-

SEI’s current trend mirrors Q3 recovery patterns.

Will the altcoin extend recovery gains to +35%?

As a seasoned crypto investor with a knack for recognizing patterns and trends, I find the current SEI (Sei) performance intriguing. The Q3 recovery patterns seem to be echoing in the present, with SEI displaying a similar resilience at the crucial $0.25 support level.

During this week’s rally, SEI experienced significant growth in the double digits and appears ready to continue its upward trend. This layer 1 altcoin recently transformed the short-term resistance zone at $0.28 into a support level and has been holding steady just below $0.30 for two consecutive days.

SEI experienced an increase of 15%, moving up from $0.25 to $0.30 during the course of the week. Will the bulls be able to maintain their victorious trend?

SEI: The calm before the storm?

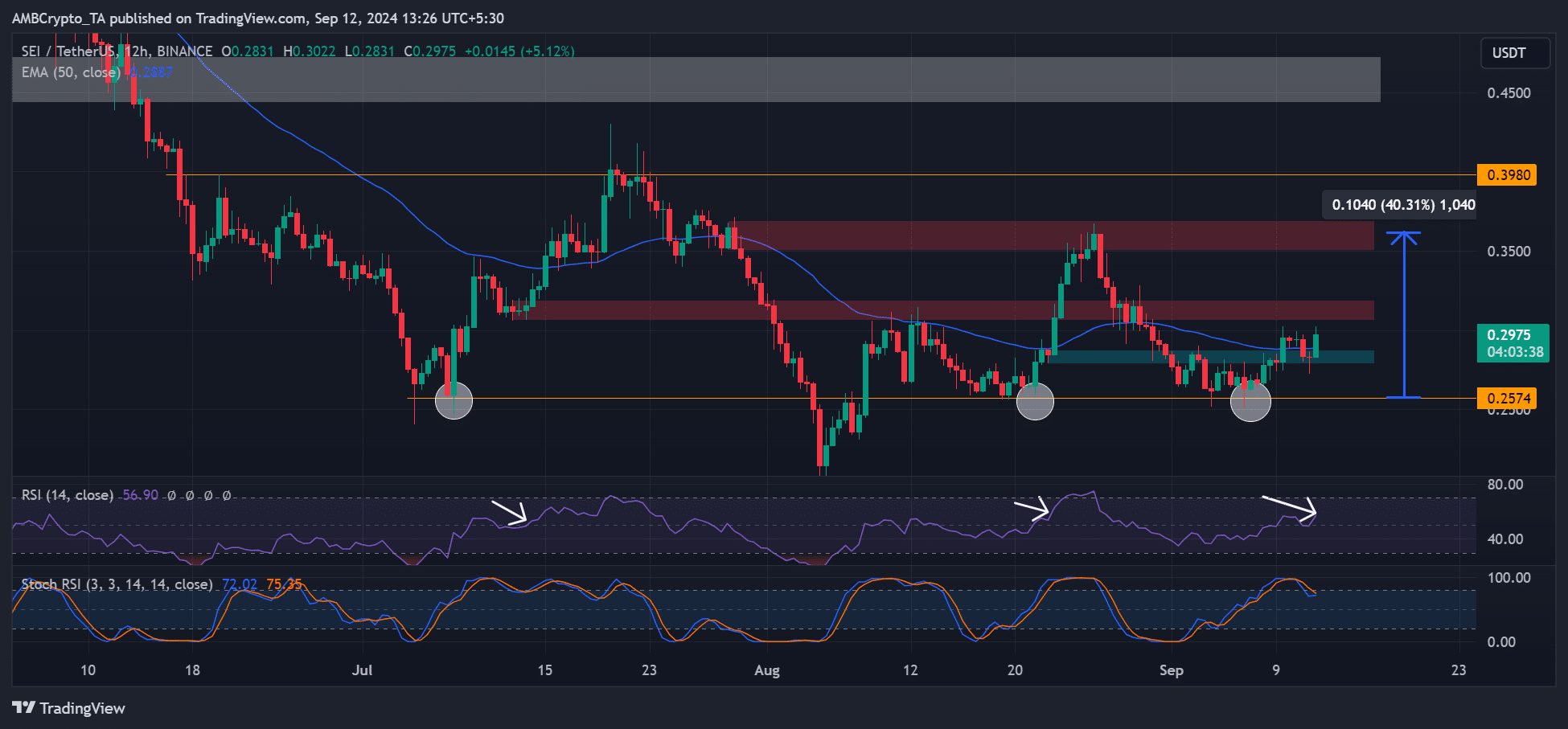

In the third quarter, SEI exhibited a steady pattern of price movement. Notably, every significant price drop in July, August, and September found a reversal point at $0.25. This made $0.25 a key level of support for SEI during Q3.

Over the last two instances where support was provided, SEI focused on a potential increase of $0.35. This led to a surge of approximately 35% in price rise for each subsequent advance once the resistance at $0.30 (indicated in red) was surpassed.

In recent weeks, we’ve seen a pattern that seems reminiscent of the last two Q2 trends. Early in the week, SEI has already achieved a 15% increase. As I speak, though, the $0.30 milestone remains unattained.

As an analyst, I noticed that based on technical chart analysis, SEI appeared poised to advance towards $0.35. This observation is supported by the Relative Strength Index (RSI), which indicated that the stock was not in overbought conditions. In simpler terms, this means that there was still potential for further recovery or growth beyond its current levels.

If the pattern from Quarter 3 recurs, investors who are late to the Secure Energy Investments (SEI) bandwagon might consider entering the market once a breakout is retested at around $0.30. Following this, potential targets for these investors would be $0.35 and $0.39.

However, a break below the Q3 support would invalidate the above bullish outlook.

On-chain and derivatives data say…

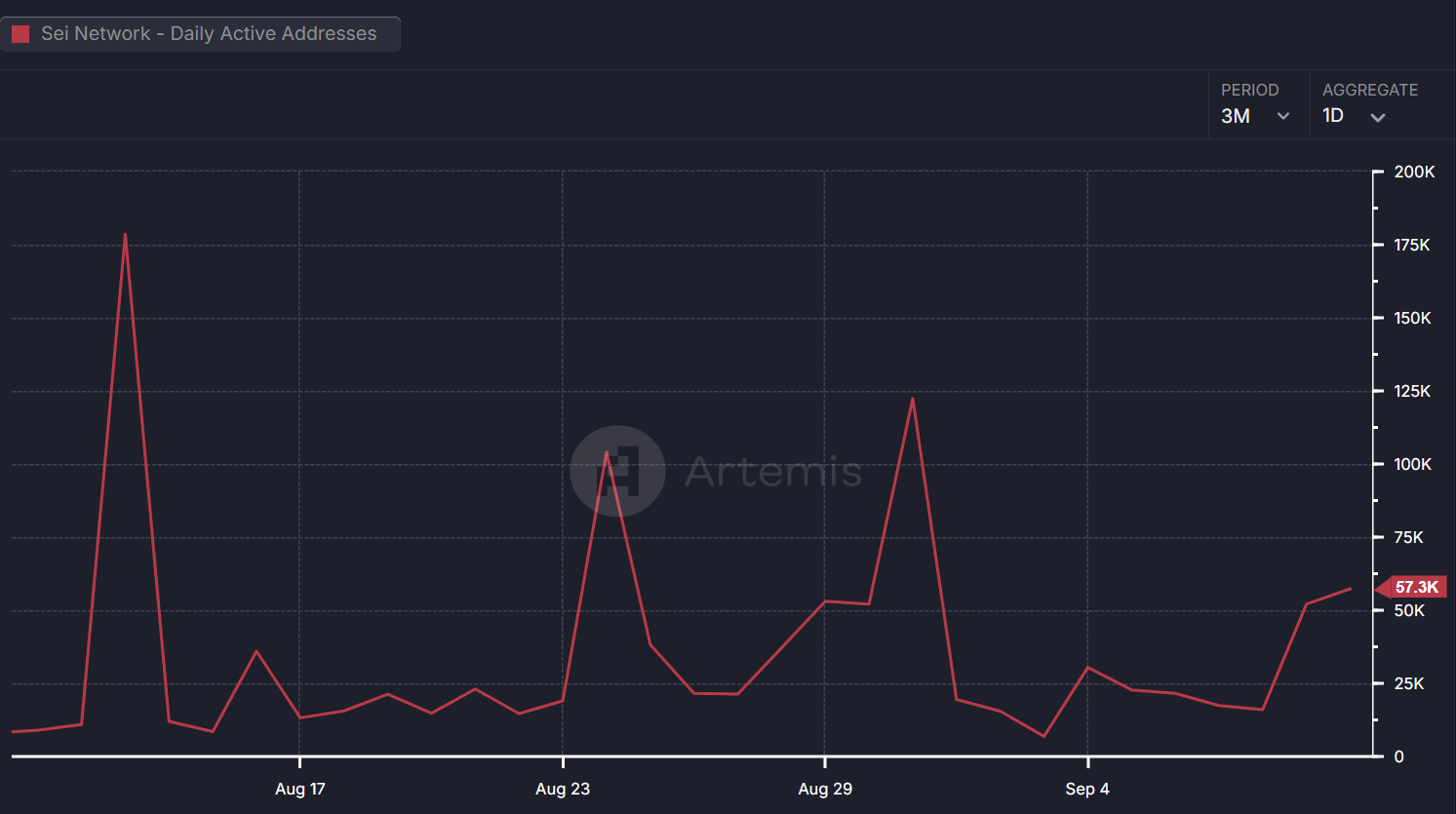

Based on Artemis’ findings, there was a significant increase in the number of daily active addresses within the Sei network starting from early September.

In recent days, the metric has dropped beneath 25,000 and risen above 55,000. This suggests increased network usage and activity, which may potentially fuel a rebound in its price.

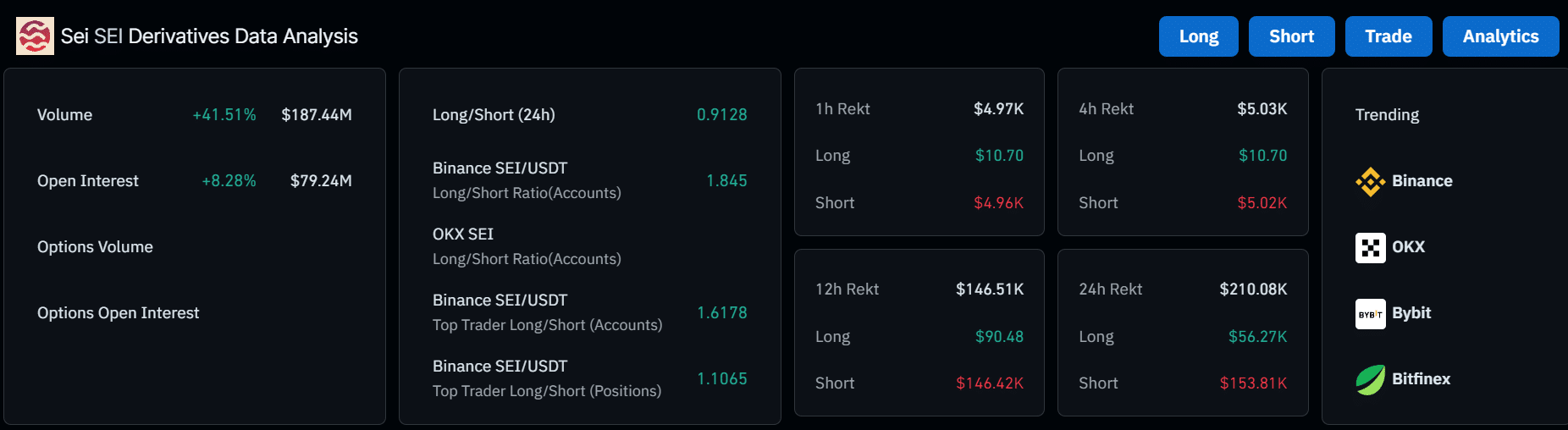

In simpler terms, during regular business hours on Friday, SEI saw a nearly 5% increase. This rise was notable for an 8% growth in open interest rates (OI) and a significant jump of over 40% in trading activity within the derivatives market.

Read Sei [SEI] Price Prediction 2024 – 2025

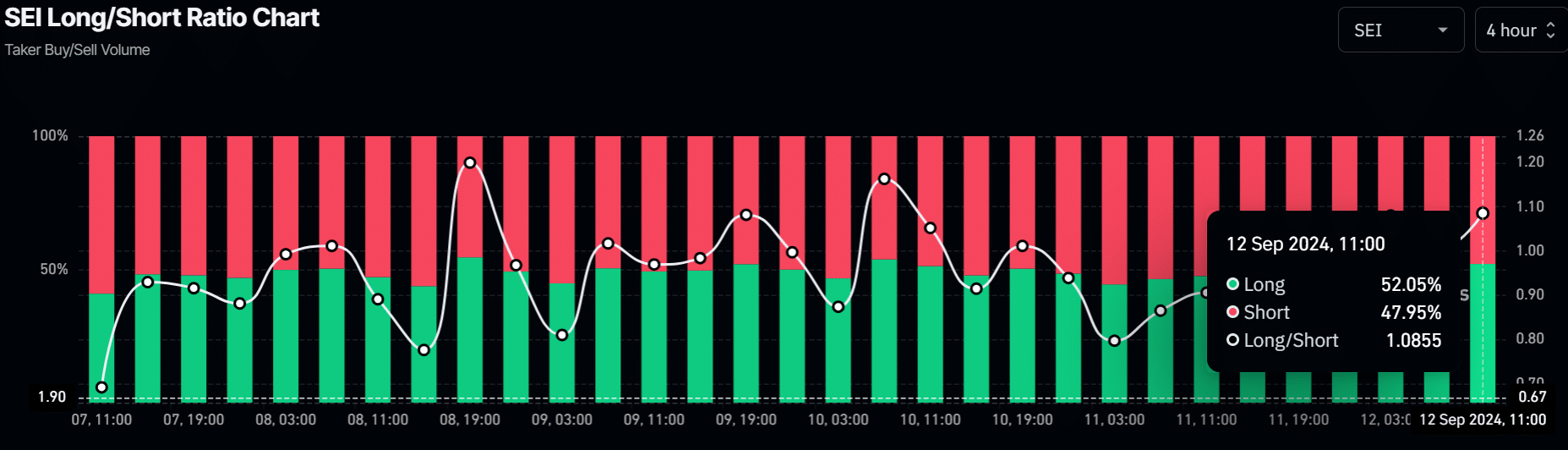

This demonstrates that SEI drew substantial speculative investment, in the form of liquidity injections, due to anticipation for future price increases. Moreover, the overwhelmingly positive outlook on this altcoin is underscored by the fact that long positions accounted for 52% of all positions.

However, any sharp losses from Bitcoin [BTC] could drag SEI and invalidate the bullish thesis.

Read More

- The Bachelor’s Ben Higgins and Jessica Clarke Welcome Baby Girl with Heartfelt Instagram Post

- WCT PREDICTION. WCT cryptocurrency

- Royal Baby Alert: Princess Beatrice Welcomes Second Child!

- PI PREDICTION. PI cryptocurrency

- Sea of Thieves Season 15: New Megalodons, Wildlife, and More!

- SOL PREDICTION. SOL cryptocurrency

- Playmates’ Power Rangers Toyline Teaser Reveals First Lineup of Figures

- Superman Rumor Teases “Major Casting Surprise” (Is It Tom Cruise or Chris Pratt?)

- Buckle Up! Metaplanet’s Bitcoin Adventure Hits New Heights 🎢💰

- Owen Cooper Lands Major Role in Wuthering Heights – What’s Next for the Young Star?

2024-09-12 20:07