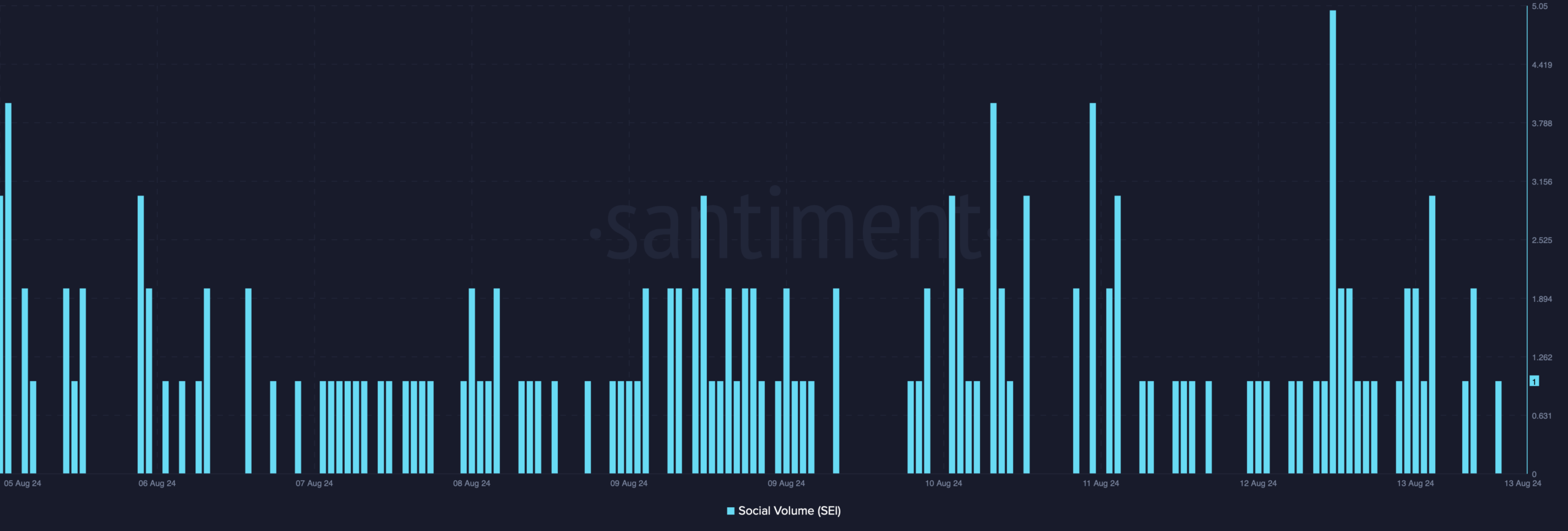

- Thanks to the price rise, SEI’s social volume also increased.

- However, some metrics were bearish on the token.

As a seasoned analyst with years of experience navigating the volatile world of cryptocurrencies, I must say that SEI has been quite the intriguing case study over the past week. The token’s impressive double-digit surge has indeed caught my attention, but it’s always important to delve deeper and consider various metrics before making any predictions.

Just like many other digital currencies, SEI has demonstrated impressive growth over the past week. Given its strong performance, it’s worth delving deeper into its current status to examine its key indicators and other variables that could influence SEI’s future pricing.

How is SEI doing?

As an analyst, I observed a significant increase in the value of SEI tokens last week. In fact, the token experienced a substantial growth of over 20% during the past seven days, demonstrating strong bullish sentiment among its supporters.

Over the past day, the bulls have been actively pushing the token’s value up by approximately 5%. Currently, SEI is being traded at $0.2927 and has a market capitalization exceeding $929 million, placing it as the 68th largest cryptocurrency in terms of market cap.

As a researcher observing the token’s behavior, I noticed an uptick in its bullish momentum around the 12th of August. This surge was mirrored by a significant rise in social volume, indicating a growing interest and buzz about this token within the market.

SEI price prediction

Over the past week, the token’s strong performance prompted AMBCryptoi to further examine its current status with the aim of identifying potential targets that investors should focus on in the upcoming week.

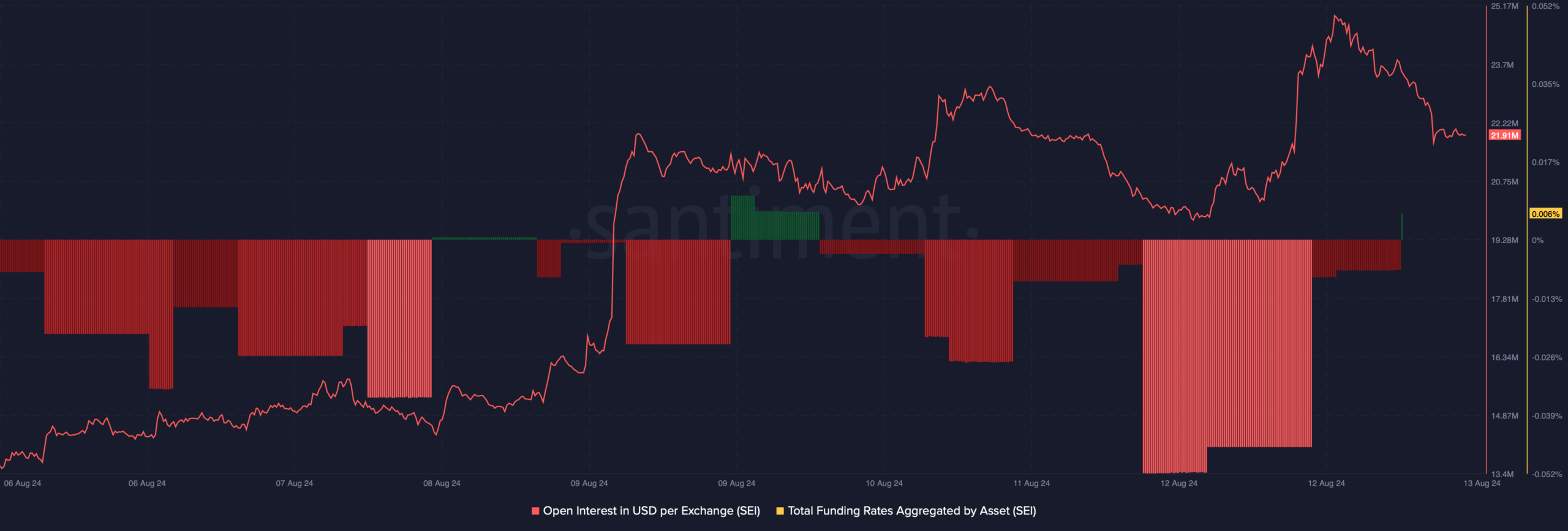

As a researcher analyzing Santiment’s data, I noticed an intriguing pattern: while the token’s price surged, its open interest decreased. Typically, a drop in open interest can signal a potential trend reversal, and in this instance, it pointed towards a bearish market scenario.

As a cryptocurrency investor, I’ve noticed that when the funding rate turns red, it typically suggests an increase in the asset’s price. This is because market dynamics often cause values to move in opposite directions compared to this metric.

Additionally, our analysis of Coinglass’ data, as presented by AMBCrypto, uncovered another potential bearish indicator. Specifically, we noticed a significant drop in the long/short ratio within the 4-hour timeframe, suggesting a possible bearish trend.

Significantly, the difference between whales and retail in SEI’s measurement was almost 25 points. This metric can vary from -100 to 100, where 0 signifies an equal balance between whales and retail investors.

As a researcher, when I see values near 100 indicating increased activity, it suggests that whales are more actively participating in the market. On the other hand, a value of 25 implies that retail investors were somewhat less influential in comparison, suggesting they may have had a smaller presence or impact on the market dynamics.

Realistic or not, here’s SEI’s market cap in BTC terms

Subsequently, we examined its daily graph to gain insights into potential price levels for the current week. It appeared that the SEI token was attempting to breach its $0.3 resistance point. If it successfully does so, there’s a possibility it could reach approximately $0.39 soon.

Moving north could offer a view of $0.5 for the token, but if bears dominate, there’s a possibility it could drop to $0.22 by the end of this week instead.

Read More

- PI PREDICTION. PI cryptocurrency

- WCT PREDICTION. WCT cryptocurrency

- Guide: 18 PS5, PS4 Games You Should Buy in PS Store’s Extended Play Sale

- LPT PREDICTION. LPT cryptocurrency

- Gold Rate Forecast

- Shrek Fans Have Mixed Feelings About New Shrek 5 Character Designs (And There’s A Good Reason)

- SOL PREDICTION. SOL cryptocurrency

- FANTASY LIFE i: The Girl Who Steals Time digital pre-orders now available for PS5, PS4, Xbox Series, and PC

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Solo Leveling Arise Tawata Kanae Guide

2024-08-14 04:07