institutional interest point to a bullish trend in the long run. If the crucial resistance level is surpassed, SAND may surge towards $0.50 in the upcoming period.

Read More

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- How to Get to Frostcrag Spire in Oblivion Remastered

- LUNC PREDICTION. LUNC cryptocurrency

2024-11-20 10:15