-

Judge Jackson dismissed SEC’s claims that secondary sale of Binance coins qualified as securities.

However, she allowed the SEC to pursue claims associated with Binance’s BNB staking program.

As a long-term crypto investor with experience in the industry, I’m closely monitoring the developments between Binance and the SEC. The recent ruling by Judge Amy Berman Jackson is a significant step forward in clarifying the regulatory landscape for cryptocurrencies.

Last Friday, a Federal judge gave the green light for most parts of the SEC’s lawsuit against Binance (BNB), the globally leading cryptocurrency trading platform, to move forward.

Judge’s orders

In a recent decision made by Judge Amy Berman Jackson of the District Court for the District of Columbia, the Securities and Exchange Commission (SEC) was granted permission to move forward with the majority of their accusations against Binance.

The accusations encompass infringements concerning the initiation of the BNB token sale and subsequent transactions, as well as unregistered activities involving their BNB Vault and staking program, with allegations of deceptive practices included.

The verdict against Binance signifies a significant setback, implying that the SEC’s arguments concerning these particular offerings and activities carry substantial weight in the eyes of the court.

The judge dismissed the charges against Binance and its founder, Changpeng Zhao, concerning the secondary sale of BNB tokens and their Simple Earn program.

Last summer, the Securities and Exchange Commission (SEC) initiated a legal action against Binance, Binance US, and Zhao, alleging that they provided unregistered securities and financial services within the United States.

As an analyst, I’ve observed that this specific case is aligned with a broader pattern. The Securities and Exchange Commission (SEC) has taken enforcement actions against several notable cryptocurrency firms including Coinbase, Kraken, Consensys, and MetaMask.

These actions highlight the growing regulatory scrutiny surrounding the cryptocurrency industry.

Comparisons in the past

The judge drew attention to past judicial decisions that meticulously draw a line between investment contracts, classified as securities, and the underlying tokens in question.

This distinction aligns with the Supreme Court’s definition of a security.

This Securities and Exchange Commission (SEC) case against Binance is distinct from the criminal charges filed against its founder Changpeng Zhao by the Department of Justice (DOJ) and Treasury Department, for which he is now serving a 4-month term in prison.

The judge, just like other judges before him, dismissed contentions that the Securities and Exchange Commission (SEC) was without jurisdiction based on the “major questions doctrine.”

Under this principle, it is essential that Congress explicitly grants regulatory authority to agencies over major industries. However, due to crypto’s novelty, there exists a degree of ambiguity in the law regarding its regulation.

As a crypto investor, I can interpret Judge Jackson’s rejection of the argued points as fortifying the Securities and Exchange Commission (SEC) in their pursuit of enforcement actions within the cryptocurrency market.

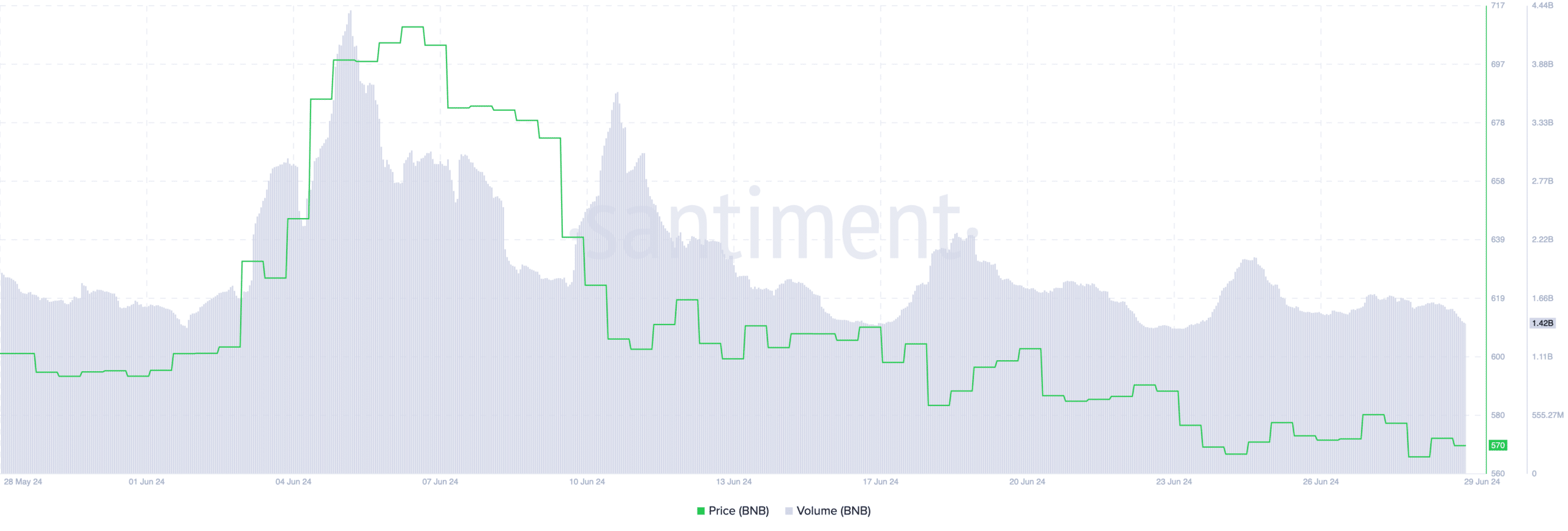

How is BNB doing?

As of now, the price of BNB was at $574.38 during our latest check. Over the past 24 hours, there was a 0.53% increase in its value. However, the trading volume had dropped by nearly 11% compared to the previous day.

Read More

- Gold Rate Forecast

- PI PREDICTION. PI cryptocurrency

- SteelSeries reveals new Arctis Nova 3 Wireless headset series for Xbox, PlayStation, Nintendo Switch, and PC

- Masters Toronto 2025: Everything You Need to Know

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Elden Ring Nightreign Recluse guide and abilities explained

- Solo Leveling Arise Tawata Kanae Guide

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-06-30 16:39