- SEC imposed $4.68 billion in fines in 2024, setting a record for regulatory action.

- Crypto firms faced rising penalties, emphasizing the need for regulatory compliance and transparency.

As a seasoned researcher with a decade-long career in financial regulation, I have witnessed the evolution of regulatory oversight in the digital asset space. The recent actions by the SEC against crypto firms, particularly in 2024, have been nothing short of remarkable.

Over the past few years, particularly in 2024, there’s been a significant escalation in the scrutiny exercised by the U.S. Securities and Exchange Commission (SEC) over the cryptocurrency market.

Despite causing friction with cryptocurrency companies, the Securities and Exchange Commission (SEC) continues to be firm about promoting transparency, safeguarding investors, and ensuring compliance with legal regulations.

This has resulted in substantial fines for companies violating regulatory requirements.

SEC fines report unveiled

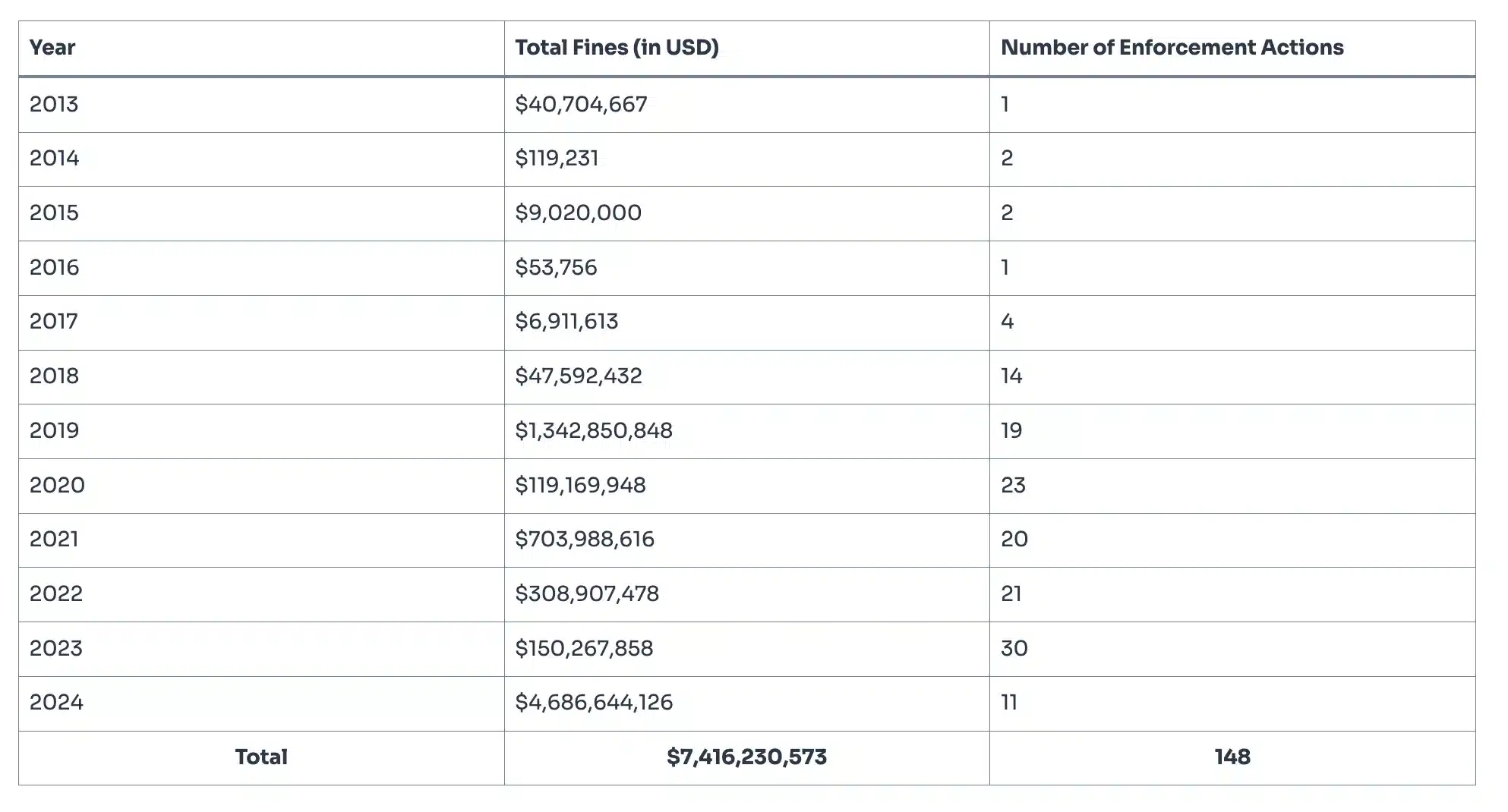

A newly published report details the fines levied against prominent cryptocurrency companies between 2013 and 2024, providing insight into notable instances of misconduct and the types of infractions that occurred.

According to the report,

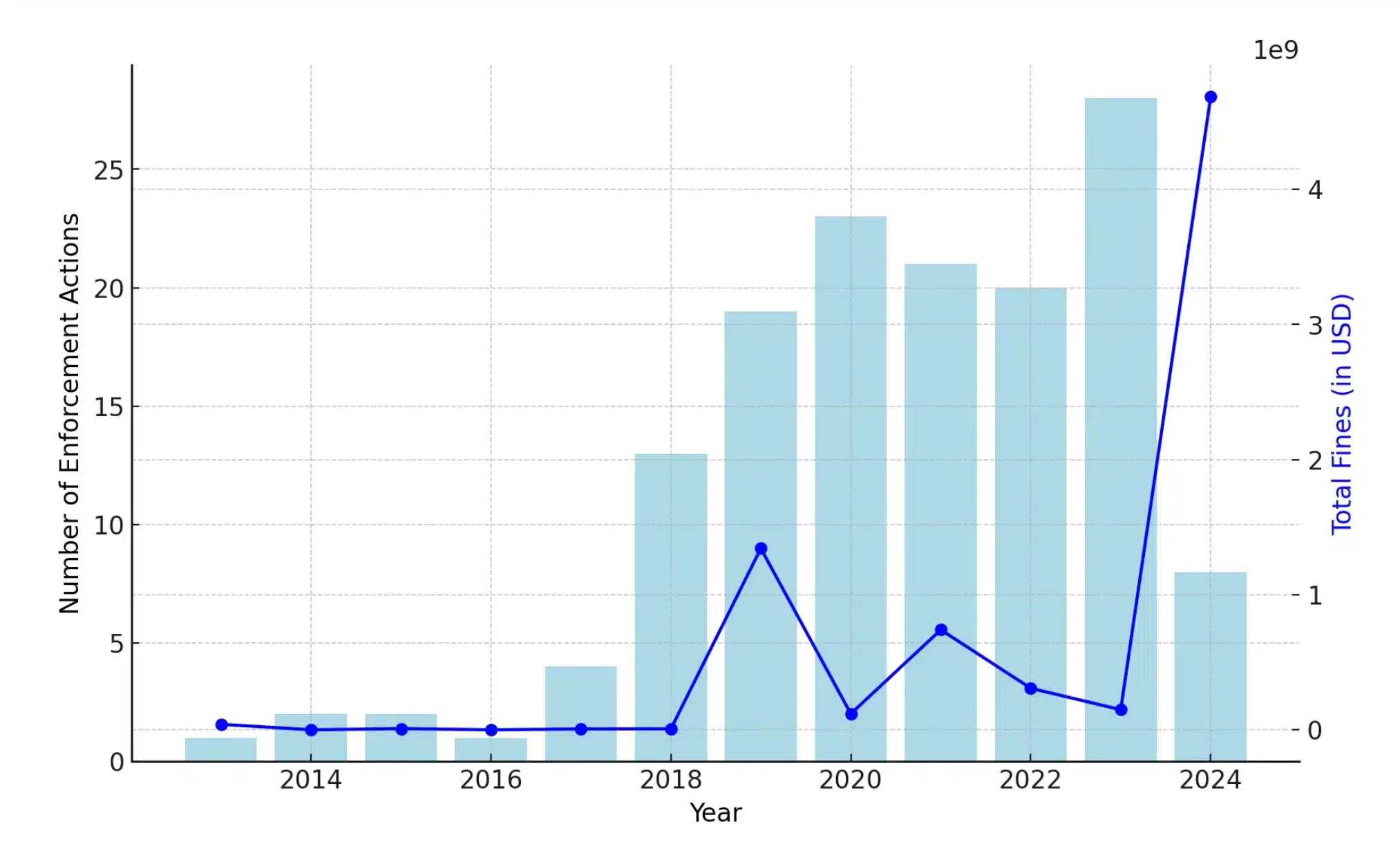

From 2013 onwards, the Securities and Exchange Commission (SEC) has imposed over $7.42 billion in penalties on cryptocurrency companies and individuals. Notably, a significant portion of this total, around 63%, or about $4.68 billion, was levied solely in the year 2024.

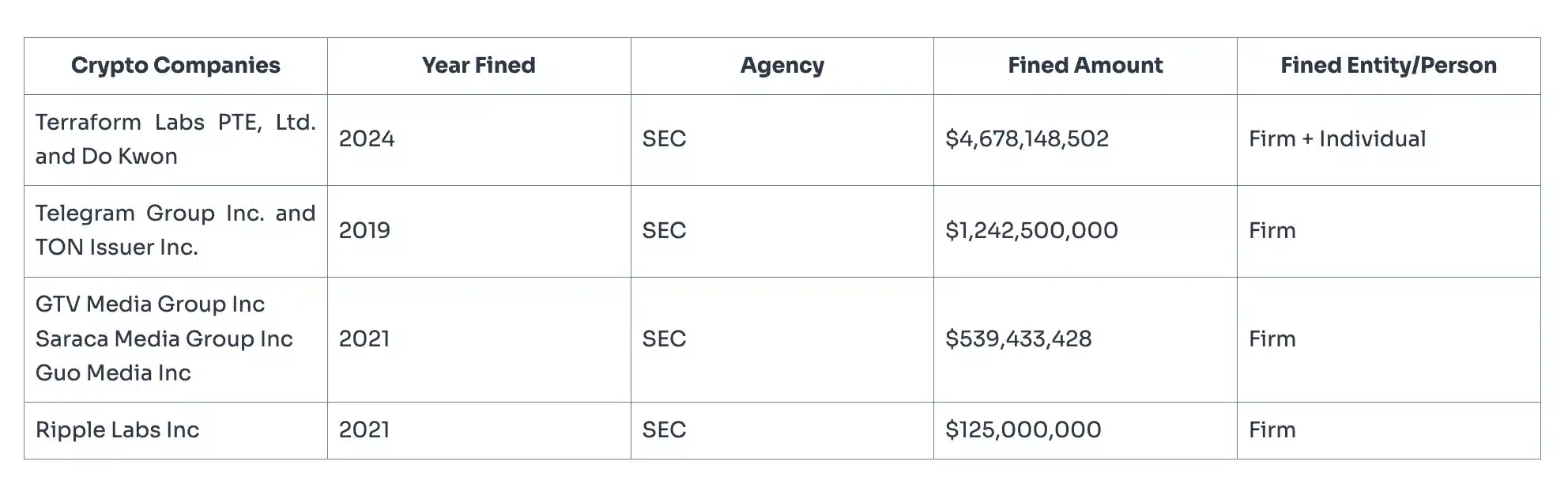

2024 saw an astounding total of $4.68 billion in penalties being imposed, with Terraform Labs and its founder, Do Kwon, being the main contributors to this significant amount.

This unprecedented penalty underscores the SEC’s aggressive stance so far, focusing on prominent cases and putting greater emphasis on unregistered securities infractions.

It further added,

The fine grew exponentially, rising from approximately $150.26 million in 2023 to an astounding $4.68 billion in 2024, which represents an increase of around 3,018%.

The rise in fines over the years

Starting from 2019, I’ve noticed a significant escalation in penalties, with landmark cases such as the $1.24 billion fine imposed on Telegram Group. This trend has subsequently led to a dramatic increase in the typical size of these fines.

Even though the numbers dipped in 2020, fines rebounded in 2021 with cases like Ripple Labs.

By 2024, the typical penalty skyrocketed to a record-breaking $426 million, primarily due to the massive $4.68 billion fine levied against Terraform Labs and Do Kwon.

Key figures like Ripple (XRP), Telegram, and Terraform Labs have been singled out due to allegations of participating in unapproved initial coin offerings (ICOs).

Starting from 2022, the SEC has been taking a stronger approach, not just fining companies, but also pursuing actions against their high-ranking officials. This move highlights their dedication to increased supervision within the cryptocurrency sector.

Due to a rise in fines, adherence to regulatory standards has grown increasingly vital for cryptocurrency businesses.

Read More

2024-09-12 11:04