-

Driven by anticipation for a major event, interest in SEI surged and the price increased.

Traders who expected a price decrease encountered liquidations valued at $476,500.

As a seasoned crypto investor with several years of experience under my belt, I’ve learned that more positions don’t always equate to more profits. The recent surge in interest around SEI, the token of the modular blockchain project, is a prime example of this.

The SEI crypto token, derived from the layer-1 project utilizing modular blockchain technology, experienced a 10% increase in value over the past 24 hours. Currently, SEI is trading at $0.33, positioning it among the top performing assets in the market.

The token came quite near to reaching its highest point for particular reasons. Notably, a summit focused on creating modular blockchain projects named Modular Summit is scheduled from the 11th to the 13th of July.

More positions is not more profits

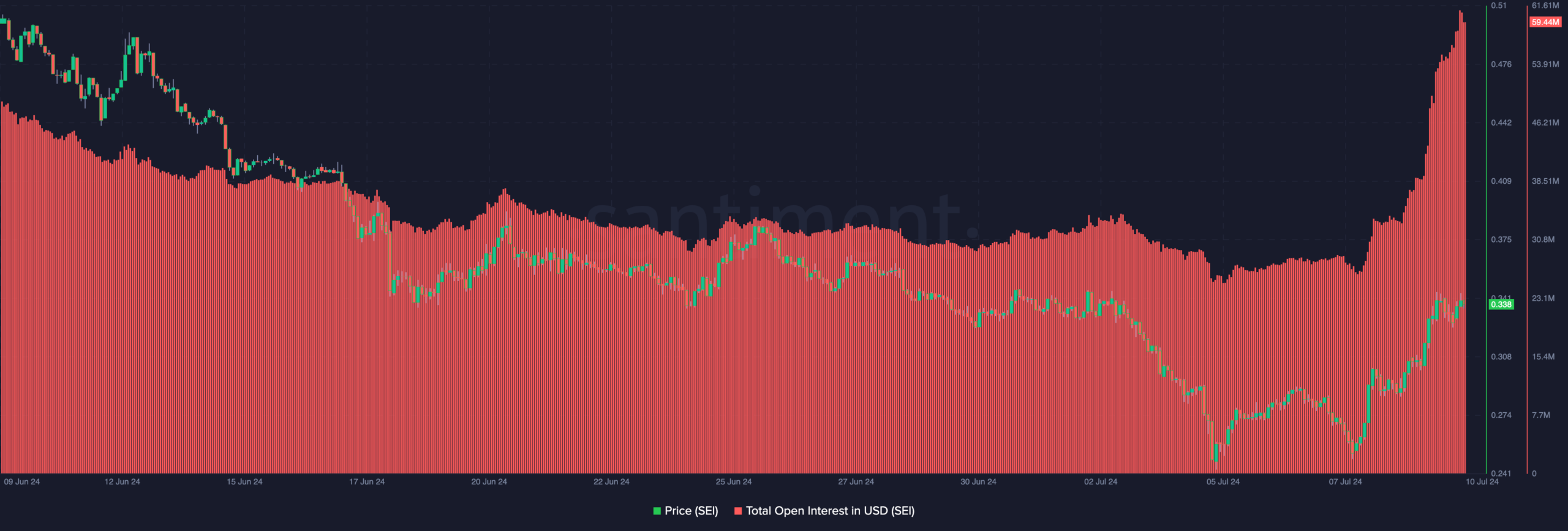

I discovered a notable increase in demand for crypto assets associated with a specific sector based on my analysis of SEI‘s Open Interest data. Open Interest represents the total number of outstanding derivative contracts across various markets.

As an analyst, I would interpret this as: When the open interest (OI) in the SEI crypto market increases to $59.44 million, it signifies that traders are actively entering new positions and adding liquidity to the market. Conversely, a decrease in OI indicates that traders are closing their positions, thereby reducing liquidity.

Trading this token resulted in the traders upping their investment, aiming to capitalize on its price fluctuations.

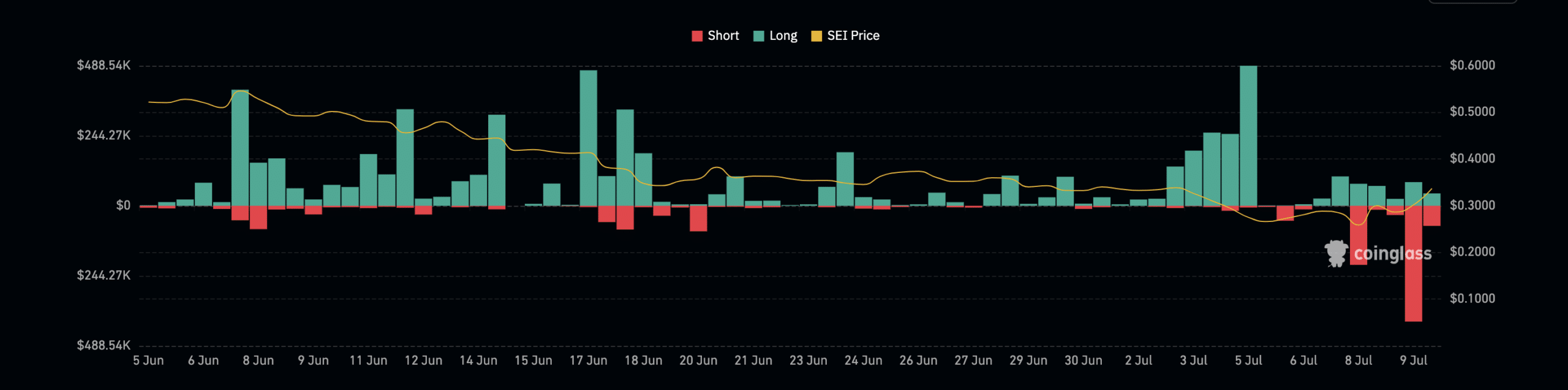

In spite of the growing curiosity, many traders were taken by surprise by the unpredictable behavior of cryptocurrencies. As reported by Coinglass, a staggering $612,400 worth of SEI positions were forcibly closed in the market over the past day.

As a crypto investor, I can explain that out of the total loss, short positions amounted to $476,500. In contrast, long positions were responsible for only $135,900 of the damage. When market conditions become unfavorable, exchanges may choose to liquidate a trader’s position to prevent further losses.

“The cause of this situation could be a low margin account or considerable market instability. To clarify, short sellers are individuals who believe the price will fall, while long position holders are those expecting the price to increase.”

As a crypto investor, I’ve analyzed the liquidation data, and it appears that the majority of traders who were negatively impacted were betting on a decline in SEI‘s cryptocurrency price.

SEI’s price prediction points to another hike

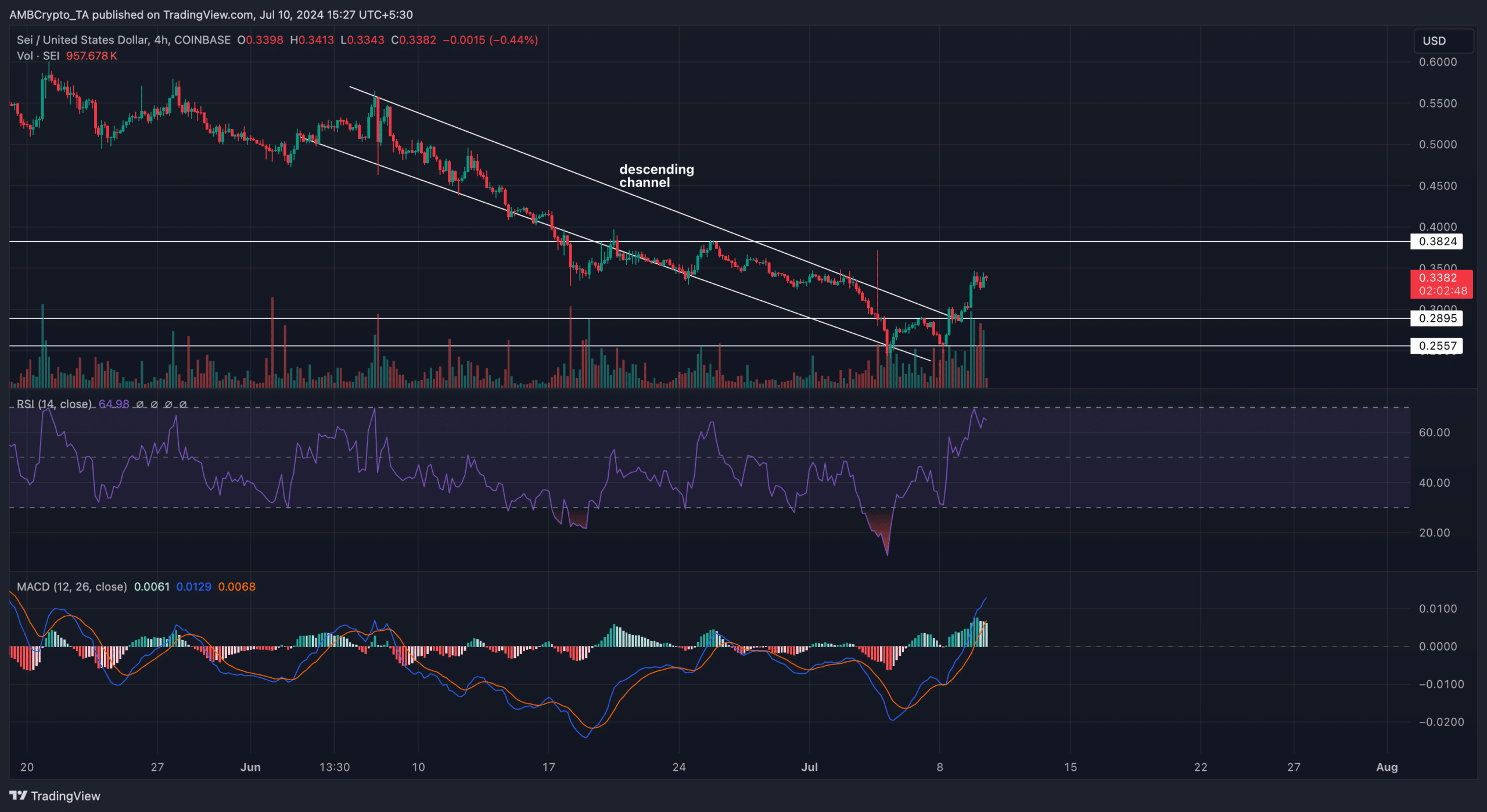

As a crypto investor, I’ve been keeping an eye on SEI‘s price action and I’m curious if it will continue to rise. From a technical standpoint, the 4-hour chart indicates that SEI has formed a descending channel since hitting $0.55 on July 7th. This pattern suggests potential downward pressure on the price, so I would exercise caution before making any significant investments or adding to existing positions. However, it’s important to remember that technical analysis should not be the only factor considered when making investment decisions. Other fundamental and market-related factors should also be taken into account.

As an analyst, I’ve observed that a descending channel pattern emerges when the price of a token forms successively lower highs and lower lows. This pattern is generally considered bearish as it indicates a downward trend, which can potentially lead to further price decreases.

As of the moment we’re looking at, AMBCrypto noted that bulls had identified seller exhaustion near the $0.25 mark. The rising demand then enabled the price to surmount the $0.28 resistance.

As a market analyst, I’ve noticed that the current trading price is at $0.33. Based on my technical analysis, the Moving Average Convergence Divergence (MACD) indicator presents a positive reading for this token. This signifies a bullish momentum in the market. Additionally, the Relative Strength Index (RSI) aligns with this finding, indicating similar market conditions.

Realistic or not, here’s SEI’s market cap in TIA terms

If the current trend continues, the SEI price may reach $0.35. In an extremely optimistic scenario, it could even go up to $0.38 within the week.

If holders choose to sell their tokens, the forecast may no longer hold true. In such an event, the SEI token’s price might decrease to $0.28.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-07-11 04:08