-

SEI’s price has dropped 74% since March, with ongoing declines in Open Interest and development activity.

The token faced critical resistance at $0.30, and breaking this level could trigger a potential rebound.

As a seasoned crypto investor with over a decade of experience navigating the digital asset market, I’ve seen my fair share of ups and downs. The recent performance of SEI has caught my attention, particularly given its significant drop in price and ongoing declines in Open Interest and development activity.

In March, the SEI token reached an impressive peak price of $1.14. However, over the past few months, there has been a substantial decline in the token’s value. Currently, at the time of writing, each SEI token is being traded for approximately $0.2648. This represents a drop of about 74% from its March high price.

Over the last week, there’s been a steady drop in the value of this token, with it shedding close to 10% of its worth. This decline is part of a more extensive dip that’s been ongoing.

Over just the last day, there has been a 3.3% drop in the price of SEI, leading some to question the potential future performance of this token.

Is there room for a rebound?

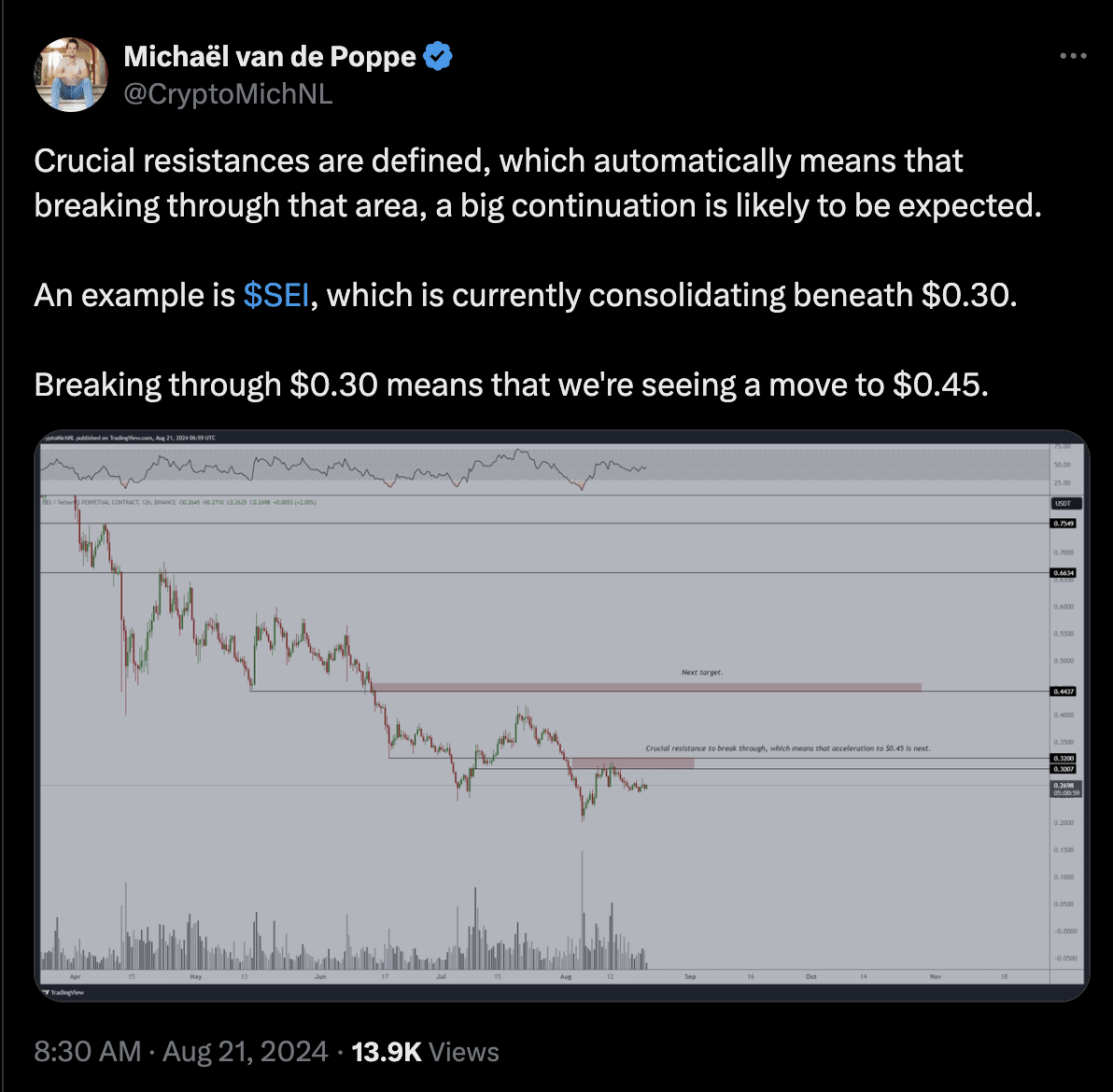

In the current downward trend of the cryptocurrency market, well-known analyst Michael Van De Poppe has expressed his viewpoint about SEI, hinting that the token may be approaching a significant turning point.

Van De Pooppe highlighted that SEI was consolidating below the $0.30 level, which he identified as a ‘crucial resistance’ point.

He noted that breaking through this resistance could pave the way for a significant upward move, potentially pushing the token’s price to $0.45.

But, to determine if SEI has potential for significant growth, it’s crucial to analyze the fundamental factors that may impact its price fluctuations.

Fundamental outlook on SEI

Although there’s a possibility for an upward price movement (bullish breakout), Sei’s underlying factors paint a more intricate scenario.

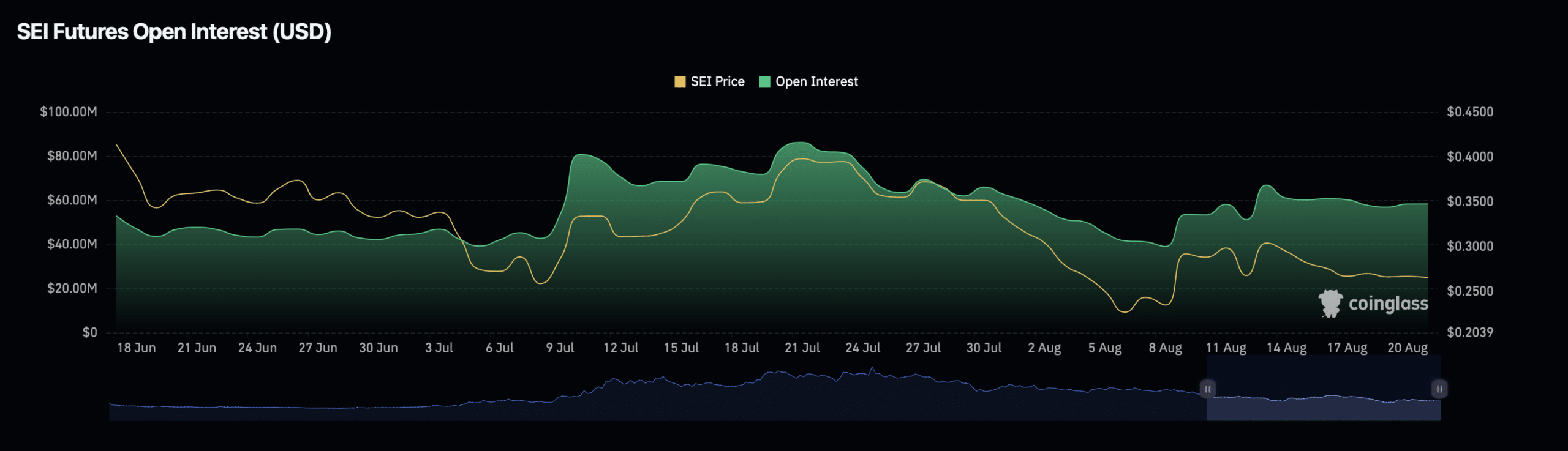

As a crypto investor, I’ve noticed that the Open Interest of SEI seems to be following its price trend. This correlation suggests that the Open Interest, which represents outstanding contracts in the market, has been decreasing. This decrease might hint at diminishing investor confidence in SEI.

Over the past 24 hours, SEI’s Open Interest has decreased by approximately 5.40%, bringing its press time valuation to $58.60 million.

Similarly, the Open Interest volume dropped by 23.72%, now standing at $70.50 million.

As a researcher observing the market trends, I noted a decrease in Open Interest and trading volume, which might imply that traders are adopting a more cautious approach. This could potentially be attributed to the persistent price deterioration, as they seem to be exercising prudence in their trades.

The number of open contracts in the Futures market (referred to as ‘open interest’) frequently mirrors the general attitude or feelings of market participants, known as market sentiment.

A drop in the number of open trades, particularly when the market is falling, might suggest that fewer traders are eager to keep existing positions or start new ones. This could result in less market fluidity and possibly more price declines.

For SEI to change its present direction, it seems plausible that there should be an increase in the number of active contracts or positions (open interest), which could indicate growing curiosity and trust among traders.

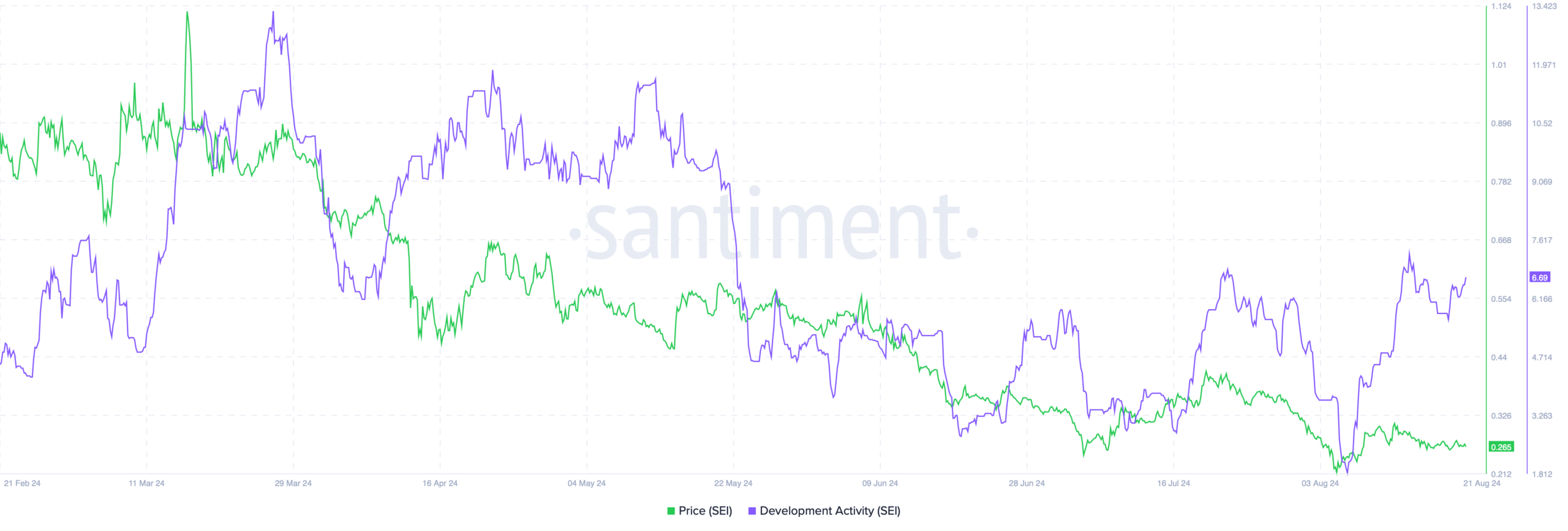

Besides a decrease in Open Interest, it appears that SEI‘s network expansion efforts have also been trending downwards.

Based on data from Santiment, it appears that SEI‘s level of development activity has significantly decreased. In March, it peaked at over 13, but by the time of this report, it had fallen below 2.

Read Sei’s [SEI] Price Prediction 2024 – 2025

Measuring the growth of a project’s source code and its broader development environment is crucial, as it provides insights into the advancement of the project.

A drop in this key indicator might serve as a warning sign, implying potentially less creativity and project advancements, which could subsequently influence investors’ feelings and long-term trust in the investment.

Read More

- WCT PREDICTION. WCT cryptocurrency

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- AMD’s RDNA 4 GPUs Reinvigorate the Mid-Range Market

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- Chrishell Stause’s Dig at Ex-Husband Justin Hartley Sparks Backlash

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Studio Ghibli Creates Live-Action Anime Adaptation For Theme Park’s Anniversary: Watch

- SOL PREDICTION. SOL cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

2024-08-21 20:08