- Judge Amy Berman Jackson dismissed parts of the SEC’s lawsuit against Binance

- Crypto community remains optimistic, despite ongoing legal proceedings between Binance and SEC

As a seasoned crypto investor with a keen interest in regulatory developments, I find the recent court ruling in favor of Binance on certain counts against the SEC’s lawsuit to be a promising sign. While the case is far from over and there are still ongoing proceedings, this development seems like a significant victory for the exchange.

The protracted dispute between cryptocurrency exchange Binance and the US Securities and Exchange Commission (SEC) seems to be nearing a resolution based on recent developments within the past day. Indications suggest that the outcome could potentially benefit Binance.

A win-win for Binance?

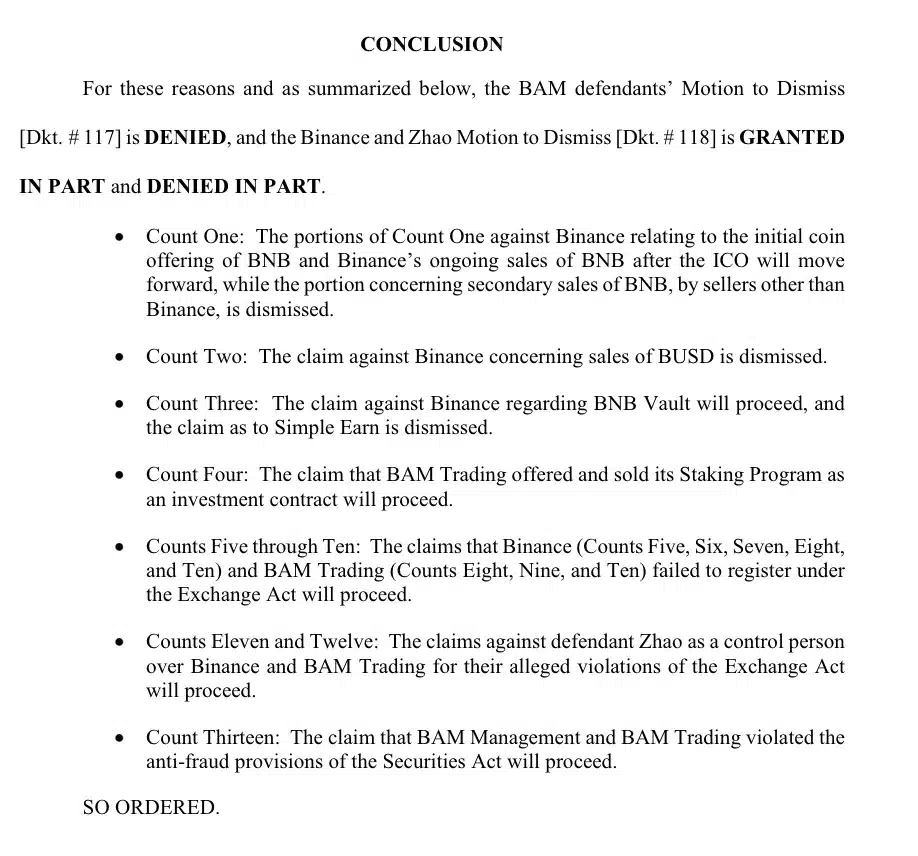

In a recent judicial decision on June 28, Judge Amy Berman Jackson has excluded certain claims from the Securities and Exchange Commission (SEC)’s lawsuit against Binance and its CEO, Changpeng Zhao.

Explaining the reasons behind the same, Judge Jackson noted,

To successfully resist a motion to dismiss based on Federal Rule of Civil Procedure 12(b)(6), the complaint needs to include enough factual information, which is assumed to be true, to outline a valid claim for relief that appears credible upon initial examination.

As an analyst, I would rephrase it this way: I noticed that she allowed other accusations to come forward, specifically those aimed at Binance.US’s holding company and the ex-CEO of Binance, Changpeng “CZ” Zhao, who is believed to have exercised significant influence over the company’s operations.

A court ruling permitted the argument that Binance should register under the Securities Exchange Act of 1934 to move forward.

Charges filed against Binance

The Securities and Exchange Commission (SEC) has brought 13 accusations against Binance, BAM Trading Services Inc. (Binance.US), and Changpeng Zhao, alleging violations of securities laws.

They faced allegations for managing unlicensed trading platforms, such as exchanges, broker-dealers, and clearing agencies. Moreover, they were charged with providing false information about the trading controls on Binance.US and selling securities without registration.

The court filing concluded by affirming its decision and stated,

The blended decision issued in this dispute signifies a substantial advancement in the long-running clash between the prominent cryptocurrency trading platform and the leading US regulatory authority.

Crypto community’s enthusiasm

Although the legal proceedings regarding crypto have yet to reach a conclusion, there is a strong sense of positivity and confidence among many members of the cryptocurrency community.

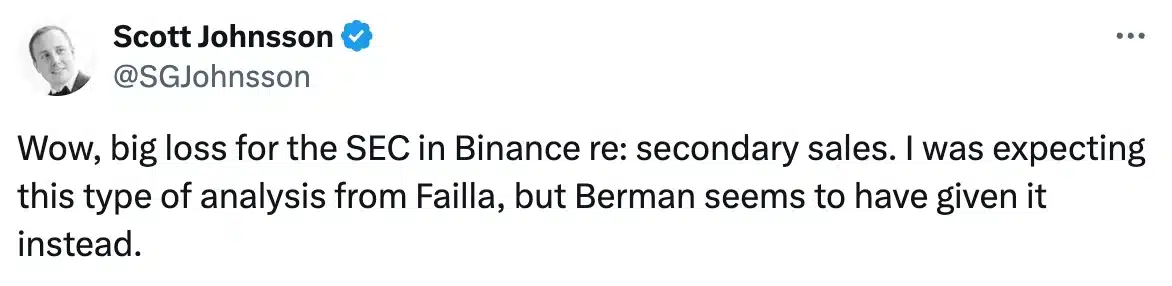

One of them was, Scott Johnsson, an associate at Davis Polk & Wardwell LLP, claimed,

The main cause for executives at Binance rejoicing over this outcome is that Judge Jackson rejected a significant argument by the SEC against the platform. He determined that Binance’s secondary sales of BNB coins do not meet the criteria of securities under the Howey Test.

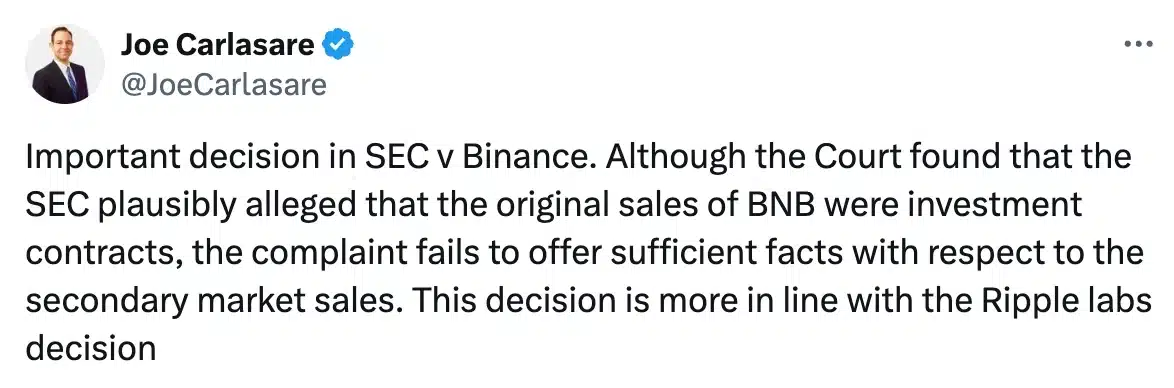

In a recent judgment reminiscent of Judge Torres’ ruling on Ripple‘s lawsuit against the SEC, this decision underscores the significance of assessing the genuine economic actions behind token deals when implementing the Howey Test.

Remarking on the same, Joe Carlasare, Partner at Amundsen Davis LLC added,

As a crypto investor, I believe that the outcome of this case holds significant weight for shaping the future of digital asset regulations and, consequently, investor confidence in the market, irrespective of which party emerges victorious.

Read More

2024-06-29 11:35