- Sei had a bullish short-term outlook at press time.

- The volume indicators flashed a warning that the range highs might not be reached.

As a seasoned trader with over a decade of market experience under my belt, I find myself cautiously optimistic about SEI‘s short-term prospects at press time. The bullish daily price action and the breach of the mid-range resistance on the 19th of September are certainly encouraging signs. However, my years in this field have taught me to never underestimate the power of volume indicators.

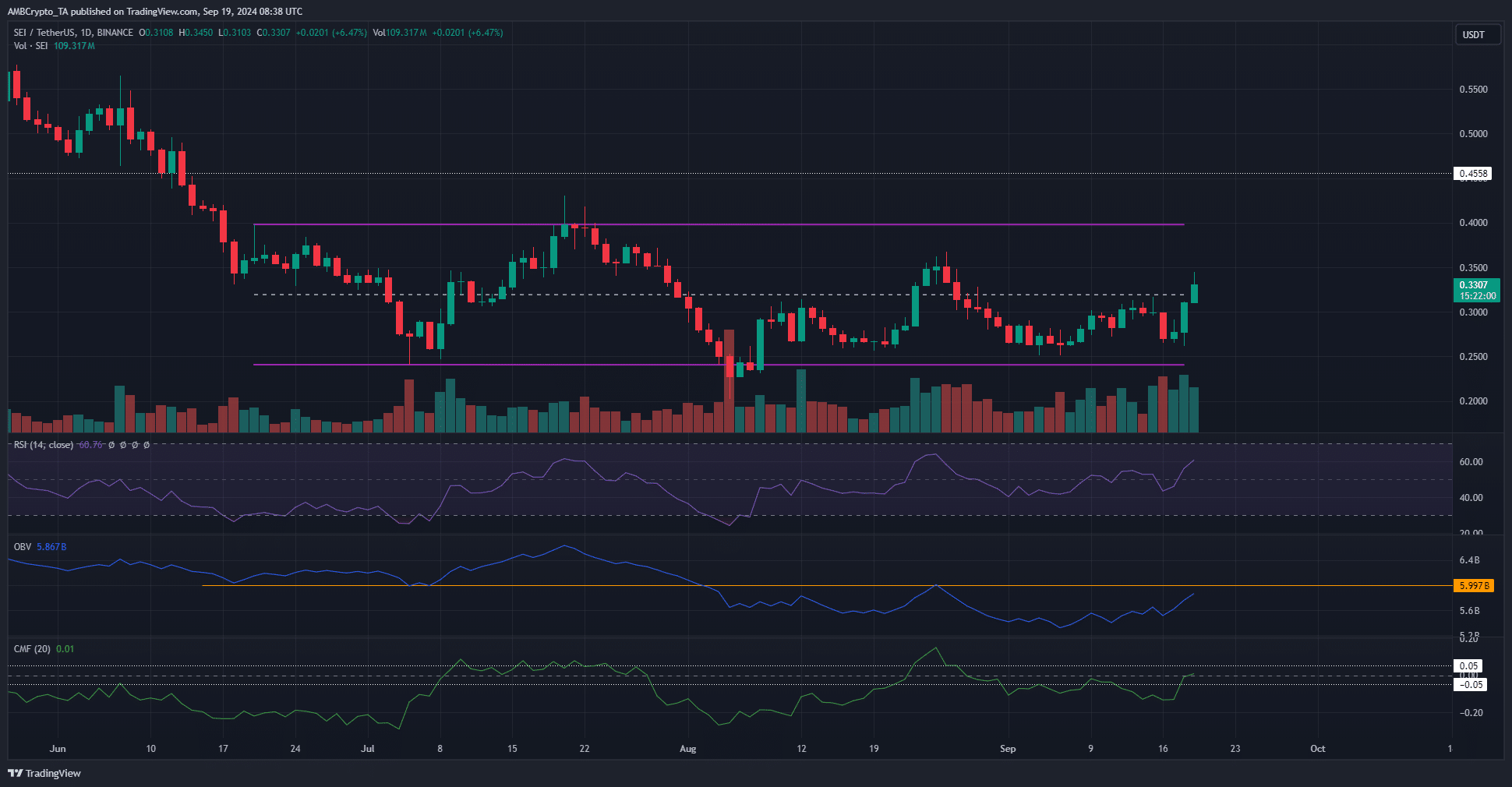

At the current moment, [SEI] was found fluctuating between two points: a low of $0.242 and a high of $0.4. On September 15th, the midway resistance at $0.32 was probed as resistance by the bulls, but they were unsuccessful in breaking through this barrier.

On September 19th, there was a significant shift. Even though the market’s day hasn’t ended yet, the resistance level has been broken, which increases the likelihood that SEI cryptocurrency could surge towards approximately $0.4 in the near future.

SEI crypto’s volume indicators advocate caution

On the daily graph, the market trend showed a positive, or bullish, direction. Following a rebound from the $0.262 price support area, there was initial resistance at an intermediate level, but subsequently, the positive trend regained strength.

Every day, the Relative Strength Index (RSI) surpassed the neutral 50 level, suggesting that buyers had been more influential recently. Yet, neither the On-Balance Volume (OBV) nor the Chaikin Money Flow (CMF) provided a clear ‘buy’ indication.

The OBV hasn’t reached the peak levels it attained by the end of August. As long as it doesn’t surpass this point, it’s probable that the $0.35 resistance will push back the bulls.

Similarly, the CMF was at +0.01 and did not yet denote significant buying pressure.

Not all magnetic pools will be retested

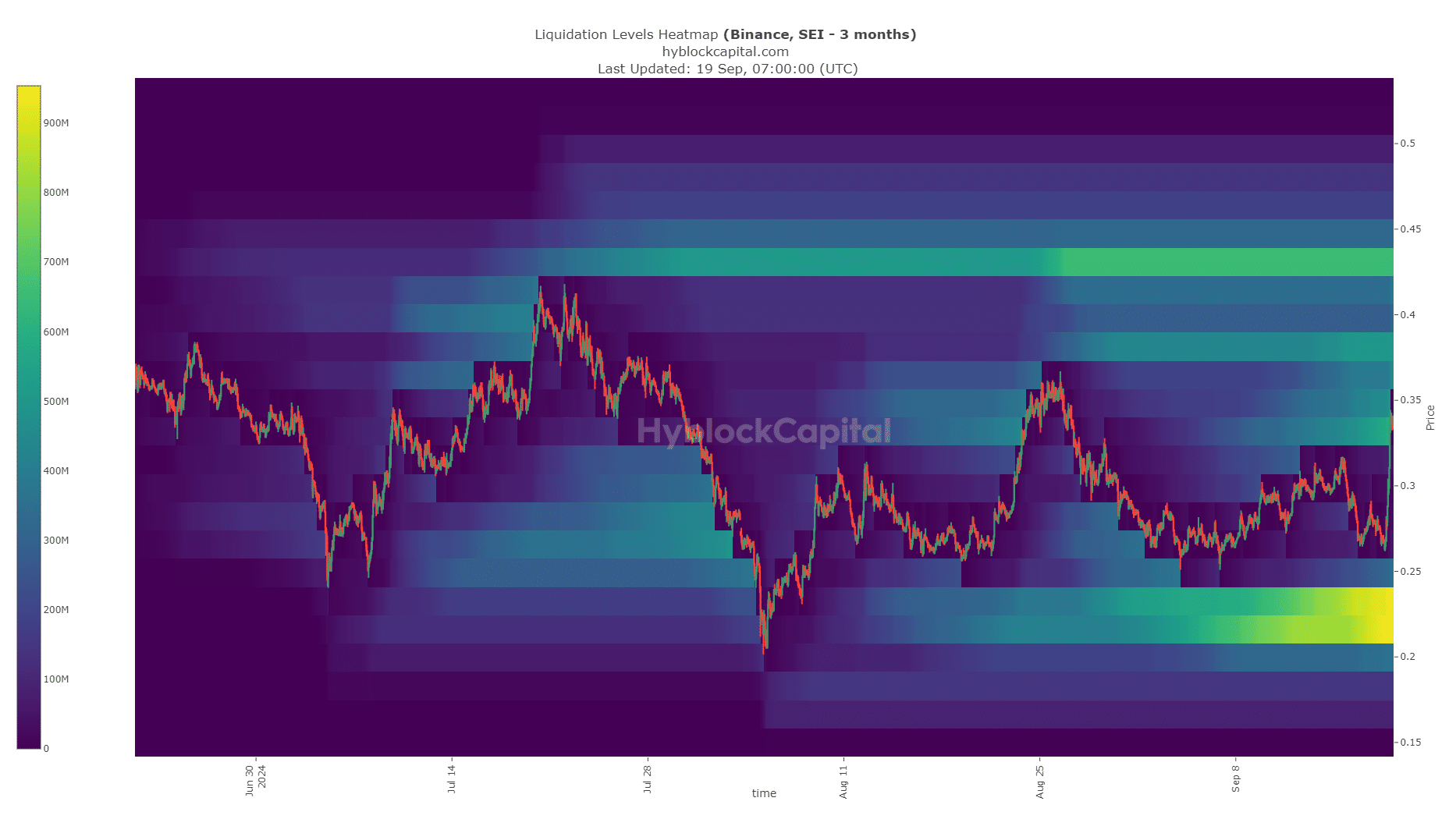

By examining liquidation heatmap data provided by Hyblock, AMBCrypto discovered a significant concentration of liquidity extending from approximately $0.216 to $0.232.

Over the past few days, given that SEI crypto seemed to lack bullish movement, it seemed probable that we might return to this particular region.

Realistic or not, here’s SEI’s market cap in BTC’s terms

Conversely, the Federal Reserve’s move to lower interest rates by 50 basis points had a favorable impact on Bitcoin [BTC], thereby enhancing the overall optimism surrounding SEI.

This price bounce meant that the $0.43 liquidity pocket was the next magnetic zone for prices.

Read More

- Jujutsu Kaisen Reveals New Gojo and Geto Image That Will Break Your Heart Before the Movie!

- Hut 8 ‘self-mining plans’ make it competitive post-halving: Benchmark

- Gaming News: Why Kingdom Come Deliverance II is Winning Hearts – A Reader’s Review

- The Elder Scrolls IV: Oblivion Remastered – How to Complete Canvas the Castle Quest

- Kylie & Timothée’s Red Carpet Debut: You Won’t BELIEVE What Happened After!

- We Ranked All of Gilmore Girls Couples: From Worst to Best

- Quick Guide: Finding Garlic in Oblivion Remastered

- S.T.A.L.K.E.R. 2 Major Patch 1.2 offer 1700 improvements

- Shundos in Pokemon Go Explained (And Why Players Want Them)

- LUNC PREDICTION. LUNC cryptocurrency

2024-09-20 05:11