- SEC’s decision on the Bitwise Crypto Index ETF application has been postponed to March

- Will the incoming administration accelerate Crypto ETF approvals?

The Securities and Exchange Commission (SEC) has deferred its decision on Bitwise’s application for a Crypto Index ETF until March, as they require additional time to evaluate the proposed rule change submitted via the New York Stock Exchange (NYSE). A portion of their statement indicates that they are seeking more deliberation on this matter.

It seems fitting for the Commission to extend the deadline for acting on the suggested rule modification, giving them ample time to carefully review the proposal and address any concerns or questions that arise from it.

The Bitwise 10 Crypto Index Fund follows the performance of leading cryptocurrencies that are primarily influenced by Bitcoin [BTC], Ethereum [ETH], Ripple [XRP], and Solana [SOL]. Similar to how Grayscale transformed its Grayscale Bitcoin Trust Fund into a BTC ETF, Bitwise aims to do the same with its index fund. In simpler terms, Bitwise wants to make it possible for their crypto index fund to work similarly to an ETF.

Will the new regime accelerate crypto ETFs?

While applications for Crypto Index ETFs by Hashdex and Franklin Templeton have recently received approval, their focus is limited to Bitcoin and Ethereum. These two tokens enjoy a degree of regulatory clarity, being classified as securities.

Nevertheless, eight additional assets such as XRP and SOL within the Bitwise platform remain uncertain regarding their classification as security tokens due to a lack of regulatory clarification. Regardless, there’s optimism in the market that favorable results might emerge under the upcoming Trump administration.

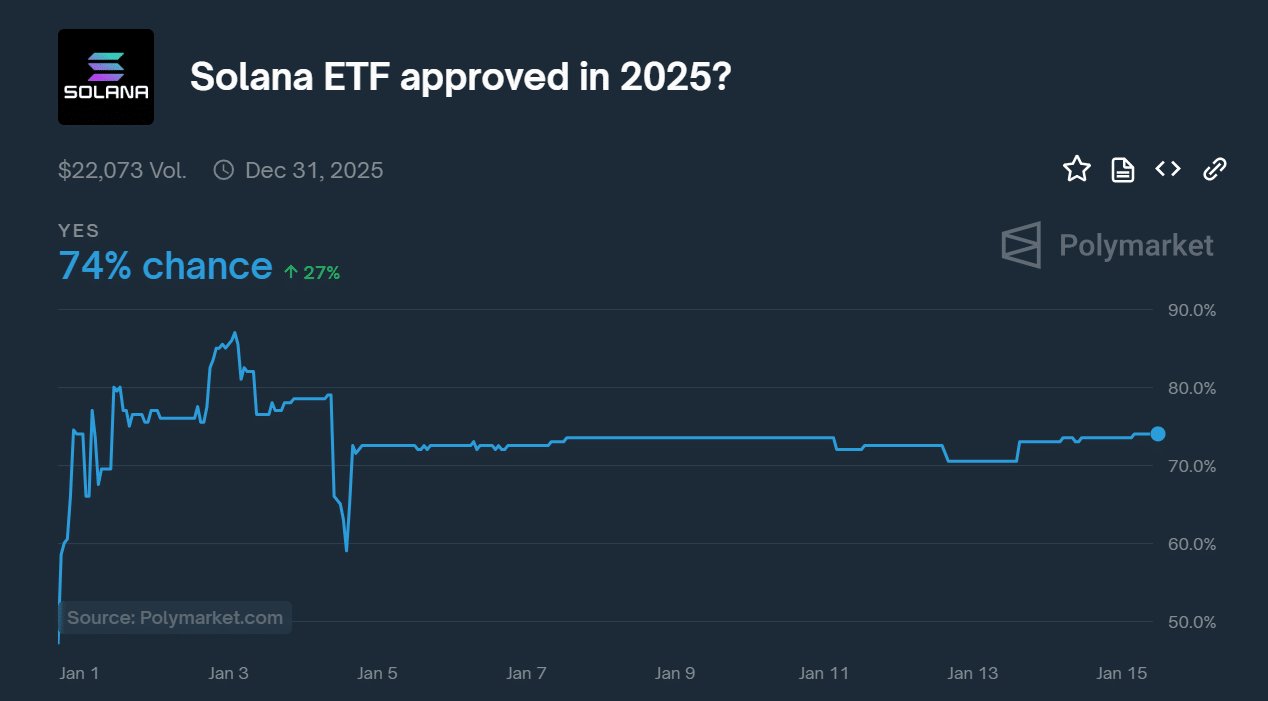

Currently, as we speak, Polymarket estimates that there is approximately a 50% likelihood of an XRP and SOL Exchange-Traded Fund (ETF) being approved by 2025. The chances for an XRP ETF are estimated to be about 60%, while the market anticipates a 74% chance of approval for the SOL ETF this year.

In simpler terms, the financial market anticipates that the new administration will expedite the approval process for altcoin Exchange Traded Funds (ETFs), potentially aiding in the acceptance of crypto index ETF applications. This could be more likely if there’s clarity regarding the legal status of other digital tokens.

Currently, departing SEC Chairman Gary Gensler is standing by his actions in enforcing regulations and reiterating his viewpoint that many cryptocurrency projects lacking fundamental value will ultimately collapse. In a conversation with CNBC, he stated this position explicitly.

For any other cryptocurrency initiatives out there, it’s crucial that they demonstrate real-world applications and solid foundational elements. Otherwise, they may not survive in the long run.

It’s uncertain yet if the new SEC chair, Paul Atkins, who is supportive of cryptocurrency, might undo certain perceived negative crypto policies and speed up the process for approving altcoin ETFs.

Read More

- Masters Toronto 2025: Everything You Need to Know

- Forza Horizon 5 Update Available Now, Includes Several PS5-Specific Fixes

- Gold Rate Forecast

- ‘The budget card to beat right now’ — Radeon RX 9060 XT reviews are in, and it looks like a win for AMD

- We Loved Both of These Classic Sci-Fi Films (But They’re Pretty Much the Same Movie)

- Valorant Champions 2025: Paris Set to Host Esports’ Premier Event Across Two Iconic Venues

- Karate Kid: Legends Hits Important Global Box Office Milestone, Showing Promise Despite 59% RT Score

- Eddie Murphy Reveals the Role That Defines His Hollywood Career

- Discover the New Psion Subclasses in D&D’s Latest Unearthed Arcana!

- The Lowdown on Labubu: What to Know About the Viral Toy

2025-01-15 18:31