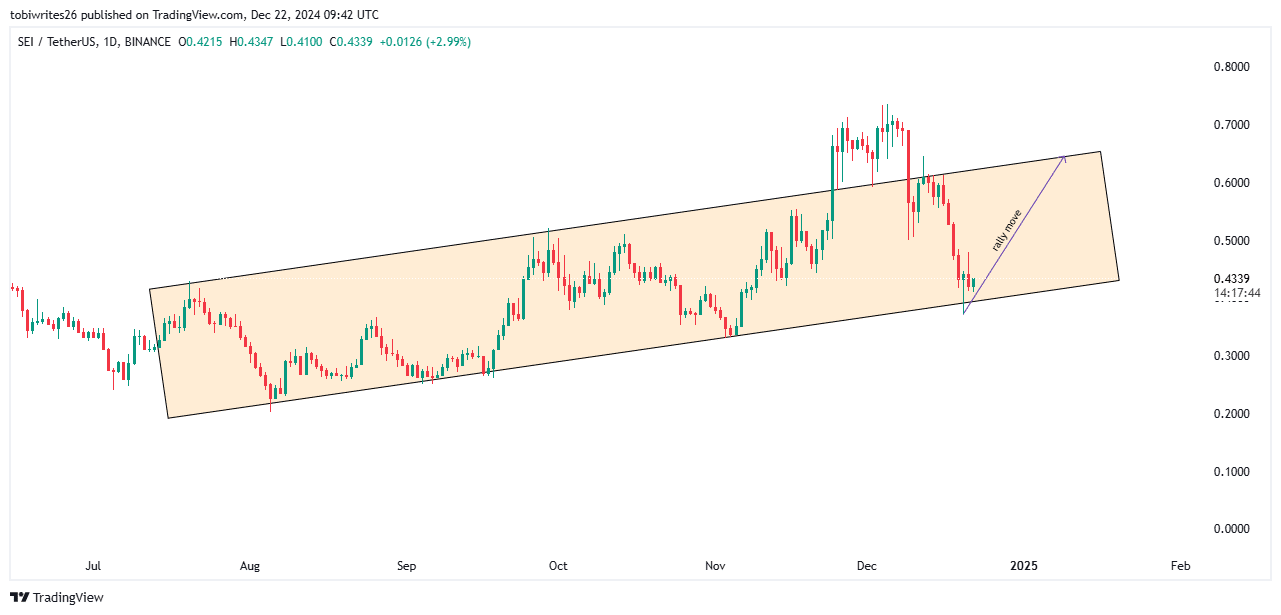

- The price has tested the bottom of its ascending channel, a potential indicator of an upward move.

- However liquidity movement within SEI’s blockchain and to exchanges, tells a decline could be near.

As a seasoned crypto investor who’s seen more than a few market cycles, I find myself at a crossroads with SEI [SEI]. On one hand, the asset has tested the bottom of its ascending channel, which historically has been a strong indicator of an upward move. Moreover, top traders on Binance are showing a bullish bias towards SEI, as evidenced by their long-to-short ratios and liquidation data.

Over the past month, SEI has experienced a consistent decrease since a significant resistance point, resulting in a 9.48% drop. More recently, within the last day, the value of SEI has dipped even more by 5.95%.

The current market trends are unclear, forcing traders to assess crucial technical indicators and benchmarks more closely in order to discern a clearer path, as highlighted by AMBCrypto.

An upward path emerges

On the graph, SEI has moved downwards to the bottom edge of its rising trendline, which functions as a form of underlying support, following a strong pushback at the upper trendline’s resistance point.

According to technical patterns, it’s predicted that the asset will likely increase from its current level, aiming for around $0.65 in future trends.

As I analyze the market dynamics, it’s crucial to note that the next substantial shift towards our new target – be it an uptrend or a downtrend – hinges on the amount of selling pressure we encounter at this potential resistance level.

Top traders position for an upswing

Based on data from Coinglass, it appears that the leading traders on Binance exhibit a generally optimistic outlook towards SEI. This assumption comes from analyzing their long-to-short ratios, which are influenced by the size of their accounts and the scale of their positions.

On Binance, the short-to-long account ratio for leading traders is presently 3.65, suggesting a greater number of accounts anticipate an increase in SEI’s price.

In simpler terms, a ratio of 2.2286 between long and short investments indicates that bullish traders are investing about twice as much capital in long positions than in short ones, suggesting a strong preference for holding onto assets rather than betting against them.

Evidence supporting a positive outlook continues to build, as demonstrated by recent liquidation figures. In the last four hours, there have been significantly more short positions being closed, amounting to $14,230, while long positions resulted in only $1,340 in closures.

This imbalance reflects increased pressure on short traders as SEI’s price shows upward momentum.

Liquidity flow opposes SEI

In simple terms, the money movement in the market seems to be working against SEI, as there’s limited action suggesting that funds aren’t being funneled into this particular asset at the moment.

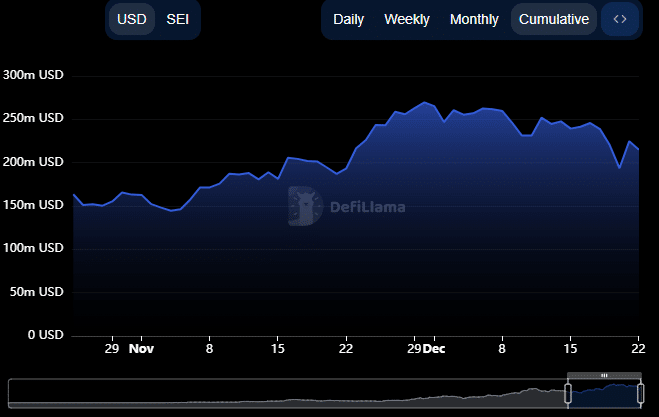

In simple terms, the amount of money put into various platforms associated with SEI, used for tasks such as staking, borrowing, and providing liquidity, has decreased to about $216.44 million over the last day.

Yesterday’s decrease is consistent with a downtrend that started on November 30th, as reported by DeFiLlama, which follows an uptick observed the day before.

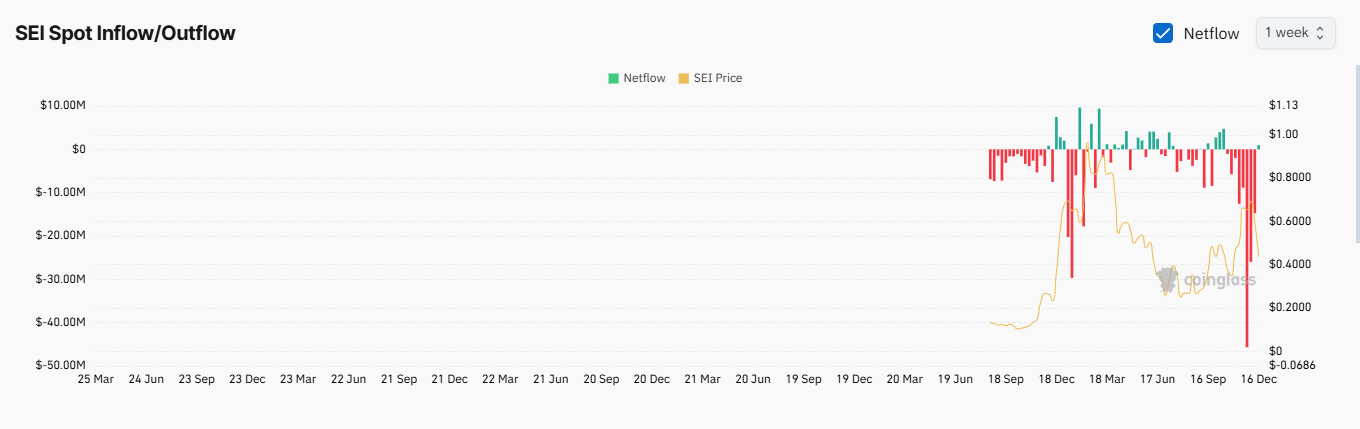

At the same time, the supply of SEI on cryptocurrency trading platforms has significantly increased, as observed on Coinglass. Interestingly, this marks the first time since October 14 that the amount of SEI transferred to exchanges has shown a positive trend.

Realistic or not, here’s SEI’s market cap in BTC’s terms

Observing a positive Exchange Netflow, according to SEI, suggests that spot traders are moving their funds to the exchanges in anticipation of making sales.

If the current pattern continues, it’s possible that the SEI price may drop even more from its present value, as the underlying support remains fragile.

Read More

- WCT PREDICTION. WCT cryptocurrency

- PI PREDICTION. PI cryptocurrency

- Viola Davis Is an Action Hero President in the ‘G20’ Trailer

- EastEnders’ Balvinder Sopal hopes for Suki and Ash reconciliation: ‘Needs to happen’

- Has Unforgotten Season 6 Lost Sight of What Fans Loved Most?

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Michael Saylor’s Bitcoin Wisdom: A Tale of Uncertainty and Potential 🤷♂️📉🚀

- Michelle Trachtenberg’s Mysterious Death: The Unanswered Questions

- Upper Deck’s First DC Annual Trading Cards Are Finally Here

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

2024-12-23 09:11