-

SEC-Ripple settlement sends XRP soaring to a three-month high of $0.61.

XRP’s spot market sell pressure dropped in the past 7seven days amid the upswing.

As a long-term crypto investor with a particular interest in Ripple [XRP], the recent news of a potential SEC-Ripple settlement has left me both hopeful and cautious. I’ve been following this legal battle closely, having witnessed the ups and downs of XRP’s price action throughout the years.

Ripple’s XRP token reached a price point of $0.6, marking a three-month peak, fueled by rumors of an impending SEC-Ripple settlement.

Based on reports from industry insiders, a clandestine encounter between the SEC and Ripple slated for the 18th of July may bring an end to the protracted legal dispute between them.

‘XRP VS SEC settlement. Keep your eyes on July 18th, 2024.’

No Ripple settlement, says former SEC laywer

As a legal analyst, I’ve closely followed the ongoing SEC-Ripple lawsuit. While there have been recent speculations about a potential settlement between the two parties, I want to share some insights based on my understanding of past events.

Based on my extensive experience in following legal proceedings and observing the cryptocurrency community, I’ve attended numerous meetings between the involved parties since the case was filed. Each gathering sparked widespread speculation among Crypto Twitter that a settlement was imminent. However, after attending yet another meeting with high expectations, I must admit, this one did not yield the anticipated result. It appears that reaching an agreement in this complex case is proving to be more challenging than initially presumed.

Some market players believed that the significant price surge of XRP might be due to insider knowledge of an impending settlement or favorable news.

The price chart experienced a notable increase to $0.61, resulting in a daily profit of 7%. This upturn successfully offset all the losses sustained during the second quarter.

In July, XRP experienced a significant increase of 30%, rising from $0.38 to above $0.6 on a monthly adjusted basis. This impressive surge outshone the entire market, including Bitcoin [BTC], which managed a more modest gain of 3% during the first half of the month.

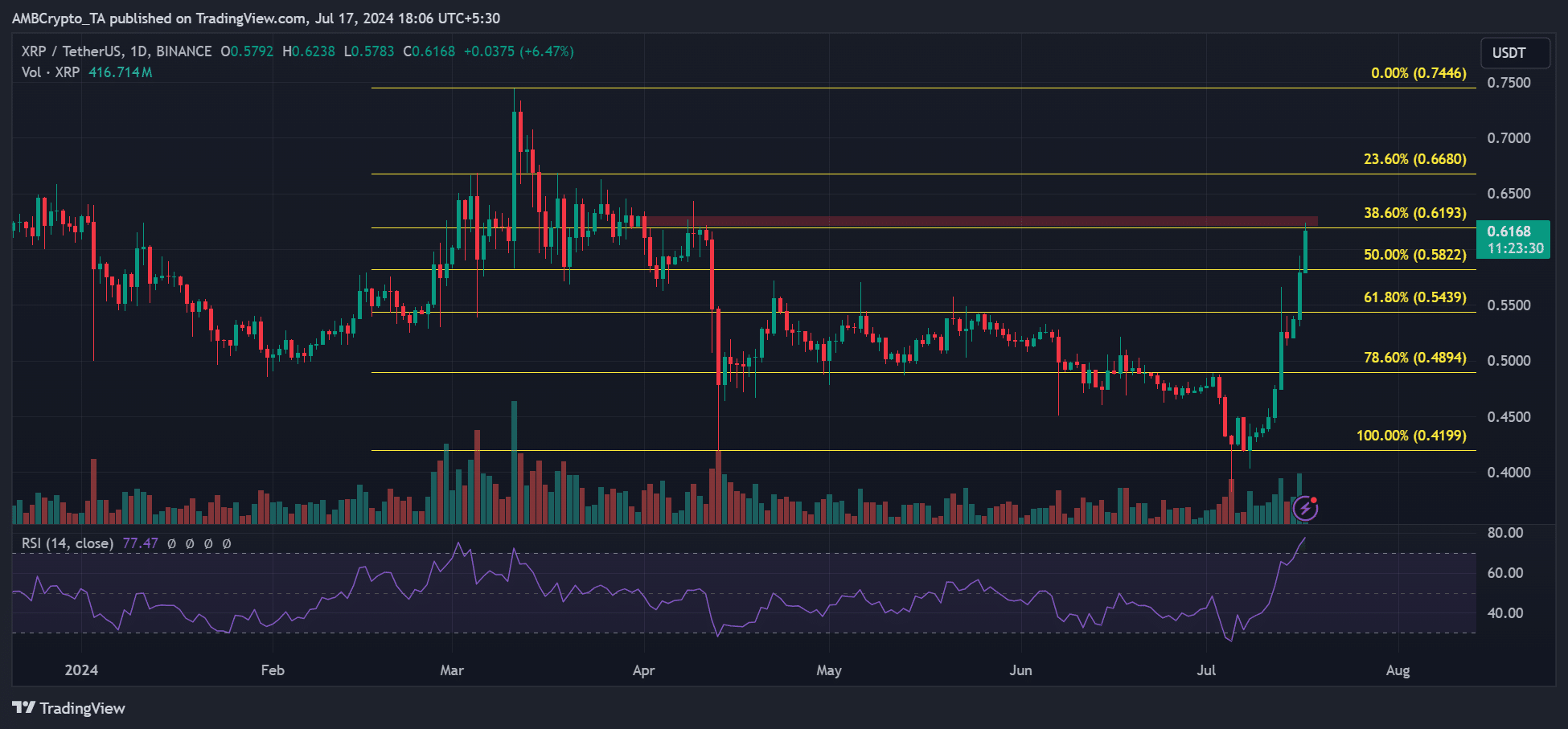

If XRP successfully regains the 38.6% Fibonacci level, around $0.61, and looks poised to hit the subsequent bullish objective at the 23.6% Fibonacci mark, approximately $0.66, a potential increase of nearly 7% could ensue.

XRP encountered a significant resistance level, represented by a red-marked bearish order block, which coincided with the 38.6% Fibonacci retracement point. Furthermore, the RSI indicator indicated that the market was overbought, suggesting that while buying pressure was robust, the potential for a reversal due to buyer fatigue couldn’t be disregarded.

if that’s the case, a pullback to the 50% Fibonacci retracement level might present an opportunity for investors who have been sidelined to jump back in and profit from the potential continuation of the rally up to the 23.6% Fibonacci level.

XRP traders’ position and sentiment

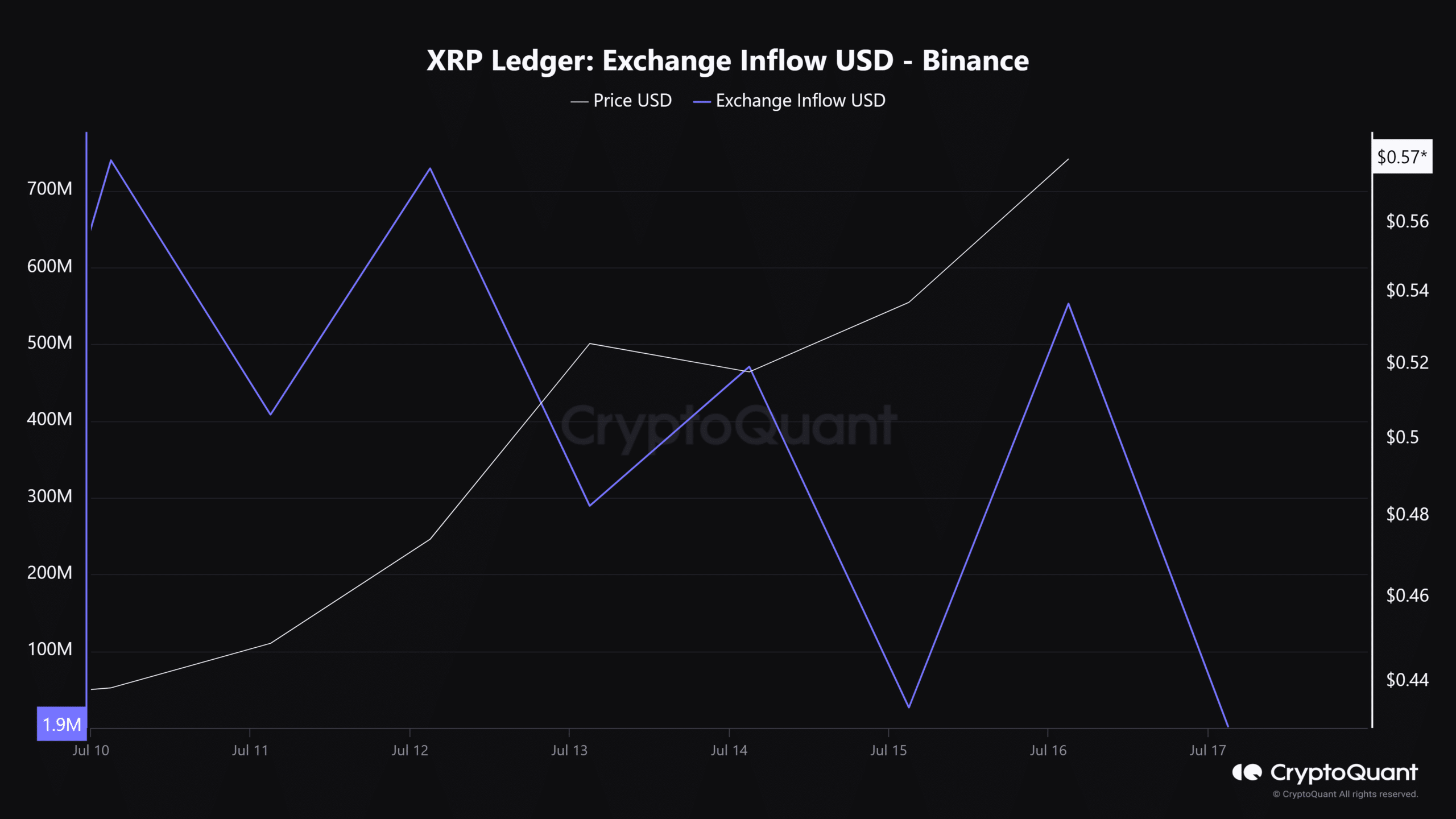

In simple terms, the Binance spot market as a whole showed less urgency for sellers over the last week based on a decline in new coins entering the exchange through transactions.

The metric has dropped from $739 million on 10th July to $1.9 million as of press time.

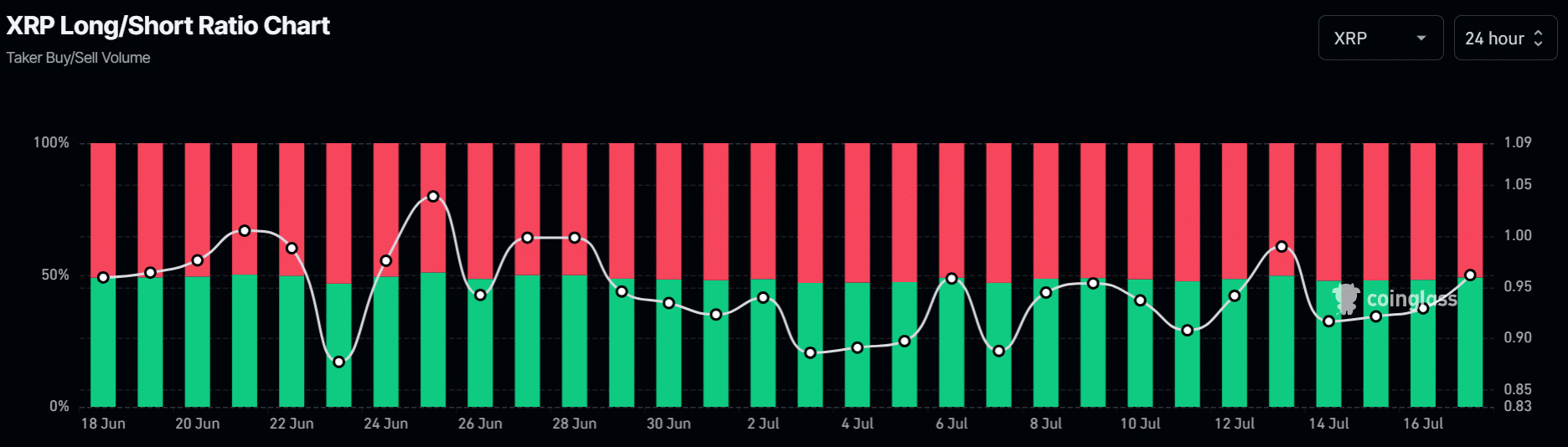

As a crypto investor, I’ve noticed an uptick in buying interest for XRP since Monday. The percentage of long positions in futures trading has risen from 47% to 49%. However, the real test lies ahead with the upcoming Ripple Labs’ July 18th meeting. Its outcome could significantly impact the continuation or reversal of this rally.

Read More

- PI PREDICTION. PI cryptocurrency

- Gold Rate Forecast

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Despite Bitcoin’s $64K surprise, some major concerns persist

2024-07-18 09:11